WESTERN AIRLINES 1984 ANNUAL REPORT =

FIVE YEARS AT A GLANCE (in million

Operating revenues ........................... .. ..... . .. .. ...... $

Operating expenses . .. ...... . . . . . ...... . .............. . ........ .

Operating Income (loss) . .. . .. ... ................... .. ....... .

Other Income (Expenses):

Interest exp nse, n t ... . ... . .................... ........ . ... .

Gain on asset dispositions and oth r incom , n t .. . .. . ... ..... . . .

Loss before income taxes and extraordinary item . .. ..... .. . ... . .

Income tax (benefits) ........... ..... ............... ... .......... .

Loss before extraordinary item ........... .. .............. . ... .

Extraordinary item:

Gain on pen ion plan terminations ... . . ... . . ................. .

Net loss ............ . .... . ..... .. .. ... ..... ....... . . .... . .. .

Loss per common share:

Before extraordinary item .......... . . ... ... .. ... ............ . .

Extraordinary item ................... . . .. . .. .. . ... .......... .

Net Loss . . .. . .... ..... ... . . . . ........ . .. . .................. .

Average common shares outstanding (000) .. ................. . .... . .

Passengers carried (000) .... . . . . . ... . .... ... .. . .... . . .... . ....... .

Available seat miles (000,000) . . .... ...... ... . ... ... .. .. ... .. ..... .

Revenue passenger miles (000,000) .... . . . ....... . .. . .. . . . . . ..... . .

Passenger load factor - actual(%) ....... . .......... ... ..... . ....... .

- breakeven (%) ....... ....... ... ..... .. .... . .

In Recognition . . .

har am unt)

1984

1,181.9

1,170.5

11.4

(58.1)

17.5

(29.2)

(29.2)

$ (29.2)

$ (1.37)

$ (1.37)

24,104

8,307

16,318

9,417

57.7

59.9

1983

1,142.

1,199.0

(56.4)

(51.5)

11.6

(96.3)

(0.3)

(96.0)

41.5

(54.5)

(6.22)

2.62

(3.60)

15,821

9,134

16,654

9,416

56.5

62.5

(46.7)

14.0

(63.5)

(3.6)

(59.9)

15.9

(44.0)

(4.78)

1.22

(3.56)

13,044

8,441

15,125

8,893

58.8

63.1

1981

(66.0)

(45.0)

18.2

(92.8)

(19.4)

(73.4)

(73.4)

(5.81)

(5.81)

13,037

8,402

14,496

8,548

59.0

65.8

1980

995.7

1,041.5

(45.8)

(38:5)

35.1

(49.2)

(19.6)

(29.6)

(29.6)

(2.46)

(2.46)

13,031

9,130

15,516

8,832

56.9

62.0

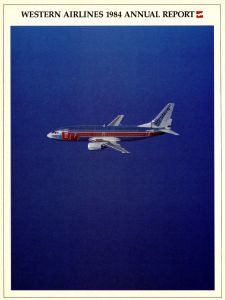

The newest aircraft in Western's fleet, the new generation Boeing 737-300, i f atur d nth c v r f thi y ar'

The first 737-300 was delivered in March 1985. Inside this year's Report t Shar hold r , m

sands whose efforts make Western the quality airline of the Wi tar featur d.

Annual R port.

nting th thou-

Chief Executive Officer Gerald Grinstein,

Chairman Lawrence H. Lee and President Robin H. H. Wilson.

1

REPORT TO SHAREHOLDERS:

Western Airlines turned the corner in 1984. The

company reported its first full-year operating profit

in five years as well as a fourth quarter operating

profit of $6. 9 million, Western's highest fourth

quarter ever. Although the company still finished

the year with a net loss, it was reduced by $25 mil-

lion from 1983. Not counting an extraordinary gain

in 1983, the net loss reduction was $67 million. At

the same time, the company was positioned to

return to full profitability in 1985. These results

begin to demonstrate what many within the com-

pany have believed for some time - that Western

can operate profitably in the deregulated airline

industry.

The successes of 1984 did not _come about by

chance. They are the result of strategies designed

in the preceding year, and of management and

labor reaching the understanding that both sides

can cooperate in key areas to assure Western's

future success.

The prime example of this cooperation was the

development and successful implementation of

the Competitive Action Plan (CAP), which has

provided Western with a new, highly competitive

cost structure. Building on the foundation estab-

lished by the Partnership Program in 1983, the

company and its five domestic unions negotiated

new labor agreements, making Western the first

major airline to restructure its costs permanently

through the collective bargaining process. The

ben fit of this improved cost structur began to be

felt in the fourth quarter and will be even more evi-

dent in 1985.

Western's employees will share the benefits.

As a result of the Partnership and CAP efforts,

Western's employees now own nearly a third of

the airline's common stock, and four union repre-

sentatives have joined the company's board of

directors.

The company has significantly improved its

internal financial budgeting and reporting proce-

dures in order to keep all expenses at the lowest

possible level. The system provides for tight cost

accountability from first line managers to the office

of the Chief Executive.

MARKETING THE AIRLINE OF THE WEST

Management moved aggressively in 1984 to

position Western to be the dominant full service

carrier of the western United States by refining

schedules and strengthening connecting opera-

tions at Salt lake City and Los Angeles, the air-

line's primary hubs.

Western is by far the largest airline operating

at Salt lake City with over 70 percent of the air-

port's daily departures. The terminal capacity of

Western's domestic connecting complex was ex-

panded by 40 percent in 1984, with the opening

of Concourse D in October. Flights now operate

from 21 second-level boarding gates. A further 29

percent increase in departures in April 1985 will

give Western 108 daily flights serving 38 non-

stop destinations.

2

u tamer Seroi e' Th lma onklin,

Debbi B nnett, Denni Van ampen, Linda Ra mu en,

Bob L and Claudia Taylor.

WAD FAClOR-Actual Vs. Breakeven

66

64

62

.. 65.8

............

...........

.....

-

-

.

-

....

.......... ' 63.i .............................. 62.5

,,,.

~- -

62.0 -

.......

..

60

58 ,,

~

56.9

56

1980

_,

,,

58.8

,.

;9~0-------

,, .,

'~

1981 1982

.. ..

59.9

~, --

,, _____ 57.7

', ...

~-

56.5

1984

111111111111111

Breakeven Load Factor - Actual Load Factor

Fli ht ontrol' andy Han n, Dary Zu o and

Alan Nakao, Air raft Routin ' Leonard S ott and

Panny a tillo of Ii ht ontrol.

Maintenance's Robert Montgomery, Virgil Hans,

Dick Snyder, Tom Tiara and Frank Purkart.

The Salt Lake City hub is operating smoothly,

and it is an increasingly attractive alternative to

Denver for passengers throughout th western

United States. Western continues to be grateful for

the help and cooperation received from the people

of Salt lake City and the State of Utah in the devel-

opment of this important facility.

Western also boosted its schedule at Los Angeles

International Airport. The airline now operates the

most daily departures from Los Angeles. With

nonstop flights to 25 cities, Western serves more

points nonstop from Los Angeles than any other

airline. In addition, the Los Angeles operation is

scheduled as a connecting gateway, with service to

Canada, Hawaii and Mexico, all key pleasure travel

destinations.

With an unsurpassed mix of sun and snow des-

tinations and the combination of quality full ser-

vice at competitive fares, Western will continue to

attract a high percentage of discretionary travelers

in the West. The company is also taking action,

however, to gain a larger portion of the business

travel market through improved schedules and

service as well as a fleet-wide upgrade in the

design and configuration of the aircraft interiors.

We tern's current schedule provid s convenient

morning, midday and vening d partur , and

nabl same-daytrav ltoandfrommo tmark ts.

