Bsi^blic AipUmcc

JffSS Annual Report

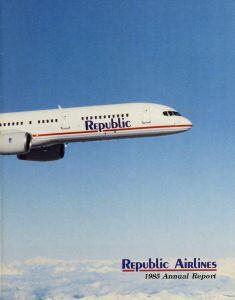

ABOUT THE COVER: Republic's

Boeing 757s entered service in 1985.

A "good neighbor'* jetliner, noted

for quiet operation, they are

powered by fuel-efficient

Rolls-Royce engines. They are used

principally on long-haul routes

from Detroit to the West Coast.

Republic's Travel Agency Advisory

Board meets quarterly to ensure a

quality relationship with the

airline's partners in travel.

Republic's personal and high-tech

training programs instill pride and

productivity in its employees.

Republic AirUnes

1985 Annual Report

Contents

The Company 1

Highlights 1

Letter to stockholders 2

Ten-year summary 4

Management's discussion and analysis 6

1985 in review 12

Route map 18

Financial statements 22

Auditors' report 26

Notes to financial statements 27

Supplemental stockholder information 33

Board of Directors and Officers 36

The Company

Republic Airlines, Inc. - now in its

39th year -

is engaged in the business of

carrying passengers on its scheduled route

system. The Company began service

February 24, 1948, as Wisconsin Central

Airlines. In 1952, its name was changed to

North Central Airlines, which merged with

Southern Airways in 1979. The following

year, Hughes Airwest was purchased. As one

of America's 10 largest airlines. Republic

now serves more than 100 cities in 34 states

coast-to-coast, plus Canada,

Mexico, and the Cayman

Islands in the Caribbean.

Highlights

1985 1984

Percent

Increase

Financial

Operating Revenues . . . .

$1,734,397,000 $1,547,232,000 12.1

Operating Expenses . . . .

$1,568,067,000 $1,447,230,000 8.3

Operating Profit ....

$ 166,330,000 $ 100,002,000 66.3

Net Earnings . . . .

$ 177,006,000 $ 29,511,000 499.8

Net Earnings per Common Share:

Primary

Fully Diluted

$ 4.74

$ 3.98

$

$

.76

.75

523.7

430.7

Stockholders' Equity . . . .

$ 196,081,000 $ 8,640,000 2,169.5

Common Stock Outstanding at Year End ....

33,567,000 30,639,000 9.6

Statistical

Passengers 17,465,000 15,257,000 14.5

Revenue Passenger Miles . . . .

10,736,918,000 8,594,040,000 24.9

Available Seat Miles ....

18,267,960,000 17,113,170,000 6.7

Passenger Load Factor 58.8% 50.2% 8.6 pts.

Cargo Ton Miles 116,943,000 94,773,000 23.4

Number of Employees at Year End:

Full Time

Part Time

. . . .

13,700

. . . .

1,500

12,900

500

6.2

200.0

To our stockholders, employees and friends:

YourCompanyenjoyedthebestfinancial

performance in its history during 1985. Net

earnings reached $177 million on operating

revenues of $1.73 billion. The earnings equate to

$4.74 per share (primary) -- a sixfold improvement

over 1984 when we earned $29.5 million or 76 cents

per share (primary), with operating revenues of

$1.55 billion.

For the year, passenger traffic jumped almost

25 percent over 1984 while seat capacity increased a

modest 7 percent. As a result, 1985 load factor was

59 percent --

nearly a 9 point improvement over the

preceding year. Traffic growth exceeded 30 percent

each month May through December year over year,

and in October and November your Company posted

the highest load factor among the major airlines.

This outstanding financial and traffic performance

is the direct result of actions taken by your

management over the past two years following our

objective of becoming a carrier of preference. This

goal involved all operational elements of the airline

and resulted in a major repositioning of Republic in

the intensely competitive airline industry. We have

dedicated the resources of your Company to building

a competitive hub structure at Detroit,

Minneapolis/St. Paul, and Memphis. These hubs

offer passengers the convenience of single airline

service as they flow through these uncongested

traffic centers. To stimulate traffic growth, we

closely timed arrivals and departures at the hubs to

maximize connecting opportunities for in-bound

passengers. With the April 1985 schedule

modification, connecting opportunities at Memphis

increased 156 percent; at Minneapolis/St. Paul,

88 percent; and at Detroit, 82 percent.

Because of the increased traffic, we placed an

earlier-than-anticipated order for six Boeing 757

jetliners. Three of these quiet and fuel efficient,

190-passenger aircraft already operate on long-haul

flights, principally from Detroit. The remaining

three 757s will join Republic by mid-1986. Republic

has options for future delivery of six more

Boeing 757s.

