Notice to Stockholders

A rule adopted by the Civil Aeronautics Board

("CAB") in July 1970, as amended on December 29,

1972, imposes obligations on certain stockholders of

air carriers. Any person who owns as of December 31

of any year or subsequently acquires, either benefi

cially or as a trustee, more than 5% of any class of

capital stock of an air carrier must file with the CAB a

report containing the information required by Part

245.12 of the CAB's Economic Regulations on or before

April 1 as to the capital stock owned as of December 31

and/or a report containing the information required

by Part 245.13 of the CAB's Economic Regulations

within 10 days after acquisition as to the capital stock

acquired after December 31. Any bank or broker which

holds as trustee more than 5% of any class of capital

stock of an air carrier on the last day of any quarter

of a calendar year must file with the CAB within .30

days after the end of the quarter a report in accord

ance with the provisions of Part 245.14 of the CAB's

Economic Regulations.

Any person required to report under either Part

245.12, Part 245.13 or Part 245.14 of the CAB's Economic

Regulations who grants a security interest in more

than 5% of any class of capital stock of an air carrier

must within 30 days after granting such .security inter

est file with the CAB a report containing the informa

tion required in Part 245.15. Any stockholder who

believes that he may be required to file such a report

may obtain further information by writing to the

Director, Bureau of Operating Rights, Civil Aero

nautics Board, Washington, D.C. 20428.

Eorm 10-K: Stockholders may obtain free of charge a

copy of the company's annual report on form 10-K as

filed with the Securities and Exchange Commission

by writing to the Secretary, P.O. Box 92005, World

Way Postal Center, Los Angeles, California 90009.

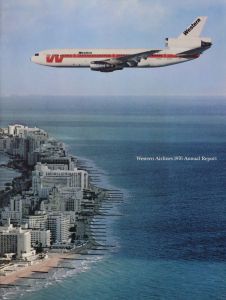

Cover: Western's DC-10 over Miami Beach.

The company started serving Miami on

August 1,1976.

1

Western Air Lines, Inc., 1976 Annual Report

Description of Business

Western Air Lines, Inc. is a certificated air carrier

providing scheduled air transportation over approxi

mately 32,000 route miles. The company serves 41

cities in 15 states, Canada and Mexico. Western has

competition from other airlines on substantially all

of its routes. It is regulated hy the United States, cer

tain state and foreign governments.

Index

3 Chairman's Letter

5 Financial Review

9 Corporate Review

17 Western's Route System

21 Ten Years of Western Progress

23 Balance Sheets

25 Statements of Earnings

26 Statements of Changes in Financial Position

27 Statements of Shareholders' Equity

27 Notes to Einancial Statements

32 Accountant's Report

34 Corporate Officers

Cliairnians Letter

I ho year 197(i, in which WcstcM ii completed its lirst

hall-ceiiturv of continuous service, was an excellent

one in many respects. We are pleased to report that

your company achieved a net profit of nearly $15

million, or $1.10 j)er share. This was a ^ratilyim; level

of earnings in \'iew of all factors which impacted our

industry.

Western's oj)eratins4 revenues passed the $()()() mil

lion mark foi' the first time. We were able to add more

than 5,0()() miles to onr route system and increase our

ax ailahle seat miles 15 percent while holdini; operat

ing expenses to a 1.5 j)ercent increase. Onr hreakeven

load factor (the {)oint at which we realize a profit) was

reduced significantly from 50.8 percent in 1975 to 55.8

percent in 1976.

Onr passenger traffic for the year increased 10 }X*r-

cent, and cari^o traffic, which includes air freiy,ht and

mail, increased 24 percent. Althoinj;h Western's aver

age passenger load factor in 1976 was down slightly

to 58.2 percent, it remained one of the hij^hest in the

industry.

(iivil Aeronautics Board decisions <!;aye us two new

lon^-haul routes duriny; the year, one coverini; the

2,700 miles between Honolulu and \5mcouyer,

and the other--onr first transcontinental route --from

l.os ,\ny,eles to Miami/Ft Lauderdale.

These two route additions are extremely important

to Western. While they initially added to our expense

level and reduced our averai^e load factor, they offer

substantial potential for profitable operation. Both

are leisure-oriented routes which have had monopoly

ser\ ice until now, and oni' company has the experience

to de\elop them, pins a record of success in the mar-

kc'tin^ of vacation travel.

Our idtimate ^oal is to capture an equal share of

the Cialifornia-Florida market. Nearly two-thirds of

the traffic which flows over this route orijj;inates at

West Ooast cities lony; served by Western and in which

your company is well identified. In addition, we are

working with criuse ship o])erators and government

tourist bureaus in Florida, the Bahamas and the

Oarihhean to develop traffic into these areas.

Our confidence that Western can effectively com

pete on these two new routes is based on the fact that

we have won the No. 2 position in terms of passengers

carried between the Mainland and Hawaii, despite

heavy competition from many other carriers. Our

record in this was recognized by Air Transport World

mai;azine when it pre.sented Western with its 1976

"Market Development Award" for "outstanding per

formance in the development of the Hawaiian

market!'

While we believe that through ai2;^ressive market-

ini; programs,cost controls and continued route devel-

oj)ment, we can make 1977 an even better year than

1976, there are several non-controllahle matters facing

your com])any and the entire industry which could

adversely affect our profit j)osition in the future.

Among the most noteworthy of these are deregnla-

tion, noise abatement (and ecjuipment replacement)

and fuel j)ricing.

For nearly four decades, the air transportation

system in the ILS. has grown and developed under

regnlation by the (!ivil Aeronautics Board, that deter

mines which carriers provide serx ice over which

routes and oversees the level of fares and rates.

Although this system is admittedly not {)erfect, it has

nevertheless given the American public the finest air

transportation in the world --both in terms of price

and service for the consumer --and it has encouraged

economic viability for the airlines in producing that

service.

The past two years have seen a number of deregula

tion pro])osals come forth. These are based on the

premise that the public would get better service at less

cost if the airlines were given greater freedom to enter

and exit markets of their choice and given greater

flexibility in setting their own fares. We strongly sup

port free enterprise, hut we also maintain that particu

larly in the area of route authority and pricing, air

transportation shoidd he regarded and regidated as a

public utility. If a maximum number of communities

are to continue to receive good passengei', mail and

cargo .service by air, at reasonable fares and rates, the

present regidatorv system must he })reserved.

The erosion of such a federal regulatory pattern by

irresponsible changes under the guise of pid)lic

interest will lead only to a deterioration of the world's

best transportation network with little or no perma

nent reduction in fares.

We recognize that some limited })rocedural changes

mav be constructive, hut this can be accomplished by

the Civil Aeronautics Board pursuant to pro\'isions

of the Federal Aviation Act now in eliect. Accordingly,

we believe it unwise and unnecessary to enact any of

the pending deregidation projjosals.

The noise abatement issue, as explained in the body

of this report, has had a sidistantial im})act on West

ern fleet ))lanning, as well as on most of the industry.

In essence, we will be required to replace prematurely

or modify more than half of our present aircraft within

the next eight years. Legislation has been introduced

in Congress which, if approved, will help reduce the

financial burden created by having to comply with

.5

the new FAA noise requirements, but it will not pro

vide a complete solution.

Western's present j)lan calls for ultimately replacing

all 720 aircraft with a comhination of quieter Boeins;

727s and McDonnell Dous>;las DC-fOs. At the same

time, we will modify all Boeing 737 aircraft which

remain in the fleet and either modify or replace the

five 7{)7s. While this will be a costly program overall,

it will result in fewer aircraft types in oiir fleet, which

in the lon|> run shoidd ]>roduce improved economy

and efficiency of operations.

Of continuing concern also is the price of jet fuel.

Although Western is one of the most efficient fuel

users in the industry, our total hill for 1976 amounted

to $108 million, compared to $93 million in 1975 and

$44 million in 1973 before the fuel crunch took effect.

Almost all of the increase experienced has been the

residt of price escalation. Our last major contract

covering fuel prices ex])ired on December 31, and

fuel prices are now based on "open market" conditions.

As a residt, we are estimating that our cost will con

tinue to rise in 1977. With an expected consumption

of 386 million gallons, each cent-a-gallon increase

results in nearly $4 million annual increase in fuel

expense.

Labor costs in the airline industry continue to pre

sent a difficidt control problem, and Western's are no

exception. We will be or are presently negotiating new

agreements with unions representing aj)j)roximately

88 percent of our labor force. In each of these, we are

studying ways to attain the increased jnoductivity

which we feel is essential if we are to keep W'estern's

oj:)eration reasonably j)rofitable.