S rvic geared to th bu ine trav 1 r uch as

advanc eat a ignm nt and roundtrip ch ck-in

hav b n add d. In additi n, W t rn nrich d it

Travel Pass II frequent flyer program in 1984 to

maintain its competitive edge through a simple

structure and fast rewards.

WESTERN'S FLEET

McDonnell

Boeing Boeing Boeing Douglas

727-200 737-200 737-300 DC-10-10

Owned 36 11 7

Leased 8 10 3

Delivery

1985 3

1986 3

1987 6

1988 3

During this past year, the airline began a longer-

term program of redesigning its aircraft interiors.

First class sections, reflecting the commitment to

full service and providing a key incentive for the

frequent flyer program, will be available on all

Western flights. Equally important is the upgrad-

ing of coach sections throughout the fleet, adding

newly designed seats to give passengers additional

leg room without sacrificing capacity. Larger over-

head bins have been installed aboard 727 aircraft to

accommodate demand for carry-on space and the

same is being done on 737 aircraft.

Finally, all of Western's aircraft will be given a

face-lift, replacing the red, white and black paint

scheme of the last 15 years with a simple, bright

red Western "W" outlined in blue and white on a

4

In-Fli ht's llen Ru h and Jim Grime

with Pilots Dudley Moore and

John Billon and In-Fli ht's Pat Silva.

Payroll's Sumi Yodogawa, Susie Johnson, Arnold Binder,

Sue Endo, Mario Perez, Cheryl Kunis and Pat Heitz.

Telecommunication ' Elaine Shue, Dori Parrish,

Bob Yoder, Linda Guevara and Donn Smith.

OPERATING INCOME $ Millions

1980 1981 1982 1983 1984

5

gleaming aluminum fuselage. (One of the first

airplanes to sport this new design, a new genera-

tion Boeing 737-300, is pictured on the cover of this

report.)

All of these changes position Western to take

advantage of new opportunities in what is and will

be a rapidly changing competitive environment in

the western United States.

STRENGTHENING MANAGEMENT

Western continues to strengthen its manage-

ment and board of directors. Gerald Grinstein,

Western's president and chief operating officer

since January 1984, was elected chief executive offi-

cer in February 1985. He succeeds Lawrence H.

Lee, who remains chairman of the board. Robin

H.H. Wilson also joined the company in February

as president and chief operating officer after three

years as president and general manager of the

Long Island Rail Road where he is credited with a

major turnaround. He previously spent 17 years

with Trans World Airlines in operations, planning

and marketing. He was senior vice president-oper-

ations when he left TWA.

In connection with these appointments, West-

ern implemented a new organization involving

fewer layers of management, thus enabling the

company to respond more quickly to change in

the marketplac . Under the new organization, six

staff functions and th chi f op rating offic r

r port to Mr. Grin tein, whil nin p rating func-

tions report directly to Mr. Wilson.

The company was also fortunate to attract

Thomas J. Roeck, Jr., as senior vice president-

finance and chief financial officer. Mr. Roeck came

to Western from Global Marine Inc., where he

spent 18 years, most recently as vice president and

treasurer.

In addition to Mr. Wilson, Western has six new

directors who expand the expertise and broaden

the background of Western's board. The two new

outside directors are Archie R. Boe and Joseph T.

Casey. Mr. Boe is the retired president of Sears and

the former chairman and chief executive officer of

the Allstate Companies. Mr. Casey is executive vice

president and chief financial officer of Litton

Industries. Representing Western's employees on

the board are J.A. Kammermeyer of the Air Line

Pilots Association; Dr. Charles Levinson, an inter-

national trade unionist and economist who is

representing employees affiliated with the Interna-

tional Brotherhood of Teamsters and the Transport

Workers Union; Susan Edwards Pace, Chair-

woman of Western Airlines Master Executive

Council of the Association of Flight Attendants,

and James J. Shields, National President of the Air

Transport Employees.

Western's management is pleased with the com-

pany's progress in 1984 and believes that the far-

reaching changes of the last few years provide the

company with a new and stronger position ena-

bling it to compete and grow in the deregulated

6

Re eruation' Mar ie Lui , indy Avila, Jerry Wood,

Philip a kin, Carol John on and Avis John on.

Ramp Service's Bruce L. Cass, Luke Myles,

Laura Lee, Barry Smith, Randy Bates,

Jeff Sanborn, Frank Godfrey and Troy Coyle.

Fie t ervi e' Mi ha l 'Malley, Rilb rt Martin z,

Thom L mmon, Felix alaz:ar, Micha l D Ian y,

Jame Walker, Larry M arthy, Ni k Vella and andor Toth.

Computer Operations' Stu Koren,

Hal Healy and Susan Riemer.

7

environment. Western's passengers already are

responding to improvements the company has

been making: Western's load factor in recent

months has been among the highest in the indus-

try. Equally important, the investment community

is beginning to realize the significance of the

changes at Western, which can result in more

attractive financing opportunities for the company.

Western is grateful for the support of its share-

holders, passengers, travel agents, and most of all,

its employees, over the last few difficult years. The

company is confident that support will be

rewarded in the years to come.

Lawrence H. Lee

Chairman

March 20, 1985

Gerald Grinstein

Chief Executive Officer

BOARD OF DIRECTORS

Fred Benninger*

President

Tracinda Corporation

Las Vegas

Walter J. Hickel

Chairman of the Board

Hickel Investment Company

Anchorage

Susan Edwards Pace

Chairwoman

Western Air Lines Master

Executive Council

Assoc. of Flight Attendants

Los Angeles

Archie R. Boe

Retired President

Sears, Roebuck & Co.

Chicago

John A. Kammermeyer

Air Line Pilots Association

Los Angeles

Spencer R. Stuart*

Chairman of the Board and

Chief Executive Officer

InveQue t Incorporated

Dallas

Victor L. Brown*

Presiding Bishop

The Church of Je u Christ

of Latter-Day Saint

Salt Lake City

Bert T. Kobayashi Jr.

Kobayashi, Watanabe,

Sugita and Kawashima

Attorney-at-Law

Honolulu

James J. Shields

ational President

Air Transport Employees

Los Angeles

8

Joseph T. Casey

Executiv Vic President

Chief Financial Officer

Litton Industries

Beverly Hills

Lawrence H . Lee*

Chairman of the Board

Western Air Lines, Inc.

Los Angeles

Robert H . Volk

Chairman and Chief

Executive Officer

Martin Aviation, Inc.

Santa Ana

Gerald Grinstein*

hi f Ex cutiv Officer

W tern Air Lines, Inc.

Los Angeles

Charles Levinson

International Trade

Unionist and Economist

Geneva

Robin H.H. Wilson

President and Chief

Operating Officer

We tern Air Line , Inc.

Los Angeles

* Ex cutive ommitte

CORPORATE OFFICERS

Lawrence H. Lee

hairman of the Board

Gerald Grinstein

Chief Executiv Offic r

Robin H. H. Wilson

President & Chief Operating Officer

Thomas J. Roeck, Jr.

Senior Vice President & Chief Financial Officer

Harold L. Achtziger

Vice President-Airport Operations

Jack W. Boisen

Vice President-Human Resources

Gregory P. Chambers

Vice President & Controller

Thomas J. Greene

Vice President, General Counsel & Secretary

Joseph C. Hilly

Vice President-Labor Relations

Robert L. Moore

Vice President-Market Planning

General Offices

Western Air Lines, Inc.