Daniel F. May

Other 1985 highlights:

Adding eight other aircraft: three

Boeing 727-200s and five DC-9s, bringing

the fleet size to 168 jetliners;

Inaugurating service at 12 additional cities;

Signing agreements with regional airlines for

passenger support at each of Republic's three

hubs;

Opening a state-of-the-art reservations center in

Livonia, Michigan, a Detroit suburb;

Completing major construction programs at key

airports;

Opening expanded Executive Suite lounges in

Detroit, Memphis, and Minneapolis/St. Paul;

Planning First Class service which was

introduced in February 1986; and

Adding front-cabin service to 33 aircraft with

First Class now available on all DC-9,

Boeing 727, and Boeing 757 aircraft.

2

REPublic AIrUnes

We also report with sorrow the October 20 death

of Eric Bramley, a director of the Company since

1976 and previously editor of Aviation Daily, the

airline industry's leading trade publication. His

contribution to the direction of your Company is

gratefully acknowledged and his absence deeply felt.

NWA Inc., parent of Northwest Airlines, and

Republic jointly announced January 23, 1986, an

agi'eement for NWA to purchase Republic for

approximately $884 million. The Northwest-Republic

combination will produce one of America's largest

and most dynamic airlines. When government and

stockholder approvals are received, the resources of

the combined carriers will make a formidable

airline, strongly positioned for further growth.

The association of your Company with Northwest

will benefit Republic's three constituencies --

stockholders, passengers, and employees. As part of

the agreement, NWA will pay $17 a share to

stockholders. Many of those stockholders are

Republic employees who as a group own

approximately one-fourth of the Company. The

rewards to employees result not only from the

increased value of their Republic holdings, but also

from the personal and professional opportunities

created by the merger.

Passengers and shippers will be the real winners

when the airlines combine. Single-carrier service

from cities large and small will be available to a

dozen destinations in the Far East and Southeast

Asia, and eight in Europe. The blending of

Republic's strong domestic route system with the

international resources of Northwest will result in a

financially strong carrier dedicated to providing

quality service.

The merger process is proceeding smoothly

through the Department of Transportation, and we

expect government and Republic stockholder

Stephen M. Wolf

approval soon. Once these are received. Republic

will be combined with Northwest Orient Airlines,

offering travelers a superior network of world-wide

travel convenience.

We want to thank you for the support you have

provided during Republic's 38-year history. It is

dearly appreciated and will long be remembered.

Sincerely,

Daniel F. May [/ Stephen M. Wolf

Chairman of the Board President and

Chief Executive Officer

March 6, 1986

3

Ten-year summary

OPERATIONS (in thousands, except per share amounts)

OPERATING REVENUES

Passenger

Other

OPERATING EXPENSES

OPERATING PROFIT (LOSS)

OTHER EXPENSES (INCOME)

Interest expense-net of capitalized interest

Gain on disposition of property, equipment and lease rights

Other income-net

EARNINGS (LOSS) BEFORE INCOME TAXES AND EXTRAORDINARY ITEMS

Income tax credit (expense)

Extraordinary items

Effect of utilization of tax loss carryforwards

Gain on pension plan termination

NET EARNINGS (LOSS)

NET EARNINGS (LOSS) PER COMMON SHARE

Primary

Fully diluted

OTHER FINANCIAL DATA (in thousands, except per share amounts)

Current assets

Property and equipment-net

Total assets

Total long-term debt and capital lease obligations

Redeemable preferred stock of subsidiary

Stockholders' equity (deficit)

Cash dividends per share of common stock

STATISTICS

Passengers

Revenue passenger miles (000)

Available seat miles (000)

Passenger load factor

Cargo ton miles (000)

Revenue plane miles (000)

1985 1984

$1,598,237

136,160

1,734,397

$1,415,583

131,649

1,547,232

1,568,067 1,447,230

166,330 100,002

90,092

(21,368)

(21,925)

46,799

97,000

(17,316)

(9,193)

70,491

119,531

(50,300)

29,511

(15,802)

45,600

62,175

15,802

$ 177,006 $ 29,511

$4.74 $.76

$3.98 $.75

$ 528,285 $ 302,796

$ 738,332 $ 761,678

$1,286,297 $1,084,909

$ 633,659 $ 675,215

-

$ 28,000

$ 196,081 $ 8,640

17,465,000 15,257,000

10,737,000 8,594,000

18,268,000 17,113,000

58.8% 50.2%

117,000 95,000

172,000 162,000

Includes results of Republic Airlines West, Inc., a consolidated subsidiary, from October 1980 through December 1985.

During December 1985, the subsidiary was dissolved and remaining net assets were transferred to the Company.