Western has a sound record on which to stand and

we are proud to he serving 41 cities, 15 states, Canada

and Mexico, as part of the nation's vital transporta

tion system. We will do our best to operate Western's

routes in a manner which will provide good service

to the traveling and shijiping pidilic at reasonable

fares and rates and, at the same time, return sullicient

})rofit to justify the continuation of a sound dividend

Cdiairman and Chief Executive Officer

March 21,1977

4

Financial Review

1976 1975 1974

1976 vs.

Amount

Che

1975

%

inge

1975 vs

Amount

Operating revenues:

Passenger $544,188 1465,081 $437,345 79,107 17 27,736

Cargo 37,926 31,329 27,662 6,597 21 3,667

Other 23,091 22,563 23,390 528 2 -827

605,205 518,973 488,397 86,232 17 30,576

Operating expenses:

Wages, salaries and employee benefits 226,367 201,661 182,334 24,706 12 19,327

Fuel 108,279 93,134 71,437 15,145 16 21,697

Depreciation and amortization . . .

38,058 36,054 40,478 2,004 6 -4,424

Other 202,643 179,563 155,788 23,080 13 23,775

575,347 510,412 450,037 64,935 13 60,375

Operating income 29,858 8,561 38,360 21,297 249 -29,799

Other income (expenses):

Interest expense, net (8,889) (8,524) (10,334) (365) 4 -(1,810)

Gain on disposal of equipment . . .

1,809 379 9,575 1,430 377 -9,196

Other, net 1,237 3,919 4,222 -2,682 -68 -303

Earnings before provision for

taxes on income and cumulative

effect of accounting change . .

24,015 4,335 41,823 19,680 454 -37,488

Provision for taxes on income

....

9,050 (825) 17,725 9,875 * -18,550

Earnings before cumulative effect

of accounting change 14,965 5,160 24,098 9,805 190 -18,938

Cumulative effect of accounting change --

7,160 --

-7,160 -100 7,160

Net earnings $ 14,965 $ 12,320 $ 24,098 2,645 21 -11,778

Earnings per share:

Primary:

Earnings before cumulative effect

of accounting change $ 1.10 $ 0.34 $ 1.59

Cumulative effect of accounting

change

Net earnings $ 1.10

0.47

$ 0.81 $ 1.59

Fully diluted:

Earnings before cumulative effect

of accounting change $ 0.98 $ 0.33 $ 1.41

Cumulative effect of accounting

change

Net earnings

Passengers carried (000)

$ 0.98

8,098

0.41

$ 0.74

7,531

$ 1.41

7,391 567 8 140

Available seat miles (000,000) ....

13,450 11,696 11,124 1,754 15 572

Revenue passenger miles (000,000) . .

7,834 7,103 6,747 731 10 356

Passenger load factor--actual (%) .

58.2 60.7 60.7 -2.5 -4 -

--

breakeven (%) .

55.8 59.8 56.0 -4.0 -7 3.8

Note: In thousands of dollars except per share amounts.

*Not computed.

5

Management's Discussion

The adjacent table of Financial Review compares Western's

activities during the past three years --1976, 1975 and 1974.

Items in the table which in the opinion of Western's manage

ment need explanation are discussed in the following section.

A 10-yearfinancial and statistical summary follows the

report's Corporate Review.

Western's net earnings of $14,965,000 for 1976 repre

sented a 21 percent increase from the $12,320,000

reported for 1975. Comparing the two years, but exclud

ing a $7,160,000 after-tax credit from a change in the

company's method of accounting for maintenance of

aircraft in 1975, the 1976 earnings were almost triple

those of 1975. Earnings in both years were substantially

below the record 1974 earnings of $24,098,000.

Operating revenues increased primarily because of

higher passenger revenues reflecting traffic growth

and higher average revenue per passenger mile

(yield). Traffic growth was 10 percent in 1976 and five

percent in 1975. Yield increased six percent in 1976

and one percent in 1975 as a result of fare increases.

Cargo revenues increased on traffic growth of 24 per

cent in 1976 and 14 percent in 1975.

Passenger revenues constitute 90 percent of West

ern's operating revenues and of these passenger

revenues 93 percent come from coach and economy

travelers.

Negotiated increases as a result of collective bargain

ing were the primary factor in the increases shown in

wages, salaries and employee benefits. The greatest

impact was from wage increases. These agreements

are open for amendment in 1977 and early 1978.

Included in the 1976 increase was a $4.3 million

increase in the costs of retirement plans, group insur

ance and payroll taxes. The major factor was higher

pension expenses due to higher wages and participa

tion in the plans by a larger number of employees.

Costs of retirement plans for 1976 were $1.2 million

lower than they would have been had not certain actu

arial assumptions been changed. The 1975 increase of

$5.5 million was attributable mainly to higher group

insurance premiums. In both years payroll taxes

increased because of legislated changes.

In 1976, 55 percent of the fuel expense increase

reflected higher consumption and 45 percent reflected

price increases. Western increased its available seat

miles by 15 percent in 1976 but used only nine percent

more fuel.The 1975 fuel expense increase was due to

price increases. Effective January 1, 1977, Western's

fuel prices were no longer under contract and are

subject to open market conditions.

The 1976 depreciation and amortization expense

would have been $1.2 million greater if the depre

ciable lives of 727 and 737 aircraft had not been

extended from 12 years to 15 and 14 years, respectively.

In 1975 this expense showed a decrease because the

depreciable lives of the 720B aircraft were extended to

Dominic P. Renda

President and Chief Operating Officer

6

1978. Amortization of pre-opcrating; costs increased

in 1976 because of costs incurred in inaugurating

services on the bos Angeles-Mianii and Honolulu-

Vancouver routes.

"Other" expenses increased approximately S23

million in both 1976 and 197.6. The major increases

were in travel agent commissions, passenger food

expense, rentals, materials and repairs for aircraft

maintenance and Mutual Aid expenses.

The proportion of total sales being made by travel

agents continued to increase and together with traffic

increases resulted in the increases in travel agent

commission expen.ses--by 15 million, or 2.3 percent,

in 1976 and $2.5 million, or 13 percent, in 1975.

Traffic growth was also the cause of a $2.9 million,

or 16 percent, increase in passenger food expense

in 1976.

Rentals increased 22 percent in both years, or by

$4.2 million in 1976 and $3.5 million in 1975. Contrib

uting factors were leases of two DC-10 aircraft, one in

June 1976 and one in ]une 1975, and the leasing of a

DC-10 hangar and a parking structure in April 1975.

Materials and repairs for aircraft maintenance

increased by $2.9 million, or 10 percent, in 1976 as the

result of a greater number of cyclical replacements of

engine components and higher costs for parts. In 1975

higher prices of parts and materials resulted in the

$3.6 million, or 14 percent, increase.

Mutual Aid increased $3.6 million in 1975 because

of payments made to other carriers under this agree

ment but declined sharply in 1976. See Note 11 of Notes

to Financial Statements.

Traffic growth and fare increases in 1976 outpaced

inflation and resulted in higher operating income. In

1975 Western's inability to offset inflated operating

expenses with either traffic growth or fare increases

resulted in lower operating income than in 1974.

In 1976 interest expense increa.ses reflect the issu

ance of $23 million in principal amount of the 10%

Subordinated Sinking Fund Notes. The decrease in

"Other--net" resulted from the fact that 1975 included

$2.1 million in interest income related to a federal tax

refund. See Note 6 of Notes to Financial Statements.

These were partially offset by gain on the sale of a

737 aircraft.

The 1975 interest expense decrease was produced

by a combination of a reduction of outstanding debt

and a reduction in interest rates on the bank debt.The

gain on sale of equipment decreased from 1974 to 1975

because 10 aircraft were sold in 1974.

The provision for taxes on income is reconciled to

the tax rate of 48 percent in Note 6 of Notes to Finan

cial Statements.

Financial Position

Sources of working capital totaled $87,717,000 in 1976.

Working capital from operations increased from

$45,412,000 in 1975 to $54,807,000 in 1976 because of

higher earnings. The other major source was the issu

ance of $23,000,000 in principal amount of 10% Subor

dinated Sinking Fund Notes.

Applications of working capital were $102,471,000.

Expenditures for the repurchase of common stock

totaled $30,527,000. Reductions in debt totaling

$20,000,000 included scheduled maturities of long

term tlebt and that portion of the revolving fund

credit which management intends to repay in 1977.