6060 Avion Drive

Los Angeles, California 90045

(213) 216-3000

Registrar/Transfer Agent-Common &

Preferred Stock

Bank of America National Trust & Savings

Association

555 South Flower St., Los Angeles, California 90071

Debenture and Subordinated Note Trustee

United States Trust Company of New York

45 Wall Street, New York, New York 10005

Exchange Listing-Common & Preferred Stock

Debentures and Subordinated Notes

New York Stock Exchange

Pacific Stock Exchange

Ronald D. Marasco

Vice Presid nt-Maint nanc & Engin ring

Seth M. Oberg

Vice Pr sid nt-Flight Op ration

Calvin L. Rader

Vice President-Information Sy tern

William Semos

Vice President-Corporate Communication

Glen L. Stewart

Vice President-Operations Administration

Douglas B. Swets

Vice President & Treasurer

Jorge Valencia

Vice President & General Manager-Mexico

C.F. Van Every

Vice President-Inflight Service

James R. Watson

Vice President-Passenger & Cargo Sales

Ticker Symbols

Common Stock WAL

Preferred Stock Series A-WALPRA

Preferred Stock Series B-WALPRB

5% Debentures WAL93

10% Notes WALDC98

14% Notes WALD98

Common Stock Warrants WALWS

Independent Accountants

Peat, Marwick, Mitchell & Co.

555 South Flower Street

Los Angeles, California 90071

Annual Meeting of Shareholders

Second Thursday in May

SECURITIES AND EXCHANGE COMMISSION

Wa hington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For fiscal year ended December 31, 1984 Commission File Number 1-1521

WESTERN AIR LINES, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction

of incorporation or organization)

95-1360150

(1.R.S. Employer

Identification No.)

6060 Avion Drive, Los Angeles, California 90045

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 216-3000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Cla

Common Stock-$1 par value

$2 Series A Cumulative Convertible Preferred Stock

$2.1375 Series B Cumulative Convertible Preferred Stock

5% Convertible Subordinated Debentures

10% Senior Secured Trust Notes

14% Senior Secured Convertible Notes

Warrants to Purchase Common Stock

Name of Each Exchange on Which Registered

New York and Pacific Stock Exchanges

New York Stock Exchange

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has

been subject to such filing requirements for the past 90 days. Yes X No _

Registrant's Common Stock outstanding at March 27, 1985 was 24 151 ,157 share .

The aggregate market value of the voting stock of the Registrant held by non-affiliates of the

Registrant at March 27, 1985 was $144,906,942.

DOCUMENTS INCORPORATED BY REFERENCE

Title of Document

Definitive Proxy Statement Relating to

1985 Annual Meeting of Shareholders

Part Hereof Into Which Document i Incorporated

Part III

PART I

ITEM 1. BUSINESS

General

We tern is a commercial airline serving the continental United States, Alaska, Hawaii, Canada and

Mexico. It is the eighth largest domestic airline in terms of 1984 United States revenue pas enger miles.

We tern' operations serve principally the western portion of the United States where it provide service to

virtually all major cities. The Company's service is based on a "hub-and-spoke" system, with its principal

hubs in Salt Lake City and Los Angeles. The Company emphasizes the use of short-haul, narrow body

aircraft suitable for hub-and-spoke operations and focuses its scheduling and marketing to attract the

frequent business traveler.

Routes and Services

The Company provides air transportation services to 63 destinations, on routes extending from New

York and Washington, D.C. in the east to Honolulu and Anchorage in the west. Other principal cities on

Western's routes include Albuquerque, Chicago, Dallas/Ft. Worth, Denver, Houston, Kansas City, Las

Vegas, Los Angeles, Minneapolis/St. Paul, Oakland, Phoenix, Portland, St. Louis, Sacramento, Salt Lake

City, San Diego, San Jose, San Francisco and Seattle/Tacoma. Western's international certificates

authorize service to Canada and Mexico. Western serves Vancouver from Los Angeles, San Francisco and

Portland and Calgary /Edmonton from Denver, Los Angeles and Salt Lake City. Western provides service

from Los Angeles to six cities in Mexico including Mexico City, Acapulco, Guadalajara, Puerto Vallarta,

Mazatlan and Ixtapa/Zihuatanejo.

Western 's passenger traffic mix reflects the fact that, in addition to serving the principal business

centers in the western United States, it also serves most of the major vacation areas in western North

America. Western estimates that presently more than half of its passenger traffic is vacation or pleasure

oriented and believes that this portion of its business is particularly susceptible to changes in general

economic conditions. Marketing programs introduced by Western during 1984 are designed to attract

frequent business travelers.

The business of Western is seasonal in nature, with the highest revenues of the year normally being

recorded in the third quarter. This seasonality is attributable to the propensity of the public to take

pleasure trips during the summer months of the year. Western's new business traveler marketing programs

are designed to attract revenue throughout the year.

2

Revenue and Traffic Information

The following table set forth certain tatistics relating to We tern' operation during the five years

ending December 31, 1984:

Revenue Component a Percent

of Total Operating Revenue:

Passenger .......................................... .

Cargo ................................................ .

Contract service and other ............... .

Total .................................. .

Traffic:

Aircraft operated at end of period ....

Average daily utilization per aircraft

( block hours) ............................... .

Passengers carried ( 000,000) .......... .

Available seat miles ( 000,000) ........ .

Revenue passenger miles ( 000,000)

Passenger load factor

- actual ( % ) ............................. .

- breakeven (%) ...................... .

Passenger revenue per revenue pas-

senger mile ("yield") ................... .

Operating expense per available

seat mile ........................................ .

Average length in miles per passen-

ger trip ........................................... .

Available ton miles (000,000) ......... .

Cargo revenue ton miles ( 000,000) ..

Cargo tons carried ( 000) ................. .

Average number of employees ........ .

1984

88%

6

6

100%

76

8:22

8.3

16,318

9,417

57.7

59.9

$.1108

$.0717

1,134

2,090

156

106

10,264

Year Ended December 31,

1983

87%

6

7

100%

74

8:42

9.1

16,654

9,416

56.5

62.5

$.1055

$.0720

1,031

2,150

167

117

10,355

1982

87%

6

7

100%

72

8:09

8.4

15,125

8,893

58.8

63.1

$.1042

$.0725

1,053

1,964

156

114

9,670

1981

90%

6

4

100%

70

7:57

8.4

14,496

8,548

59.0

65.8

$.1113

$.0777

1,017

1,941

151

110

10,120

1980

89%

6

5

100%

71

8:24

9.1

15,5 16

8,832

56.9

62.0

$.1010

$.0671

965

2,071

163

121

10,657

Passenger load factor is the ratio of revenue passenger miles ("RPMs") to available seat miles

("ASMs"). The breakeven passenger load factor represents the approximate percentage of available seats

which must be occupied for revenues to cover all expenses except income taxes, assuming no changes in

yield and expenses.

Revenue Management

Concurrently with the route and capacity adjustments described above, the Company is improving its

system of revenue management so as to improve yields by capturing a higher percentage of full fare

passengers on flights with high demand by monitoring demand and adjusting the availability of discount

fares on such flights. For example, the percentage of full fare passengers carried by Western in the

continental United States and Canadian markets has increa ed from 12.0% for 1983 to 15.5% for 1984.

Cost Controls

The Company has instituted improved procedures for controlling costs, including measures to as ure

minimum but effective staffing level while still providing high quality pas enger service. The use of

computer modeling for manpower level was implemented by the Company in 1983 to help optimize field

and reservation taffing. A new sy tern of labor and material co t collection in the maintenance area was

implemented in early 1984. Thi y tern ha enabled co ts to be more readily identified with pecific

3

functions and provides information necessary for the development of standard costs and profitability

analyses. Improved methods of inventory control have been implemented for aircraft spare parts, which

should result in lower investment costs and better utilization of existing inventories. In addition, the

Company has improved its procedures for budgetary review of operating and capital expenditures.

Travel Agents

Western's business is substantially dependent upon sales made by travel agents. During 1984 and

1983 approximately 76% and 73%, respectively, of Western's passenger sales were generated by travel

agents. See "Risk Factors and Certain Recent Developments- Industry Conditions."