4

REptjbLic AirUnes

1983 1982 1981 1980*

$1,388,285

123,209

1,511,494

$1,402,693

127,975

1,530,668

$1,311,951

136,465

1,448,416

$827,678

89,037

916,715

1,542,511 1,493,445 1,431,960 903,491

(31,017) 37,223 16,456 13,224

97,852

(923)

(16,915)

100,703

(2,570)

(21,049)

108,362

(13,369)

(32,326)

48,341

(4,112)

(4,403)

80,014 77,084 62,667 39,826

(111,031) (39,861) (46,211)

(58)

(26,602)

1,940

$ (111,031) $ (39,861) $ (46,269) $ (24,662)

$(4.28) $(1.99) $(2.30) $(1.19)

$(4.28) $(1.99) $(2.30) $(1.19)

$ 263,067 $ 328,640 $ 263,296 $ 249,010

$ 829,830 $ 846,036 $ 882,196 $ 778,375

$1,108,672 $1,186,174 $1,154,567 $1,036,226

$ 759,395 $ 797,287 $ 722,434 $ 652,257

$ 28,000 $ 28,000 $ 28,000 -

$ (22,381) $ 27,938 $ 72,348 $ 117,627

- -

$ .10 $ .20

17,787,000 18,075,000 16,841,000 13,220,000

9,675,000 9,231,000 7,641,000 4,760,000

17,773,000 16,585,000 15,119,000 10,185,000

54.4% 55.7% 50.5% 46.7%

80,000 65,000 51,000 37,000

168,000 156,000 145,000 102,000

1979 1978 1977 1976

$527,792 $408,243 $317,469 $272,365

81,438 79,322 71,165 58,950

609,230 487,565 388,634 331,315

581,177 444,756 360,839 312,024

28,053 42,809 27,795 19,291

20,122 16,673 11,476 9,347

(2,002) (1,306) (8,904) (280)

(1,378) (2,593) (700) (924)

16,742 12,774 1,872 8,143

11,311 30,035 25,923 11,148

1,750 (5,464) (2,885) (3,144)

$ 13,061 $ 24,571 $ 23,038 $ 8,004

$.70 $1.42 $1.38 $.48

$.68 $1.31 $1.23 $.43

$144,691 $107,764 $ 89,088 $ 71,362

$399,632 $314,054 $235,671 $195,807

$549,381 $428,424 $330,336 $271,536

$263,035 $196,637 $142,648 $129,512

$145,514 $113,288 $ 89,266 $ 67,247

$ .20 $ .16 $ .12 $ .10

12,156,000 11,143,000 9,180,000 8,397,000

3,847,000 3,364,000 2,584,000 2,304,000

7,479,000 6,010,000 5,152,000 4,611,000

51.4% 56.0% 50.2% 50.0%

32,000 28,000 23,000 22,000

81,000 71,000 62,000 58,000

5

Management's discussion and analysis

Operating revenues

otal operating revenues

increased 12.1 percent in

1985 to $1.7 billion

following a 2.4 percent increase in

1984, primarily from substantial

gi'owth in passenger revenues.

Representing more than

92 percent of total operating

revenues, passenger revenues

increased 12.9 percent in 1985 due

primarily to the 25.9 percent

gi'owth in scheduled revenue

passenger miles. The impact of

this substantial traffic growth was

partially diminished by a

10.3 percent decline in average

revenue per scheduled passenger

mile (yield) which decreased from

16.63 cents in 1984 to 14.92 cents

in 1985.

The increase in scheduled

revenue passenger miles in 1985

exceeded the increase in capacity

resulting in an 8.6 point increase

in passenger load factor to

58.8 percent. The major route

restructuring implemented during

1985 along with a strong economy,

discount fares which stimulated

leisure travel, and strong support

of Republic Express service

contributed to the growth in

traffic. Discount fares such as the

Ultimate Super Saver Fare were

introduced to stimulate leisure

travel on a capacity controlled

basis. This resulted in an increase

in revenue per available seat mile

even though yields declined.

Increased competition from low

fare airlines has continued to exert

pressure on fares and will continue

to impact yield in the future.

In 1984, passenger revenue

increased 2 percent over 1983

because of the substantially higher

yield of 16.63 cents compared with

14.41 cents in 1983. Scheduled

revenue passenger miles dropped

11.7 percent in 1984 following

inflated traffic levels of 1983

which were stimulated by

extensive fare wars and special

promotions.

Cargo revenues increased

8.4 percent in 1985. On

January 1, 1985, the Postal

Service implemented a system of

competitive bids which determines

carriage of mail by all airlines.

The Company aggressively pursued

these contracts and as a result,

mail ton miles increased

116.2 percent in 1985 while mail

revenue rose 79.5 percent to

$37.2 million from $20.7 million

in 1984. Other cargo revenues

dropped 17.6 percent due to lower

freight yields caused by the

discounting of freight rates and

also a 23.1 percent decline in

freight ton miles.

Operating expenses

Operating expenses increased

8.3 percent in 1985 following a

decrease of 6.2 percent in 1984.

The largest component, salaries

and employee benefits, which

represented 33.8 percent of total

operating expenses in 1985,

increased 4.7 percent over the

previous year. A wage freeze and

Load Factor

(percent)

1981 1982 1983 1984 1985

Elements of

Operating Expenses 1985

Salaries and Benefits 33.8 %

Fuel 23.6 %

Maintenance, Rentals,

and Landing Fees 9.5 %

Agency Commissions 8.4 % J

Depreciation and

Amortization 4.9 % A

Other 19.8%

6

REPublic AirUnes

15 percent pay reduction instituted

in September 1983, utilization of

part-time employees, and lower

starting rates for new employees

which were effective for all

employee gi'oups, enabled the

Company to hold salaries exclusive

of benefits at $410.8 million which

is an increase of less than

1 percent from 1984. This was

accomplished even though the

average number of employees

increased 3.5 percent in 1985.