Purchases of property and equipment, including

advance deposits of approximately $25 million, were

$42,362,000.

Seven 727 aircraft are scheduled for delivery in 1977

at an approximate cost of $78 million. Western will

lease five and purchase two out of internally gener

ated funds. During January 1977, Western exercised

options to purchase five 727 aircraft and agreed to

purchase two DC-10 aircraft, all for delivery in 1978,

at a total cost of approximately $116 million. These

orders are subject to lender approval.

The aircraft to be delivered in 1977 and 1978 will

accommodate forecast traffic growth and will also

replace some of those aircraft which Western will

retire before January 1, 1985, in accordance with cur

rent noise regulations. External equity and debt finan

cing or a combination thereof will be required.

The Bank Loan Agreement, dated June 30, 1976,

provides Western with a $75 million revolving line of

credit until December 31, 1978. On this date the line

of credit can be replaced by a term note in an amount

not to exceed $75 million which will mature on June

30,1983, with quarterly payments of principal starting

March 31,1979.

Operating Income--(Dollars in Millions)

0.9% from other

2.1% from transport related

0.7% from charter

6.3% from cargo

6.0% from deluxe passenger service.

Operating Revenue 84.0 % from coach passenger service-

Dollar

39.3% for wages, salaries

:

and employee benefits -

j 18.8% for aircraft fuel

} 6.6% for depreciation

j 5.8% for materials and repair

! 5.0% for utilities and services

] 4.7% for commissions

I 3.7% for food and beverages

2.0% for advertising and publicity

14,1% for other

7

Finance and Administration

Division is headed by Robert O.

Kinsey, Senior Vice President-

Finance and Administration, with

(from left) Pan! V. Donahue, Vice

President-Procurement; FI.S.Gray,

Vice President-Financial Planning;

Dan A. Zaich, Vice President-

Personnel Relations; Richard O.

Hammond, Vice President and

Treasurer, and Roderick G. Leith,

Vice President and Controller.

Corporate Review

Annual Meeting

I'he 1977 meeting; of sliarcholders will be held at the

Beverly Hilton Hotel, Beverly Hills, Calif., on April

28. Formal notice of the meeting and proxy material

are enclosed with this report.

Shareholders, Stock and Debentures

As of December 31, 197h, there were 12,659,(K)() shares

of Western stock outstanding, d'he number of shares

outstanding had been reduced in May by 2,508,832

from 1975's year-end total of 15,164,000 after share

holders approved at the 1976 annual meeting the com

pany's proposal to purchase Kirk Kerkorian's hold

ings. At that meeting 85.4 percent of all outstanding

shares were represented in person or by proxy.

An additional 2,465,(XK) shares are reserved for the

conversion of the company's 574% Convertible Subordi

nated Debentures. Holders of the debentures received

interest payments on February 1 and August 1.

Shareholders' equity at December 31, 1976 was

$117,100,000, or $9.25 per share, compared to

$137,938,000, or $9.10 per share, at the end of 1975.

The company's stock was held by approximately

16,900 shareholders of record at year's end, compared

to approximately 17,500 shareholders at the end of

1975. The stock is traded on the New York and Pacific

Stock Exchanges.

The following table sets forth the range of sale

prices of the stock on the New York Stock Exchange:

1975 High Low

First Quarter 9V2 57/8

Second Quarter 87/8 71/8

Third Quarter 91/2 6%

Fourth Quarter 93/8 6^4

1976

First Quarter 117/8 91/8

Second Quarter 107/8 91/8

Third Quarter 125/8 10

Fourth Quarter 101/4 83/4

Dividends

Shareholders received four regular cash dividends

during 1976. These dividends in the amount of 10

cents per share were paid in March, June, August and

November.

In January 1977, the hoard of directors declared the

first regular quarterly cash dividend of 1977 in the

amount of 10 cents per share, payable on February 28

to shareholders of record on February 8.

Equipment and Facilities

At the end of 1976, as at the end of 1975, Western oper

ated 75 jet aircraft.

One McDonnell Douglas DC-10 was added to the

fleet in June and one Boeing 737 was sold during the

first quarter.

Scheduled for delivery during 1977 are seven

Boeing 727-200s.'Fhree of the 727s are being delivered

in March, two in May and the remaining two in

December. Western has arranged to lease the five air

craft being delivered in the spring.

In January 1977 the company announced it had

reached agreements to purchase two DC-lOs and five

727s for delivery in the first half of 1978. In addition

to these firm orders, Western obtained options on two

additional DC-lOs for delivery in 1979 and on 10 addi

tional 727s for delivery in 1979 and 1980.

The two DC-lOs and the five 727s being acquired

in 1978 are part of the company's re-equipment pro

gram designed to meet anticipated traffic growth and,

at the same time, to bring the fleet into conformity

with new regulations limiting aircraft noise emissions.

The F'ederal Aviation Administration has issued

aircraft noise abatement regulations which require

that all airline aircraft meet FAA noise standards

which have previously applied only to newly manu

factured aircraft within specified periods prior to

January 1, 1985. To meet the standards, non-conform

ing aircraft must either he replaced by newer, quieter

aircraft or modified to reduce their noise output. Four-

engine aircraft must be replaced or modified on the

following schedule: one-quarter of the aircraft within

four years, one-half of the aircraft within six years

and all aircraft within eight years. Two- and three-

engine aircraft must be replaced or modified to meet

the standards within six years with one-half of such

aircraft to be replaced or modified within four years.

The company presently has in its fleet 24 two-engine

Boeing 737 aircraft and 23 four-engine aircraft (five

Boeing 707s and 18 Boeing 720B's) which do not com

ply with the prescribed noise limitations. (By the end

of 1977 all of its three-engine aircraft will meet the

noise standards prescribed in the regulation.) Within

the prescribed time limits, the company presently

intends to modify some of its two-engine aircraft and

to dispose of the remainder, and to replace all eighteen

720B aircraft. The total cost of retrofit of two-engine

aircraft cannot be estimated with any degree of cer

tainty until a decision is made as to the number to be

modified, but it has been decided that such retrofits

are economically and operationally feasible. Retrofit

of the five 707 aircraft may be economically and opera

tionally feasible, but such does not seem to he the

case with the eighteen 720Bs.

9

Western became the first U.S. carrier to connect

Vancouver, B.C. (top) and Honolulu on June 25,1976.

Legislation has been introdnced in Congress which

wonld provide financial assistance to the airlines by

authorizing them to collect surcharges on passenger

fares and cargo rates. Funds produced by such sur

charges would be available for use by the airlines to

assist in financing the costs of modification of non

complying aircraft and of acquisition of replacement

aircraft. The legislation also propo.ses that grants be

made to the airlines from funds in the Airport and

Airways Development Trust Fund to finance the pro

gram if and to the extent that funds produced by the

surcharges are insufficient for that purpose. The

amount and kind of financial assistance which the

airlines may receive from this legislation will depend

upon whether and in what form it is enacted. In any

event, with or without governmental assistance the

requirement that all Western's aircraft, except the

DC-lOs and 727-200s, be modified or prematurely

replaced in eight years or less will impose a substan

tial financial burden upon Western.

Western's Fleet

1977 1978

Owned Leased Delivery Delivery

DC-10 3 4 -

2

B707--300C 5 - - -

B720B 18 -- -

-

B727-200 15 8* 5 5

B737-200 24 --

-- --

As of March 1,'j, 1977.

65 12 5 7

*I'wo were delivered in early March 1977.

Western continued to modernize and, in some cases,

expand its ground facilities at a number of locations

during 1976. A new all-purpose building including

an air cargo terminal was constructed at Honolulu

and a new cargo terminal/maintenance building was

completed at Salt Lake City. A new Western cargo

facility at Denver's Stapleton International Airport

is scheduled for completion in mid-1977 and one is in

the design development stages at Seattle-Tacoma

International Airport. Major expansion to the pas

senger terminal buildings at Salt Lake City, San Diego,

Phoenix and Honolulu will give Western improved

passenger facilities.

Fares and Rates

Most of Western's fares and rates underwent changes

in 1976. Western's passenger fare structure is divided

into six geographical areas--domestic U.S., Hawaii,

intra-California, Alaska, Mexico and Canada--with

each area regulated separately by the Civil Aeronau

tics Board, agencies of other national governments or,

in the case of intra-California markets, by the state

Public Utilities Commission.

Domestic U.S. fares were increased one percent in

February and two percent in March, in May and in

September while fares between Alaska and the "Lower

48" fares were increased three percent in October.

