Cover

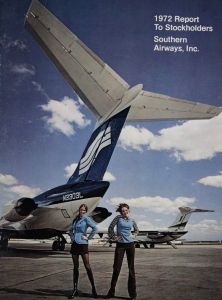

There is a new addition

to the Southern skies and soon

the airline's entire

jet fleet will display this

contemporary design featuring a

new corporate symbol, the

Flight Mark. Whether

flying throughout, from or

to the Southeast,

Southern's jet fleet will

contribute to the

comfort, convenience and

pleasure of its

passengers.

,

Southern

Financial and Operating Highlights

Southern Airways, Inc.

Years ended December 31 , 1972 1971 Growth

Passenger revenues $ 52,052,000 $ 45,302,000 14.9%

Operating revenues $ 68,637,000 $ 60,334,000 13.8%

Operating income s 2,893,000 $ 407 ,000 610.8%

Net income (loss) $ 1,600,000* $ ( 1,059,000)

Primary earnings (loss) per share

including extraordinary credit $ 1.06* $ (1 .02)

Yield per passenger mile 8.7~ 8.6G: 1.2%

In scheduled service:

Revenue passenger miles 596,197,000 527,552,000 13.0%

Available seat miles 1,279,175,000 1,222,289,000 4.7%

Passenger load factor 46.6% 43.2% 7.9%

Revenue passengers carried 2,101,000 1,875,000 12.1%

Revenue plane miles flown 20,844,000 20,003,000 4.2%

Number of employees 2,084 1,994 4.5%

*This amount is exclusive of ransom money not yet returned by the Republic of Cuba.

In the event this is written off, it will result in a loss of $359,000 and $.30 per share.

Contents

System Routes Cover Foldout

Financial and Operating Highlights 1

President's Message 2

Answers for our Publics 3-18

Statement of Operations 19

Balance Sheet 20-21

Statement of Changes in Financial Position 22

Statement of Stockholders' Equity 23

Report of Independent Accountants 24

Notes to Financial Statements 24-29

Reaching the Public in 1973 30

Our Contributions to Good Citizenry 31

Southern's Directors and Officers 32

CHARLESTON

ILLUSTRATION BY TOM ALBIN

To our stockholders

2

Our Reports during the past five years have emphasized activities

that were strengthening the Company and contributing to growth

that was expected to materialize in the near future. Now, we can

report these activities have reached fruition , and this past year is

established as the most significant in our history. New highs were

attained in all areas as revenues reached $68.6 million and our

largest profit - $1 .6 million - resulted .

Factors contributing to this success include a greatly improved

economy, a tight reign on costs, expanded sales and maturing

markets, and an outstanding effort on the part of the employees who

comprise the "Southern family."

Nevertheless, the year had some problems, the most significant

of which was the hijacking of a Southern DC-9 in November. The

subsequent events were reported by news media throughout the

world . The skill and determination of our flight crew resulted in the

safe return of the passengers and aircraft. Ransom paid to insure

the safety of the passengers is expected to be ultimately returned

to the Company.

To insure continued growth, 13 additional DC-9s have been

acquired and the first four of these are now in service. This will

enable us to offer substantial improvements in service. This and

other significant events are explained further in this report.

Realizing that you are interested in our current operations,

expansion opportunities, and the related problems facing Southern

during 1973, we are departing from the usual annual report format.

This year, we have selected key points brought up most frequently

by the many publics we serve. In the pages following are answers

to the questions we hear most often.

April 30, 1973

Respectfully,

Frank W. Hulse

President

Answers for our publics

MR. HULSE: "The five of you have

been asked to participate in the

presentation of Southern's 1973

Report to Stockhold.

ers. We appreciate

your representing some of our most

important publics: our more than

6,000 stockholders, who own this

Company; the 2,575 loyal employees

who operate our Company; the banks

and other members of the financial

community on whom we depend for

capital; the news media, ever

responsible for keeping the public

aware of our successes - and

sometimes our failures; and certainly

the customer and general public

which is the reason we are in business

and on whom our existence depends.

"Before we open this discussion to

your questions, let me tell you some of

the things we are accomplishing at

Southern.

"Your Company has been returned

to operating profitability. Many factors

contributed to this. Revenues are the

highest in our history, and while

attaining this, we have beeri able to

control our expense levels and operate

with minimum overhead. Also, subsidy

received was consistent with the

needs of service to our small

communities which do not generate

a profitable level of passenger activity.

This is, of course, as it must be.

"We are acquiring 13 additional

DC-9 aircraft, bringing our jet total to

28, the second largest jet fleet in the

regional airline industry. This enables

us to decrease the number of Martin

404 planes operated. At the same

time, we are being asked by some why

we are not replacing the remaining

Martins with turbo-prop equipment.

This we have elected not to do as we

believe the turbo-prop equipment

available today offers our passengers

Southern serves five important publics and many representative questions

are answered in this Report.

no greater speed or comfort than our

Martin fleet. In fact, Southern is the

only regional carrier and is among

only three U.S. certificated carriers

not taking the intermediate step into

turbo-prop aircraft. For us, this has

been a wise decision as we will serve

more than 90 per cent of our

passengers with pure-jet aircraft by

the end of this year. At such time as

an economical small jet is marketed,

Southern will consider it as a Martin

replacement.

"Southern is seeing a change in the

pattern - and need - for scheduled

airline service in many Southeastern

cities. This area has few natural and

almost no man-made barriers. We

have neither the mountains of the

Northeast and Far West, nor the

deserts and plains of the West, nor

congested city life of the Upper East

Coast. In turn , excellent highways

make automobile travel to regional

airports or to large city airports a

logical substitution for short air hops.

The result is that many air travelers

on our system are taking advantage of

our flight frequencies at nearby, large

airports. This is resulting in the

suspension of service at some smaller

cities, contributing to a reduction in

subsidy, but without inconvenience to

local passengers who are often little

more than a half-hour drive from our

jet service with accompanying better

schedules.

"More of this change is expected

along the Southern system. Coupled

with some improved passenger

services that we are introducing, we

believe we will offer even more

convenience to the air traveler moving

throughout, from and to the

Southeast.

"Another change we are seeing is

in our Company employee mix.

Southern long has had a policy of

promoting from within when available

skills meet the job qualifications. This

practice encourages employee pride

and ensures opportunity for our

personnel. Because of our rapid

growth, however, we have gone into

the job market to fill some positions.

We have been fortunate in attracting

intelligent, qualified people who will

add to our senior management base

for further growth.

"Southern has redoubled its efforts

3

" ... in order to achieve the

appearance of a modern, progressive airline,

we are changing our look."

to increase job opportunities among

minorities. Although we seek job

qualification first, we have found

minority people with these

qualifications and we are hiring them .

"Another change very much in evi-

dence is our new identity program. In

order to achieve the appearance of a

modern, progressive, successful

airline, we are changing our look.

Remember, I said "look," not image.

Southern has become an airline in

step with the times and we want to

communicate the new Southern. To

do this, we have developed a new

corporate identity, the focal point

being the Flight Mark which has

become our corporate symbol. Our

flight and ground equipment is

appearing in modern colors and our

ticket and gate facilities, advertising ,

and printed material will contribute an

appearance of professionalism. We

will change to our new look as we

introduce our newly acquired aircraft,

purchase additional equipment, and

expand passenger facilities.

"As we see it, we have a three-fold

obligation : to provide a satisfactory,

reliable standard of service for our

customers, to operate as profitably as

possible for our stockholders, and to

offer our employees fair wages with

good working conditions. This

continues to be our aim for the

coming year.

"Now, I realize that each of you has

questions about these and other areas

of our performance. Inasmuch as we

at Southern work for our stock-

holders, and furthermore as she is

representative of our lady public, I

am asking her to begin the first

question."

STOCKHOLDER: "I am sure other

stockholders would add many

questions to those I have so I hope

these are representative of all

Southern stockholders. The first, and

certainly one of the most important

things I want to know, is why does

Southern need more jets when no

new routes have been received?"

