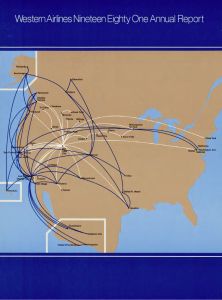

Our Cover:

On May 1, 1982, Western will launch a major

restructuring of its route system . The key feature

will be the establishment of a hub-and-spoke oper-

ation at Salt Lake City where arrival and departure

times of flights will be coordinated to provide

connecting services to a broad range of destina-

tions. This system will permit Western to "feed "

its flights with passenger and cargo from connect-

ing services and will increase fleet utilization .

Routes serving the new hub are shown in white.

Description of Business

Western Air Lines, Inc. is a certificated air carrier

originally organized in 1925. The company is

engaged in one industry - the scheduled air trans-

WESTERN

AIR LINES,

INC.

1981

ANNUAL

REPORT

portation of passengers, air cargo and mail . It

serves cities in the United States, Canada and

Mexico.

LETTER TO SHAREHOLDERS

1981 was a disastrous year for Western Airlines.

Capped by a fourth quarter loss of $56.1 million ,

the largest quarterly deficit in company history,

Western experienced a net loss of $73.4 million

for the year.

There were a number of reasons for this result:

a recession-related slowdown in air travel , excess

capacity in the marketplace, rate wars that diluted

revenues, and continuing inflation that drove up

costs. Hardest hit by these conditions were a

number of established carriers like Western that

had developed their route systems and their cost

structures in the regulated environment that ex-

isted prior to October 1978 and had not changed

them significantly since that time.

These systems, based almost entirely on point-

to-point linear routes, were generally profitable

during the era of controlled competition . However,

because this type of system does not produce

or control connecting traffic, linear routes are

vulnerable to competition and rate wars. Com-

2

pounding the problem for Western was the fact

that it had higher costs than many of its com-

petitors, which left the company in the position

of either matching competitors fare cuts at a loss

or abandoning markets.

When I came to Western Airlines on December

8, I found the company on the verge of collapse.

It had lost money for two years and monthly losses

had increased at a frightening rate. It was virtually

out of cash, and because it was not in compliance

with certain tests under its loan agreements, it was

unable to borrow additional funds. As a conse-

quence, Western had retained bankruptcy counsel ,

which the new management team decided was

premature. A thorough analysis of the problems

showed that in order to survive and prosper West-

ern would have to make major changes in its

structure and its way of doing business and that

it must develop a strategy that would be respon-

sive to the deregulated environment.

We determined that because of its sizeable

fixed costs the company would have great diffi-

culty becoming profitable by shrinking to a new

size or shape. Under-utilized aircraft and facilities,

which could not be disposed of at anywhere near

their true value, would have to be put to more

productive use along with Western's employees.

In short, we would have to fly our way back into

the black by doing more, not less. And in order

to do this and survive, we would have to control

our costs.

As essential elements of this plan we concluded

that we would have to:

develop a new marketing organization and a

more competitive marketing philosophy;

reduce overhead costs by eliminating excess

layers of management, by cutting salaries and

by getting more productivity out of those who

remain ;

obtain from unionized employees wage cuts

and changes in work rules that would increase

productivity;

convince our lenders that we have formulated

a workable short-term survival plan and a long-

term strategy for profitability in order to obtain

additional working capital and waivers of defaults

under existing loan agreements.

Programs to accomplish all of these objectives

are well underway.

On May 1, Western will launch the most dramatic

route realignment in its history. The new route

system will reflect our conviction that the proper

role for Western Airlines is as a strong regional

carrier serving the West through a strategically

located hub and a cohesive pattern of regional

service. Our objective is to develop a hub-and-

spoke system that will enable us to control a greater

share of the passenger and cargo travel that

emanates from cities we serve. Western's hub will

be at Salt Lake City, a city that is located in a rapidly

growing region , is near the center of our route

system and is an established Western city in which

we have excellent facilities and a long history of

service. Most flights from throughout our system

will be routed through Salt Lake City where con-

nections will be available to other Western cities.

We will strengthen the hub furth.

er by inaugurat-

ing service to new cities in the West and to New

York City, Baltimore and Washington , D.Cs Dulles

Airport. Our Seattle/Tacoma gateway to Alaska

and California gateways to Mexico and Hawaii

also will be strengthened by direct links with the

Salt Lake City hub.

Implementation of these changes will not

require additional aircraft or other major capital

expenditures. The realignment will be achieved

by increasing the use of existing resources. For

example, we will increase the average daily utili-

zation of our fleet by almost two hours per day

per aircraft. This figure will rise even more as

additional routes .and schedules are blended

into the new system .

Our marketing strategy will be very simple. We

will price our product competitively, prqvide good

schedules and service and make it easy for our

customers to do business with us by answering

our reservations phones promptly, simplifying our

fare structure and making ticketing easier.

In order to be a tough competitor we also must

reduce our costs to a level that will permit us to

make a profit from the low fares that now dominate

3

and will conti

nue to dominate high-density routes.

Since December, we have been taking the

necessary steps to lower Western's costs. We have

reduced annual payroll costs for the management

staff, have obtained wage concessions from some

of our unionized employees and we are attempt-

ing to obtain similar concessions from the re-

maining group. Although our new schedules and

contractual concessions from our pilots will pro-

vide some gains in productivity, we need more

and are working toward that end.

We are confident that the route realignment and

our marketing program will stimulate traffic over

the Western system and increase revenues. We

are not optimistic that we will receive any help from

an improvement in the economy in 1982 nor are

we relying on such an upswing to make Western

profitable, although such a development certainly

would be beneficial and welcome.

The key to 1982 and the future of Western

Airlines lies in our ability to control our costs and

increase the productivity of our work force. We

believe that Western can be a viable company.

Your management is doing everything possible

to ensure that this objective is achieved as soon

as possible.

Chairman and Chief

Executive Officer

April 22, 1982

The Year At A Glance

(in millions of dollars)

Operating revenues

Operating expenses

Operating loss

Other Income (Expenses):

Interest expense, net

Gain on disposition of equipment

Other-net

Loss before income taxes

Income tax

Net loss

Passengers carried (000)

Available seat miles (000,000)

Revenue passenger miles (000,000)

Passenger load factor - actual %

- breakeven %

1981

$1 ,059.8

1,125.8

(66.0)

(45.0).

16.9

1.3

(92.8)

(19.4)

$ (73.4)

8,402

14,496

8,548

59.0

65.8

4

1980 % Change

995.7 6

1,041.5 8

( 45.8) 44

(38.5) 17

32.1 (47)

3.0 (57)

(49.2) 89

(19.6) ( 1 )

(29.6) 148

9,130 (8)

15,516 (7)

8,832 (3)

56.9 4

62.0 6

MANAGEMENT'S DISCUSSION

Results of Operations

The last several years have been very difficult

for Western. The company reported net losses in

1980 and 1981 and a 24 percent decline in net

profits in 1979. Prior to December 1981, when

the company's new management embarked on a

rebuilding program , the company had responded

to this downturn by reducing its production of

available seat miles (ASM's) in 1981 and 1980.

Since 1979 ASM 's have decreased 13 percent;

however, revenues escalated 14 percent because

of fare increases. This level of revenue growth

was not adequate to support the cost base

Western had established in the regulated environ-

ment. Operating expenses increased 23 percent

from the 1979 level, more than offsetting the 14

percent increase in revenues and creating the

company's substantial operating losses.

The largest contributor to the rise in operating

expenses was fuel costs, which increased 45

percent since 1979. Consumption actually de-

creased du ring this period by 21 percent but the

average cost per gallon increased 82 percent,

from $0.57 in 1979 to $1.04 in 1981. Early in 1982

fuel prices dropped to slightly under $1.00 per

gallon. They are expected to remain at this level

or decline slightly throughout 1982.

Wages, salaries and employee benefits in-

creased by nearly $47 million from 1979 through

1981 despite the fact that the number of em-

ployees decreased by more than 1,100 during

that period . The company is currently negotiating

with its labor unions to reduce wage levels and

increase productivity during 1982. Labor costs

for the company in 1982 and subsequent years

depend in large part on these negotiations.