Although the company applied for a five percent

increase in all Mainland-Hawaii fares, effective May

15, the increase was approved only for discount fares.

The Hawaii discount fares underwent another 4.5 per

cent increase on January 1, 1977, and regular fares

went up two percent.

California intra-state fares were increased eight per

cent in January and fares between the U.S. and Canada

were increased seven percent in May.

These fare increases were partially responsible for

a six percent increa.se in Western's average yield in

1976. Nevertheless, our system average yield was still

the lowest in the industry at 7.05 cents. For the 12

months ended September 30, 1976, the industry aver

age was 7.52 cents, whereas Western's average was

only 6.9 cents, or eight percent below the industry

average.

Operating Income --(Dollars in Millions

1976

\975 1 H 8.6

1974

1973

1972

38.4

40.1

11

Corporate Planning Division

headed by James L. Mitchell,

Senior Vice President-Corporate

Planning, with (from left) VV. Jeffrey

Terrill, Director-Regulatory

Proceedings; Carleton E. Nesbitt,

Director-Profit Planning; William

E. Lindsey, Director-Fleet Planning;

Charles S. Fisher, Vice President-

Schedule Planning; Eugene D.

Olson, Vice President-Data

Processing and Systems; Peter

P. Wolf, Vice President-

Communications.

While Western continues to try to improve its yield

throui^h fare increases and reduced emphasis on dis

count fares, it has maintained certain discount fares

for the purposes of stimulatinj; specific markets or

attracting large group movements as well as for the

purpose of remaining competitive in other markets.

Air freight rates underwent increases in April, Sep

tember and October.

Marketing

Western's 1976 marketing was headlined by a new

advertising theme entitled,"We've Got A Good Thing

Going'' and highlighted by the challenges of inaugu

rating two major new routes--Honolulu to Vancouver,

in June and the company's first transcontinental route,

Los Angeles to Miami/Ft. Lauderdale, in August.

A total of 8,098,000 passengers were carried in 1976,

compared to 7,531,000 in 1975. Passenger load factor

for the year was 58.2 percent, compared to 60.7 per

cent in 1975.

The two new routes are primarily vacation-oriented,

and they have given Western yet another opportunity

to demonstrate its marketing expertise in such mar

kets. Marketing over both routes was launched with

attractive Triangle Fares. For example, over the Los

Angeles-Miami route, this fare permits travelers to

take a side trip to Mexico City for no additional cost.

This same theme has been used most successfully for

a number of years in the California-Alaska-Hawaii

market.

Western is increasingly optimistic about the

potential of its first transcontinental route. Since

approximately two-thirds of the traffic on this route

historically has been generated on the West Coast--

where Western is experienced in promoting leisure

travel --the company is in an excellent position to

stimulate new traffic to Florida and the Caribbean.

Within four months after service was launched, the

company had established commitments with two

major cruise ship lines operating out of Miami and

was launching joint advertising programs with these

operators as well as tourism organizations in Florida

and the Caribbean.

As part of its continuing program of joint advertis

ing and promotion with the Hawaii Visitors Bureau,

the company will be concentrating new efforts on the

promotion of traffic between Hawaii and Western

Canada.

The company's success in the Hawaii market was

recognized nationally in January 1977 when it received

the third annual Market Development Award from

Air Transport World magazine. The award was pre

sented for Western's "...outstanding performance in

the development of the Hawaiian market. From a non

existent position in this market prior to 1969, it has

moved upward rapidly to become the second-largest

airline to Hawaii, carrying close to 850,000 passengers

in 1976!'

More updating of Western's services to the traveling

public during the year resulted in the installation of

high-speed ticket printers at 15 locations, the develop

ment of a fare quote system which covers 90 percent of

the possible itineraries in the reservations computers

and the placing of an 18-month schedule in these same

computers. The 18-month schedule now makes it pos

sible for Western's sales force to confirm space by

specific flight and time for individuals and groups

who are making long-range travel plans.

The Alaska pipeline construction plus the new busi

ness attention it has focused on Alaska continued to

have a favorable impact on Western's passenger and

cargo traffic between the Mainland and the 49th state.

Systemwide, Western's cargo, expressed in revenue

ton miles, increased 24 percent for the year. Cargo

marketing studies, plus the increase in the use of air

transportation for mail by the U.S. Postal Service,

indicate that this portion of Western's business will

continue to grow at a healthy rate.

Available Seat Miles vs. Revenue Passenger Miles

13,450

1975 L

L Ll.:! ii. j

7,103

.!

.i 11,696

1974 6,747

1973 6,476

5,996

124

11,176

Millions

Seat Miles

300

Passenger Miles

13

Marketing Division headed by

Richard P. Ensign, Senior Vice

President-Marketing, with (from

left) Bert D. Lynn, Vice President-

Advertising and Sales Promotion;

Jack M. Slichter, Vice President-

Field Management; Willis R.

Balfour, Vice President-Sales and

Service; Lawrence H. Lee, Vice

President-Inflight Service, and

J.S. Neel,Vice President-Marketing

Administration.

Route Proceedings

Western is involved in a number of route proceedings

now under consideration by tbe (livil Aeronautics

Board. If approved, tbe company's proposals in these

cases woldd give Western access to new cities or would

provide new service between cities presently served

by tbe company.

riie Civil Aeronautics Board did award to Western

two e.xtremely inn)ortant new routes in 1976. First, in

February came tbe award of a 2,7()()-mile segment

between N^uicouver, British Columbia, and Honolulu.

\Vith this new service, inaugurated June 25, Western

became the first U.S. flag carrier to provide service

between tbe 5()tb state and Canada.

In March the CAB gaveW'estern a long-sought-after

transcontinental route --covering tbe 2,.`145 miles

between Los Angeles and Miami/Ft. Lauderdale.

Although tbe decision is tbe subject of appeals by

.some unsuccessfid applicants, we inaugurated service

over this route on August 1.

In tbe Oklahoma-Denver-Southeast Points Investiga

tion, Western .seeks to provide nonstop service between

Denver and Atlanta,Tidsa, Tampa and Miami as well

as between Tulsa and Florida points. Western also pro

posed through service via Denver between Calgary/

Fdmonton and Tulsa and Florida and from Salt Lake

City and San Francisco to Florida. A route for Western

was not recommended in tbe administrative law

judge's initial decision,which was issued in November;

however, the case is being reviewed by the five-member

board, and Western continues to be an active applicant.

This case should be concluded in 1977.

I'wo important international route cases are cur-

rentlv awaiting initial decisions by CAB administra

tive law judges.

The first is an international route case which will

be decided by the end of 1977 involving new U.S. flag

carrier routes between tbe California cities of San

Francisco and Los Angeles and the Canadian cities of

Calgary and Edmonton. These routes were added by

amendment of tbe U.S.-Canadian bilateral agreement

in 1974. In the second. Western is seeking to extend its

route system to Tokyo from the U.S. gateway cities of

Seattle/Tacoma and Portland.

In September, the CAB awarded a nonstop route

between Calgarv/Edmonton and Las Vegas to Hughes

Airwest. I bis is a route which Western had been

actively seeking.The company has appealed this deci

sion to a federal court of apj^eals.

Western also has applications in pending cases for

the following routes: Los Angeles to Columbus, Ohio,

and Pbiladeljjbia; Sacramento to Denver; Spokane

to Billings and Denver; Las Vegas to Dal las/Et. Worth;

LasVTgas to Reno and Sacramento to Seattle/l'acoma.

4'be Transatlantic Route Proceeding m which Western

sought to provide tbe first direct service from Minne

apolis/St. Paid to London, Paris and Frankfurt was

sent to the White House for Presidential approval in

1976. It did not include a recommendation for Western.

However, the White House returned the decision to

tbe CAB for further consideration and for what West

ern hopes will he a more favorable decision.

Another important apjjlication now under CAB

consideration is Western's route realignment proposal

which would consolidate all Mainland route segments

into one linear segment and eliminate certain out

dated conditions which impede Western's ojierating

flexibility.

Western is also seeking additional routes into

Mexico from the California cities of .San Francisco,

Los Angeles and San Diego. The company currently

serves Acapulco from Los Angeles and Mexico City

from Los Angeles and San Diego. Application has

been filed to also provide .service to La Paz, Mazatlan,

Puerto Vallarta, Guadalajara, Manzanillo and

Zihuatanejo. No action has been taken on this applica

tion pending possible amendment to the bilateral

agreement between the United States and Mexico

which is due to expire April .30,1977.