Employee benefits increased

21.5 percent to $120.1 million in

1985. Amortization of the value of

securities and the preferred stock

profit-sharing dividend for 1985,

both gi'anted to employees in

exchange for pay concessions,

added $16.5 million to employee

benefits compared with $6 million

in 1984.

In 1984, salaries and benefits

decreased 12.8 percent from 1983

as a result of the impact of

employee concessions and a change

in actuarial assumptions for all

defined benefit pension plans

which reduced pension expense by

$8.7 million.

Aircraft fuel expense increased

2.9 percent over 1984. Fuel prices

continued to drop during 1985

resulting in a 4.5 percent drop in

average price per gallon to

80.6 cents in 1985 compared with

84.4cents

in 1984. This followed a

drop of 4.4 percent in 1984 from

88.3 cents in 1983. Expansion of

service and addition of 11 aircraft

in 1985 resulted in an increase of

5.8 percent in revenue plane miles

which accounted for the overall

increase in fuel expense. In 1984,

revenue plane miles decreased

3.3 percent, which contributed to

the 8.1 percent decrease in fuel

expense. Expenditures for

maintenance materials and repairs

increased 19.5 percent in 1985,

largely attributable to interior

modifications and exterior painting

of aircraft. First Class seating now

is offered in all Boeing 727 and

DC-9 aircraft. Agency commissions

increased 26.6 percent as a result

of the 12.9 percent increase in

passenger revenue and because

78 percent of sales were generated

by travel agents compared with

72.5percent

in 1984. In order to

meet the competition, the

Company was forced to expand

override commission programs

throughout the United States.

The expansion of operations

through development of major

hubs at Minneapolis/St. Paul,

Detroit and Memphis and related

marketing activities had

significant impact on other

operating expenses which

increased 15.2 percent. Of this

$41 million increase, $17.1 million

reflects an increase in co-host fees

for computer reservations systems

which increased because of the

higher volume of bookings and

significant rate increases. Outside

services purchased increased

$8.8 million in conjunction with

hub development.

In 1984, other operating

expenses increased 2.6 percent.

The increase in selling and

marketing expense, including

co-host fees for computer

reservations systems of

$5.1 million and $6.4 million

in costs related to route

realignment (including addition of

8 destinations and suspension of

operations at 23 points), were the

factors causing the increase over

1983. Expenditures for advertising

were reduced $7.3 million,

reflecting elimination of numerous

promotions initiated in 1983 and

the adoption of more efficient

direct marketing techniques.

Operating profit

The 1985 operating profit of

$166.3 million was 66.3 percent

over 1984. The operating margin

of 9.6 percent increased from

6.5 percent in 1984, and was

favorably impacted by

improvement in load factor of

8.6 points. The $131 million

increase in operating profit in

1984 was the result of

substantially higher yields and the

6.2 percent reduction in operating

expenses.

Other expenses (income)

Interest expense decreased

7.1 percent to $90.1 million in

1985 as the average prime rate

and outstanding long-term debt

and obligations under capital

leases declined.

Gains from disposition of

property, equipment and lease

rights totaled $21.4 million in

1985 compared with $17.3 million

in 1984 and $923,000 in 1983. In

1983, $13 million was realized

from the sale of tax benefits which

is not expected to occur in the

future.

Interest income from temporary

investments of excess cash

generated $17.9 million in 1985

compared with $6.9 million in

1984 and $2.5 million in 1983.

Income taxes

The Company recorded income

tax expense of $50.3 million in

1985 and $15.8 million in 1984.

Utilization of tax loss

carryforwards of $45.6 million in

1985 and $15.8 million in 1984

was recorded as an extraordinary

7

Management's discussion and analysis (continued)

gain in the financial statements.

In both years, payment of virtually

all of the provision for federal

income taxes was deferred due to

timing differences between

financial and tax reporting. For

additional analysis of income tax

expense and utilization of tax loss

carryforwards, see Note E to the

consolidated financial statements,

page 29.

Gain on pension plan termination

As part of the Company

agi'eement with the pilots' union,

the pilots' defined benefit pension

plan was terminated in 1985 and

replaced with a defined

contribution plan. The Company

had received waivers of the 1981,

1982, and 1983 funding obligations

for this plan. Since assets of the

plan exceeded the fully vested

benefits, the obligation to fund the

waived amounts and other accrued

pension liabilities for the plan

were eliminated resulting in the

recording of a $62.2 million

extraordinary gain in 1985.

Net earnings

Net earnings of $177 million

($4.74 per primary share) were

achieved in 1985 compared with

$29.5 million (76 cents per share)

in 1984 and a net loss of

$111 million ($4.28 loss per share)

in 1983. The 1985 and 1984

earnings include extraordinary

gains of $107.8 million ($2.94 per

share) and $15.8 million (46 cents

per share), respectively.