Other operating expenses, which are suscep-

tible to inflationary pressures, include costs such

as aircraft and ground equipment rentals, adver-

tising and commissions. Commission expense in-

creased 20 percent from 1980 to 1981 , reflecting

the impact of deregulation on the industry. Because

scheduled carriers are no longer permitted to

jointly establish travel agency commission rates,

competition for the agents' business has forced

commission rates up. This has resulted in increas-

ing the commission rate paid by Western to travel

agents from an average of 8.9 percent in 1980

to 10.4 percent in 1981. Also, higher fares and

increased ticket purchases through agencies

5

have contributed to the rapid growth in commis-

sion expense. These conditions are not expected

to change in 1982.

New equipment financed at higher interest

rates, as well as a higher level of interest rates

in general, have resulted in increased interest

expense of the company in 1979, 1980, and 1981.

Depreciation expense also has increased because

of significant equipment purchases. In 1981 ,

sales of aircraft helped maintain the level of depre-

ciation expense despite the acquisition of three

new aircraft.

For a detailed discussion of the impact of infla-

tion on operating results see Note 13 to financial

statements.

Western's operations have been affected in

these years by activities within the industry. In

1981 , revenues during the peak season of the third

quarter were reduced slightly by the walkout of air

traffic controllers on August 3. The grounding of

the DC-10 aircraft in 1979 affected operations in

that year, as did strikes against major competitors.

Liquidity

During the first six months of 1981 Western

was able to fund current operations and debt

repayment with cash generated from operations

and the sales of excess aircraft. In addition, $30

million of the $50 million outstanding at December

31 , 1980, on its revolving line of credit was repaid .

In the second half of 1981 , however, traffic and

revenues were significantly lower than anticipated .

Operations no longer generated enough cash

to meet operating requirements. The company

borrowed additional funds of $20 million from

two foreign banks and $7 million on its revolving

line of credit. During that same period the com-

p~ny also sold and leased back two 737s and sold

tax benefits under the provisions of the Economic

Recovery Tax Act of 1981 , generating cash of

approximately $11 million and $5 .6 million , re-

spectively. Throughout 1981 Western made all

scheduled debt payments and paid preferred

dividends regularly.

The effects of the losses on retained earnings

and equity resulted in Western's default of some

of the covenants of its various loan agreements.

Since these defaults allow certain of Western's

lenders to demand immediate payment of the total

amounts owed to them and because Western

has not obtained waivers for a period in excess

of one year, a portion of the long-term debt has

been classified as current. Decisive steps have

been taken by Western to cut its labor force ,

reduce the wages paid to remaining employees,

modify current labor contracts, negotiate the sale

of additional assets and negotiate additional loan

and security agreements with its various lenders.

Western entered into agreements in January

1982 with its lenders to waive the company's

defaults under its loan agreements until June 10,

1982. Western also entered into an agreement

with its previously unsecured lenders to secure

their loans with 29 of Western's aircraft and 77 of

its engines. In addition , the company obtained a

$30 million line of credit due April 30, 1982, all of

which had been drawn down as of March 15,

1982. (See Note 6 to financial statements.) The

company is continuing to negotiate with its lenders

to restructure a portion of its debt. This restruc-

turing is essential to the continuing operations of

the company. Western has entered into agree-

ments with third parties to sell certai n other assets,

which will generate approximately $31 million .

Western is required to use the proceeds from

asset sales to pay off any amounts outstanding

on the new line of credit. See Note 14 to financial

statements.

Capital Resources

Western has on order six 767 aircraft and three

767 spare engines, the deliveries of which have

been delayed until 1984 and 1985. The total com-

mitment for the acquisition of these aircraft and

spare engines is approximately $305 million . Long-

term secured debt or capital lease financing is

expected to be utilized to finance these acquisi-

tions although no assurances can be given that

su_

ch methods of financing will be available. West-

ern also holds options for the purchase of six

additional 767s which would be delivered in 1985

and 1986. (See Note 3 to financial statements.)

Shareholders and Stock

As of December 31 , 1981 , there were 13,043,621

shares of Western common stock outstanding

held by approximately 15,000 individuals and insti-

tutions. Holders of the common stock last received

a dividend in the t_

hird quarter of 1980. Because of

continuing losses, Western has not paid a dividend

on the common stock since that time. Retained

earnings available for payment of common stock

dividends are restricted by various debt agree-

ments. At December 31, 1981 , no retained earn-

ings were available for dividends on common or

preferred stock.

Western has 2,992,300 shares of common

stock reserved for issuance upon conversion of

its preferred stock and an additional 1,952,554

shares reserved for issuance upon conversion of

its 5% Convertible Subordinated Debentures.

At December 31 , 1981 , there were 1,196,920

shares of the $2.00 Series A Cumulative Con-

vertible Preferred Stock outstanding held by 1,353

individuals and institutions who have been paid

regular quarterly dividends. On January 29, 1982,

Western's board of directors voted to defer pay-

ment of the quarterly dividend payable at the end

of March 1982 on the preferred stock. This is the

first preferred stock dividend to be omitted since

the stock was issued in September 1977. If six

consecutive dividends are omitted , the holders of

the preferred stock have the right, voting as a

class, to elect two board members. See Note 6

to financial statements.

Western's common and preferred stock are

traded on the New York and Pacific Stock

Exchanges.

Market Prices

Common Stock Preferred Stock

1980 High Low High Low

First Quarter 11 % 6 29 19

Second Quarter ?'fa 6 23Ya 19

Third Quarter 8 6 24 21

Fourth Quarter 10 6 25 20%

1981

First Quarter 10 8 26. 21

Second Quarter 11 8 30 22Ya

Third Quarter 11 6 29 15%

Fourth Quarter 8Ya 4% 20 14

On December 8, 1981 , the Board of Directors

of Western elected Neil G. Bergt as Chairman

and Chief Executive Officer. Bergt is a principal

shareholder of Eagle International Corporation

(Eagle), a privately held corporation which agreed

in November 1981 to acquire Wien Air Alaska, Inc.,

(Wien) from Household International , Inc.

In connection with Bergt's selection as Chief

Executive Officer, Western , Eagle, and Mr. Bergt

6

signed an agreement in principle dated December

8, 1981, regarding (a) Eagle completing its

acquisition of Wien, and (b) the preparation and

execution of a definitive agreement pursuant to

which Western shall acquire Wien or a business

combination shall otherwise be accomplished

between Western and Wien .

The letter of intent indicates that in connection

with the acquisition by Western of Wien, 5,000,000

shares of a new series of preferred stock of

Western or the surviving corporation (the "Pre-

ferred Stock") will be issued to Eagle or its share-

holders. The Preferred Stock will be convertible

into 12,500,000 shares of common stock and will

be substantially equivalent to the outstanding

Western Series A Preferred Stock, except that it

will have voting rights equivalent to those of the

common shares issuable upon conversion and

no dividends will be payable in respect of the

Preferred Stock for the first year after it is issued .

The proposed acquisition will be subject to

approval of Western's shareholders, lenders, and

the Civil Aeronautics Board .

Regulatory Matters

The required filings in the Bergt-AIA-Western-

Wien Acquisition and Control Case have been

made with the Civil Aeronautics Board, and the

board's decision should be announced by the end

of July 1982. Details of this proposed acquisition,

which is subject to approval of Western's share-

holders and lenders, are contained in proxy mate-

rials being mailed to shareholders in connection

with the 1982 Annual Meeting of shareholders,

presently scheduled for June 1982.

The Civil Aeronautics Board has approved Air

Florida System, lnc.'s application to acquire

control of Western . Air Florida had filed its appli-

cation with the CAB in July 1981 and been given

permission to purchase up to 50 percent of

Western's outstanding common stock to be

placed in a voting trust pending the outcome of

the CAB's hearings. The final CAB decision in

the matter was announced January 29, 1982. Air

Florida, which holds approximately 12.6 percent

of Western's common stock, has not announced

its intentions.

Western's planned merger with Continental

Air Lines, Inc. was thwarted by the successful

takeover of that carrier by Texas International.

7

Western withdrew from the merger agreement in

September 1981 .