Recently the CAB eliminated the exclusivity held by the travel agent industry for the sale of airline

tickets. Consequently, airline tickets now may be distributed through any retail channel, and airlines are

free to reach individual agreements with such outlets. This decision by the CAB could have a substantial

impact on airline distribution methods in 1985.

Fuel

Western's arrangements with suppliers of aircraft fuel presently provide for substantially all of its

actual and anticipated needs.

Western purchases the bulk of its fuel from major oil companies under annual agreements which

guarantee supply but not price. However, the ability of Western's suppliers to furnish Western with fuel is

dependent upon a number of factors, including national and international petroleum supplies and

government regulation. Western expects fuel supplies to remain more than adequate for the foreseeable

future. In recent years Western has faced a tightening of credit terms by fuel suppliers.

Price of fuel, rather than supply, has been the major problem in recent years. For many years, prices

of fuel continued to escalate and the cost of fuel has become a major item of expense for Western and all

other airlines. In 1984 fuel costs were $300 million and accounted for 26 percent of Western's total

operating expenses compared to 20 percent in 1978. The difference was due entirely to the increased price

of fuel since the amount of fuel consumed actually declined between 1978 and 1984. During 1982 fuel

prices first leveled off and then began to decline somewhat, averaging six percent below 1981 levels. The

trend of lower fuel prices continued during 1983 averaging twelve percent below 1981 levels. Prices

through 1984 continued to decline, averaging seventeen percent less than in 1981. The impact of fuel

prices upon total operating costs is illustrated by the fact that based upon Western's fuel consumption

during 1984, a one cent per gallon change in fuel prices would have resulted in an increase or decrease of

approximately $3.5 million in Western's annual fuel costs.

Western's operating procedures are designed to keep fuel consumption to a minimum, primarily

through reduced airspeeds and elimination of excess weight.

The following table sets forth Western's fuel consumption and related information for the past five

years:

Consumption

(Millions of Average Price

Gallons) Per Gallon

1980 ............................................. 342 $0.87

l 981 ............................................. 315 1.04

1982 ............................................. 320 0.98

l 983 ............................................. 354 0.91

1984 ............................................. 348 0.86

Total

Fuel Cost

(Millions)

$296.4

326.6

312.0

320.0

300.2

Fuel Cost

Total Asa

Operating Percent of

Expense Operating

(Millions) Expense

$1 ,041.5 28.5

1,125.8 29.0

1,096.1 28.5

1,199.0 26.7

1,170.5 25.6

Western understands that the California State Board of Equalization, which is auditing variou of

Western's fuel suppliers for periods during 1978 through 1982, may challenge the qualification for

exemption from California sales tax of certain fuel sales by the suppliers to Western and other airlines. No

4

claim or demand ha yet been made upon We tern or, to We tern' knowledge, upon any of We t rn' fuel

supplier . In the event that deficience with re pect to fuel ale to We tern are impo ed again t We t rn'

uppliers, the uppliers could be expected to eek indemnity from We tern under their contract with

We tern. While any uch deficiences could be sub tantial, We tern believe that its fuel purcha e

qualified for exemption from the tax and plans to conte t vigorou ly any deficiencie that may be a erted.

Western believes that these matters will not have a material adver e effect on it financial po ition or

operations.

Competitive Action Plan

In September 1984 Western received approval from each of its major unions for a combination of pay

reductions and productivity improvements ( the "Competitive Action Plan" or "CAP") designed to

achieve substantial reductions in labor costs, effective September 1, 1984 through December 31, 1986. In

contrast to temporary concessions obtained by Western in the past, these new agreements have no

contractual provisions for reversions to higher wage levels in the future. Western began implementation of

CAP in September 1984. The full effect of the CAP provisions will first be felt in the first quarter of l 985.

Had the CAP cost structure been in effect during all of l 984, the Company estimates that breakeven load

factor would have decreased from 59.9% to 55.5% and that it would have recorded an operating profit of

approximately $84 million in lieu of actual operating profit of $11 .4 million and net earnings of

approximately $43 million in lieu of an actual net loss of $29.2 million, reflecting a reduction of $47. l

million in cash labor expense and $25.5 million in non-cash stock issuance expense for l 984. Such

estimates may not, however, be indicative of actual results under CAP in 1985.

In addition, CAP provides for an increase in profits subject to distribution annually under a profit

sharing plan adopted pursuant to the Company's 1983 Partnership Plan to 20% of the first $75 million of

annual profits and 35% of profits thereafter ( profits for this purpose are pre-tax profits exclusive of

extraordinary items and gains from disposition of property), for a reduction in the monthly management

budget by 12.5%, by a combination of pay and head count adjustments and for the nomination for election

to the Board of four union representatives ( rather than the two representatives to which the unions were

previously entitled). All of such directors have been elected.

Each of the CAP proposals also provides that if, after September I, I 984, Western agrees to pay

increases or productivity reductions for any group of employees, then similar increases or reductions will be

afforded employees represented by other unions.

Employee Relations

The number of Western employees during 1984 averaged 10,264, down from an average of 10,355 in

1983. Labor unions represent approximately 92% of Western's employees. Western has not suffered a

significant work stoppage by its employees during the past fourteen years, and considers its relation with

its employees to be satisfactory. If Western were to suffer a strike or work stoppage, it could have a

material adverse effect on the Company. Western's business also can be adversely affected by strikes or

work stoppages by non-employees. For example, the air traffic controllers' strike during 1981 had an

adverse impact on Western's operations and earnings.

5

The following table sets forth Western's union-represented employees by classification a of

December 31 , 1984:

Employee Group

Agent and Clerical (U.S.)

Flight Attendants

Mechanics and Related

Employees

Pilots

Stock Clerks

Flight Operations Ground

School Instructors

Flight Superintendents

Agent and Clerical (Mexico)

Agent and Clerical (Canada)

* In conciliation.

Competition

Number of

Employees

4,491

1,783

1,396

1,196

81

30

29

150

137

Contract Open

Union for Amendment

Air Transport Employees December 31, 1986

Association of Flight Attendants December 31 , 1986

International Brotherhood December 31 , 1986

of Teamsters

Air Line Pilots Association December 31 , 1986

International Brotherhood December 31 , 1986

of Teamsters

International Brotherhood December 31, 1986

of Teamsters

Transport Workers Union December 31 , 1986

Sindicato N acional de January 19, I 986

Trabajadores de Aviacion

y Similares

Air Transport Employees Julyl , 1984*

Western is presently subject to multiple carrier competition on most major domestic routes that it

serves. Some of Western's competitors are larger with more extensive route systems and with greater

financial or other resources. Western's hub-and-spoke system centered in Salt Lake City competes with

similar systems of other carriers centered in other cities, such as Denver where three competing carriers

maintain hubs. Other competitors of Western are regional and newly-formed carriers, some of which have

lower cost structures or efficient hubs enabling them to compete effectively on particular routes.

Airlines are operating in an environment where price is a major and, in many instances, the most

significant element of competition. Since domestic fare reductions are no longer government-controlled,

the airlines are now free to offer lower basic fares and promotional fares involving virtually unlimited

discounts. Many airlines, including Western, have taken advantage of this freedom to offer low basic fares

or deep discounts on major routes. Carriers, including Western, generally have elected to match such fares

when offered by competitors. See "Risk Factors and Certain Recent Developments- Industry Condi-

tions."

Western's services to both Canada and Mexico are subject to competition by carriers of those

countries, but on most routes only one such airline has been authorized by each country. Fares between

United States points and Canada and Mexico are still controlled by the governments concerned, and the

International Air Transportation Competition Act of 1979, which authorized airlines to reduce inter-

national fares up to 50% or increase them up to 5% without justification for changes, has not had

substantial impact to date on the fare structures on United States-Canada and United States-Mexico

routes.