MR. HULSE: "This is a question we

have been asked many times,

particularly by the financial

community. During the mid-1960s,

the Civil Aeronautics Board began a

program to strengthen the regional

airline industry. Basically, the plan

was to grant regional carriers new,

profitable, longer haul routes, using

profits therefrom to cross-subsidize

losses on service to smaller cities.

Accordingly, Southern was awarded

several major routes, opening

service to Washington, D.C. and

New York, N.Y. in September 1968,

to St. Louis, Mo. in July 1969, to

Tallahassee, Orlando, and Miami, Fla.

in February 1970, to Newark, N.J.

in March 1970 and to Chicago, Ill.

in April 1970.

"Simultaneously , route restrictions

within our existing system were

reduced , enabling us to offer service

between new combinations of city

points.

"Unfortunately, the timing was bad

as the nation, and particularly the

Southeast, was entering a long and

severe recession . Although Southern

did capture a large share of the new

markets, the size and growth of these

markets, together with older, subsidy-

eligible markets which were the

backbone of our system, were

curtailed by the recession. As a result ,

Southern suffered losses during the

period 1968 through 1971 . Capital

that would have been used to acquire

additional aircraft to develop the new

authority was consumed by those

losses.

"Even though Southern was unable

Southern 's highly competent pilot force

is supported by continuing programs for

maintaining high standards and skills.

5

"Our short haul business

was so good it was competing with our

long haul flights.,,

to obtain sufficient aircraft to

achieve the full market potential,

studies were made to define and

establish these markets. In other

words, we used this as a get ready

period for the time when we could

add more aircraft into these markets'.'

B ER: Obviously, Southern's

marketing studies justified the

addition of new aircraft. How did you

o ch this?"

MR. HULSE: "During the late Sixties

and even into 1970 and 1971, we

improved our techniques for

identifying factors which determine

traffic growth. One of the most

significant findings was that although

overall load factor on many flights was

in the area of 50 per cent, a short

segment of a given flight might have a

near-100 per cent load factor,

blocking the entire flight sequence to

our long haul passengers. Our short

haul business was so good it was

com peting with our long haul flights.

"Additionally, by early 1972, it was

clear that economic recovery had

enabled Southern to return to

profitability . Seats occupied were

catching up with seats available.

"We felt the return to profitability

would make possible new financing .

Used DC-9s, well suited to our system,

could be bought at extremely

attractive prices and availability was six

months compared with 18 months

for delivery of new equipment.

"Marketing studies were intensified

and specific benefits to be gained

from each additional aircraft were

determined, indicating that additional

jet aircraft could be utilized

profitably on our current system. We

were offered 13 DC-9s at an extremely

favorable price and it was evident that

these could be introduced

immediately-and profitably.

"Our findings were reinforced by

an independent analysis and research

firm . Their report recommended that

the expansion be implemented. With

this added assuredness, we began a

program that increases our jet fleet

by 87 per cent. "

NEWSMAN: 'We ran a story recently

about the details of the financing for

these airplanes, a $39 million loan.

What other avenues of financing did

you explore?"

MR. HULSE: "During the Fall of 1972

we determined that several financing

methods were available. Based on

this, we signed a letter of intent to

purchase the airplanes, which ,

together with related engines and

parts, resulted in a commitment of

$30 million. Our Fiscal management

considered several programs,

including stock issue, debentures,

various kinds of loans, and finally,

what proved to be the most advan-

tageous method -and the one we

selected - under which a group of

banks led by The First National Bank

of Chicago would make the loan, with

90 per cent of the $27 million needed

for aircraft acquisition guaranteed by

the Department of Transportation,

Federal Aviation Administration, under

a Federal law enacted to stimulate

growth within the regional airline

industry. (Southern's loan is the

largest of this kind yet made.)

"The $1 2 million above the amount

for aircraft will be used to reduce

existing debt, purchase equipment ,

and provide additional

working capital'.'

Some 3 million Southern passengers will

enjoy inflight service during the next 12

months. Stewardesses receive four weeks

of intensive training before they begin

their careers.

7

"Much of our present

maintenance facility ... is being taken

for airport expansion."

STOCKHOLDER: "Speaking of items

in the news, I see that Southern is

building a multi-million dollar

maintenance base in Atlanta. Is this

necessary, and if so, why build

">"

MR. HULSE: "Yes, it is necessary, and

there are several reasons for selecting

Atlanta.

"Much of our present maintenance

facility, located on airport property

owned by the City of Atlanta, is being

taken for airport expansion.

Additionally, these buildings cannot

satisfy our ultimate ne~ds, even if we

could retain them , as they do not

permit efficient maintenance of our

expanded fleet. In addition to more

functional space in the new facility, we

will be able to perform many money-

saving activities which are now

provided by outside firms.

"Accordingly, we discussed these

needs with several major cities on our

system and many of these made

proposals to build a maintenance base

to our specifications. Naturally, there

are many factors to consider, not the

least of which is our own employees.

"After an extensive study, the

conclusion was reached that Atlanta is

the most efficient and economical

location for the facility for a number

of reasons.

"It has taken years to develop our

outstanding maintenance staff. These

are highly qualified , well trained

people. Many are homeowners in the

Atlanta area and most have strong

family ties here. We determined that

as many as one-half of our

maintenance personnel would not be

willing to relocate. Another

consideration was the availability of

material suppliers and support

services; as a major airline city, Atlanta

has these. Another significant factor is

the routing of our equipment - Atlanta

is the operational hub of our route

system.

"This maintenance base will be

owned and paid for by the City of

Atlanta and will be built with little

capital outlay on our part. Southern

will lease it for a 30-year period. We

believe it will satisfy not only our

immediate needs but also will allow

the fleet expansion we anticipate for

further growth .

"The City of Atlanta has set aside

a 75-acre tract adjoining the airport's

newest runway. Construction is

scheduled to begin in early 197 4 with

completion near the end of 1975. The

cost is estimated at $18 million'.'

NEWSMAN: "In the preliminary

drawings shown when you released

the story on the maintenance base,

Southern specified work bays

capable of servicing a DC-10 or a

727-200. Does this mean you are

""'-'r!lltt?"

MR. HULSE: "Not at this time, but we

are planning for the future."

Maintenance functions are performed

in Atlanta and range from complete aircraft

overhaul to specific work on engines

and aircraft components.

9

"A collateral benefit of

our route system is that we can offer our

passengers direct flights ... "

NEWSMAN: "Southern has been

awarded a substantial number of new

routes in the past few years. Do you

feel you are likely to receive any

more routes in the near future?"

MR. HULSE: "Yes, it's true that we

have received some very high quality

route additions in the past five years.

Now that the national economy has

reversed its downward trend , we

believe service over these new routes

will generate substantial additional

traffic and revenues. This will enable

us to improve our financial position

so that other cities on our system can

enjoy improved service to distant

terminal points. For example,

Southern's extension to Chicago

permits our passengers in such

communities as Columbus, Miss. ,

Monroe, La. and Mobile, Ala. to utilize

direct through-plane jet service with

Chicago. Previously these

communities' traffic with Chicago was

provided only by connecting flights.

"There are still other communities

on our system which have not enjoyed

the benefits of our route extensions

and we will be concentrating on these.

A case in point is our application for

nonstop authority between Nashville

and Detroit. If successful, we will link

such presently served communities

as Nashville, Huntsville/Decatur,

Mobile and Gulfport/Biloxi with Detroit

by their first direct, single-plane

service. For Birmingham, this will

mean its first competitive service. Of

course, in the prime Nashville-Detroit

market, this backup type traffic will

enable us to provide a maximum of

Nashville-Detroit flight frequencies.

This was a principal factor in a CAB

Administrative Law Judge recom-

mending Southern over several

competing applicants.