With the suspension of its services to Great

Britain in late 1981 and to Nassau, the Bahamas,

earlier in the year, Western now serves three

countries - the United States, Canada, and Mexico.

In its service to Canada and Mexico, Western is

subject to conditions of bilateral agreements be-

tween these nations and the United States as well

as to policies of each of the governments with

respect to air transportation and pricing.

Service within the United States has been given

increased flexibility since the passage of the Airline

Deregulation Act of 1978. Effective January 1,

1982, Western and other air carriers have author-

ity to fly between any points within the U.S. that

they desire. However, the air traffic controllers

strike has temporarily limited flights at 22 busy

airports in the U.S.

Under terms of the Deregulation Act, the Civil

Aeronautics Board will cease to exist January 1,

1985. Certain of the Board 's functions will be

transferred to other governmental departments,

primarily the Departments of Transportation and

Justice.

Western's Fleet

In Operation* 1984/1985 1985/1986

Owned Leased Delivery Options

DC-10-10 7 3

OC-10-30

727-200 33 14

737-200 10 2

767-20Q 6 6

*As of March 15, 1982.

Western's present fleet is in compliance with fed-

eral noise regulations with the exception of the

two-engine 737s. An undetermined number of

these aircraft will be retrofitted at a cost of approxi-

mately $275,000 each in advance of the 1985

deadline for compliance.

Schedule reductions in 1981 caused Western's

traditionally high level of aircraft utilization to drop.

The 727s, which represent more than half of the

company's available seat miles, flew a daily hourly

average of 7:58, down from 8:23 in 1980, while

DC-10-10 utilization was down to 9:18 from 10:46

in 1980. Average daily hours flown by all aircraft

during 1981 was 7:57, compared with 8:24 the

year before.

Ground Properties and Equipment

Western's general office and principal overhaul

and maintenance base are located at LosAngeles

International Airport. These facilities, including

a DC-10 hangar and a parking structure com-

pleted in 1975, have been built by the company

as improvements on leased land. The lease on

the land and buildings expires in 1993, subject to

the right of the City of Los Angeles to terminate

the lease on March 31 , 1988, or any March 31

thereafter.

The company also leases hangars at Seattle/

Tacoma, San Francisco and Minneapolis/St. Paul ,

as well as terminal faci lities at all airports served ,

plus ticket and administrative offices throughout its

system. A leasehold interest in a hangar at Denver

was transferred to another carrier in March 1982.

Public airports are utilized for flight operations

generally under contractual arrangements with

municipalities or agencies controlling them .

Western's Management

Major changes took place in Western's manage-

ment structure during the latter part of 1981 and

early 1982.

On December 8, 1981 , Neil G. Bergt was elected

chairman and chief executive officer of Western .

Mr. Bergt, 46 , is chairman and sole owner of

Alaska International Industries, Inc., which has

subsidiaries active in construction , energy devel-

opment and international air cargo . He also is

the principal shareholder of Eagle International

Corporation , a privately held corporation that

was formed in November 1981 to acquire Wien Air

Alaska Inc. from Household International, Inc.

Employees

The number of Western employees during 1981

averaged 10,120, down from an average of

10,657 in 1980. Labor unions represent approxi-

mately 92 percent of Western's employees. These

unions include the Air Line Pilots Association ,

Air Transport Employees, Association of Flight

Attendants, Brotherhood of Railway and Airline

Clerks, International Brotherhood of Teamsters,

Sindicato Nacional de Trabajadores de Aviacion y

Similares and the Transport Workers Union .

Following is the contractual status of each of

these collective bargaining groups:

Number of Contract

Employees Open for

1-1-82 Union Amendment

Mechanics & Related

Employees and Stock

Clerks 1,810 IBT 1-1-83

Pilots 1,27 1 ALPA 5-1-84

Flight Attendants 1,677 AFA 1 2-31 -82

Agent & Clerical -

U.S. 3,740 ATE 7-1 -82

Canada 110 BRAC 7-1-82

Mexico 212 SNTA 1-18-83

Flight Superintendents 21 TWU 10-3 1-83

Ground School Instructors 30 IBT 1-1-83

Legal Proceedings

Western and other airlines are parties to numerous

actions in state courts wherein owners of property

located in the vicinity of major airports, primarily

Los Angeles International Airport, are seeking to

enjoin certain aircraft operations at the airport

and/or to recover damages because of aircraft

noise and engine emissions. Most of these cases

have been brought in the Los Angeles County

Superior Court against the City of Los Angeles,

which in a number of these cases has in turn cross-

complained against the airlines for indemnifica-

tion . The aggregate amount of damages sought

in cases against the city has been reported by the

city to be in excess of $57 million. The aggregate

amount of damages sought in actions to which

Western is a party as cross-defendant is in excess

of $36 million .

Western and its counsel in these actions,

O'Melveny & Myers of Los Angeles, believe that

the damages claimed are not a real istic measure

of the airlines' exposure and that in most cases

the request for relief is wholly out of proportion to

any actual damage that may have been suffered.

Western's counsel , which also represents most of

the other airlines, is of the opinion , based on the

current state of the law, that the airlines have sub-

stantial defenses to the imposition of any liability.

Moreover, in each case to date in which the issue

of the airlines' duty to indemnify the airport pro-

prietor has been tried , the airlines have obtained

favorable rulings. However, all the issues of law

involved in these matters have not been finally

settled, and , pending further judicial clarification ,

the relative rights and liabilities among such

owners of adjacent areas, the airport operators,

8

the air carriers and the federal, state, and local

governments are not entirely clear. Unfavorable

decisions against Western in these actions could

have a materially adverse effect on the company.

Further, any liability of airport operators, or

the granting of any injunctive relief against them,

could result in higher costs to air carriers, for

example through higher landing fees. In light of

this litigation , operators of certain airports, includ-

ing those at Los Angeles, Orange County, San

Diego, Calif. , and Washington , D.C.'s National,

have imposed or are considering imposition of

limitations on frequency and timing of airline

flights or upon the proportion of an airline's fleet

which may continue to operate without complying

with specified noise standards. In the case of

Orange County, the local board of supervisors

adopted an airport access plan for John Wayne

Airport which would have the effect of denying

Western access to that airport. Implementation of

the plan was enjoined by a Federal District Court

and that decision presently is on appeal . Generally

speaking , enforcement of such restrictions at a

major airport served by Western could have a

materially adverse effect upon its operations.

A number of actions have been filed in both

federal and state courts against Western and other

defendants seeking damages for death or injury

suffered in the October 31 , 1979, crash of a

Western aircraft at the Mexico City airport. Western

has ample insurance coverage for this type of

accident, although insurance may not cover liabil-

ity for punitive damages which are sought in sev-

eral of the actions premised on bodily injury. Most

of the claims arising from the accident have been

settled , and Western does not believe that such

claims for punitive damages will result in any

material liability to Western .

Western is also involved in various other liti-

gation , including cases alleging discrimination

(including age discrimination) in employment

practices. In one such action involving the ability

of Western pilots to continue after age 60 as

second officers, a judgment was entered during

1981 directing the company to allow three pilots

to continue working as second officers after

age 60 and awarding those pilots back pay and

attorneys fees. That case presently is on appeal ,

and at least one other similar action has been

filed . Western does not believe such claims will

result in any material liability to Western .

9

(In millions except per share amou nts and other items indicated by*)

Summary of Operations

Operating Revenues:

Passenger . . . . . ........ .

Carg o, charter, and other .

Total operating revenues .

Operating Expenses:

Wages, salaries, and em ployee benefits . .

Fuel.

Othera .

Total operating expenses .

Operating income (loss) ..

Interest expense, net . . ...... .

Other income, net

Earnings (loss) before income taxes and cum ulative effect

of changes in accounting princi ples .

Income taxes .

Ea rning s (loss) before cumulative effect of changes in accounting principles .

Cumu lative effect of changes in accounting principles .

Net earnings (loss) ... . .. .... .

Preferred stock dividends .

Net earn ings (loss) available for common stock

Earn ings (Loss) per Com mon Share:

Primary:

Before cumulative effect of changes in accounting principles .

Net earnings (loss) .

Fu lly diluted :

Before cumulative effect of changes in accounting principles .