Another case which recently has been set for hear

ing is the West Coast-Alaska Investigation in which West

ern is seeking nonstop authority from Los Angeles

and San Francisco to Anchorage as well as nonstop

authority from Portland and Seattle to Fairbanks.

Passenger Load Factor--Actual vs. Breakeven

Actual

Breakeven

Legal Division headed by (erald

P. O'Grady, Senior V'ice President-

Legal and Secretary, with (from

left) Thomas J. Greene, Assistant

Secretary and Director-Corporate

Law; Henry M. deButts, V'ice

President-Regidatory Law, and

Donald F. Drews, Director-

Properties and Facilities.

FAIRB^KS

KODIAK

KETCHIKAN

,\ VANCOUVER

SEATTL^TACOMA

SPOKANE

WHO F/y-LS

OCATELLO

iRENO COLUMBUS

SACRAM^I CHEYENNI

LAS VEGAS

TULSA

ONTAI

OKLAHOMA Cr

DALLAS?^ ^

FORT WORTH

JAM PA

:atlan

HONOLULU

HILO

MANZANILLO

Western's Route System

WESTERN AIR LINES SYSTEM

PROPOSED ROUTES

Western/Continental Interchange

`Service temporarily suspended by order of CAB

ANCHORAG

CALGARY

GREAT FALLS

MINNEAPOLIS/ST. PAUL

N PIERRE

=

SIOUX FALLS

RAP D CITY

BILLINGS

SHERIDAN

SAN FRANCISCO

OAKLAND

SAN JOSE

LOS ANGELES V PALM SPRINGS ^

V \ PHOENIX

SAN DIEGO

(TO LONDON)

(TO FRANKhUHiT

(TO PARIS)

--^

PHILADELPHIA

ATLANTA

JUNEAU*

EDMONTON

ZIHUATANEJO

ACAPULCO

MIAi^ - S

FORT LAUDERIII/VLE'

W

^ GUADALAJARA

0 VALLARTA

MEXICO CITY

17 18

Management Changes

Iwo new directors were elected to Western's board at

the annual meeting in April. They were Robert H.

Volk, chairman of llnionamerica, Inc. (now Westmor

Ciorporation) and Roy Ash, president of Idtton Indus

tries from 1961 until 1972 and Director of the Office of

Management and Budget from 1972 until 1975.

Mr. Ash's election required approval by the Civil

Aeronautics Board because he is also a director of

Bankamerica Corporation; Bank of America has been

one of Western's major lenders for many years. After

CAB action on an application for such approval was

not forthcoming for nearly 10 months, the application

was withdrawn, and he will not stand for election as a

member of the hoard this year.

With shareholder approval of the purchase of Kirk

Kerkorian's holdings, Mr. Kerkorian and five other

directors who are or had been associated with him did

not stand for re-election. They included Fred

Benninger, who had served as Western's chairman

since 1971; James D. Aljian, Peter M. Kennedy, Walter

M. Sharp and William Singleton.

Following the annual meeting, the board elected

Arthur F. Kelly, formerly president and chief execu

tive officer, as chairman and chief executive officer,

and elevated Dominic P. Renda, formerly executive

vice president, to president and chief operating officer.

Early in 1977, James L. Mitchell was elected senior

vice president-corporate planning to succeed Robert

O. Kinsey, who became senior vice president-finance

and administration following the retirement of

Charles J. J. Cox on January 31,1977.

Mitchell returned to We.stern after eight years with

Continental Airlines where he was most recently vice

president of regidatory proceedings. He first joined

Western in 1946 and was named assistant vice presi

dent of research in 1965. Kinsey was controller and

assistant to the president at Pacific Northern Airlines

prior to the 1967 merger of PNA into Western. He

came to Western as vice president and assistant to the

president and was elected senior vice president-

corporate planning in 1974.

Cox had been with Western for 25 years having

joined the company as controller and assistant trea

surer in 1951. He was elected vice president and con

troller in 1966, vice president-finance in 1969 and

.senior vice president-finance in 1972.

Edwin W. Mitchell, who joined Western in 1941, was

elected vice president-maintenance to succeed Jo.seph

M. Fogarty who retired on September 30, 1976.

Mitchell was previously director of base maintenance

in Los Angeles. Fogarty was hired by National Parks

Airways (which was merged into Western) in 1931 and

retired from Western after completing more than 45

years of service.

Personnel

As of December 31, Western employed 10,113 people,

compared to 9,4,30 at the entl of 1975.

Wages and salaries for 1976 amounted to .'S188,418,000,

up 12 percent from the 1168,029,000 in the previous

year. Social Security taxes and company contributions

to group insurance and employee retirement plans

increased 13 percent, from $3.3,632,000 in 1975 to

$37,949,000 in 1976.

Western is committed to a policy of equal employ

ment. Job assignments are determined on the basis of

qualifications without discrimination in race, color,

creed, age, sex or national origin.

The company confirms its continuous commitment,

and, in this regard, maintains Equal Employment

Opportunity/Affirmative Action Plans which are filed

with the Federal Aviation Administration and the

Department of the Interior (in Alaska).

Approximately 88 percent of the company's

employees are represented by labor unions. These

unions include the International Brotherhood of

Teamsters, Air Line Pilots Association and Associa

tion of Flight Attendants (affiliate of ALPA), Brother

hood of Railway and Airline Clerks (U.S. and Canada),

Sindicate Nacional de Trabajadores de Aviacion y

Similares (in Mexico), and the Transport Workers

Union. Following is the contractual status of each

group of these employees:

Employee Group

Number of

Employees

12/31/76 Union

Contract Open

for Amendment

Flis^ht .-Xttenclants 1 ,.')86 ALPA/AFA Aug. 1, 1977

Assent & Clerical 3,674 BRAC Jan. 1, 1978

--

Canada 39 BRAC Jan. 1,1978

--

Mexico 155 SNTA Jan. 1,1978

Pilots 1,374 ALPA Sept. 1. 1977

Flight Superintendents 33 TWU April .30, 1978

Mechanics & Related 1,921 IBT Nov. 16,1976

Employees (Presently in

mediation)

19

Operations Division headed by

Anton B. Favero, Senior V'ice

President-Operations, with (froi

left) Mark E. Leafstedt, Director

Operations Budgets and Cost

Control; Robert V. Johnson, Vic

President-Flight Operations;

Richard B. Ault,\'ice President

Engineering, and Fldwin \V.

Mitchell, Vice President-

Maintenance.

Ten Yeai's of Western Proi^ess

Financial 1976 1975 1974

Operating^ revenues;'^

Passen2;er $544,188 465,081 4.37,.34.5

Cargjo 37,926 31,.329 27,662

Other 23,091 22,.563 23,.390

Total operatintr revenues 605,205 518,973 488,.397

Operatinir expenses:^

VV'atres, salaries and employee benefits 226,367 201,661 182,3.34

Fuel 108,279 93,1.34 71,4.37

l)ej)reciation 38,058 .36,054 40,478

Other 202,643 179,56.3 155,788

Total operating; expenses 575,347 510,412 4.50,037

Operating; income (loss)^ 29,858 8,.561 38,360

Interest expense, net of amounts capitalized^. (8,889) (8,524) (10,.3.34)

Gain (loss) on disposal of equipmentZ 1,809 379 9,.575

Other income and expense, net^ 1,237 3,919 4,222

Earning;s (loss) before taxes on income and cumulative

effect of accounting; chang;e^ 24,015 4,3.35 41,82.3

Taxes on income (tax credits)^. 9,050 (825) 17,725

Earning;s (loss) before cumulative effect of accountini^ change ^ .