Economic Regulation of Air Transportation

From 1938 to 1978 the airline industry was subject to the comprehensive economic regulatory

jurisdiction of the CAB. Under that framework of regulation, authority to operate new services could be

obtained only by proving a public need therefor, competition was restricted, rates and fares were tightly

controlled, intercarrier arrangements for cooperative purposes were closely supervised and mergers and

consolidations between air carriers were carefully scrutinized.

6

The Airlin Deregulation Act of 1978 ( the "Deregulation Act" ) materia11y changed th tatutory

cheme of regulation of dome tic air tran portation. Under the Deregulation Act, the AB lo t it

authority with re pect to dome tic route on December 31 , 1981 , and it authority over fare and

intercarrier tran action , including merger , as of January 1, 1983. Under the Deregulation Act, the AB

went out of exi tence a of January 1, 1985, and certain of it functions were tran ferred to the Departm nt

of Tran portation. The Deregulation Act made no change in the law a it relates to authority to engage in

foreign air tran portation, except the CAB's power to grant exemption for temporary authority wa

liberalized. Nevertheless, the United State government has followed a practic of trying to convince

foreign governments that multiple carrier designation on international route hould be authorized by

intergovernment agreement. While many countrie have acceded to the po ition of the United States

government, Mexico and Canada have not.

The airlines presently operate in an environment of unrestricted competition in domestic air

transportation. Carriers no longer have an obligation to provide service but can start and stop service on

any route virtually at will ( subject to slot and gate availability, and small community essential air service

requirements) and have complete freedom in pricing their products.

Western is unable to predict the ultimate effect of the Deregulation Act on its operations, but if the

increased competition that has resulted since the Deregulation Act became effective continues to result in

overcapacity and uneconomically low fares, the financial position of the Company could be materially

adversely affected.

Environmental Regulation

For a number of years the federal government has been tightening its controls over aircraft noise.

Pursuant to Congressional directive, the FAA in 1969 prescribed aircraft noise limits for all aircraft

designed after 1969. In 1973 and again in 1977 the FAA broadened the application of these noise limits

and promulgated a phased compliance schedule whereby essentially all non-complying commercial jet

aircraft must be replaced or modified by 1985 in order to meet the prescribed limits. All of the Company's

aircraft are in compliance at this time.

California authorities have promulgated noise standards in an attempt to limit the total noise impact

of airport operations on surrounding communities throughout the state. In connection therewith these

authorities have asserted jurisdiction over such matters as curfews at local airports, even to the extent of

attempting to override the decisions of airport proprietors. In addition, proprietors at several airports have

adopted or are considering noise regulations that are more stringent than the pertinent federal or state

standards. The stricter standards could hinder carriers, including Western, from commencing or

continuing operations at those airports.

ITEM 2. PROPERTIES

Flight Equipment

The following table summarizes the composition of Western's fleet of 75 jet aircraft and aircraft on

order:

Boeing

727-200 ................................. .

737-200 ................................. .

737-300 ................................. .

McDonnell Douglas

DC-10-10 .............................. .

Total ..................................... .

Seating

Configuration

First Class/

Coach

12/136

0/121

8/120

24/267

Owned*

36

11

7

54

Fleet Composition

at March 12, 1985

Leased* On Order

8

10

3

21

6

9

15

* See Note 2 to Financial Statements for aggregate lease obligations and lease terms, and Note 6 to

Financial Statements for information on pledged assets.

7

Western's system of hubs relies heavily on "feed" traffic which i be t erved by narrow-bodied

aircraft. The lower operating costs of the Boeing 737 make it particularly well- uited to We tern' routes, a

significant number of which involve markets where the smaller capacity of thi aircraft i adequate to meet

normal demand. This cost advantage is attributable, among other things, to the fewer pilot and flight

attendants required for the operation of this model aircraft as compared to the 727-200 and its two-engine

versu three-engine configuration, which results in lower fuel consumption and maintenance cost than the

727-200. The DC-10 aircraft is a high capacity, wide-body aircraft well-suited for medium to long haul

routes, such as Western's Hawaii routes, but is not well-suited for short haul routes. It is the Company'

current intention to dispose of a portion of its 727-200 and DC-10 aircraft as new 737 aircraft on order are

delivered. The Company has recently entered into an agreement for the sale of a DC-I 0-10 aircraft early

in the second quarter of 1985, from which the Company expects to receive proceeds, net of amounts

applied to release security arrangements, of approximately $9 million.

Western has on order three Boeing 737-300 aircraft scheduled for delivery in the spring of 1985, six

737-300 aircraft scheduled for delivery in 1986 and 1988, and six 737-200 aircraft scheduled for delivery in

1987. The total cost of all aircraft on order is approximately $394 million, of which approximately $43

million was on deposit at December 31, 1984. Western is currently negotiating terms for financing the

three aircraft scheduled for delivery in the spring of 1985; however, no commitments for financing the

aircraft have been obtained and no assurance can be given that financing will be concluded. Failure by

Western to complete the purchase of any of these aircraft could result in significant damages. If the

changes in investment tax credits and deductions for accelerated depreciation proposed by the Treasury

Department were to be adopted, the Company's ability to arrange lease financing for the acquisition of

aircraft could be adversely affected.

Ground Properties and Equipment

Western 's general offices and principal overhaul and maintenance base are located at Los Angeles

International Airport. These facilities, including a DC-10 hangar and a parking structure completed in

1975, have been built by Western as improvements on leased land. The lease on the land and buildings

expires in 1993, subject to the right of the City of Los Angeles to terminate the lease under certain

circumstances on March 31 , 1988, or any March 31 thereafter. Upon such termination or expiration, the

improvements revert to the city. Western also leases hangars at Seattle/Tacoma and San Francisco, as

well as terminal facilities at most airports served, plus ticket and administrative offices throughout its

system. Public airports are utilized for flight operations generally under contractual arrangements with

municipalities or agencies controlling them.

Western expects to expend a total of approximately $5.4 million during 1985 in connection with

improvements in its passenger terminal facilities at Salt Lake City, modification of its Los Angeles customs

clearance facilities and expansion or remodeling projects at other airports in its system.

ITEM 3. LEGAL PROCEEDINGS

During the last several years Western and other airlines have been parties to numerous actions

regarding the subjects of aircraft noise and engine emissions. Such actions have included both suits

brought directly against the airlines and cross-complaints against the airlines in suits brought against

airport proprietors. Unfavorable decisions in such actions could have a material adverse effect on the

Company.

While extensive in recent years, such litigation has substantially diminished during the last year and

Western does not believe any material liability will result to Western. In light of this litigation, however,

operators of certain airports, including those at San Jose, Orange County and Burbank, California, and

Washington, D.C.'s National, have imposed or are considering imposition of limitations on frequency and

timing of airline flights or upon the proportion of any airline's fleet which may continue to operate without

complying with specified noise standards. In general, enforcement of such re triction at a major airport

served by Western could have a material adver e effect on its operation .

8

Western is al o involved in variou other litigation, including cases alleging di crimination (including

age di crimination) in employment practice . In one uch action involving the ability of We tern pilot to

continue after age 60 a econd officer , a judgment was entered during 1981 directing the Company to

allow three pilots to continue working as econd officers after age 60, and awarding tho e pilots back pay

and attorney 'fees. That ca e was affirmed on appeal by a federal appellate court and Western' appeal to

the U.S. Supreme Court is pending. Additionally, at least one other similar action has been filed. Western

does not believe such claims will result in any material liability to Western.