"A collateral benefit of our route

system is that we can offer our

passengers direct flights between

many major points, without the need

of congested connections. Our

Columbus, Ga.-New York/ Newark

service eliminates a plane change in

Atlanta, as does the new Jacksonville-

Memphis schedule. Mobile's

Washington and New York service is

another example of the benefits of

direct, single-plane service."

EMPLOYEE: "We've been flying

charters throughout much of the

United States, to Canada and to the

Bahamas. Will we continue this

emphasis on charter flights?"

MR. HULSE: "As you point out,

Southern's charter operation is

extensive not only in the area we

serve but also in the revenue it

provides. In fact, our charter sales'

contribution to profit is helping to

reduce our need for subsidy. We are

continuing charter emphasis and hope

to increase income from this area."

PASSENGER: "It appears Southern

will operate more jets over more

routes and will carry more

passengers, but what else does the

passenger have to look forward to?"

MR. HULSE: "I think we can

summarize passenger-oriented

improvements as better schedules

with more nonstop service, new

service between additional city pairs,

better reservations service, improved

snack and meal service and more

efficient ground service."

PASSENGER: "If you accomplish

that, Southern will have a new

appearance."

MR. HULSE: "Yes, and we are

determined to accomplish it, even if

not all at one time. Let's consider

schedules and more nonstop

service first .

"The first additional jet went into

service on April 1. By June 1, six will

be in use and all of the 13 additional

aircraft will be in service by the end

of 1973. In turn , on April 1 Southern

Southern 's highly trained technicians

provide virtually all support assistance

including refurbishing seats and carpets,

radio and avionics service, and

jet engine maintenance.

11

"Memphis and Mobile

have become key cities in our

expansion plans."

added additional nonstop service

between Mobile and Atlanta, first time

nonstop service between Mobile and

Washington , nonstop service between

Memphis and New Orleans and

between Memphis and Orlando, and

one stop service between Memphis

and Miami and between St. Louis and

New Orleans. Our June 1 schedule

adds new service between Jacksonville

and Memphis, Jacksonville and

Birmingham and Jacksonville and

Columbus, Ga. Additionally, we

are increasing New Orleans-Memphis-

Chicago and Memphis-New Orleans

frequencies.

"Another city receiving attention is

Nashville. Very recent new authority

permits us to schedule Atlanta-

Nashville nonstop service and later

this year we have plans for linking

Nashville by direct jet flights with points

in Alabama, Florida and Louisiana.

"Memphis and Mobile have become

key cities in our expansion plans. For

example, Southern boarded 106,000

passengers in Memphis in 1968,

increasing to more than 240,000 in

1972. We expect to increase this to

approximately 350,000 by the end of

1973. At the end of 1972 we had 18

jet flights daily in Memphis. At the

end of 1973 we will have 40 jet flights.

Memphis is becoming our major

connecting point for west-bound

travelers and this year we will become

the number two airline serving Memphis,

pushing hard for first place in 197 4.

"We are already first in Mobile in jet

departures and we expect a 90 per

cent gain in passengers this year.

Equally significant is that we are flying

these passengers greater distances

than before."

A modern reservations center in

Atlanta answers 90 percent of reservations

calls Customers in New York,

Chicago, St. Louis and many other cities

are answered in Atlanta.

13

" ... we have some of the

best inflight service in the regional

airline industry ... "

PASSENGER: "What effect will these

new jets have on routes served by

you M rtin 404s?"

MR. HULSE: "During the past years

we have gradually reduced the

number of Martins in our fleet. Two

years ago we had 24. By the end of

1973 we will have only ten in our

pattern of service. We have

accomplished this by substituting jets

on many of the high load factor

Martin flights. Ultimately, all Martins

will be replaced by either DC-9s or

some other modern jet powered

aircraft. 11

STOCKHOLDER: "You mentioned

improving reservations facilities. Is

this an expensive addition?"

MR. HULSE: "Fortunately, no. You

may recall , some three years ago we

entered into a lease agreement for a

computerized reservations system to

replace the method that we had

outgrown. The system selected neither

operated to our expectations nor did

it satisfy our requirements. To replace

this with the best system possible, all

available systems were considered .

Last Fall we implemented one of the

finest, most efficient reservations

networks in the airline industry. Again ,

we leased the computer support with

little capital outlay. It is sufficient to

meet our needs for many years. And ,

I will add , this was accomplished at a

favorable lease rate'.'

PASSENGER: "I .have noticed

significant improvement in your

reservations service. Is this

the reason?"

MR. HULSE: "This is part of the

reason , probably a major part. But,

there are other contributors. For

example, we have implemented close

control on our reservations center

staffing needs. Last year we installed

a small computer that determines

our staffing needs based on call

projections. This warns us when we

need to bring in more help. In turn , we

have a backup force of thoroughly

trained , competent part time

reservations agents who can be called

in on short notice. This enables us to

staff for normal requirements yet have

a ready reserve. As a result, our

answering time has been reduced

remarkably, yet our costs are being

kept in line."

BANKER: 'Will the improved inflight

meal service you mentioned justify

the additional expense of the

program?"

MR. HULSE: "The passenger

acceptance we have encountered

certainly proves the value of more

frequent snacks and tastier meals.

Interestingly, this has been introduced

without an increase in cost per

passenger. Although we have some of

the best inflight service in the regional

airline industry, we provide this at the

lowest cost per passenger. This has

been done by careful planning .

" For example, our serving trays,

table ware, and dishes were designed

not only as passenger pleasers but

also for being functional. Over a

year's time the saving is enormous.

"Much care goes into our food

selection. Several years ago we

introduced our French Quarter Wine

Basket. This includes a hearty roast

beef or turkey sandwich , a praline, on

some flights a piece of fruit, and a

bottle of premium imported wine. This

is served on many of our shorter

flights and we find that passengers

prefer this to a hurried meal. On the

other hand , we are now flying many

flights of more than one hour and this

enables us to serve a meal as we feel

it should be offered. On some flights

our meals include a choice of entree

accompanied by a selection of wines

served by the stewardesses, another

first in standard class service.

"Southern is the only airline offering

all early morning passengers either a

continental or a hot breakfast. 11

Responsive ground service -

before and after a flight - is a Southern

tradition. Competent, friendly personnel

contribute to passengers' convenience.

15

"We try to make

Southern a good place

to work."

EMPLOYEE: "Many of the points that

have been brought up here have

been discussed with Company

employees during the past few

weeks. I don't recall ever having so

much information about the operation

of the Company. Will this program

ti ?"

MR. HULSE: "Most certainly.

Management recognizes that all

employees must be informed and

trained . As a pilot, you are one of the

most skilled in the industry. You are

receiving the best recurrent training

possible and this will continue. In

addition, you will see continuing

programs to keep all Southern

employees aware of both goals and

problems. Training is receiving

significant attention, and this extends

to every job classification, beginning

with entry positions. Every ramp agent

receives 40 hours of classroom

instruction before putting on a

uniform. This makes a substantial

contribution to upgraded ground

service and on-time performance.

Reservations agents are schooled four

full weeks before they are assigned

duties. Our stewardesses are given

four weeks instruction , including both

classroom and inf light. And, every

employee is being introduced to

Southern through a new orientation

program designed to acquaint

newcomers to our methods and goals.

"We are continuing a management

seminar program for all supervisory

personnel. To date, almost 200 have

taken this excellent two week course.

We have seen positive results."

BANKER: "I realize that salaries are

of prime importance to your

employees, but so are other things.

How is Southern competing in the

fringe benefit area?"

MR. HULSE: "We try to make

Southern a good place to work. Our

employees generally agree that their

fringe benefits are among the best in

the airline industry, and in some areas

they lead the industry. We have

improved an already first rate group

insurance plan. Southern has a liberal

employee retirement program. We

offer high limits of Company-paid life

and accident insurance, optional

additional protection, and now have a

group program for buying automobile

and home insurance at substantial

savings. Our personnel are offered

generous vacations and holidays. We

have recently announced a tuition

participation program to stimulate

employees to increase their

education level. Many of our people

are attending college in the evening

and a great number of these are in

graduate programs."