Inflation and changing prices

For information concerning the

effects of inflation and changing

prices on the Company's

operations, see "Supplemental

stockholder information,"

pages 34 and 35.

Stockholders' equity

Total stockholders' equity

increased $187.4 million in 1985

and $31 million in 1984 primarily

as a result of improved earnings

which generated increases in

retained earnings of $173.3 million

in 1985 and $25 million in 1984.

The remaining increase is

attributable to the exercise of

stock options and issuance of

securities to the Employee Stock

Ownership Plans in connection

with the agreements with

employees for reductions in

salaries and wages.

Cash flow, liquidity and

capital resources

The Company's liquidity position

has improved significantly since

the end of 1983. Cash and

Operating Revenues

and Expenses Per

Available Seat Mile

Net Earnings

(Smillions)

Operating Revenues

H Operating Expenses

(cents)

1981 1982 1983 1984 1985 1981 1982 1983 1984 1985

short-term cash investments were

$59.8 million at December 31,

1983, $123.1 million at

December 31, 1984, and

$300.1 million at December 31,

1985. Cash used in operations

amounted to $73.8 million in 1983,

while cash provided from

operations was $132.3 million in

1984 and $258.7 million in 1985.

During December 1985, all

remaining Republic Airlines West,

Inc., $100 par value Cumulative

Preferred Stock was purchased by

the Company. Following this

purchase. Republic Airlines West,

Inc., was dissolved, with remaining

net assets transferred to the

Company.

Since 1982, the Company has

supplemented its working capital

and conserved cash primarily by

the means discussed below:

1. Reduction of Wages

In September 1983, all

employees, including management.

accepted a wage freeze and

15 percent wage reduction. During

1984, these agreements were

extended for all employee groups

with contract amendable dates in

late 1986 and early 1987 and

contained additional productivity

provisions.

In exchange for the concessions,

the Company agreed to issue

5,529,195 shares of common stock

and provide a profit-sharing

arrangement in the form of

$72.3 million face amount of a new

class of participating,

non-cumulative, non-voting junior

preferred stock with 2,170,000

callable warrant rights to purchase

common stock at $10 per share.

The preferred stock allows the

employees to receive dividends,

based on a per share dividend rate

of 1/10,000 of 15 percent of the

Company's profit (operating profit,

less interest expense and income

taxes to be paid) in excess of

$20 million. The profit-sharing

distribution cannot exceed

$10.8 million in any one year. The

amount to be paid in 1986 for the

year 1985 will be approximately

$6.8 million. In addition, the

Company has agreed not to pay

dividends on common stock

through December 31, 1986, and to

fill one position on the Board of

Directors with an individual of

national prominence to be chosen

by agreement of all the Company's

union groups and reasonably

acceptable to the Company's Board

of Directors. As of the date of this

report, the Board member has not

yet been selected by the union

gi'oups.

2. Pension Contribution Waivers

Pursuant to waivers granted by

the Internal Revenue Service, the

Company deferred pension funding

payments totaling $47.1 million

which were due to be paid to

pension plans for its employees for

Operating Expenses

Per Available Seat Mile

Labor Fuel Other

9.5d

9.0d

8.7$

8.5(t

8.6(}:

1981 1982 1983 1984 1985

Capitalization

I Debt

(Smillions)

Equity

800

700 .

600 -

500 -

400 -

300 -

200 -

100 -

0 -

-100 -

1981 1982 1983 1984 1985*

Includes conversion into common stock of convertible

subordinated debentures called for redemption in 1986

9

Management's discussion and analysis (continued)

the years 1981 and 1982. Payment

of the 1981 and 1982 deferred

amounts plus interest is being

funded over a 15-year period,

commencing in 1983.

As part of the labor negotiations

in 1984, the Company and pilots'

union agi'eed that the Company

would terminate the pilots' defined

benefit pension plan and establish

defined contribution retirement

and health benefit plans. The

Company also received a waiver of

the 1983 funding obligation of

$21.8 million for this pilots'

pension plan. The Company's

obligation to fund its accrued

pension liability for the pilots'

plan has been eliminated because

the assets of the plan exceeded the

fully vested benefits. The

elimination of these accrued

pension liabilities resulted in

recording an extraordinary gain of

$62.2 million in 1985.

3. Sale of Tax Benefits, Aircraft

and Other Property

During 1983, the Company

received net proceeds of

$13 million from the sale of tax

benefits related to the acquisition

of new flight equipment which

were applied to the purchase of

new aircraft. Due to changes in

the tax laws, the Company is no

longer able to sell tax benefits for

new property which it acquires.

During the years 1983 through

1985, the Company received

$56.6 million from the disposition

of aircraft, other property, and

lease rights. Of these net proceeds,

$18.9 million was used to repay

indebtedness, and the balance was

used for working capital.