In an action filed by Western in the Los Angeles County Superior Court for breach of contract arising

from the failure of defendants to pay for contract maintenance services performed by Western on certain

DC- lO aircraft, the defendants, International Air Leases Inc. and Capitol Air Inc., filed cross-complaints in

September and October 1983 seeking damages in excess of $37 million, plus punitive damages. The cross-

complaints allege that Western's maintenance services were not performed adequately, all of which

allegations Western has denied. Subsequent to the filing of the cross-complaints, Capitol Air Inc. was the

subject of an involuntary petition in bankruptcy and Western was advised that a mandatory stay of all

actions involving Capital Air Inc. had resulted. Western believes that these cross-complaints will not result

in any material liability to Western.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter of 1984.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND

RELATED STOCKHOLDER MATTERS

As of December 31, 1984, the 24,147,290 shares ofoutstanding Western Common Stock were held by

approximately 15,000 stockholders of record. There were 1,196,270 shares of Series A Preferred Stock

issued and outstanding and 979,500 shares of Series B Preferred Stock issued and outstanding held by

approximately 1,300 stockholders of record. The Common Stock and Series A Preferred Stock are listed

on the New York and Pacific Stock Exchanges. The Series B Preferred Stock is listed on the New York

Stock Exchange. The following table sets forth the high and low sale prices of the Common Stock on the

New York Stock Exchange ("NYSE") as reported by the National Quotation Bureau, Inc. for the periods

indicated:

1983

1st quarter ........................................................ .

2nd quarter ....................................................... .

3rd quarter ....................................................... .

4th quarter ........................................................ .

1984

1st quarter ........................................................ .

2nd quarter ....................................................... .

3rd quarter ....................................................... .

4th quarter ........................................................ .

Price Range

High Low

7

6

6

41/s

5

4

4

41/s

41/s

4

31/s

4

4

21/s

23/s

3

Because of continuing losses and restrictions in various loan agreements, the Company has not paid

dividends on its Common Stock since the third quarter of 1980. Resumption of dividends on the Common

Stock will depend upon the Company's earnings, financial condition, capital requirements and terms of

financings. The Company does not anticipate the payment of cash dividends on the Common Stock in the

foreseeable future.

9

ITEM 6. SELECTED FINANCIAL DATA

The following financial information should be read in conjunction with the Financial Statements and

Notes thereto contained elsewhere herein.

Income Statement Information:

( in millions except per share amounts)

Year Ended December 31,

1984 1983 1982 1981 1980

Operating Revenues:

Passenger ............................................... $1,041.4 $ 993.4 $ 925.8 $ 949.6 $ 887.9

Cargo ..................................................... 69.3 72.2 68.0 62.9 63.8

Contract service and other .................... 71.2 77.0 71.5 47.3 44.0

Total operating revenues ............... 1,181.9 1,142.6 1,065.3 1,059.8 995.7

Operating Expenses:

Wages, salaries, and employee

benefits ............................................... 412.1 422.7 368.5(a) 403.4 384.2

Fuel ........................................................ 300.2 320.0 312.0 326.6 296.4

Other ...................................................... 458.2 456.3 415.6 395.8( b) 360.9

Total operating expenses ............... 1,170.5 1,199.0 1,096.1 1,125.8 1,041.5

Operating income (loss) ............... 11.4 ( 56.4) ( 30.8) ( 66.0) ( 45.8)

Interest expense, net ...................................... (58.1) (51.5) ( 46. 7) ( 45.0) ( 38.5)

Gain on asset dispositions and other

income, net ................................................ 17.5 11.6 14.0 18.2 35. l

Earnings (loss) before mcome taxes

and extraordinary item ...................... (29.2) ( 96.3) ( 63.5) ( 92.8) ( 49.2)

Income taxes (benefits) ................................ (0.3) (3.6) (19.4) (19.6)

Earnings (loss) before extraordinary

item .................................................... (29.2) ( 96.0) ( 59.9) ( 73.4) ( 29.6)

Extraordinary Item:

Gain on pension plan terminations( c) 41.5 15.9

Net earnings (loss) ........................ $ (29.2) $ ( 54.5) $ ( 44.0) $ ( 73.4) $ ( 29.6)

Earnings (Loss) per Common Share( d):

Before extraordinary item ..................... $ (1.37) $ ( 6.22) $ ( 4. 78) $ ( 5.81) $ (2.46)

Net earnings (loss) ............................... (1.37) ( 3.60) ( 3.56) (5.81) (2.46)

Cash dividends paid per share of Common

Stock( e) .................................................... 0.25

Balance Sheet Information:

( in millions)

At December 31,

1984 1983 1982 1981 1980

Current assets .................................... $173.3 $197.2 $168.7 $167.2 $191.1

Property and equipment- net .......... 611.l 595.0 634.8 662.4 718.8

Total assets ........................................ 803.6 812.2 808.6 834.6 917.0

Current liabilities ............................... 277.6 262.7 284. l 278.4 246.5

Long-term obligations less current

installments .................................... 428.2 437.9 411.5 401.9 435. l

Shareholders' equity .......................... 62.5 86.7 77.6 121.7 197.3

(a) During 1982 actuarial assumption changes to pension plans were made reducing the net loss by $7.2

or $0.55 per share (primary) for the year 1982.

( b) Effective January 1, 1981, Western revised its procedures for recognizing commission expense to more

closely identify the expense with the period in which the related revenue is recognized. This change

reduced the 1981 net loss by $3.3 or $0.26 per share (primary).

( c) See Note 4 to Financial Statements.

( d) Fully diluted earnings per share amounts are equal to primary because the inclusion of the assumed

exercise of stock options and warrants and conversion of convertible securities would be anti-dilutive.

( e) The Company does not anticipate the payment of cash dividends on its Common Stock in the

foreseeable future. See "MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED

STOCKHOLDER MATTERS."

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Results of Operations

Years Ended December 31, 1984, 1983 and 1982

Although operating results for 1984 are significantly improved over 1983, Western incurred a net loss

for the year 1984. Western has not recorded an annual profit since 1979.

In 1984 Western produced an $11.4 million operating profit, the first in five years, as compared to

operating losses of $56.4 million in 1983 and $30.8 million in I 982. Western had a net loss of $29.2

million in 1984, compared to net losses of $54.5 million in 1983 and $44.0 million in 1982. The 1983 and

1982 net losses reflect extraordinary gains of $41.5 million and $15. 9 million, respectively, resulting from

terminations of certain pension plans.

The disastrous fare wars that began in mid-1982 continued into the first half of I 983. At the same

time, Western's operating costs increased, primarily due to the significant expansion begun in May 1982.

Higher traffic was obtained in part by selling Western's product at a lower price and therefore failed to

produce a revenue increase sufficient to cover the increased operating costs. The operating loss increased

from $14. l million for the first half of 1982 to $59.2 million in the same 1983 period.

During the second half of I 983, Western's management began to redirect the Company's efforts

toward the business traveler and took other steps designed to return the carrier to profitability.

Major areas of emphasis included: ( i) implementation of a partnership plan, including cash wage

concessions from each of the Company's domestic labor groups in return for establishment of an employee

stock plan, a cash profit sharing plan and the right to name two nominees for election to the Board of

11

Director ; (ii) trengthening the Salt Lake City hub and d veloping Lo Angele Int rnational Airport a a

more effective econd hub to feed Hawaii, Canada and Mexico; (iii) focu ing cheduling and marketing

efforts to attract the frequent busines traveler; (iv) adju ting capacity to meet ea onal fluctuation in

demand; ( v) emphasizing short-haul narrow body aircraft uitable for the hub-and- poke y tern; (vi)

establishing more effective revenue and yield management y terns; and (vii) in ti tu ting improved co t

control measures.

Certain of the e steps, combined with the general economic recovery, re ulted in a ignificant yield

increase in the second half of 1983 compared to the econd half of 1982 and the fir t half of 1983, with

only a slight decrease in load factor. Revenues rose eight percent from the 1982 second half, while

operating expenses were up only 4.4 percent, and Western recorded an operating profit for the second half

for the first time since 1978.