EMPLOYEE: 'Other than the

maintenance base, is Southern

considering other facilities to make

us more functional and even to

improve working conditions?"

MR. HULSE: "Very definitely. We

anticipate that a new pilot and

mechanic training center will be

incorporated into the maintenance

base. This will enable us to provide

all flight and maintenance training

within Company facilities. As you

know, in addition to our maintenance

and training facilities, we occupy

office and support space in all or part

of five buildings around the Atlanta

airport. We have had several attractive

offers to combine this into one leased

property and this is being considered ."

EMPLOYEE: "Our ticketing and

ground service at several of the

larger cities we serve is still provided

by other carriers. Is this going to

change?"

MR. HULSE: "When we began serving

New York, Chicago, St. Louis, Miami

and Newark, it was impossible to get

counter space and gate areas to meet

our needs. Accordingly, we contracted

with various carriers and they have

been providing this service for us. We

recognize this as being far less

desirable than our own operations,

but the key has been getting space in

the terminals. We have worked out

very desirable arrangements at

Chicago and St. Louis and we are

preparing to open our own operations

at each of these cities. We are

continuing to look at other contract-

operated stations and will improve our

operations there when facilities are

available. Let me point out, this is not

an unusual situation as we have

provided ground services for a trunk

airline serving Atlanta. "

Southern flies not only people

but also "things," ranging from specialized

industrial cargo to family pets. A small

package delivery service. Lickety-Split,

provides fast service to small

item shippers.

17

" ... the best look

at Southern is aboard one

of our flights."

EMPLOYEE: "Is it true that we are

developing a new waste treatment

plan n Atlanta?"

MR. HULSE: "We have never shouted

about our contribution to an improved

environment. Nevertheless, we have

several environmental programs

underway. One of these is the waste

treatment plant you mentioned. It will

be a deterrent to both solid and liquid

waste entering streams adjoining the

Atlanta airport. This is being

developed in a joint effort with the

City of Atlanta and is scheduled for

operation by the end of this year.

Southern is spending in excess of

$300,000 for this badly needed

addition. In another area, we are 90

per cent complete in a program

retrofitting our jet engines to reduce

smoke and particulate matter. We

anticipate other programs to further

reduce engine emissions and noise.

Also we are a major participant in

landing and takeoff patterns that result

in reduced noise pollution levels over

residential areas.

"Let me summarize a few points.

Essentially, 1973 began a significant

era in Southern's history, but the real

change will not be recognized until

197 4. Then, we will have a full year's

results from our expanded fleet. Our

employee level will have grown more

than 25 per cent, compared with

1972, and revenues will have soared

to over $100 million, an increase

of more than 55 per cent.

Passenger travel on our

18

routes will increase 60 per cent

compared with 1972 levels. We will

have developed a strong identity in all

cities we serve and a reference to

Southern will be synonymous with

quality air service.

"The participation of each of you is

appreciated. Certainly, your questions

are representative of those we hear

most frequently. Regardless of the

in depth approach we take in any

discussion, the best look at Southern

is aboard one of our flights. I hope

those of you not in our employee

family will give us an opportunity to

show you how we are improving . We

want you to know that 'Southern is

going your way.' We hope you will

come our way."

bout this Report

The panel oh page 3, representing

Southern's many publics, includes

(left to right) William C. Henry, a vice

president of the Trust Company of

Georgia, Heyward Siddons of Stein

Printing Company who posed as the

newsman, Captain James E. Bass, a

Southern pilot for 22 years,

Mrs. Frances B. Ray, secretary to

Southern's president, and as the

customer, H. Roy Kaye of Stein

Printing Company where this report

was designed and produced. No

professional models were used in this

Report and all pictured are either

actual passengers photographed with

consent, or Southern employees. The

cover and most of the interior

photography is by Frank Garner.

Notice to Stockholders of

Southern Airways, Inc.

Any person who owns as of

December 31 of any year. or

subsequently acqwres 0Nnersh1p

either personally or as a trustee of

more than five per cent (5%} tn the

aggregate of any class of capital stock

or capital of Southern Airways Inc

shall file with the C1v1I Aeronautics

Board a report containmg the

tnformat1on reqwred by Part 245 12

of the Boards Economic Regulatt0ns

This report must be flied on or before

Apnl 1 of each year as to the capital

stock or capital owned as of

December 31 of the precedmg year

and tn the case of capital subsequently

acquired a report must be filed w1thtn

ten (1 OJ days after such acqws1t1on

unless such person has otherwise filed

with the C1v1I Aeronautics Board a

report covenng such acqws1tt0n or

ownership

Any bank or broker covered by this

provist0n, to the extent that it holds

shares as trustee on the last day of

any quarter of a calendar year shall

file with the Civil Aeronautics Board

withtn thirty (30) days after the end

of the quarter a report tn accordance

with the provisions of Part 245 14 of

the Board's Economic Regulatt0ns

Any person reqwred to report

pursuant to these provisions who

grants a secunty interest tn more than

five per cent {5%) of any class of the

capital stock or capital of an air earner

shall w1thtn thirty {30) days after

granttng such secunty interest. file

with the Ctv1I Aeronautics Board a

report contatntng the tnformatt0n

reqwred tn Part 245 15 of the

Economic Regulatt0ns

Any stockholder who believes that

he may be required to file such a

report may obtatn further tnformatt0n

by wnttng to the Director, Bureau of

Operattng Rights, Ctvil Aeronautics

Board, Washmgton, D C 20428

Statement of Operations

Southern Airways, Inc.

OPERATING REVENUES

Passenger . . ....... .

Mail, express and freight . . ....... .

Public service revenue ..

Charter .

Other operating revenues - net

OPERATING EXPENSES

Flying operations .............. .

Maintenance .

Aircraft and traffic servicing . ...... .

Passenger service ..

Promotion and sales .

Years Ended December 31 ,

General and administrative . . . . . . . . . . ............. .

Depreciation and amortization - Notes A and I ........... .

OPERATING INCOME

OTHER DEDUCTIONS (INCOME)

Interest on long-term debt .......... .

Miscellaneous deductions (income) - net

INCOME (LOSS) BEFORE INCOME TAXES

INCOME TAXES (CREDIT) - Note D

Current

Federal .

State ...

Deferred .

Investment credit .

INCOME (LOSS) BEFORE EXTRAORDINARY CREDIT .

TAX BENEFITS OF OPERATING LOSS CARRYFORWARD - Note D .

NET INCOME (LOSS) ......... .

EARNINGS (LOSS) PER COMMON AND COMMON EQUIVALENT SHARE - Note H

Primary

Income (loss) before extraordinary credit

Extraordinary credit .

Net income (loss) ................ .

Fully Diluted

Income (loss) before extraordinary credit .

Extraordinary credit ..

Net income (loss) ... .. ....... .

See Notes to Financial Statements.

...... . ..

........

. . . . . . . . . . . . . . .

. .

1972 1971

$52,052,394 $45 ,301,780

3,531,100 3,090,002

7,137,964 6,973,875

4,838,759 4,067,008

1,077,220 900,907

68,637,437 60,333,572

22,431,226 20,949,971

11,890,014 10,807,844

15,433,205 13,522,854

4,343,393 3,773,582

5,303,672 4,774,385

3,783,878 3,461,427

2,559,029 2,636,732

65,744,417 59,926,795

2,893,020 406,777

1,361,913 1,678,112

(109,460) 22,449

1,252,453 1,700,561

1,640,567 (1 ,293,784)

762,000

80,500

(235,000)

(393,000)

449,500 (235,000)

1,191,067 (1 ,058,784)

409,250

$ 1,600,317 $ (1 ,058,784)

$ .77 $ (1 .02)

.29

$ 1.06 $ (1 .02)

$ .60 $ (1 .02)

.20

$ .80 $ ( 1 .02)

19

Balance Sheet

Southern Airways, Inc.