4. Issuance of Securities

In June 1983, through a unit

offering of 7,480,000 shares of

common stock and 3,740,000

warrants to purchase common

stock, the Company received net

proceeds of $58.3 million which

were used for working capital.

TheCompanyishighly

leveraged. At December 31,

1985, the Company had

long-term debt and capital lease

obligations, including current

maturities, of $726.7 million.

Interest rates float with prime on

27.7 percent of this debt.

At December 31, 1985, the

Company had approximately

$185.9 million outstanding under

its Bank Credit Agreement. The

agreement requires the Company

to meet certain financial covenants

including debt-to-equity ratios and

net-worth requirements, a cash

and short-term cash investments

minimum, limitations on capital

expenditures and additional debt,

and sets restrictions on the

payment of common stock

dividends. The Company expects to

remain in compliance with the

covenants contained in the Bank

Credit Agreement over the

remaining term of the loan based

on assumed operating results.

In February 1985, the Company

sold $150 million of Senior Secured

Trust Notes ($75 million due

February 1, 1990, at 14.625 percent

and $75 million due February 1,

1993, at 15.125 percent). The

proceeds were used to prepay

$110 million under the Bank

Credit Agreement with the net

balance of $35 million, after

discounts and expenses of

$5 million, used to increase

working capital.

During 1985 the Company leased

three used Boeing 727-200 aircraft

and three used DC-9-30 aircraft

under operating leases which

extend for periods ranging up to

five years. The Company also

purchased a used DC-9-30 aircraft.

two DC-9-30 aircraft previously

under operating leases and one

DC-9-30 under a capital lease.

These four aircraft were financed

primarily through an $18.7 million

promissory note. One used DC-9-10

aircraft was purchased in

December 1985. One MD-80

aircraft which was previously

leased was returned to the

Company for scheduled operations.

During the third quarter of 1985,

the Company signed a purchase

agreement with The Boeing

Company for the purchase of six

190-seat 757-2S7 aircraft. Three

were delivered in December 1985

with the remaining three

scheduled for delivery in May

1986. The total cost of the six

aircraft, including Rolls Ro3^ce

engines, spare engines, and parts

is approximately $231 million. The

Company arranged operating lease

financing on the first three

aircraft. Financing for the

remaining aircraft has not been

determined. The Company also has

options to acquire up to six

additional Boeing 757-2S7 aircraft.

The Company has major

terminal expansion and

improvement activities taking

place at each of its three hubs.

Besides significantly expanding the

number of gates, new Executive

Suites and baggage handling

facilities will be included. In

Detroit, planned improvements

include installation of an

underground fueling system, an

addition to the terminal for

baggage handling, acquisition of

additional gates, construction of a

new flight kitchen, and

installation of moving sidewalks.

The Detroit airport improvements

are being financed with proceeds of

$90.5 million of Special Airport

Facilities Revenue Bonds issued by

a municipality. The Company has

10

guaranteed the bond payments.

Projected costs of the Memphis

terminal expansion and

improvements, including baggage

handling facilities, are estimated

at $21.5 million and are being

financed primarily through general

obligation bonds issued by the

airport authority. The Company

has entered into revised lease

agreements at these locations

which provide for increased rent as

a result of these improvements. In

Minneapolis/St. Paul, terminal

additions and improvements are

anticipated to be approximately

$10 million, of which $3 million is

to be paid by the airport authority,

with the remaining portion funded

internally.

In addition, reservations services

have been consolidated to improve

efficiency and reduce line costs. A

new 54,000 square-foot facility in

Livonia, Michigan, a Detroit

suburb, was constructed. The

Capacity and Traffic

Total Available Seat Miles

im- Total Revenue Passenger Miles

(billions)

20-r- -- -- -- -- -- -- -- -- ~

1981 1982 1983 1984 1985

converted into 1,043,919 shares

(see Note M to the consolidated

financial statements on pages 32

and 33 of this report).

On January 23, 1986, the

Company entered into a merger

agreement with NWA Inc. (NWA).

NWA is the parent company of

Northwest Airlines, Inc., a

certified air carrier. Under this

agreement the Company will

become a subsidiary of NWA. On

the effective date of the merger,

NWA will acquire all of the

outstanding shares of the

Company's common stock at a

price of $17 per share. The merger

is subject to several conditions

including approval by the

Company's stockholders and

certain governmental authorities.

For additional information on the

proposed merger, see Note M to

the consolidated financial

statements on pages 32 and 33.

Daily Departures

(December)

202

Minneapolis/ Detroit Memphis

St. Paul

facility began operation during the

third quarter of 1985 and now

answers more than 50 percent of

all reservations calls.

The timing and source of future

capital needs cannot be estimated

and will largely depend on new

and replacement aircraft

requirements. The Company

periodically acquires computer

equipment, ground property and

equipment, and leasehold

improvements. Future capital

expenditures and debt to be

incurred are subject to restrictions

contained in the Bank Credit

Agreement.