Net earn ings (loss) . . ... ... ..... .... ......... .

Number of Shares Used to Com pute Earni ngs (Loss) per Share:

Primary . . ............................. .. . .

Fully diluted. . ........ . . . . . . .. ..... . ........ . ....... . .

Other Financial Data

Cash dividends paid per share of com mon stock .

Total assets ........... ........ . ........... . . . .. .. ...... .

Property and equipment-net .

Long-term obligations .

Shareholders' eq uity ........ .

Operations

Ai rplanes operated at end of year* .

Passengers carried .

Available seat miles . . ............ .

Revenue passenger miles . . . . . . . . . . . . . . . . . . ............ .

Passenger load factor - actual (%)* ......... .. ..... . ..... .. .... .

- breakeven point (%)* ...................... . .

- profit marg in (point difference)* . . ....... .

Average revenue per passenger mile* . . .... .. ..... . ..... .. ....... . . .

Average length in miles per passenger trip* . . ...... .

Operati ng expense per available seat mile* . . .. . . . ..... .. . .... ... .

Cargo revenue ton miles ... ... .......... ... ..... ... .... . . .

Average number of employees* .

(in millions of dollars except per share amounts)

1981

$ 949.6

110.2

1,059.8

403.4

326.6

395.8

1,125.8

(66.0)

(45.0)

18.2

(92.8)

(19.4)

(73.4)

(73.4)

2.4

$ (75.8)

$ (5.81)

$ (5.81)

$ (5.81)

$ (5.81)

$

13.0

13.0

$ 834.6

$ 662.4

$ 248.5

$ 121.7

70

8.4

14,495.8

8,547.9

59.0

65.8

(6.8)

$ .1113

1,017

$ .0777

151.3

10,120

1980

887.9

107.8

995.7

384.2

296.4

360.9

1,041 .5

(45.8)

(38.5)

35.1

(49.2)

(19.6)

(29.6)

(29.6)

2.4

(32.0)

(2.46)

(2.46)

(2.46)

(2.46)

13.0

13.0

0.25

917.0

718.8

435.1

197.3

71

9.1

15,515.6

8,832.1

56.9

62.0

(5.1)

.1010

965

.0671

163.2

10,657

(a) C hanges in the estimated useful lives of certain aircraft were implemented in January 1978 and October 1976. These

changes increased net income in 1978 and 1977 by approximately $1 .5, or $0.12 per share (primary) , and $2.4 , or

$0.19 per share (primary) , respective ly.

10

1979

827.7

104.4

932.1

356.6

225.7

331 .6

913.9

18.2

(24.9)

46.1

39.4

(2.1)

41.5

41.5

2.4

39.1

2.99

2.99

2.31

2.31

13.1

18.2

0.40

821 .4

634.6

318.3

232.6

76

11.2

16,630.5

10,494.8

63.1

63.2

(0.1)

.0807

926

.0550

162.0

11 ,256

1978

734.0

100.5

834.5

309.4

154.9

315.3

779.6

54.9

(20.2)

10.7

45.4

6.9

38.5

16.2b

54.7

2.4

52.3

2.82

4.09

2.15

3.04

12.8

18.2

0.40

710.1

519.7

265.7

198.5

78

10.4

16,254.9

10,634.8

65.4

61.1

4.3

.0720

994

.0480

176.3

10,787

1977

614.6

76.9

691 .5

263.1

138.0

260.9

662.0

29.5

(17.5)

7.8

19.8

7.1

12.7

12.7

0.5

12.2

0.96

0.96

0.85

0.85

12.7

15.9

0.40

574.9

427.9

214.5

147.4

77

8.8

14,963.8

8,588.8

57.4

56.1

1.3

.0734

966

.0442

157.3

10,413

1976

544.2

61.0

605.2

226.4

108.3

235 .1

569.8

35.4

( 16 3)

3.1

22 .2

8.2

14.0

14.0

14.0

1.03

1.03

0.92

0.92

13.6

16.1

0.40

515.1

378.6

192.5

112.1

75

8.1

13,450.4

7,833.8

58.2

56 .0

2.2

.0705

963

.0424

135.0

9,799

1975

465 .1

53.9

5'19.0

20 1.7

93. 1

21 1 .1

505.9

13. 1

(14.4)

4.3

3.0

( 1 .5)

4.5

7.2

11. 7

11 .7

0.30

0.77

0.29

0.70

15.2

17.6

0.47

488 .3

367 .6

175.4

133.9

75

7.5

11 ,696.5

7,102.9

60.7

59 .7

1 .0

.0665

942

.0433

108.6

9,357

1974

437.3

51.1

488.4

182.3

71.4

192.5

446.2

42.2

(15.3)

13.8

40.7

17.2

23.5

23.5

23.5

1.55

1.55

1.38

1.38

15.1

17.6

0.39

448.8

350.3

167.4

129.3

72

7.4

11 ,123.5

6,747 .5

60.7

56.1

4.6

.0660

902

.0401

95.2

9,696

1973

376.7

44.6

42 1.3

165.4

44.5

168.3

378.2

43. 1

(13.0)

4.2

34.3

14.4

19.9

19.9

19.9

1.32

1.32

1.18

1 .18

15.1

17.5

0.23

431 .7

316.4

178.0

110.8

74

7.4

11,175.5

6,476.1

57 .9

52.5

5.4

.0593

877

.0338

76.5

9,826

(b) Effective January 1, 1978, Western changed its method of accounting for post-1971 investment credi ts for financial

reporting purposes from the deferral to the flow-through method . The cumulative effect of the change, amounting

to $16.2, has been included in net earnings for 1978.

11

1972

342.9

31 .1

374.0

147.3

40.1

160.8

348.2

25.8

(11 .8)

2.7

16.7

5.9

10.8

10.8

10.8

0.72

0.72

0.66

0.66

15.0

17.5

0.08

372.7

262.1

158.6

94.4

71

6.9

10,300.2

5,995 .9

58.2

54.6

3.6

.0578

865

.0338

76.2

9,383

December 31 , 1981 and 1980

(in thousands of dollars)

ASSETS

Current Assets:

Cash (Note 6) . . . . .. . ..... . . . . . .. .

Temporq.ry investments ..... . . . . . . . . .

Receivables (less allowance for doubtful accounts

of $2,959 - 1981 and $2,379 - 1980) . . .

Receivable from sale of aircraft (Note 11) . . .

Flight equipment expendable parts at average cost

(less allowance for obsolescence of $15,422 - 1981

and $14,062 - 1980) ... .

Prepaid expenses and other current assets .

Total current assets . . .. .... .

Property and Equipment at Cost (Notes 2, 3, and 6):

Flight equipment . . . . . . . . . . . . . . . . . . . ... . .. .

Facilities and ground equipment .. ... .... . . . ... .. . .

Deposits on equipment purchase contracts .. . . .... .. . . .. . . .. . .. .. .

Less allowance for depreciation and amortization .... .

Deferred Charges and Other Assets . .. . .. . .. . .. . .. . .. . . .. . . . . .

See accompanying notes to financial statements.

12

1981

$ 24,057

24,057

89,311

20,212

20,953

12,646

167,179

828,276

139,400

21,508

989,184

326,737

662,447

4,944

$834,570

1980

8,759

25 ,579

34,338

121,859

26,908

8,025

191 ,130

848,111

130,703

37 ,966

1,016,780

297,962

718,818

7,100

917 ,048

LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities:

Current portion of debt (Note 6) . . .... . ........... ... .... .

Current portion of capital leases (Note 2) . . ............. . .. .

Notes payable (Note 6) . . . . ..... . ..... . .... .

Long-term debt classified as current (Note 6) ..... . .... . .... . . .

Accounts payable .

Airline traffic liability . . . . . ....... . . .

Salaries, wages and vacation benefits payable . . . . . . . . ....... .

Accrued liabilities . . . . . .. . ...... .

Total current liabilities . .......... .

Long-term Obligations:

Debt (Note 6) . . . . . .. . . . .

Capital leases (Notes 2 and 6) ..

Deferred Credits and Other Liabilities:

Deferred taxes on income (Note 5). . .... .. ... . .