14,965 5,160 24,098

Cumulative effect of accounting change^ --

7,16(d -

Net earnings (loss)"^ S 14,965 12,.320 24,098

Earnings (loss) per share:

Primary:

Before cumulative effect of accounting change $ 1.10 0..34 1.59

Net earnings (loss) $ 1.10 0.81 1.59

Eully diluted:

Before cumulative effect of accounting change S 0.98 0..3.3 1.41

Net earnings (loss) $ 0.98 0.74 1.41

Pro-forma amounts assuming the accounting change is applied

retroactively:

Net earnings (loss)^ $ 14,965 5,160 24,608

Net earnings (loss) per share --primary >-2 $ 1.10 0..34 1.6.3

Net earnings (loss) per share --fully diluted $ 0.98 0.3.3 1.44

Return on investment (%) 9.7 8.0 13.1

Cash dividends paid per share $ 0.40 0.47 0.39

Average shares outstanding'-^:^ 13,601 15,163 15,125

Shareholders'equity ^ $117,100 137,938 132,718

Long-term debt 7 $110,420 107,617 114,917

Property and equipment --net $308,112 309,685 307,307

Total assets^ $431,133 420,093 .396,825

Operations

Airplanes operated at end of year 75 75 72

Passengers carried^'^ 8,098 7,531 7,391

Available seat miles'^ 13,450,395 11,696,478 11,123,.544

Revenue passenger miles 3.7 7,8.33,843 7,102,917 6,747,451

Passenger load factor--actual (%) 58.2 60.7 60.7

--

breakeven point (%) .55.8 59.8 56.0

--

profit margin (point difference) 2.4 0.9 4.7

Average revenue per passenger mile $ .0705 .0665 .0660

Average length in miles per passenger trip 963 943 913

Operating expense per available seat mile $ .0428 .04.36 .0405

Cargo revenue ton miles^'^ 134,955 108,619 95,2.39

Average number of employees 9,799 9,.357 9,696

1. Stock dividends were: 3% and 57o in 1974, 3% in 1973 and 10% in 1971. Stock split was: 2V!i for 1 in 1972.

2. Per share data are adjusted to f^ive retroactive effect to stock splits and stock dividends.

3. Operations of other carriers were substantially suspended from October 23 to November 16, 1976; September 1,

1975 to January 4,1976; December 6 to December 21,1975; [uly 14 to October 30, 1974; November 5 to December

18, 1973; June 30 to October 2,1972; December 15, 1971 to April 10,1972; July 8 to December 14, 1970. Operations

of a competing intrastate carrier were partially suspended.during the fourth quarter, 1973. Western's operations

1973 1972 1971 1970 19693 1968 1967

376,722 342,851 295,807 274,792 220,5.30 205,753 178,527

23,040 20,819 20,231 18,745 16,472 13,459 11,802

21,524 10,321 12,009 9,926 5,245 4,454 3,209

421,286 373,991 328,047 303,463 242,247 22.3,666 193,5.38

165,363 147,282 127,075 113,116 97,156 78,535 64,024

44,510 40,137 38,663 .37,-357 .32,857 27,191 21,9.37

38,304 36,224 35,144 .36,583 .34,821 25,051 20,085

132,987 126,741 110,859 104,-596 89,814 73,207 62,152

381,164 350,384 311,741 291,652 254,648 203,984 168,198

40,122 23,607 16,306 11,811 (12,401) 19,682 25,-340

(9,016) (8,787) (11,162) (14,586) (14,748) (6,536) (3,011)

945 582 1,349 111 26 (7.3) (304)

3,235 2,114 3,114 1,009 (151) 88 321

35,286 17,516 9,607 (1,655) (27,274) 13,161 22,346

14,900 6,,300 3,150 (2,2-50) (15,075) 4,725 10,125

20,386 11,216 6,457 595 (12,199) 8,4,36 12,221

20,386 11,216 6,457^ 595 (12,199) 8,4.36 12,221

1.35 0.75 0.43 0.04 (0.81) 0.-56 0.82

1.35 0.75 0.43 0.04 (0.81) 0.-56 0.82

1.21 0.68 0.41 0.04 (0.81) 0.-54

1.21 0.68 0.41 0.04 (0.81) 0.-54

16,074 10,573 8,247 3,290 (10,664) 9,527 13,263

1.07 0.70 0.55 0.22 (0.71) 0.64 0.89

0.96 0.65 0.52 0.22 (0.71) 0.60

12.3 8.5 6.7 5.4 1.1 7.6 10.6

0.23 0.08 -- --

0.16 0.3.3 0.33

15,050 15,0.30 15,012 15,011 15,010 14,981 14,892

113,652 96,723 86,-397 79,905 79,310 93,862 90,016

124,387 130,487 152,040 174,184 197,1.50 183,718 80,189

269,374 239,029 216,7.38 247,426 285,757 284,787 183,106

377,457 342,531 340,352 355,168 -367,588 349,039 2.31,342

74 71 70 72 78 64 51

7,382 6,931 6,206 6,188 5,7-52 5,693 5,108

11,175,518 10,300,178 9,776,869 9,8-39,299 8,-509,441 7,096,229 5,879,442

6,476,087 5,995,925 5,251,989 5,159,081 4,021,296 3,841,864 3,-327,160

57.9 58.2 53.7 52.4 47.3 -54.1 .56.6

52.4 54.4 52.2 52.2 53.1 -50.7 49.5

5.5 3.8 1.5 .2 (5.8) 3.4 7.1

.0597 .0578 .0577 .0542 .0551 .0537 .0537

877 865 846 8.34 699 675 651

.0341 .0340 .0319 .0296

.

.0299 .0287 .0286

76,474 76,233 73,249 68,646 60,514 47,446 38,940

9,826 9,383 8,951 8,961 9,286 8,052 6,920

were suspended from July 29 to Aui^ust 16,1969.

4. See Note 2 of Notes to Financial Statements.

5. Includes $560,000 from involuntary conversion of an aircraft.

6. The methodolof;^ used to compute the rate of return is the CAB Corporate Return on Investment.

7. OOO's omitted.

22

Balance Sheets

WES FERN AIR LINES, INC.

Dt'CcMiibor :il, 1976 and 1975

(in tliousaiuls of dollars )

ASSETS 1976

Current Assets:

Cash

(-ertificatos of dcj)osit

Coniinercial paper at cost and accrued interest

(which approximate market)

Receivables (net of allowance for doubtful

accounts of $1,S45--1976 and $950--1975)

Flight equi})ment expendable parts, at average

cost (less allowance for obsolescence of

$11,525-1976 and $9,65.5-1975)

Prepaid exj^enses and other current assets

Total current assets

Properties and Equipment at Cost (Notes 2, 3 and 4):

Flight equi{)ment

Facilities and ground eciuipment

Deposits on aircraft purchase contracts ....

Less allowance for tlepreciation and amortization

$ 11,476

7,748

25,911

45,L55

48,951

16,311

6,264

116,661

480,1.36

94,1,37

19,418

593,691

285,579

.308,112

Deferred Charges and Other Assets:

Preoperating costs

Other

4,.504

1,856

6,360

$431,133

See accompanying notes to financial statements.

1975

$ 10,.546

16,878

9,960

37,.384

48,5.39

14,943

6,944

107,810

477,816

88,241

613

566,670

256,985

309,685

1,045

1..5.53

2..598

$420,093

23

LIABILITIES AND SHAREHOLDERS' EQUITY 1976 1975

Current Liabilities:

Accounts payable

Salaries, wages and vacation benefits payable

Accrued liabilities (Note 5)

Income taxes payable (Note 6)

Advance ticket sales

Current portion of debt (Note 7)

Total current liabilities

$ 28,760

28,345

13,912

5,825

29,563

27,800

129,205

Long-Term Debt (Note 7) 110,420

Deferred Credits (Notes 6 and 8):

Deferred federal taxes on income

Unamortized investment credits

Other

Shareholders' Equity (Notes 7, 9 and 10):

Common stock --$1.00 par value per share

Authorized 25,000,000 shares

Issued 12,659,000 shares-1976 and 15,164,0(X) shares-1975

Capital in excess of par value

Retained earnings

47,007

17,644

9,757

74,408

12,659

28,937

75,504

117,100

Commitments and Contingent Liabilities (Notes 3 and 8)

$431,133

$ 28,857

19,680

13,088

679

27,546

15,750

105,600

107,617

42,435

18,645

7,858

68,938

15,164

37,461

85,313

137,938

$420,093

24

Statements of Earnings

For the vcars ended December 31, 197b and 1975

(in thousands ol dollars except per share amounts)

197b 1975

Operating revenues:

Passenger 1544,188 I4b5,081

(largo 37,92b 31,329

Other 23,091 22,5b3

b()5,2()5 518,973

Operating expenses:

Fuel 108,279 93,134

Wages, salaries and employee henelits (Note 5) 22b,3b7 201,bbl

Depreciation and amortization (Note 2) 38,058 .3b,054

Other (Note 11) 202,b43 179,.5b3

575,347 510,412

Operating income 29,858 8,5b 1

Other income (expenses):

Interest, principally on long-term debt (9,b75) (8,9b4)

Interest capitalized 78b 440

Interest income 1,941 3,b30

(iain on sale of equi}>mcnt 1,809 379

Other --net (704) 289

Farnings helore provision lor taxes on income

and cumulative effect of a change in accounting

(5,843) (4,22b)

princi{)le 24,015 4,335

Provision for taxes on income (Note b) 9,050 (825)

Farnings before cumidative effect of a change

in accounting principle 14,9b5 5,lb0

(Inmnlative effect of a change in accounting principle (Note 2) . .