For the year 1983, Western's capacity (ASMs) rose 10.1 percent, while traffic ( RPMs) rose only 5. 9

percent. Load factor declined to 56.5%, the lowest level since 197 l. The significant yield increases in the

second half of 1983 resulted in a slightly higher yield for the year ( $.1055 vs. $. 1042 ). Revenue rose 7.3

percent. Although unit costs ( cost per ASM) declined from $.0725 to $.0720, total operating costs rose 9.4

percent due primarily to increased flying and higher labor rates. Some of the wage concessions obtained in

early 1982 expired in early 1983. New wage concessions were obtained from all domestic labor groups

beginning in October and November 1983.

Increased flying, combined with institution of service to several cities not previously served, required

additional employees in 1983. Fuel expense and other operating expenses also rose as a result of the

increased flying and higher traffic levels. Fuel expense rose only 2.6 percent, as lower prices substantially

offset a 10.6 percent increase in fuel used. Other operating expenses rose 12.2 percent, reflecting significant

increases in ground handling services purchased from other airlines, landing fees, rents, maintenance, food

and beverage, commissions to travel agents, and crew travel expenses.

Interest expense rose 10.4 percent, reflecting both higher debt levels and higher rates resulting from

the Company's refinancing activities.

In 1984, the improvement in operating results continued, primarily as a result of increased passenger

revenue, coupled with reductions in labor and fuel expenses. Western's passenger revenue for 1984

increased five percent from the 1983 level as a result of a yield increase of five percent. Capacity decreased

two percent, while traffic was relatively unchanged. Load factor for 1984 versus 1983 increased from 56.5

to 57.7 percent.

The yield improvement, which started in the second half of 1983, continued into the first half of 1984

and was partially offset by slight decreases in late 1984. Yield for the year 1984 was $.1108, an increase of

5.0 percent from 1983 and 6.3 percent from 1982.

Operating expenses decreased two percent, primarily in fuel and labor expenses. Fuel cost decreased

six percent as a result of a five percent price decrease, combined with a one percent decrease in

consumption.

Wages, salaries, and employee benefits decreased three percent as a result of Western's five labor

groups agreeing to new contracts effective September 1984, which contain lower pay rates and improved

productivity provisions. The contracts are open for amendment December 31 , 1986. The new contract

wage rates are lower than the rates in place since late 1983 under the partnership plan with employees as

described above. The amortization of the employee stock plan expense relating to the 1983 partnership

plan terminated in October 1984, and totalled $25.5 million for I 984. Excluding the employee stock plan

expense, labor cost would have decreased seven percent for 1984 versus 1983.

Interest expense rose 13% in 1984 primarily reflecting higher debt levels.

Gains on asset dispositions were $11.3 million, $9.0 million, and $7.4 million in 1984, 1983, and 1982,

respectively.

12

Liquidity and Capital Resource

We tern' ca h and ca h equivalent totalled $57.5 million at December 31 , 1984, up from $46.3

million at December 31 , 1983 and from $47.4 million at December 3 I, I 982. We tern' ca h balance

fluctuate ignificantly from day to day and have increa ed from December 31 , 1983, primarily a the r ult

of proceed from a et di po ition , drawing down under the Credit Agreement and operating profit ,

offset by intere t and debt repayment . The Company' working capital deficit wa $104.3 million at

December 31 , 1984, up from $65.5 million at December 31 , 1983, primarily due to the financing of

advance depo it related to aircraft deliveries, additional borrowing , and the amortization of the

employee stock plan. The Company anticipates refinancing the deposit in conjunction with delivery of the

aircraft. Because airlines typically have no product inventories and revenue are generated principally by

utilizing long term assets, minimal or negative working capital balances are not uncommon. Since mid-

1981 cash generated from operation has not been sufficient to fund debt repayment. However, We tern

has made all debt repayments by upplementing ca h generated from operation with other ca h re ource .

In order to maintain liquidity during 1982, 1983 and 1984, Western sold certain assets, terminated

certain pension plans, deferred progress payments on aircraft purchase contracts and in tituted new

borrowing and financing arrangements. The most significant of these transactions were as follows:

In April 1982 Western sold for $21 million the conditional sales contracts covering an

earlier sale of two DC-10 aircraft, and terminated a pension plan, receiving $ l 5. 9 million in

cash.

During December 1982 Western sold privately $12.5 million principal amount of 12%

convertible subordinated debentures due December 1992, and entered into a term loan and

security agreement to borrow $33.4 million from an affiliate of an aircraft manufacturer. At the

same time, Western placed an order for three 737-300 aircraft and utilized $3 million of the

proceeds as deposits for those aircraft. The term loan has been substantially repaid. The

outstanding balance at December 31 , 1984 was $2. 9 million.

In January 1983 the Company terminated a pension plan and received $33.4 million in

cash in 1983.

In June 1983 the Company completed a public offering of units consisting in the aggregate

of $90 million principal amount 10% Senior Secured Trust Notes due June 15, 1998,

3,240,000 shares of Common Stock and warrants to purchase an additional 9,000,000 shares of

Common Stock. The net proceeds of approximately $84 million were used in part to repay $78

million of debt.

In 1983 and 1984 Western obtained agreements from an aircraft manufacturer to finance

aircraft advance deposit payments through the manufacturer until after February, 1985.

In September 1983 Western entered into the Credit Agreement to provide it with a

revolving line of credit of $22 million through August 31 , 1984.

In December 1983 the Company completed a public offering of $65 million principal

amount of 14% Senior Secured Convertible Notes due December l, 1998 of which approxi-

mately $28.8 million of the net proceeds of $61.2 million were used to repay debt. In

conjunction with the December 1983 public offering, the Company's lenders agreed to allow

the Company to extend the Credit Agreement beyond August 31 , 1984, to provide an $11

million revolving line of credit through June 30, 1985.

In April 1984, Western issued one million shares of $2.1375 Series B Cumulative

Convertible Preferred Stock (" Series B Preferred Stock" ), convertible into Common Stock at

$5 per share, subject to adjustment. The net proceeds of $13.6 million were used to prepay $2.6

million of debt, and for payment of $5.4 million of dividend arrearages on the $2.00 Series A

Cumulative Convertible Preferred Stock (" Serie A Preferred Stock" ). In conjunction with the

is uance of the Series B Preferred Stock, the Company' lender agreed to extend the Credit

Agreement to provide a $20 million revolving line of credit through Augu t 31 , 1985. On April

2 7, 1984, We tern drew down $10 million under the Credit Agreement. In Augu t 1984,

Western drew down the remaining $10 million available under the Credit Agreement. In

13

March 1985 We tern repaid the full $20 million under the Credit Agreement, which remain

available. Subject to documentation, Western's lenders have agreed in principle to extend the

Credit Agreement through June 30, 1986.

During 1984 Western sold two Boeing 727-200 aircraft for $16.3 million.

The Company has recently entered into an agreement for the sale of a DC-10-10 aircraft

early in the second quarter of 1985, from which the Company expects to receive proceeds, net

of amounts applied to release security arrangements, of approximately $9 million.

Substantially all of Western's owned aircraft and engines are pledged as collateral for debt

and other obligations. In addition, some of the Company's agreements require that collateral

be maintained at specified levels.

Reference is made to Note 6 to Financial Statements for a discussion of Western's

covenants under debt agreements.

In November and December 1984, Western took delivery of six B737-200 aircraft and two

spare engines that were previously on order from the manufacturer. In that connection,

Western entered into 14-year operating lease agreements for the spare engines and four of the

aircraft and sold the remaining two aircraft to a foreign carrier. Western was reimbursed for

previously recorded capitalized interest and buyer-furnished equipment on the six aircraft and

spare engines.