ASSETS

CURRENT ASSETS

Cash and short-term investments ..

Accounts receivable

U.S. Government - Transportation and public

service revenue ..... .

Trade receivables, less allowance for doubtful

December 31 ,

accounts (1972 - $28,945; 1971 - $41 ,849) ....... .

Maintenance and operating supplies, at average

cost less allowance for obsolescence

(1972-$928,817; 1971 - $695,787) - Note A .

Prepaid expenses .......... .

Total Current Assets ..

OTHER ASSETS

Hijacking payment - Note B .................. .

Equipment purchase deposits ..... .

Miscellaneous ... . ............................... .

PROPERTY AND EQUIPMENT - on the basis of cost -

Notes A and C

Flight equipment ..... .

Other property and equipment

Less allowances for depreciation and maintenance ..

DEFERRED CHARGES - Note A

Unamortized preoperating, route extension

and development costs .................. .

Deferred lease costs . . . ...... .

Unamortized long-term debt expense .

20

1972

$ 5,744,808

2,127,449

5,341,247

7,468,696

1,885,545

824,001

15,923,050

2,000,000

416,840

109,290

2,526,130

26,766,370

3,822,489

30,588,859

13,601,677

16,987,182

417,918

188,560

452,977

1,059,455

$36,495,817

1971

$ 5,057,849

1,481 ,210

4,989,452

6,470,662

2,015,280

791 ,765

14,335,556

90,621

90,621

27,237,131

3,625,547

30,862,678

12,123,973

18,738,705

691 ,245

217,788

580,524

1,489,557

$34,654,439

LIABILITIES December 31,

CURRENT LIABILITIES

Accounts payable . . . . . . . . . . . . . . . .................... .

Collections and withholdings as agent

Salaries, wages and vacations .

Accrued interest payable .

Accrued taxes and other expense .

Air travel plan deposits

Current maturities of long-term debt - Note C . . . . . . . . . . . ...... .

Total Current Liabilities ..

LONG-TERM DEBT - Note C

Notes payable, less current maturities

Convertible subordinated debentures .

STOCKHOLDERS' EQUITY - Notes C and E

Preferred Stock, $1 par value, authorized 2,000,000

shares issuable in series:

Series A $.36 convertible-voting (liquidation value $6

per share plus cumulative dividend-aggregate of

$1 ,209,055 in 1972 and $1 ,523,316 in 1971) issued and

outstanding-190, 103 shares (1972) and 253,886

shares (1971). . ....... .

Series B $.36 convertible - non-voting (liquidation

value $6 per sham plus cumulative dividend -

aggregate of $1 ,060,002 in 1972 and $1 ,000,002

in 1971) issued and outstanding - 166,667 shares ....... . .... . .. .

Common Stock, $2 par value:

Authorized - 7,500,000 shares

Issued and outstanding-1 ,271 , 191 shares (1972)

and 1,061 ,766 shares (1971) ...

Other paid-in capital ........ .

Retained-earnings (deficit) ..... .

COMMITMENTS AND CONTINGENCIES-Note G

See Notes to Financial Statements.

$

1972

3,008,194

4,837,482

1,745,155

342,532

367,689

97,750

10,398,802

9,238,016

11,345,000

20,583,016

190,103

166,667

2,542,382

4,437,970

(1,823,123)

5,513,999

$36,495,817

$

1971

2,983,250

3,298,405

1,647,268

248,002

462,807

102,000

2,202,471

10,944,203

8,535,032

12,682,000

21 ,217,032

253,886

166,667

2,123,532

3,372,559

(3,423,440)

2,493,204

$34,654,439

21

Statement of Changes in Financial Position

Southern Airways, Inc.

FUNDS PROVIDED

From operations

Years ended December 31 ,

Income (loss) before extraordinary credit .....

Items not requiring outlay of working capital in current period

Depreciation . . . . ...... .. ... .

Increase in allowance for maintenance . . . . . . . . . . . . . . . ... . .. .

Amortization of deferred charges . ................. . .... .

Deferred income tax (credit) . . . . . . . . . . . .. .... . ...... . ...... .

Total from operations, exclusive of extraordinary credit.

Extraordinary credit ... .

Long-term borrowings ..

Sale of Pref erred Stock . .. ... . .

Exercise of Common Stock Purchase Warrants .

Conversions to Common Stock

Debentures ........... . . . .. .

Series A Preferred Stock .... .

Property and equipment sold or converted to lease,

less gain included above . . . . . . . . . . . . . . ..... . .... .

Refund of equipment purchase and lease deposits . .. ... . .. .... .

FUNDS USED

Additions to property and equipment .... .

Hijacking payment . . . . . . . . . . . .. .. ....... .

Equipment purchase and lease deposits . . . .. . ... . . .

Reduction of long-term notes payable .

Conversions to Common Stock

Debentures . . . . . . . . . . . . ...... .

Series A Preferred Stock . .

Increase in deferred charges .

Increase in other assets .

INCREASE IN WORKING CAPITAL .

Working capital at beginning of period .

WORKING CAPITAL AT END OF PERIOD

INCREASE (DECREASE) IN WORKING CAPITAL BY COMPONENTS

Cash and short-term investments .... .

Accounts receivable . . . . . . . . . . . . . . . . . . . .. . . . . ... .

Maintenance and operating supplies ..... ...... . ... .

Prepaid expenses . . . . . . . . . . . ........... . ........ . .. .

Accounts payable . . . . . . . . . . . . ... . . .

Collections and withholdings as agent . . . .. . . . .

Salaries, wages and vacations . . . . ..... .. . . . . .. . .. ... . .. .... . . . .. .

Accrued interest, taxes and other expenses . . . .

Air travel plan deposits . . . . . . . . . . . . . . . . . . . . . . . . . ... . .. .

Current maturities of long-term debt ...

INCREASE IN WORKING CAPITAL

See Notes to Financial Statements.

22

1972

$ 1,191,067

2,039,695

544,721

382,153

4,157,636

409,250

2,952,130

145,314

1,337,000

63,783

92,368

9,157,481

925,261

2,000,000

416,840

2,249,146

1,337,000

63,783

13,887

18,669

7,024,586

2,132,895

3,391,353

$ 5,524,248

$ 686,959

998,034

(129,735)

32,236

(24,944)

(1,539,077)

(97,887)

588

4,250

2,202,471

$ 2,132,895

1971

$ (1 ,058,784)

2,094,991

322,946

484,478

(235 ,000)

$

1,608,631

787,757

2,637,379

36,895

588,915

490,000

6,149,577

1,409,959

3,008,041

36,895

6,459

11 ,879

4,473,233

1,676,344

1,715,009

3,391 ,353

$ 2,383,503

(1 ,084,513)

373,621

282,946

807,803

(670,743)

(315 ,014)

280,782

6,375

(388,416)

$ 1,676,344

Statement of Stockholders' Equity

Southern Airways, Inc.

Years ended December 31 , 1972 and 1971

Balance, January 1, 1971 ........... . . ..... . . . ..

Net loss ..... ... ...... .. .......... .. . . ......

Preferred Stock sold .........................

Common Stock issued upon

Conversion of Preferred Stock ..... .........

Balance, December 31 , 1971 .... . ... . ......... . .

Net income ..................... . . . .... . ....

Common Stock issued upon:

Conversion of Preferred Stock ' '

........ '

..

Conversion of $1 ,000,000

principal amount of 6-1 /2%

Convertible Subordinated

Debentures, less $53,692 deferred

finance cost .......... . .. . ... . ... .. .. . .. .

Conversion of $337,000 principal

amount of 5-3/4% Convertible

Subordinated Debentures, less

$8,144 deferred finance cost ....... .. . .... .

Exercise of stock purchase warrants ..........