--

7,lb0

Net earnings S 14,9b5 1 12,320

Farnings per share (Note 12):

Primary:

Farnings before cumidative effect of a

change in accounting principle $ 1.10 $ 0.34

(lumulative effect of a change

in accounting prineijile --

0.47

Net earnings $ 1.10 $ 0.81

Fully tliluted (assuming conversion of debentures):

Farnings before cumulative effect

of a change in accounting principle $ 0.98 $ 0.33

(Inmidative effect of a change

in accounting principle --

0.41

Net earnings $ 0.98 $ 0.74

See accompanying notes to financial statements.

25

Statements of Changes in Financial Position

For the years ended December 31,1976 and 1975

(in thousands of dollars)

Sources of Working Capital:

Earnings before cumulative effect of a change

in accounting principle

Add (deduct) items which did not affect working capital:

Depreciation and amortization (Note 2)

Taxes (Note 6):

Deferred income taxes

Deferred investment credits

Amortization of deferred investment credits

Ciain on disposal of property and equipment

Other

Total from operations before cumulative effect

of a change in accounting principle

Cumulative effect of a change in accounting princij)le

in 1975 amounting to $7,160 which did not affect

working capital (Note 2)

Total from operations

Reimbursements upon leasing of DC-10 aircraft and facilities.

Proceeds from disposal of {)roperty and equipment

Proceeds from issuance of long-term debt

Other--net

1976

$ 14,965

36,132

2,350

4,145

(2,925)

(1,809)

1,949

54,807

54,807

7,295

3,771

23,000

(1,156)

87,717

Applications of Working Capital:

Purchase of property and equipment

and advances thereon

Repurchase of common stock (Note 10) ....

Reduction of long-term debt including transfers

to current liabilities

Cash dividends

Preoperating costs related to route development

Increase (decrease) in working capital

42,362

30,527

20,000

5,312

4,270

102,471

$(14,754)

Summary of Increases (Decreases) in Working Capital:

Cash, certificates of deposit and commercial paper

Receivables

Expendable parts and prepaid expenses ....

Accounts payable, advance ticket sales, accrued and

other liabilities

Net increase (decrease)

$ 7,751

412

688

(23,605)

$(14,754)

See accompanying notes to financial statements.

1975

$ 5,160

34,781

9,905

(2,555)

(2,975)

(379)

1,475

45,412

45,412

15,882

2,535

8,450

2,816

75,095

41,985

15,750

7,126

64,861

$10,234

$10,017

9,401

3,834

(13,018)

$10,234

26

SlaleiiitMils of Shareliolders Equity

For the years ended December 31, 1976 and 1975

(in tlionsands of dollars )

Balance at |annarv 1, 1975

Kxercise ol stock oj)tions

Net earnin^;s

(iash dividends

Balance at Decembei' 31, 1975

Kxercise of stock options

Rej)nrcbase of common stock

Net earnings

(iasb dividends

Balance at December 31,1976

(Notes 7, 9 and 10)

See accompanving notes to financial statements.

(lonimon

Stoc k (lapital in

SI.00 Excc'ss ol Rotainc'd Sha rc'holdcrs'

'ar \'alnc* Par \'aliic` Earnings Ecpiity

$15,1.59 $37,440 $80,119 $132,718

5 21 --

26

-- --

12,320 12,.320

-- --

(7,126) (7,126)

15,164 .37,461 85,31.3 1.37,9.38

4 .32 --

.3()

(2,.509) (8,.5.56) (19,462) (.30,.527)

-- --

14,965 14,965

-- --

(5,312) (5,312)

$12,6.59 $28,9.37 $75,.504 $117,100

Notes to Financial Statements

(In tlionsands of dollars excejit per share amounts).

Note 1. Summary of Significant Accounting Policies.

Property and Equipment: Propertv and ecpiipment,

exclusive of residual values, are depreciated ovei' esti

mated nsefid lives bv the straight-line method. Main

tenance and repairs are expensed as incurred. (See

Note 2.) Major l enewals and betterments are charged

to jii'opertv and eqnijiment accounts.

Preoperating Costs: Significant costs, such as those

for traffic jiromotion and personnel training, related

to the inangnration of service over major new routes

and to the introduction of new tvpes of aircraft arc

deferred and amortized over five vears.

Interest Capitalized: Interest related to dejiosits on

aircraft jiurchasecontracts iscapitalized and amortized

over the useftd lives of the aircraft.

Investment Credits: Investment credits generated by

acquisition of assets are amortized to income on a

straight-line basis over the useful lives of the related

assets. Amortization for financial statement purposes

may exceed accumulated amounts utilized on West

ern's tax returns to the extent of available deferred

lederal taxes on income on the accompanving balance

sheets.

Obsolescence of Expendable Parts: An allowance for

obsolescence of flight ccjuipment exjiendable parts is

accrued over the useftd lives of the related aircraft

types.

Advance Ticket Sales: Passenger ticket sales are

recorded as a current liahilitv until hilled by other

carriers for trans])ortation provided by them or until

recognized as revenues for services provided bv West

ern. At December 31, 1976, S12,.343 (1975-Sl 1,476) was

estimated to he })ayahle to other carriers and $17,220

(1975 --$16,070) was estimated to be related to trans

portation to be pro\'ided b\AVestern.

Note 2. Depreciation and Amortization.

The estimated useful lives and residual values of air

craft are as follows:

Estimated Rcsidttal

I'sclul I.ile N'ulue

DC-IO 16 years 10%

727 l.'j years* 13%

I'M 11 years* 13%

707 12 years 13%

720B C.ommoii Retirement Date --

December 31. 1978 Slot)

*Elle(tiye October 1. 1976 tbe estimated dejireciable lices ol lilteeii

727 iiircrtilt and twenty-loni 737 tiirc ralt were extended Irom 12 years.

1 his change recognizes mtinagement's decision to continue using

these iiircralt beyond the period in which they would base become

hilly de|)reciated. For 197(). depreciation expense was decreased

approximately SI.200; net earnings was incieased by approximately

S600 or SO.01 |)er share (primary).

Khe estimatctl useful lives of ground ecini})ment

range from four to ten years. For buildings and

im])rovements on leased property, the estimated use

ful lives are generallv the periods of the leases.

"Other" operating expenses included de])reciation

and amortization expense of $350 in 1976.

In 1975 Western changed its method of accounting

for costs of major flight equipment maintenance from

27

one of charging; such costs to reserves (accumulated

by charges to income on an hours-flown basis) to one of

direct expensing of such costs as incurred. The $7,f60

cumulative effect of this change on prior years ($13,7H5

less deferred income taxes of $6,625) is included in

net earnings for the year f975. This change had no

other material effect on net earnings for 1975.

Note 3. Commitments and

Contingent Liabilities.

At December 31, 1976 WTstern had on order seven 727

aircraft for deliverv in 1977.The total purchase {)rice,

including related spares, is estimated to be $78,000 of

which approximately $23,500 has been paid in advance

dejiosits. Lease financing for five of these aircraft is

being finalized.

During January, 1977, subject to lender ajiproval.

Western exercised options to }>urchase five 727 air

craft and agreed to purchase two DC-10 aircraft for

deliverv in 1978. The cost of these aircraft will be

approximately $116,000.

Outstanding commitments for flight ecpiipment

modifications amounted to approximately $6,200 anti

lor lacilities and ground equipment amounted to

approximatelv $2,500 at December 31, 1976.

At December 31, 1976 various legal actions were

pending against the Citv of Los Angeles anti various

cross complaints were pending against Western anti

other airlines because of aircraft noise and engine

emissions. Western's counsel in these actions, which

also rejnesents most of the other airlines, is of the

opinion that the airlines have substantial tlefenses to

the imposition of any liability.

Along with Northwest Airlines, Inc., Western is a

tlefentlant in an action brought by Alaska Airlines,

Inc. alleging vit)lation of anti-trust laws on particidar

routes common to all three airlines. In the o})inion of

Western's counsel, such action will not result in any

material liability to Western.

Western is also involved in various other litigation,

including certain cases alleging discrimination in

emplovment {practices, that management believes will

not have a materially adverse effect upon Western.