Deferred gain on sale and lease back of aircraft (Note 11).

Other . . . . . . . . . . . . . . . . . ... .

Shareholders' Equity (Notes 6, 7, and 9):

Preferred stock - authorized 25,000,000 shares

$2.00 Series A Cumulative Convertible

$25.00 stated value per share

Issued 1,196,920 - 1981 and 1,196,940 - 1980 ...

Common stock - authorized 35 ,000,000 shares

$1 .00 par valu_

e per share

Issued 13,043,621 - 1981 and 13,030,915 - 1980 .......... . ...... .

Additional paid-in capital . . . . . . . . . . . . . . . . . . ..... .

Retained earnings . . . . . .............................. .

Commitments and Contingent Liabilities (Notes 2 and 3)

13

1981 1980

$ 26,650

7,962

20,000

153,369

76,504

81 ,006

41 ,838

24,460

431 ,789

149,331

99,184

248,515

11 ,002

9,335

12,265

32,602

29,923

13,044

31 ,062

47,635

121 ,664

$834,570

23,756

7,183

58,965

90,058

43,624

22,947

246,533

353,525

81 ,526

435,051

29,067

9,051

38, 11 8

29,923

13,031

30,963

123,429

197,346

917 ,048

Years ended December 31, 1981 , 1980 and 1979

(in thousands of dollars except per share amounts)

Operating Revenues:

Passenger . . . . . . . . . . . . . . . . . .. ........ . .. .. . .

Cargo . . ..... . .... . . . . . . . . . . . . . . . . . ...... .

Charter and other . . . . . . . . .. . .... .

Operating Expenses:

Wages, salaries, and employee benefits (Note 4) . . ...... .

Fuel .... ........ . ... . ........... . . ........ ... .

Depreciation and amortization ....... ... .

Other . . . . . . . . . . . . . . . . . . . . . . ... . . ... . ..... .

Operating income (loss) . . . .. . . ................ .

Other Income (Expenses):

Interest, principally on long-term obligations ... .. ...... .

Interest capitalized . . . . . . . . . .. . . .... .

Interest income . . . . . . . . . . . ....... .

Gains on disposition of equipment . . . . . ..... .

Settlement with vendor ..

Other, net (Note 11 ) . .... . .... . ... .

Earnings (loss) before income taxes .

Income taxes (Note 5) ..... .

Net earnings (loss) . .. . . .. .

Earnings (Loss) per Common Share (Note 8):

Primary . . . . .. .. . . . . ...... . .. . . .

Fully diluted .. ..... .

See accom panying notes to financial statements.

14

1981

$ 949,576

62,983

47,282

1,059,841

403,428

326,606

63,632

332,129

1,125,795

(65,954)

(49,836)

4,805

4,641

16,869

(3,333)

(26,854)

(92,808)

(19,408)

$ (73,400)

$

$

(5.81)

(5.81)

1980

887,901

63,82 1

44,033

995,755

384,201

296,365

61 ,310

299,640

1,041,516

(45,76 1)

(43,507)

4,940

3,168

32 ,099

(178)

(3,47 8)

(49,239)

(19,607)

(29 ,632)

(2.46)

(2 .46)

1979

827 ,675

61,209

43,235

932, 11 9

356,62 1

225,682

50,058

28 1,522

913,883

18,236

(29,600)

4,706

4,957

31 ,332

10,000

(192)

21,203

39,439

(2,101)

41 ,540

2.99

2.31

Years ended December 31 , 1981, 1980 and 1979

(in thousand s of dollars)

Sources of Working Capital:

Earnings (loss) . . . . . . . . . . . ........ .

Add (Deduct) Items Which did not Affect Working Capital:

Depreciation and amortization . . . . . .. . .. .

Deferred income taxes . . .. . ..... .

Gains on disposition of equipment .

Other . . . . . .. . ...... .

Total provided (used) by operations . . . ..... .

Reimbursements of deposits and capital expenditures

upon acquisition of aircraft. . . .. . .. .

Proceeds from disposition of equipment .. .

Proceeds from issuance of long-term obligations ..

Other, net . . . . . . . . . . . . . . . . . . . ....... .

Total sources ....... .

Applications of Working Capital:

Purchase of and deposits on property and equipment .

Reduction of long-term obligations including transfers

to current liabilities .

Long-term debt classified as current (Note 6) ..

Cash dividends. . . .... ..... .

Total applications ........ .

Decrease in working capital .

Summary of Increases (Decreases) in Working Capital:

Cash and temporary investments ........ .. ........ . . .

Receivables - trade . . . .................... .

- from sale of aircraft ......... . ... . .. . ... .

Expendable parts and prepaid expenses . . ....... .

Current liabilities - long-term debt classified as current .

- other . . ......... .

Decrease in working capital . .... . . . .. .. .. .. .

See accompanying notes to financial statements.

15

1981

$ (73,400)

61,780

(18,617)

(16,869)

(4,005)

(51 ,111)

15,457

61 ,208

73,212

4,000

102,766

49,810

106,400

153,369

2,394

311 ,973

$(209,207)

$ (10,281)

(32,548)

20,212

(1 ,334)

(153,369)

(31 ,887)

$(209,207)

1980

(29,632)

60,146

(21 ,2 19)

(32 ,099)

(3,557)

(26,361)

10,746

50,120

198,350

172

233,027

171 ,123

81 ,667

5,652

258,442

(25,415)

(15,975)

16,568

9,143

(35 ,151 )

(25,415)

1979

41 ,540

49,581

(4,788)

(31 ,332)

(4,706)

50,295

10,563

50,950

104,941

(5,097)

211 ,652

182,752

52 ,402

7,604

242,758

(3 1,106)

(2 1,147)

13,252

3,718

(26,929)

(3 1,106)

Years ended December 31 , 1981, 1980 and 1979

(In thousands of dollars)

Preferred Stock Common Additional Total

$25.00 Stated Stock $1.00 Paid-in Retained Shareholders'

Value Par Value Capital Earnings Eq uity

Balance at January 1, 1979 . ....... $29,923 13,010 30,792 124,777 198,502

Exercise of stock options . . 17 132 149

Conversion of debentures . 3 35 38

Net earnings ... ......... 41 ,540 41 ,540

Cash Dividends:

Preferred stock . . .. . (2, 394) (2 ,394)

Common stock ...... ........ (5,210) (5 ,210)

Balance at December 31 , 1979 ... 29,923 13,030 30,959 158,713 232,625

Conversion of debentures . 4 5

Net loss .. .. .. (29,632) (29,632)

Cash Dividends:

Preferred stock. (2,394) (2 ,394)

Common stock . (3,258) (3,258)

Balance at December 31 , 1980 ..... 29,923 13,031 30,963 123,429 197,346

Exercise of stock options . .

. . .

. . .

12 90 102

Conversion of debentures ... 1 9 10

Net loss ...... . ....... (73,400) (73,400)

Cash Dividends:

Preferred stock (Note 9) . (2,394) (2 ,394)

Balance at December 31 , 1981

(Notes 6, 7, and 9) . ... . .. . $29,923 13,044 31 ,062 47 ,635 121 ,664

See accompanying notes to financial statements.

16

(In thousands of dollars except per share amounts)

Note 1. Summary of Significant Accounting Policies

Property and Equipment

Owned property and equipment, exclusive of residual values, are depreciated over the estimated useful lives by the

straight-li ne method . Assets recorded under capital leases are depreciated over the life of the lease by the straight-line

method . The estimated useful lives and residual values of owned aircraft are as follows:

Estimated Residual

Useful Life Value

DC-10 . . . . . . . . . . . . . . . . . . . . . . . . . . 16 years 10%

727 .... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 years 15%

737 . 14 years 15%

Estimated useful lives of ground equipment range from four to ten years. Bu ildings and improvements on leased

property are depreciated over the life of the lease. Depreciation expense for assets recorded under capital leases is

included in depreciation and amortization expense

Interest Capitalized

Certain interest costs, primarily related to deposits on aircraft purchase contracts, are capitalized and amortized

over the lives of the related assets.

Investment Credits

Investment cred its are accounted for by the flow-through method .