Balance, December 31, 1972 ...... . . . . . . .. .. ....

See Notes to Financial Statements.

Preferred Stock

$1 Par Value

Series A Series B

$ $

290,781 166,667

(36,895)

253,886 166,667

(63,783)

$190,103 $166,667

Common Other Retained-

Stock Paid-In Earnings

$2 Par Value Capital (Deficit)

$2,049,742 $1 ,229,523 $(2,364,656)

(1 ,058,784)

2,179,931

73,790 (36,895)

2,123,532 3,372,559 (3,423,440)

1,600,317

127,566 (63,783)

200,000 746,308

62,046 266,810

29,238 116,076

$2,542,382 $4,437,970 $(1 ,823, 123)

23

Notes to Financial Statements

December 31 , 1972

Report of

Independent Accountants

Board of Directors

Southern Airways, Inc.

Atlanta, Georgia

We have examined the balance sheet of

Southern Airways, Inc. as of December 31 , 1972

and 1971 , and the related statements of

operations, stockholders' equity, and changes in

financial position for the two years ended

December 31 , 1972. Our examinations were made

in accordance with generally accepted auditing

standards, and accordingly included such tests of

the accounting records and such other auditing

procedures as we considered necessary

in the circumstances.

In our opinion, subject to the recovery of the

hijacking payment as explained in Note B to the

financial statements, the accompanying balance

sheet and statements of operations,

stockholders' equity, and changes in financial

position present fairly the financial position of

Southern Airways, Inc. at December 31, 1972 and

1971, and the results of its operations, changes

in stockholders' equity and changes in financial

position for the two years ended December 31,

1972, in conformity with generally accepted

accounting principles applied on a

consistent basis.

~1~

r:Jt~

Atlanta, Georgia

January 31, 1973, except

as to Note C as

to which the date is

February 28, 1973

24

NOTE A-SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

PROPERTY, EQUIPMENT, DEPRECIATION , AND OB-

SOLESCENCE - Provisions for depreciation of property

and equipment are computed on the straight-line method

calculated to amortize the cost of the properties over their

estimated useful lives. Estimated useful lives are as follows:

Airframes, engines, propellers,

communications equipment

Ground

M-404 DC-9 Equipment

and ratable parts . . (A) 1 5 years

Ground equipment . . . . . . . . . . . . 3-10 years

(A) Common depreciation point of December 31 , 1973.

At the time properties are retired , the amounts of cost

and allowances for depreciation and maintenance are

eliminated from the accounts. Profits and losses on dis-

posals of DC-9 flight equipment (exclusive of ratable parts)

are credited or charged to operations. Proceeds from the

disposal of DC-9 ratable parts and Martin 404 aircraft are

credited to the allowance for depreciation account. The

Company is engaged in a program of reducing the use of

the Martin 404 aircraft , the net investment in which

amounted to approximately $2,835,000 and $3,793,000

at December 31 , 1972 and 1971 , respectively.

Expenditures for ordinary maintenance and repairs are

charged to expense. Expenditures for major spare parts

are capitalized and minor parts are recorded in inventory

accounts and charged to expense as used .

A provision for obsolescence of the investment in minor

spare parts inventory for DC-9 aircraft is made at

an annual rate of 4% and for Martin 404 aircraft at a rate

sufficient to fully write off such investment by December

31 I

1973.

DEFERRED CHARGES - Expenditures for preoperat-

ing and route extension and development costs are de-

ferred and are amortized over a period of five years from

the dates operations of the routes are started .

Costs associated with obtaining leased DC-9 aircraft are

being amortized over the lives of the leases . De-

ferred charges associated with long-term debt are being

amortized over the lives of the financing arrangements.

INCOME TAXES- Taxes are provided at current tax

rates for all items included in the statement of operations

regardless of the years when such items are reported for

tax purposes.

The Company uses the flow-through method of ac-

counting for investment credit and the available invest-

ment credit is recognized to the extent it can be realized

or offset against current or deferred income taxes.

PENSION PLANS- The Company has several pension

plans, including a defined contribution plan, covering sub-

stantially all of its employees. There are no unfunded past

service costs. The Company's policy is to fund pension

costs accrued .

NOTE 8-HIJACKING PAYMENT

In November 1972, the Company paid $2 million in ran-

som in connection with the hijacking of one of its DC-9

aircraft. The aircraft, passengers and crew were returned

to the United States, but the ransom money has been re-

tained by the Republic of Cuba. Negotiations between

representatives of the Company and the Cuban govern-

ment are expected to result in the eventual return of the

funds, although there can be no assurance of the return .

The Company plans to continue to reflect the hijacking

payment as an asset until the funds are returned or there

is a determination that the funds will not be returned . Had

the ransom money been deemed non-recoverable and

written off as an extraordinary charge to income in 1972,

the Company would have suffered a net loss of $359,433

($. 30 per share) and stockholders' equity would have been

reduced to $3,554,249.

NOTE C-LONG-TERM DEBT

At December 31,

Notes payable to banks under

old credit agreement

(refinanced in 1 973)

Demand notes payable to

banks (refinanced in 1973)

Various notes payable under

deferral agreement. . . ...

Note payable to bank - other

Convertible Subordinated

Debentures

5-3/4%, due December

1, 1981 . . . . ......... .

6-1 /2%, with warrants

attached.due

November 1, 1983 .

Less amounts due within

one year .

1972 1971

$ 7,238,016 $ 8,091 ,413

2,000,000

2,135,257

510,833

4,345,000 4,682,000

7,000,000 8,000,000

20,583,016 23,419,503

2,202,471

$20,583,016 $21 ,217,032

On February 20, 1973, the Company entered into a

credit agreement ("New Credit Agreement") pursuant to

which certain banks will lend the Company amounts not

to exceed a total of $39,000,000 under the following com-

mitments:

(1 J The "A" Loan Commitment in an aggregate principal

amount of $27,000,000 to be used as 90 per cent of

the purchase price of flight equipment to be purchased

from Delta Air Lines, Inc. and others (see Note GJ.

All such aircraft, engines and spare parts will be

pledged as collateral on this indebtedness, which is

also 90 per cent guaranteed by the Federal Aviation

Administration. Borrowings under the "A" Commit-

ment through February 28, 1973, amounted

to $3,608,994.

(2) The "B'' Loan Commitment in an aggregate principal

amount of $10,000,000 to be used to repay existing

bank indebtedness under the old credit agreement

and the balance to be added to working capital. This

loan is collateralized by all other property of the Com-

pany. At February 28, 1973, the Company had

borrowed the full amount of the "B" Commitment

which was used to retire the outstanding debt under

the old credit agreement and the demand notes pay-

able, and the balance was added to working capital.

(3) The "C" Loan Commitment in an aggregate amount

of $2,000,000 to be reduced by $100,000 per quarter

beginning March 31 , 1973. Such Commitment will

also be reduced by recoveries of the hijacking pay-

ment discussed in Note B. At February 28, 1973, no

amounts had been borrowed under this Commitment.

Amounts borrowed under the "A" and "B" Commit-

ments on revolving credit notes may be converted to term

loan notes payable in quarterly installments beginning July

1, 1974, and May 1, 1974, respectively. The "A" and "B"

loan amounts bear interest at the lead bank's prime rate

(6-1 /4% at February 28, 1973) plus 1 % and 2-%, re-

spectively. Amounts borrowed under the "C" Commit-

ment are due in quarterly installments and bear interest

at 155% of the lead bank's prime rate. The Company has

agreed to pay a commitment fee of 1 /2 of 1 % per annum

on the daily average unused amount of the Credit Com-

mitment beginning December 29, 1972.

The 5-3/4% Convertible Subordinated Debentures due

December 1, 1981, are convertible (until maturity or prior

redemption) into Common Stock at $10.86 per share;

are subordinated, generally, to all existing and future in-

debtedness for borrowed money; are callable at premiums

ranging from 3-3/4% downward; and require annual sink-

ing fund payments beginning December 1, 1976, in an

amount equal to 10% of the principal amount outstanding

at December 1, 1975. Also, the Company may make addi-

tional voluntary sinking fund payments equal to the re-

quired amount.