Western is required by Federal Aviation Adminis

tration regidations,effective Januarv 1, 1977, to retrofit

or replace aircraft which do not comply with the speci

fied noise limitations. Modifications must take place

according to stipulated timetables and all affected air

craft must be modified or replaced by Januarv 1, 1985.

The company j)resentlv intends to replace its eighteen

72()B aircraft and to retrofit or re})lace an undeter

mined number of its twenty-four 737 aircraft and five

707 aircraft. The cost of replacing and retrofitting

these aircraft cannot be determined with any degree

of certainty. External equity and debt financing or a

combination thereof will be requirefl to finance air

craft necessarv for growth and replacement.

Note 4. General Description of the Impact of Inflation

(Unaudited).

Inflation is reflected in operating expenses in the year

in which the jn ice increases occur except for the cost

of replacing capital assets. Historically because of the

regidatory process fare increases have lagged these

[)rice increases.

Replacing capital assets, j)rimarily aircraft and

ground [)ro})erty with aji.sets having equivalent pro

ductive caj^acity has usually retjuired a greater capital

investment than was required to ])urcha.se the original

productive caj)acity. d'he.se higher acquisition costs

reflect the cumidative imj)act of inflation.

Western's annual report on form lO-K (a copy of

which is available iq)on request) contains information

with resjiect to year-end 1976 replacement cost of

productive capacity and the ajjproximate effect which

re])lacement cost woidd have had on the computation

of depreciation expense for the year.

Note 5. Retirement Plans.

Retirement j>lans cover all classes of emjjloyees. West

ern makes contributions to the comjjany sponsored

plans which, together with the participant's required

contributions, are sufficient to fund current service

costs annually and prior service costs over 10 to 20

years. Actuarial gains and losses are amortized over

ten-year periods.

The cost of retirement plans charged to operating

expense amounted to $18,211 for 1976 ($15,453-1975)

which included company contributions to a union

sponsored plan for mechanics and related employees

of $1,929 for 1976 ($1,724--1975). The increase in ex

pense was caused by higher wages and by a larger

number of employees participating in the plans.

Effective January 1, 1976, Western amended certain

plans to comply with pension legislation and to stream

line benefits. In addition the actuarial method was

changed for one plan and certain actuarial assump

tions were changed for all plans. These amendments

and changes decreased expense in 1976 by approxi

mately $1,200 and increased net earnings by $600 or

$0.04 per share (primary).

Western's actuaries are of the opinion that total assets

under the plans exceed liabilities for accrued vested

benefits. Lhifunded prior service costs of the plans

amounted to approximately $18,897 at December

31,1976.

Note 6. Taxes on Income.

I he provision for taxes on income before cumulative

effect of a change in accounting principle is summa

rized as follows:

1976 1975

Current income taxes:

Federal $4,405 $(5,425)

State 1,075 225

Deferred federal income taxes 2,550 9,905

Deferred investment credits 4,145 (2,555)

11,975 2,150

Amortization of investment credits (2,925) (2,975)

$9,050 $ (825) 28

In 1975 the Internal Revenue Service concluded

examinations of Western's federal income tax returns

throust;h 1972. Western was successful in accelerating

dej)reciation for tax purj)oses which residted in a

refund for certain of the years under review. I'he pro

vision for taxes on income for 1975 includes reclassifi

cations relating to timing differences (decreased cur

rent federal income taxes of $4,025 and restored

deferred investment credits of $1,150, which are offset

by increased deferred federal income taxes of $5,155).

Deferred income taxes ari.se from timing differences

between financial and tax reporting. The tax effects

of these differences follow:

1976 1975

Depreciation $ 464 $9,575

Interest capitalized (IW) (429)

Preoperatint;; expense 1,668 (200)

Other

. .

382 959

$2,3.50 $9,905

Investment credits unapplied on tax returns

amounted to $17,705 at December 31, 1976 ($19,925 --

1975) with $1,502 expiring in 1979, $4,093 in 1980,

$6,176 in 1981, $4,036 in 1982 and $1,898 in 1983.

Of the $17,644 unamortized investment credit bal

ance at December 31, 1976 ($18,645-- 1975), $4,170

($3,082 --

1975) remains from investment credits uti

lized by reduction of taxes paid and $13,474 ($15,563 --

1975) is related to investment credits not yet utilized

for reduction of taxes paid.

A reconciliation between the amount of reported

taxes on income and the amount computed by multi

plying earnings before provision for taxes on income

by the expected tax rate of 48% follows:

1976 197.6

Taxes on income at 48% $11,527 $ 2,081

Increases (reductions) in taxes resultin;^ from:

Amortization of deferred investment

credits (2,925) (2,975)

State income taxes net of federal

income tax benefit 559 117

Other (Ill) (48)

Taxes on income $ 9,050 $ (825)

The federal income tax returns for 1973 and 1974

are being examined by the Internal Revenue Service.

Note 7. Unsecured Debt.

At December 31,1976 and 1975 debt was as follows:

1976 1975

Current portion of debt:

Revolving bank line of credit

Current maturities of long-term debt . .

.

$19,500

8,300

$ 9,750

6,000

$27,800 $15,750

Long-term debt:

Senior

Revolving bank line of credit

5%% in.stallment notes due Se])tember 1,

1981 with annual [trincipal payments

$ -

$ 11,700

on September 1 ol $4,000

678% installment notes due September 1,

1984 with annual principal payments of

$2,(X)0 on September 1 which will

16,000 20,0(X)

increase to $7,0(K) a year starting in 1982

8%7o installment notes due November 16,

1985 with quarterly principal j)ayments

29,0(K) 31,(MX)

of $768 starting in 1981 15,362 15,362

iibordinated

.5V47o convertible subordinated

debentures due February 1,1993, with

sinking fund payments of $1,500

60,362 78,0f)2

a year starting in 1979

107o subordinated sinking fund notes

due April 15,1984, less unamortized

discount of $198,with sinking fund

payments of $2,300 a year starting

29,555 29,555

in 1977 20,503 --

.50,058 29,555

$110,420 $107,617

On June .30, 1976 borrowings under a Bank Loan

Agreement, dated July 1,1968, as amended, which pro

vided a line of credit in the total amount of $65,000

were repaid and a new Bank Loan Agreement w^as

consummated. This new Bank Loan Agreement pro-

vitles Western with a $75,000 revolving line of credit

until December 31,1978. On this date the line of credit

can be re})laced by a term note in an amount not to

exceed $75,000 which will mature on June .30, 1983

with quarterly payments of principal starting March

31, 1979. The interest rate on funds borrowed is 1/2%)

over the bank's prime commercial rate until June 30,

1979 when it will increase to 5/87o over such rate. The

commitment fee is l/27o per annum on the unused

portion. On December 31, 1976 the interest rate for

Western was 6%% and $55,500 was available for future

drawdowns.

Amounts outstanding under this agreement which

management intended to repay within 12 months

were classified as current liabilities. The remaining

amounts outstanding were classified as long-term debt.

Although this Bank Loan Agreement does not

require compensating balances. Western has infor

mally agreed to maintain on deposit average balances

equal to 10%) of the total credit available plus f07o of

borrowings.

The agreements relating to this line of credit and

other long-term debt contain provisions which limit

retained earnings from which restricted payments

(cash dividends and purchases of Western's common

stock) can be made. The most restrictive of these pro

visions limited amounts available for such payments

to $13,666 at December 31,1976.

These agreements also contain, among other things,

requirements pertaining to cash and working capital

levels and provisions which may restrict additional

borrowings.

29

The following schedule shows the amount of long

term debt due in each of the five following calendar

years excluding borrowings under the revolving line

of credit:

1977 J 8,900

1978 8,300

1979 9,800

1980 9,8(K)

1981 12,872

At December 31, 1976, 2,465,000 shares of common

stock were reserved for conversion of debentures at a

conversion price of 111.99 per share.

Note 8. Lease Commitments.

Total rental expense was 123,703 for 1976 (119,483--1975). Rental expense for noncapitalized "financing" leases was

$14,332 for 1976 ($11,740--1975). For disclosure purposes required by regulations of the Securities and Exchange

Commission, a "financing" lease is one which, during the noncancelable lease period, either (i) covers 75% or more

of the economic life of the property or (ii) has terms which assure the lessor a fidl recovery of the fair market value

of the property at the mception of the lease, plus a reasonable return on investment.

At December 31, 1976 minimum rental expense under all noncancelable leases expiring after December 31, 1977

was as follows:

Totals

Flight Airport Other Financing All Other

Flquipment Facilities Facilities Leases Leases

Annually