Obsolescence of Expendable Parts

An allowance for obsolescence of expendable parts is accrued over the estimated useful lives of the related aircraft types.

Airline Traffic Liability

Passenger ticket sales are recorded as a current liability until recognized as revenues for services provided by

Western , refunded , or billed by other carriers for transportation provided by them .

Note 2. Lease Commitments

Western leases certain flight equipment and facilities and ground equipment. Lease terms for flight equipment are 11

to 15 years for 727 aircraft, 4 years for737 aircraft, and 15 to 18 years for DC-10 aircraft. Lease terms for facilities

and ground equipment range up to 29 years. Interest expense is accrued on the basis of the outstanding obligations

under capital leases. Equipment under capital leases included in the balance sheets at December 31 , 1981

and 1980, follows:

1981 1980

Flight equipment . $137,283 113,2 19

Ground equipment ................................... . 2,006 2,006

139,289 115,225

Less allowance for depreciation . 57,501 49,028

$ 81 ,788 66,197

At December 31 , 1981 , minimum lease payments under leases expiring after December 31 , 1982, were as follows:

Capital Operating

Leases Leases

1982 . $ 20,451 22,619

1983 .. . ....... . 20,399 21 ,429

1984 .. 19,969 19,588

1985 . 15,784 16,223

1986 . 15,790 12,784

Thereafter . 100,113 106,688

Total minimum lease payments . 192,506 199,331

Less: Amount representing interest 85,360

Present value of obligations - capital leases 107,146

Less: Current portion of capital leases 7,962

Long-term obligations - capital leases . $ 99,184

See the second and th ird paragraphs of Note 6 regarding defaults and potential payment acceleration.

Rental expense for operating leases amounted to $25,967, $20,050, and $17,384 in 1981 , 1980, and 1979, respectively.

Note 3. Commitments and Contingent Liabilities

At December 31 , 1981 , Western had on firm order flight equipment which included six 767-200 aircraft scheduled

for delivery in 1984 and 1985 and three 767 engines scheduled for delivery in 1984. Western recorded advance

deposits on these orders which amounted to $15,799 as of December 31 , 1981 . The balance of the purchase price

on delivery will be approximately $288,700.

17

Outstanding commitments for flight equipment modificati on and spare parts amounted to approximately $3,300

and for facilities and ground equipment amounted to approximately $1,100 as of December 31, 1981.

Western has options to purchase six 767-200 aircraft for delivery in 1985 and 1986 . Deposits on these options

amounted to $1,125 at December 31, 1981.

For information regarding the status of legal proceedings at December 31, 1981, see " Legal Proceedings" on

pages 8 and 9 of this report.

Note 4. Retirement Plans

Western has retirement plans, including a union-sponsored plan, which cover substantially all employees. Western's

contributions to the Company-sponsored plans, together with the participants' required contributions, are sufficient

to fund current service costs annually and prior service costs over ten to twenty years. Actuarial gains and losses are

amortized over ten year periods.

Western participates in a collectively bargained multi-employer pension plan and is therefore subject to the provisions

of the Multi-employer Pension Plan Amendments Act of 1980. Under this complex law the union plan Board of

Trustees, as sponsor, is required to obtain an actuarial valuation of the present value of vested and nonvested

accumulated plan benefits. Western has been advised that its share of the liability for unfunded vested benefits in thi s

plan is not available. According ly, the table that follows excludes data applicable to this multi-employer pension plan.

A comparison of accumulated plan benefits and plan net assets for the Company-sponso red defined benefit

plans follows:

Jan uary 1,

1981 1980 1979

Actuarial Present Value of Accumulated Plan Benefits:

Vested . $140,331 137,246 114,597

Nonvested . . . . '

. . . . 11 ,984 9,876 9,015

$152,315 147,122 123,612

Net assets available for benefits . $163,995 139,000 111 ,559

The weighted average assumed rate of return used in determining the actuarial present value of accumulated plan

benefits was six percent for all years.

The cost of the retirement plans, including the union-sponsored plan , charged to operating expense, was $34,711 ,

$34 ,193 and $30,304 for 1981 , 1980 and 1979, respectively, which included amortization of prior service costs over

periods ranging from ten to twenty years for certain of the plans.

Note 5. Income Taxes

Income taxes are summarized as follows:

1981 1980 1979

Current

Federal:

Provision .

i ,

Ii I I I I I 0 0 I

(3,647) 18,901

Investment credits applied . . . . . . . .... 5,75 1 (17,792)

2, 104* 1,109*

State. (791) (492) 1,578

Deferred :

Provision ... . . . . . . . . . . (12,974) (5 ,073) (5,597)

Operating loss carryforward recognized . (5,091) (15 ,533)

Investment Credits:

Applied . . . . . . . . . . .

. . . . . . . . . . . . . .

5,697 (16,420)

Transferred to current . ... . .. . . . (5,751) 17,792

(18,065) (20,660) (4,225)

Amortization of deferred investment credits . (552) (559) (563)

$ (19,408) (19,607) (2,101)

*The Tax Reform Act of 1976 provided for 90% application of unapplied investment credits against Federal income tax liabilities for

1979. This application was reduced to 80% for 1980. Under the Revenue Act of 1978 the application remains at 80% in 1981 and

retu rns to 90% for 1982 and beyond

Deferred income taxes arise from timing differences between fi nancial and tax reporting. The effects of these differ-

ences on income taxes are as follows:

1981 1980 1979

Depreciation and amortization . . ... . .. . . . $ (13,409) (3,454) (4,825)

Sale of tax benefits . . . ..... . 2,560

Capital leases . (1,754) (1 ,084) ( 114)

Interest capitalized . 1,1 83 1,140 1,903

Employee benefits . (847) (718) (1,626)

Other . (707) (957) (935)

$ (12,974) (5 ,073) (5,597)

18

Reconciliations of income taxes at the United States statutory rate lo the provision for incomo taxos follow:

1981 1

980 1

97

Income taxes at tho United States statutory rate . $ (42,692) (22,650) 18, 14 2

Increases (reductions) in laxes resulting from :

!feet of operating loss carryforward for which no tax credi l

may be recogni7ed .

Amortization of dGferred investment credits.

Investment cred its recogn ized on flow through method .

State income taxes net of federal income tax benefit ..

Capi tal gains .

Other .

Income taxes .

24,490

(552)

(427)

(227)

$ (19,408)

(559) (563)

5,697 (16,420)

(266) 85 2

(3, 800)

( 1 ,829) (3 12)

( 19,607) (2, 101 )

A net operating loss carryforward of $98,400 has not been utilized on tax returns. For income tax purposes, $34,100

expires in 1995 and $64,300 expires in 1996. For financial statement purposes, $53,200 of the carryforward has not

been recognized and expires in 1996.

Investment credits available to reduce future years' Federal income tax liability for financial and tax purposes amount

to $23,000 at December 31 , 1981 . For income tax purposes, $5,800 expires in 1994, $16,200 expires in 1995, and

$1,000 expires in 1996.

In November 1981 tax benefits were sold under the provisions of the Economic Recovery Tax Act of 1981 . The

proceeds from this sale of $5,565 are included in Other income (expenses) on the statements of operations.

Note 6. Debt

At December 31 , 1981 and 1980 long-term debt included :

9.55% equipment trust certificates due May 1, 1993, with semi-annual

principal payments of $3,458 . . ... .. ... .

10% equipment trust certificates due April 1, 1994, with quarterly

principal payments of $1 ,000 .

Floating-rate equipment trust certificates due June 30, 1995, with

semi-annual principal payments of $2 ,609 starting June 30, 1984 .

13.29% installment notes due May 1, 1995, with semi-annual principal

payments of $1", 1 00 .

Revolving credit notes ..

5% installment notes due September 1, 1981 .

6%% installment notes due September 1, 1984, with annual principal

payments of $2,000 on September 1 which will increase to $7,000 in 1982 .

7% installment notes due May 4, 1986, with semi-annual principal payments of

$352 starting November 4, 1981 . . ....... .. ..... .

Notes payable to manufacturers,% above prime and 8%, payable in

varying installments to 1985.

5% convertible subordinated debentures due February 1, 1993, with annual

sinking fund payments of $1 ,500 starting in 1983 .