The 6-1 /2% Convertible Subordinated Debentures due

November 1. 1983, are convertible (until maturity or prior

25

Notes to Financial Statements (continued)

redemption) into Common Stock at $10 per share; are

issued in integral multiples of $1000 with an attached war-

rant for the purchase of 18 shares at $10 a share; are sub-

ordinated , generally, to all existing and future indebtedness

for borrowed money; are callable on or after November 1,

1973, at premiums ranging from 6-1 /2% downward ; and

require annual prepayments beginning November 1, 1978,

in an amount equal to 10% of the principal amount out-

standing at November 1, 1977, less credit for principal

amount converted or called subsequent to November 1,

1977. Also, the Company may make additional voluntary

prepayments equal to the required amount.

The terms of the "Old Credit Agreement ," "New Credit

Agreement" and both issues of Convertible Subordinated

Debentures place certain requirements and restrictions

New Loan Commitment

Year "A" "B"

1973 $ $

1974 1,600,000 750,000

1975 3,200,000 1,000,000

1976 3,200,000 1,150,000

1977 3,200,000 1,200,000

Thereafter 15,800,000 5,900,000

Total $27,000,000 $10,000,000

upon , among other things , (a) working capital , (b)

indebtedness and lease obligations, (c) capital expendi-

tures, (d) net worth and (e) payments relating to capital

stock, including dividends (no amount was available for

the payment of dividends at December 31 , 1972).

Since the Company repaid in February 1973 the

amounts due under its old credit agreement and the

$2,000,000 of demand notes payable from proceeds of

the "B" Loan Commitment, current maturities of indebted-

ness at December 31 , 1972, have been determined in

accordance with terms of the "B'' Loan Commitment.

A summary of minimum principal payments applicable

to the "New Credit Agreement" (if all funds available are

borrowed) and both issues of Convertible Subordinated

Debentures is as follows:

"C"

$ 400,000

400,000

400,000

400,000

400,000

$ 2,000,000

Subordinated

Debentures

$

434,500

434,500

10,476,000

$11 ,345,000

Total

$ 400,000

2,750,000

4,600,000

5,184,500

5,234,500

32,176,000

$50,345,000

Prepayments equal to 25% of net income in excess of $1 ,500,000 plus 50% of net income in excess of $3,000,000 earned

in any fiscal year beginning January 1, 197 4, will be required under the "B'' Note. The above summary of minimum

principal payments does not reflect the possible effect of any such prepayment.

26

NOTED-INCOME TAXES

At December 31, 1972, operating loss carryforwards to

future periods for income tax purposes aggregate approxi-

mately $4,108,000 and expire in 1977 ($2,374,000) and

1978 ($1,734,000). The operating loss carryforward for

financial statement purposes at December 31, 1972, is

approximately $2,208,000. Investment credit carryovers,

which may be used to offset federal income tax payable

in future income tax returns, aggregate $1,287,000 and

expire in 1976 ($65,000), 1977 ($810,000), 1978

($64,000) and 1979 ($348,000).

The Company plans to change the depreciation method

and lives applicable to certain assets for income tax pur-

poses prior to the expiration of existing operating

loss carryforwards. Because of these changes and the

carryforward of the 1971 operating loss, deferred taxes

($235,000) provided in prior years will not be paid and,

accordingly, have been recognized as an income tax credit

in the Statement of Operations for 1971 .

NOTE E-CAPITAL STOCK AND OPTIONS

The stockholders approved an amendment to the Com-

pany's charter in May 1971 to increase authorized Com-

mon Stock from 5,000,000 shares to 7,500,000 shares,

and to authorize 2,000,000 shares of $1 par value Pre-

ferred Stock in one or more series ; the terms of each

series of Preferred Stock to be determined by the

Board of Directors upon issuance .

The Series A and Series B Preferred Stock (authorized

in June 1971) is convertible into Common Stock on a share-

for-share basis, can be redeemed after July 1, 1976 at $6

per share plus accumulated dividends, and is entitled

upon liquidation to $6 per share plus accumulated divi-

dends. The liquidation preference for the 356,770 shares

outstanding at December 31 , 1972, including the divi-

dend requirement described below , aggregated

$2,269,057, which is $1,912,287 more than the aggregate

par value of such shares.

Each share of Preferred Stock is entitled to receive annual

dividends of $.36 per share, cumulative only to the extent

of annual net profits. Since the sh.ares were issued in 1971 ,

a loss year, no dividend had accumulated prior to Decem-

ber 31 , 1972. The annual dividend requirement on shares

outstanding at December 31 , 1972, aggregates $128,437.

Payment of dividends is subject to the limitations prescribed

by the indentures covering the 5-3/4% and 6-1 /2% Con-

vertible Subordinated Debentures and to limitations con-

tained in the old and new credit agreements (see Note C).

Authorized common shares include 2,110,092 shares

and 2,323, 1 25 shares reserved at December 31 , 1972 and

1971 , respectively, for issuance as follows:

For convertible securities

conversions

5-3/4% Convertible Sub-

ordinated Debentures

(Note C).

6-1/2% Convertible Sub-

ordinated Debentures

(Note C).

Series A Convertible

Preferred Stock ...

Series B Convertible

Preferred Stock.

For exercise of outstanding

warrants

At $10 per share (issued with

6-1 /2% Convertible

Subordinated Debentures -

Note C) . . ...... .

At $6 per share (issued with

Series A-290,562 shares

in 1972 and 290,781 in

1971 - and Series 8 -

166,667 shares

Convertible Preferred

Stock) .

For options under

Qualified Stock Option Plan

(45,000 shares) and

Employee Stock Option

Plan (25,000 shares) ..

1972 1971

400,093

700,000

190,103

166,667

1,456,863

126,000

457,229

583,229

70,000

2,110,092

431 ,124

800,000

253,886

166,667

1,651 ,677

144,000

457,448

601,448

70,000

2,323,125

27

Notes to Financial Statements (continued)

At December 31 , 1972, there were outstanding options

for 38,000 shares of Common Stock under the Company's

Qualified Stock Option Plan , of which options for 4,000

shares (at $8.69 to $11 . 76 per share) expire in 197 4 and

options for 34,000 shares (at $5.25 per share) expire in

1976. Option transactions during the two years ended

December 31 , 1972, are summarized as follows:

Outstanding , January

1, 1971 .......... . .

Granted .. .

Cancelled ..... .

Outstanding, December

31, 1971 .. ..

Granted ........ .

Expired ........ .

Cancelled .. .

Outstanding, December

31, 1972 .

Number Option Price

of Shares Per Share Total

9,000 $8.69-$19.18 $108,691

36,000 $5.25 189,000

(1,000) $11.76 (11 I

760)

44,000* $5.25-$19.18

1,000 $ 5.25

(1,000) $19.18

(6,000) $5.25-$13.75

285,931

5,250

(19,180)

(49,75 1)

38,000* $5 .25- $11 .76 $222,250

*Excludesoptionsfor4,000shares ( 1972) and 8,000 shares (19 71)

at $5.25 per share which become effective only after expiration

of previously issued options.

There were 7,000 shares and 1,000 shares, respectively,

available for future grant at December 31 , 1972 and 1971 .

Options granted under the Plan are intended to con-

stitute "qualified stock options" as defined in Section 424

(b) of the Internal Revenue Code of 1954, as amended .

Options are exercisable at not less than 1 00% of the fair

market value of the stock on the day of grant, terminate

not later than five years after date of grant, and are not

exercisable during the first 24 months after date of grant.

Each option is exercisable with respect to 1 / 3 of the

number of shares at any time after 24 months following

date of grant, with respect to an additional 1 /3 after

36 months, and with respect to the balance after 48

months. No options were exercised in 1972 or 1971 .