In March 1985, Western issued $30 million of 14% Senior Notes due April 1, 1988. The net

proceeds of approximately $28.3 million will be used for general corporate purposes including working

capital.

In March 1985, Western also filed a registration statement with the Securities and Exchange

Commission for a public offering of up to 1,500,000 shares of Series D Cumulative Convertible Preferred

Stock.

Western has on order from the manufacturer three Boeing 737-300 aircraft scheduled for delivery in

the spring of 1985 at a cost of approximately $73 million, of which approximately $25 million is on

deposit. Western is currently negotiating terms for financing the aircraft; however, no commitments for

financing the aircraft have been obtained and no assurance can be given that financing will be concluded.

Failure to take delivery of these aircraft could result in significant assessments against Western for

manufacturer's damage claims. An additional 12 Boeing 737 aircraft are scheduled for delivery during

1986 through 1988 for which no financing has yet been arranged. If the changes in investment tax credits

and deductions for accelerated depreciation proposed by the Treasury Department were to be adopted the

Company's ability to arrange lease financing for the acquisition of aircraft could be adversely affected. See

Note 3 to Financial Statements.

14

ITEM 8. FINANCIAL STATEMENTS

ACCOUNTANT'S REPORT

The Board of Director

We tern Air Line , Inc.:

We have examined the balance heet of Western Air Lines, Inc. as of December 31 , 1984 and 1983

and the related statements of operation , hareholders' equity and changes in financial po ition for each of

the years in the three-year period ended December 31, 1984. Our examination were made in accordance

with generally accepted auditing tandards and, accordingly, included such te ts of the accounting record

and such other auditing procedure a we considered nece sary in the circum tance . In connection with

our examinations of the financial statements, we have al o examined the upporting chedules a li ted in

the index located elsewhere in thi Form 10-K.

In our opinion, the aforementioned financial statements pre ent fairly the financial position of

Western Air Lines, Inc. at December 31, 1984 and 1983 and the results of its operations and the change in

its financial position for each of the years in the three-year period ended December 31 , 1984, in conformity

with generally accepted accounting principles applied on a consistent basi . Also in our opinion, the

related supporting schedules, when considered in relation to the basic financial tatement taken as a

whole, present fairly in all material respects the information set forth therein.

Los Angeles, California

February 19, 1985, except for the twelfth

and thirteenth paragraphs of Note 6,

which are as of March 20, 1985.

PEAT, MAR WICK, MITCHELL & CO.

15

Current Assets:

WESTERN AIR LINES, INC.

BALANCE SHEETS

(In thousands of dollars)

ASSETS

Cash and cash equivalents ..................................................... : ....................... .

Receivables ( less allowance for doubtful accounts of $12,551 - 1984 and

$8, 758- 1983)

Flight equipment expendable parts at average cost ( less allowance for

obsolescence of$18,068- 1984 and $17,073- 1983) .............................. .

Prepaid expenses ............................................................................................ .

Other current assets ........................................................................................ .

Total current assets ................................................................................. .

Property and Equipment at Cost:

Flight equipment ............................................................................................ .

Facilities and ground equipment ................................................................... .

Deposits on equipment purchase contracts ................................................... .

Less accumulated depreciation and amortization ........................................ .

Other Assets ........................................................................................................... .

See accompanying Notes to Financial Statements.

16

December 31,

1984 1983

$ 57,476 $ 46,336

81,486 91 ,019

18,652 21,238

11,946 34,957

3,789 3,648

173,349 197,198

856,049 851 ,83 1

154,482 144,9 15

42,921 35,108

1,053,452 1,03 I ,854

442,327 436,879

611 ,125 594,975

19,121 19,991

$803,595 $812,164

Current Liabilities:

WESTERN AIR LINES, INC.

BALANCE SHEETS

(Jn thou and of dollar )

LIABILITIES AND SHAREHOLDERS' EQUITY

Current installment of debt .......................................................................... .

Current in tallment of capital lease ............................................................ .

Notes payable ................................................................................................ .

Account payable ........................................................................................... .

Airline traffic liability ..................................................................................... .

Salarie , wage and vacation benefit payable ............................................. .

Accrued pension plan contributions .............................................................. .

Other current liabilities .................................................................................. .

Total current liabilitie ........................................................................... .

Long-term Obligation , Less Current Installments:

Debt ................................................................................................................ .

Capital leases ................................................................................................. .

Deferred Credits and Other Liabilities:

Deferred taxes on income .............................................................................. .

Deferred gain on sale and lea e-back of aircraft .......................................... .

Other ............................................................................................................... .

Shareholders' Equity:

Preferred stock-authorized 25,000,000 hares:

$2 Series A Cumulative Convertible, $25 tated value per share.

Liquidation preference at stated value plus accrued and unpaid

dividend , out tanding 1,196,270 shares-1984 and 1983 ............... .

$2.1375 Serie B Cumulative Convertible, $1 stated value per hare.

Liquidation preference at $15 per share plu accrued and unpaid

dividends, outstanding 979,500 shares-1984 .................................. .

Common stock-authorized 70,000,000 shares $1 par value per share,

out tanding 24,147,290 shares-1984 and 24,085,790 hare - 1983 ..... .

Additional paid-in capital .............................................................................. .

Retained earning (deficit) ........................................................................... .

Commitment and Contingent Liabilities

See accompanying ote to Financial tatement .

17

December 31,

1984 1983

$ 64,948 $ 30,958

7,739 12,353

2,275 3,642

55,357 63,890

79,603 78,822

36,210 43,090

14,950 7,387

16,533 22,584

277,615 262,726

335,531 337,424

92,682 100,429

428,2 13 437,853

10,328 l 0,328

2,334 4,667

22,638 9,930

35,300 24,925

29,907 29,907

980

24,147 24,086

87 464 83,533

(80031) ( 50 866)

62 467 86 660

$803,595 $812,164

WESTERN AIR LINES, INC.

STATEMENTS OF OPERATIONS

(In thousands of dollars except per share amounts)

Year ended December 31,

1984 1983 1982

Operating Revenues:

Passenger .................................................................................. $1,041,412 $ 993,428 $ 925,735

Cargo ........................................................................................ 69,293 72,195 68,020

Contract service and other ....................................................... 71,180 76,939 71,515

1,181,885 1,142,562 1,065,270

Operating Expenses:

Wages, salaries, and employee benefits .................................. 412,108 422,741 368,503

Fuel .......................................................................................... 300,198 319,980 311,999

Depreciation and amortization ............................................... 59,565 59,379 61,751

Other ......................................................................................... 398,602 396,834 353,815

1,170,473 1,198,934 1,096,068

Operating income (loss) .................................................. 11,412 (56,372) (30,798)

Other Income (Expenses):

Interest, principally on long-term obligations ......................... (64,136) (54,542) (49,195)

Interest capitalized ................................................................... 6,070 2,977 2,508

Interest income ......................................................................... 3,642 2,480 5,604

Gain on disposition of property and equipment.. ................... 11,279 8,956 7,385

Gain on foreign currency translation ...................................... 1,208

Other, net ................................................................................. 1,360 166 994

(40,577) (39,963) (32,704)

Loss before income taxes and extraordinary item .......... (29,165) (96,335) (63,502)

Income taxes (benefits) .................................................................. (330) (3,556)

Loss before extraordinary item ........................................ (29,165) (96,005) (59,946)

Extraordinary Item:

Gain on pension plan terminations ......................................... 41,520 15,930

Net loss ............................................................................. $ (29,165) $ (54,485) $ (44,016)

Loss per Common Share:

Before extraordinary item ........................................................ $ (1.37) $ ( 6.22) $ ( 4.78)