10% subordinated sinking fund notes due April 15, 1984, with annual sinking

fund payments of $2,300 .

Less: Current portion .

Long term amounts classified as current ..

1981 1980

$ 79,525 86,440

48,992 52,991

60,000 60,000

29,700 31 ,900

27,000 50,000

4,000

21 ,000 23,000

3,165 2,869

27,166 29,844

22,552 23,562

10,250 12,675

329,350 377 ,281

(26,650) (23,756)

(153,369)

$ 149,331 353,525

The revolving credit notes represent borrowings under the 1978 Amended and Restated Bank Loan Agreement.

This line of credit was reduced to $27,000 in 1981 and extends to June 30, 1982, at which date it may be replaced

by term notes. The term notes are due June 30, 1990, with quarterly payments starting September 30, 1982. The

interest rate at December 31 , 1981 , was 105% of prime commercial rate on $15,000 (domestic loans) and 13.2% on

$12,000 (Eurodollar loans). Although the 1978 Bank Loan Agreement does not require compensating balances,

Western had on deposit with its banks until November 1981 non-interest bearing certificates of deposit of approxi-

mately $2,500. Since November 1981 , no compensating balances have been maintained .

Western's various debt agreements contain requirements pertaining to working capital , liquid assets, and net

worth levels, as well as restrictions on amounts of cash dividends and creation of rental liabilities and additional

debt. At December 31, 1981 , Western was not in compliance with some of these requirements. This non-compliance

resulted in technical non-compliance with certain other debt agreements. Western may not resume the payment

of cash dividends on its common stock, which were discontinued in 1980, nor may it pay dividends on its preferred

stock, until certain of the financial tests referred to above have been met.

The agreements with which Western was not in compliance at December 31 , 1981 , include provisions whereby

the lenders may, at their option , accelerate the scheduled maturities. Western has not obtained waivers of these defaults

for a period in excess of one year. Therefore, a portion of the long-term debt has been classified as current obligations.

All of Western's long-term obligations, including all capital leases, contain provisions by which the lenders may

accelerate scheduled maturities if Western fails to make any required payment on its obligations. As of December

31 , 1981 , and March 15, 1982, Western had met all required payments of its obligations.

19

In January 1982 , Western entered into ag reements with its revolving c redit note lenders and certain insurance

companies to create short-term loans of up to $30,000. As of March 15, 1982 , the entire $30,000 had been received

by Western . This loan is due no later than April 30, 1982 . The interest rate on fund s borrowed is equal to 105% of

the agent bank's prime commercial rate. As part of the new short-term loan ag reement, the interest rate on previously

issued 6%% installment notes was increased to 105% of prime while any part of the new short-term notes is out-

standing . The commitment fee under the new short-term loans is % per annum on the average daily unused

portion of the $30,000 .

As part of the January 1982 short-term loan, Western was granted waivers on its existing defaults until June 10,

1982. Also granted was forbea rance fro m acceleration and collection of previously unsecured debt. In connection

with these arrangements, Western provided security on existing and new debt in th e form of a chattel m ortgage.

The chattel mortg age grants a first priority security interest in 29 aircraft and 77 aircraft engines to th e previously

unsecured lenders. The net book value of the aircraft and engines encumbered was $141,467 at December 31, 1981.

The amount of collateral must be maintained at specified levels until substantially all of Western's debt has been

repaid . Western anticipates that following the lenders' evaluation in March 1982 of an appraisal of the existing collateral,

additional collateral may be required .

Equipment trust certificates and 13.29% installment notes outstanding at December 31, 1981 , are secured by

aircraft and engines with a net book value of $255 ,310 at December 31, 1981. In addition, two holders of equipment

tru st certificates who are also participants in the new short-term loa ns referred to above are also collateralized by

the c hattel mortgage as described above.

The following schedu le shows the amount of long-term debt due in each of the five following calendar years,

excluding such amounts, if any, which may be due on acceleration , as desc ribed above:

1982 . . ..... $26,650 1984 . . . . $50,977 1986 . . . . . . . . . . . . . $23, 56 1

1983 . 29,618 1985 . 31,771

During September 1981 , Western entered into agreements with two foreign banks for lines of credit up to $10,000

eac h. In connection with these credit lines, $20,000 was outstanding under demand notes at December 31, 198 1.

The interest rate on these demand notes, outstanding at December 31, ranged from 17.8% to 13.2% during the out-

standing period in 1981. These demand notes also became secured by the collateralization of loans referred to above.

Note 7. Stock Options

Western has a non-qualified stock option plan adopted in 1974 for officers and key personnel. This plan-provides for

options to purc hase a maximum of 1,030 ,000 shares of Western's common stock at prices not less than the fair

market value of the stock at date of grant. The options are exercisable in equal annual increments over a five-year

period The options expire ten years after the date of grant. A summary of activity in the plan follows:

Options granted and outstanding at December 31 , 1978 .

Options granted . . ............... .

Options exercised . . . . . . . . . . . . . . . . .. . .... .

Options cancelled or expired .......... . ..... . ....... . .. .

Options granted and outstanding at December 31 , 1979 .

Options granted ...

Options cancelled or expired ..

Options granted and outstanding at December 31 , 1980 .

Options granted . . ....... .

Options exercised . . .. . .... . .. .

Options cancelled or expi red ........ .

Options granted and outstanding at December 31 , 1981 .

Options Exercisable at:

December 31, 1981 ...

December 31 , 1980 .

.. .. . . . .

Number of Shares Average Price

790,835 $8.56

71 ,000 8.62

(17,630) 8.47

(6,550) 9.12

837,655 8.56

21 ,500 7.27

(12,500) 8.65

846,655 8.53

12,500 9.29

(12,050) 8.46

(84,430) 8.49

762,675 $8.55

697,319 $8.57

683,493 $8.63

At December 31, 1981 , 200 ,21 0 shares (128 ,280 shares at December 31 , 1980) were reserved for the issuance of

future grants.

Note 8. Earnings (Loss) per Common Share

Earnings (loss) per common share is calculated as follows:

Adjustment of Net Earnings (Loss)

Primary:

Net earnings (loss) ..

Preferred stock cash dividends .

Net earnings (loss) available for common stock .

Fully Diluted:

Net earni ngs (loss).

Preferred stock cash dividends

Reduction in interest expense, net of income

taxes, fo r the assumed conversion of 5%

convertible subordinated debentures

Adjusted net earnings (loss) assuming full dilution

20

1981

$(73,400)

(2,394)

(75,794)

$(73,400)

(2,394)

*

$(75,794)

1980

(29,632)

(2,394)

(32 ,026)

(29,632)

(2,394)

(32,026)

1979

41 ,540

(2,394)

39,146

41 ,540

653

42, 193

1981 1980 1979

Adjustment of Shares Outstanding (in thousands)

Primary:

Weighted average shares outstanding ....... 13,037 13,031 13,026

Assumed exercise of stock options . * * 58

Total average common shares for primary . 13,037 13,031 13,084

Fully Diluted :

Weighted average shares outstanding . 13,037 13,031 13,026

Assumed conversion of subordinated debentures . * 2,073

Assumed conversion of preferred stock .. * 2,992

Assumed exercise of stock options .. * * 146

Total average common shares assuming full dilution . 13,037 13,031 18,237

Earnings (Loss) per Common Share:

Primary . $ (5.81) (2.46) 2.99

Fully diluted . . . . . . . . . $ (5.81) (2.46) 2.31

*The exercise of stock options and conversion of the convertible subordinated debentures and/or the preferred stock into common

shares has not been assumed , since the effect of such an assumption would be anti-dilutive.

Note 9. Preferred Stock

The shares of preferred stock are convertible into common stock at the rate of 2.5 shares of common stock for

each share of preferred stock, subject to adjustment under certain conditions, and may be redeemed in whole or in

part at any time at the option of Western. The redemption price of $26 .20 at December 31 , 1981 , decreases peri-

odically until 1987 after which it remains at $25.00 per share. The preference on !iquidation is at the stated value

plus all accrued and unpaid dividends.