In January 1986, the Company

called for redemption all of the

10-1/8% Convertible Senior

Subordinated Debentures and the

13% Convertible Subordinated

Debentures. The 10-1/8% Debentures

were converted into 7,442,400

shares of common stock, and the

13% Debentures are expected to be

11

1985 in review

ForRepublicAirlines, 1985

was The Year of the

Business Traveler.

Attention was focused on how to

attract and retain frequent

business travelers whose loyalty is

essential to a successful airline. To

a large degree, Republic's traffic

and financial records established

in 1985 are the results of the

airline's attractiveness to its

business clients.

During 1985, Republic took

several major steps to enhance its

standing among the important

business traveler market. Those

steps paid off with traffic growth of

more than 30 percent for eight

consecutive months -

May through

December -

and this pace has

extended into January and

February 1986. The ability to

increase traffic significantly, while

establishing only minor increases

in seat capacity, demonstrates the

effectiveness of this effort.

Route realignment

A keyelementincoaxing

business flyers to Republic

was a far-reaching route

realignment finalized in April,

then refined throughout the

remainder of the year.

Strategy called for concentration

of flights at Republic's three

primary airports -

Detroit,

Michigan; Minneapolis/St. Paul,

Minnesota; and Memphis,

Tennessee. Resources were

redeployed, and on April 28,

56 daily departures were added in

Memphis, 22 at Minneapolis/

St. Paul, and 19 at Detroit. This

brought Republic's service level in

these cities to 153, 152, and

178 daily flights respectively. On

the same day. Republic initiated

flights at eight new cities in one of

the largest service expansions in

commercial aviation history.

During 1985, flights were begun

at Pittsburgh and Erie in

Pennsylvania; Albany, Syracuse,

White Plains, and John F.

Kennedy International Airport in

New York; Little Rock, Arkansas;

Louisville, Kentucky; Shreveport,

Louisiana; Appleton, Wisconsin;

Akron/Canton, Ohio; and

Intercontinental Airport, Houston,

Texas.

On December 15, Republic began

flights from Memphis to

Puerto Vallarta, Mexico, and

announced that service between

Memphis and Cancun, Mexico,

would start in January 1986. In

addition, Dayton, Ohio, and Cedar

Rapids, Iowa, were scheduled to

join the route system and this

service was inaugurated in

February 1986.

By concentrating flights at three

key traffic centers. Republic was

able to generate 97 percent of its

available seat miles on flights to

and from these "hubs." This offers

passengers a wide variety of

connecting flights at the hubs and

ensures passengers single-carrier

service for their entire traveling

itinerary.

The success of the route

realignment became evident in

May when passenger traffic

increased nearly 31 percent with

only a 7 percent rise in capacity.

The traffic growth continued at a

record pace throughout the

remainder of the year with growth

exceeding 40 percent

year-over-year in June, October,

November, and December. In

October and November, Republic

posted the highest load factor

among the major airlines.

A change in the Postal Service's

method of awarding mail contracts.

12

REPublic AIrUnes

combined with the route

restructuring, had an impressive

effect on cargo sales and service.

Republic's cargo ton miles

increased 23 percent to

116.9 million in 1985. Particularly

remarkable growth was registered

in mail revenues, closing the year

at $37.2 million, up from

$20.7 million in 1984. Each day in

1985, Republic averaged more than

180 tons of mail, a yearly total of

132.6 million pounds, almost twice

the 1984 level.

Republic Express

Animportantelementin

the record passenger

traffic was the initiation

of Republic Express service to

smaller communities within a

350-mile radius of the three hubs.

Republic Express flights are

provided by regional airlines under

long-term marketing contracts

with Republic. Republic Express

flights are timed to reach the hubs

so passengers can make easy,

convenient connections to Republic

flights.

Republic Express service made

its debut in late April with flights

to Detroit from 16 communities in

Michigan and Ohio. The service

was provided by Simmons Airlines.

On June 1, Express Airlines I, also

operating as Republic Express,

began service at Memphis, and by

year end the airline linked

Memphis with 12 cities in the

southeastern United States.

Republic Express began flights

from Minneapolis/St. Paul in

December, with nonstops to

Aberdeen and Watertown, South

Dakota. By mid-1986. Republic

Express flights will be available to

nine other communities in the

Midwest.

The close relationship between

Republic and Republic Express is

evident in the Republic Express

name and in the marketing

services the airlines offer jointly.

Republic Express flights use

Republic gates and are listed in

computer reservations systems

under Republic's name. Advance

seat selection is offered, and

Republic Express provides the full

fare structure of Republic.

In addition to sharing Republic's

name and identity. Republic

Express partners adopt the high

standards of performance and

McDonnell Douglas DC-9s are

the backbone of Republic's fleet

of 168 jetliners. Republic

operates 134 of the versatile

twin-jets on a route system

spanning 34 states, Canada,

Mexico and the Cayman Islands

in the Caribbean.

1985 in review (continued)

Agents at Republic's new

Livonia, Michigan, reservations

center respond to more than

40,000 telephone inquiries from

Republic passengers each day.

professionalism that Republic

demands of itself.