Options became exercisable during the years ended

December 31 , 1972 and 1971 , as follows:

Number of shares ... . ...... .

Option Price

Per Share .

Total ...

Quoted Market Price

at Date Exercisable

Per Share .

Total ........ . . .

28

1972 1971

2,000 2,998

$8.69-$11 .76 $8.69-$19.18

$21 ,403 $36,214

$6.38- $9.13 $4.13-$6.75

$15,336 $17,314

A total of 25,000 shares of Common Stock are reserved

for issuance to participating employees under an

Employees' Stock Option Plan (an employee stock pur-

chase plan as defined by Section 423 (b) of the Internal

Revenue Code of 1954 ). This plan is currently inactive

and there are no participants.

The Company makes no charge to income with respect

to options.

NOTE F-PENSION PLANS

Pension expense for the years ended December 31 ,

1972 and 1971 was $1 ,211 ,687 and $868 ,779 ,

respectively. Effective July 1, 1972, the Company modi-

fied one of the plans to provide for improved benefits, with

a related increase in annual pension expense of approxi-

mately $230,000.

NOTE G-COMMITMENTS AND CONTINGENCIES

The Company has entered into an agreement with Delta

Air Lines, Inc. to purchase 13 used DC-9-14 jet aircraft, 4

spare engines and certain other spare parts and equip-

ment. The base price of each aircraft is $1 ,800,000, sub-

ject to certain adjustments. The total consideration , inclu-

ding all related parts and equipment to be purchased f ram

Delta and others is expected to approximate $30 million.

It is anticipated that delivery of the aircraft will be completed

by October 1, 1973. (See Note C for financing arrange-

ments.)

At December 31 , 1972, the Company was leasing eleven

DC-9 jet aircraft under leases expiring in 1979 through

1983 at a minimum annual rental of approximately

$4,722,000. The Company also leases certain office, ticket-

ing , hangar, computer and shop facilities with minimum

aggregate annual rentals of approximately $1 ,922,000

under various leases with expiration dates through 1992.

In November 1972, the Company entered into a new

five-year agreement to receive passenger reservations

services. At current traffic levels, the annual charge under

the agreement will approximate $600,000.

The Company is the defendant in a number of law suits.

In the opinion of management and legal counsel there is

adequate insurance coverage for such of those suits as

are being defended by the Company's insurance carriers.

In the opinion of management, the other suits will have no

material effect on the financial statements for 1972.

The Company has an employment agreement with its

President providing for his employment to September 12,

1977 at an annual salary of not less than $55 ,000. In addi-

tion, upon his retirement, the Company has agreed to

pay $1 ,250 per month to him for life or in the event of his

death, to his lineal descendants for 180 months. No pro-

vision has been made in the accompanying financial state-

ments for amounts to be paid under the terms of these

agreements.

NOTE H-EARNINGS (LOSS) PER SHARE

Primary earnings per share for the year ended Decem-

ber 31 , 1972, were computed by dividing net

income (adjusted as described below and reduced by the

preferred dividend requirement) by the weighted average

numberof common shares and common equivalent shares

outstanding during the year-a total of 1,439,517 shares.

Common equivalent shares comprise that number

of common shares issuable upon exercise of stock options

and warrants (exclusive of warrants for 126,000 shares

issued prior to June 1, 1969) in excess of 20% of the num-

ber of common shares outstanding at December

31 , 1972. Proceeds from the assumed exercise of the

options and warrants in excess of the amount which would

have been required to purchase 20% of the outstanding

Common Stock at the average market price during the

period were assumed to have been applied to debt reduc-

tion and the related interest (net of income tax effect,

where applicable) was added to income for purposes of

the calculation.

Fully diluted earnings per share for the year

ended December 31 , 1972, were determined on the

assumption that the weighted average number of com-

mon and common equivalent shares was further increased

from the beginning of the period by conversion of out-

standing convertible debentures and convertible preferred

stocks and by exercise of warrants issued prior to June

1, 1969 - a total of 3,098,588 shares. This calculation also

assumes no preferred dividend requirement , and interest

(net of income tax effect, where applicable) related to the

debentures assumed converted and debt assumed to be

retired from the exercise proceeds of the additional war-

rants was added to income for purposes of the cal-

culation .

For the year ended December 31 , 1971 , loss per share

was computed by dividing net loss by the weighted average

number of common shares outstanding (1 ,035 ,048

shares). Due to the loss, there was no preferred stock

dividend requirement and assumed conversion of con-

vertible securities or exercise of stock options or warrants

would not have increased the loss per share.

NOTE I-SUPPLEMENTARY INFORMATION

Depreciation and Amortization

Depreciation of property

and equipment .

Amortization of deferred

charges . . ...... .

Provision for inventory

obsolescence.

Deduct - Amounts charged to

other operating accounts ..

Taxes, other than income taxes,

charged to operating expenses

Payroll taxes

Fuel and oil taxes

Property taxes .

Sales and use taxes

Other .

Rents (including landing fees and

rental at airports served) .

Advertising costs .

1972 1971

$2,039,695 $2 ,094,991

382,153 484,478

233,030 182,617

2,654,878 2,762,086

95,849 125,354

$2,559,029 $2,636,732

$1 ,017,480 $ 804,765

176,755 161 ,003

340,800 327,568

166,254 130,412

103,528 95,020

$1 ,804,817 $1 ,518,768

$8,327,509 $7 ,610,311

$ 976,576 $1 ,102,715

There were no royalties or research and development costs.

29

Going your way

Southern's advertising effort is being

expanded for 1973 with emphasis on

destinations, frequency of service, and

a reminder that "Southern is going

your way."

Emphasis is being placed on

newspaper ads supported by prime

time radio, and in some cities,

television .

The aim is the business traveler who

frequents our system Monday through

Friday and who revels in our resort

attractions on the weekends.

Ads like this, 5 newspaper columns wide,

are appearing in New York and St. Louis,

~

going your way

Play Golf on the rut Coast

Southern G~~limel<u's

as lowas~gfor6days

Goffon 1

heGutt

7/ ~ GollandPlay

al the famous on MobtleBay

Broadwater Beach at 1

he

Hole! Grand H01

elnear

~ - Mobile

Biloxi

r,,...eun181'dfS.0,,.,fw

Wldlll'l18roleS..,..OwrsearlCI

1t,Jl'39t,clff'unCo.ir-se

11Qhllclioi'"9"1~.>6""""'ot

(iula.;ic,..,,os.,t1c11Yo,11

E,-.o,t~rOIJfflt..-ty

tnl~lazlUf't'ICIII.IJU!,6mar$

Pln91fMgdyQl,Ql'1!IO

!IIIY'lcJl6or,,,an:i5J'l,QNI

'-"'--serl'ICll17o.odilldlo

a,-,1ti,m(',ullll(ll'\Blcm~

YGl9"f'SPkl5kstw,qAllr!tg

df'IG--Oll;u,t,Qalll'III

~arOOOIE""Jl'lemodi'<fl

ct,a,mcttnlCnrlll~.wri

tlrUlo:IW~dn"4'f""t.,.,O

~cneniee 'b.lrchoa

of7dayS6"'9tgC<O,,O,J

weie11..o ..... vec:,.,,,010,ill'S

,_

Newspapers throughout Southern's

system are carrying similar ads

in large format.

going your way

Non-stop

Chi~j)QO

St.Louis

New Orleans

I

=-1

~

... ~:::--

l~':7--...

I ~

':-:;;:- ~-= ...

:~= t:i::::::: 1

: : : ;

1~~=

g ,_

rn~ :iis~; rnE 1i~E--

FlyYour WayCallS2576810f \"'()Ur T

ravel Agent

30

going your way. , , Southern

Southern is introducing a series of colorful posters depicting

key vacation destinations.

Television commercials are appearing in Birmingham, Jackson, Miss.;