On January 29, 1982, the Board of Directors voted to defer payment of the preferred cash dividend of $0.50

per share payable at the end of March 1982 on the 1,196,920 shares of $2 Series A Cumulative Convertible

Preferred Stock outstanding .

Note 10. Regulatory Matters

Western has announced its intention to acquire Wien Air Alaska, Inc., an Alaska regional carrier, and merge it into the

Western system. The Civil Aeronautics Board has approved Air Florida System , lnc'.s, application to acquire control

of Western . Air Florida, which holds approximately 12.6 percent of Western's common stock, has not announced its

intentions. Western's planned merger with Continental Air Lines, Inc., was thwarted by the successful takeover of

that carrier by Texas International. Western withdrew from the merger agreement in September 1981. For additional

information see the first four paragraphs under Regulatory Matters on Pages 6 and 7 of this report.

Note 11. Other Matters

In May 1981 , Western sold two DC-10-10 aircraft to International Air Leases, Inc. for $2,000 of cash and $28,000

of 12% notes which are payable in monthly principal and interest installments of $480 over 50 months with the balance

payable in 1985. In December 1981 , Western decided to sell the notes receivable and has reached agreement in

principle to sell these notes with recourse. This transaction is expected to be consummated by April 30, 1982. During

the fourth quarter of 1981 , the notes were written down by $6,557 to their estimated net realizable value.

In December 1981 , Western sold two 737 aircraft for $11 ,000 to Batch-Air Leasing , Inc., and then leased back the

aircraft from International Air Leases, Inc. , under a four-year operating lease with monthly rental payments of $130

per aircraft. The gain on the sale of the aircraft is being recognized on a straight-line basis over the lease term .

The owner of International Air Leases, Inc., and Batch-Air Leasing , Inc., holds approximately 7% of the outstanding

common stock of Western .

In the opinion of Western's management, the transactions described above were at terms comparable to those

which would have been negotiated with unrelated parties.

Note 12. Quarterly Financial Data (Unaudited)

Summarized quarterly financial data (unaudited) for 1981 and 1980 is as follows:

1981

Operating revenues ...

Operating (loss)

Net (loss) .

Net (Loss) per Common Share:

Primary

1980

Operating revenues . .

Operating income (loss) .

Net (loss) .

Net (Loss) per Common Share:

March 31

$262,159

(3,497)

( 1,692)

$ (0.18)

$232,153

(23,006)

(8,868)

Three Months Ended

June 30

270,844

(15,003)

(8,399)

(0.69)

237,707

(20, 1 77)

(5,379)

September 30

293,621

(3,753)

(7,255)

(0.60)

273,720

7,658

(6,397)

December 31

233,217

(43,701 )

(56,054)

( 4 34)

252, 175

(10,236)

(8,988)

Primary $ (0.72) (0 46) (0 54) (0.74)

Western revised its procedures for recording commission expense in the first quarter of 1981 to more closely identify

the expense with the period in which the related revenue is recognized . The effect of this change on the first through

the fourth quarters of 1981 was to reduce (increase) the net loss by $3,244 ($0.25 per share) , $504 ($0.04 per

share) , $(1 ,040) ($0.08 per share) , and $630 ($0.05 per share) .

21

The quarterly inco me tax benefits fo r the first, second , and third quarters of 1981 are based on the statutory rate.

The tax benefit available fo r the fourth quarter 1981 was limited fo r financial reporting purposes to approximately

5% of the pretax accounting loss because the tax benefits of the remaining net operating loss could not be recog ni7ed

currently. In the th ird quarter of 1980, previously recorded investment credits of $12,507 ($0.96 per share) were

reversed since they could not be utilized for fin ancial reporting purposes. No investm ent c red its were recog nized

during 1981.

Note 13. Description of Impact of Inflation (Unaudited)

Statem ent of Financial Acco unting Standard s No. 33 (SFAS No. 33) prescribes two supplemen tary incom e compu-

tations for estim ating the im pact of inflatio n. These co m putations estimate the effects of general inflation (constant

dollars) and the effects of changes in specific prices (current cost).

SFAS No. 33 defines co nstant dollar accounting as a method of repo rting fin ancial statem ent elements in dollars

each of wh ich have the same general purchasing power. Current cost accounting is defin ed as a m ethod of

measuring and reporting assets and expenses associated with the use or sale of assets at their current cost or lower

recoverable amo unt at the balance sheet date o r at the date of use o r sale. Both m ethods involve the use of

assumptio ns and estim ates. Therefore, th e resulting m easurem ents sho uld be viewed as esti mates rather than as

precise ind icators of the effects of inflation.

The amounts reported in the primary fin ancial statements have been adjusted fo r depreciation and am ortization

expense. Revenues and all other operating expenses are co nsidered to reflect the average price levels and have not

been adjusted.,Further, there have been no adjustm ents made to provisions for inco m e taxes.

Co nstant dollar values were determined by restating histo rica l costs, accumu lated depreciation and am ortization,

and depreciation expense of property and equipment into average 1981 dollars using the Consumer Price Index for

all urban consumers (C PI-U) published by the Bureau of Labor Statistics. Current costs for aircraft were determi ned

by using the direct pricing method. Current costs for spare engines and ca pital rotable spares and assem blies

were computed based on the ratio by which the c urrent cost of aircraft fleets exceeds the histo ric cost of such fleets.

Current cost for other prope rty and eq uipment were determined by indexation using the C PI -U.

An estimate of the net (loss) adjusted for changing prices for the year ended December 31, 1981, follows:

Net (loss) as repo rted in the statement of operations $ (73,400)

Adjustment to Restate Costs for the Effect of General Inflation :

Depreciation and amortization expense (32,706)

Net (loss) adjusted for general inflation .

Ad justment to Reflect the Difference Between General Inflation and Changes in Specific Prices (current costs):

Depreciation and amortization expense .

Net (loss) adjusted for changes in specific prices .

Gain from decli ne in purchasing power of net amounts owed .

Increase in specific prices (current cost) of properties and equipment held during the year* .

Effect of increase in general price level .

Excess of increase in specific prices over increase in the general price level .

(106,106)

(26,582)

$(132,688)

$ 41,716

$186,912

(108,810)

$ 78 ,102

*At December 31 , 1981 current cost of properties and equipment, net of accumulated depreciation and amortization , was $1 ,189,243.

A five-yea r comparison indicating the effect of adjusting historical revenues, purchasing power gains or losses on

net m o netary items, cash dividends, and common stock market prices to dollar am ounts expressed in terms of

average 1981 dollars as measured by the C PI-U follows:

Year Ended December 31 ,

1981 1980 1979 1978 1977

Operating revenues . $1 ,059,841 1,095 ,330 1,165,149 1,159,973 1,037 ,196

Historical Cost Information Adjusted for

General Inflation

Net earnings (loss). (106,106) (62, 434) 26,162

Net earnings (loss) per common share . $ (8.32) ( 4.99) 1.77

Net assets at year-end . 384,364 483 ,525 524 ,169

Current Cost Information

Net earnings (loss) . (132,688) (78, 1.20) 13,904

Net earnings (loss) per com mon share . $ (10.36) (619) .84

Excess of increase in specific prices over

increase in the general price level 78,102 125,487 7,157

Net assets at year-end . 654,403 739 ,133 670 ,431

Gain from decline in purchasing power of

net amounts owed .. 41 ,716 51,532 45 ,947

Cash dividends declared per common share . $ .27 .50 .56 .60

Market price per common share at year-end . $ 4.87 10 04 12.97 11.47 11.44

Average Consumer Price Index . 272.4 246.8. 217.4 195.4 181 .5

Note 14. Continued Operations

Early in 1982, Western began to implem ent a new strateg ic plan designed to return the company to profitability

and to streng then its financial co nditio n. This plan includes, am ong other factors: (1) establ ishi ng a hub and spoke

system with operations centered at Salt Lake City, (2) introd ucing service to nine new cities and increasing service

to a number of cities presently on Western's system as a means to more fully uti lize the available capacity in Western's

fleet, (3) wage and/o r wo rk rule co ncessions fro m Western's organized labor groups, and ( 4) conti nued cooperation

from Western's lenders.

If this plan is not substantially achieved , Western may not be able to co ntin ue in existence.

22