Facilities expansion

Coupledwiththeroute

restructuring, Republic

embarked on major

construction programs in 1985 to

improve its passenger service

facilities. Emphasis was placed on

enlarging Republic Executive

Suites at key airports with new

suites opening in 1985 at Detroit,

Minneapolis/St. Paul, and

Memphis; another suite opened in

early 1986 at Chicago O'Hare. The

Executive Suites offer business

travelers an opportunity to escape

the passenger concourse and turn

waiting time into productive time.

Work modules, phones, conference

rooms, cash bar, newspapers,

magazines, television, and other

amenities are available. Republic

charges only $75 for first-year

Executive Suite membership and

$50 annually thereafter.

Passenger facilities at hub

airports also were expanded to

better serve Republic's increasing

number of business clients.

Passenger gates at Detroit were

increased from nine to 34;

Memphis from 17 to 42; and

Minneapolis/St. Paul from 11 to

19. Additional improvements were

made to baggage handling areas.

Ramp control towers were

constructed to better orchestrate

the ground movement of aircraft

and support equipment.

In Detroit, Wayne County issued

$90.5 million in bonds to support

Republic construction programs at

Detroit Metropolitan Airport. On

the agenda are additional gate

space, moving sidewalks, an

enlarged baggage building, an

underground aircraft fueling

system, and a flight kitchen - as

well as other remodeling and

expansion programs.

Training

Justasrapidexpansion

forced enlargement of

passenger facilities, the

new-found business success also

demanded professional training

programs for new and seasoned

employees to ensure service

standards were not compromised.

During the year Republic hired

and trained more than

14

1,000 reservations agents to

handle a growing passenger call

volume. Most of the reservationists

are employed at a new,

state-of-the-art reservations center

which opened August 16 in

Livonia, Michigan, a Detroit

suburb. The center employs nearly

800 agents who handle more than

40,000 phone inquiries each day.

Many of the Livonia agents were

hired and trained through a

unique job program for the

unemployed and disadvantaged

offered in conjunction with the

Wayne County Private Industry

Corp. A mixture of federal, state,

and local funds was used to screen,

select, hire, and train workers for

jobs at Republic's Livonia

reservations facility.

The expanded route system

called for additional training of

passenger service personnel.

Nearly 1,600 station agents and

passenger service agents completed

coursework in 1985 during

115 training sessions varying from

one to three weeks. During one

week alone, customer service

personnel conducted 14 classes

simultaneously. In addition to

training its own employees.

Republic also assumed

responsibility for training

customer-contact personnel of

Republic Express. Republic's

computer-based instruction

programs were expanded

significantly to include additional

training modules in reservations,

ticketing, seat selection procedures,

and aircraft weight and balance

calculations. Relying heavily on

Republic-produced videotapes, a

series of training bulletins, and

on-site inspections, the airline

undertook a broad ramp awareness

program. Particular attention was

paid to ground safety, ramp

security, and foreign object damage

to jet engines. A signalman

certification program also was

developed for all Republic workers

responsible for the ground

guidance of taxiing aircraft.

During 1985, Republic recruited

and trained 698 flight attendants

at its Atlanta Training Center. For

each flight attendant position,

50 applicants are considered -

indicative of the high standards

Republic demands. The intensive

month-long flight attendant school

focuses on awareness of customer

needs, passenger service

techniques, emergency medical

procedures, first-aid practices, and

federal rules governing air

transportation.

The Atlanta training facility was

a busy place in 1985. In addition

to flight attendant training, the

bulk of Republic pilot training is

conducted in Atlanta, including

Efficient, coordinated movement

of aircraft and ground support

equipment results from the

efforts of Republic personnel

staffing new ramp control towers

at each of the airline's main

traffic centers.

1985 in review (continued)

Flight crew skills are honed

through frequent visits to one of

Republic's four flight simulators

where instructors can safely

present flight conditions to crew

members and gauge the speed

and effectiveness of their

responses.

that for 337 newly hired pilots.

More than 1,200 other pilots

received simulator instruction in

1985, with 217 receiving initial

Boeing 727 training; 53 in their

initial MD-80 program;

416 received initial DC-9

instruction, and 80 were qualified

for Convair 580s. Refresher and

requalification training saw

another 400 pilots pass through

Republic's complement of four

flight simulators. These programs

are in addition to recurrent ground

school training, required annually

of all pilots and first officers, and

the proficiency checks provided

captains every six months and

given first officers each year.

In addition to training its own

cockpit crews. Republic earned

more than $3.3 million in 1985 in

contract training for other airlines.

FAA inspectors also used Republic

simulators for their annual

training requirements.

Republic uses the latest in

audiovisual technology to

standardize training and reduce

related costs for personnel in the

air as well as on the ground. As

an example, the airline's

audiovisual support included a

video show outlining the pre-flight

responsibilities of a Boeing 727

flight engineer. This eliminated

the costly expense of removing a

Boeing 727 from service for

training and also eliminated the

need for classes to make a field

inspection of the aircraft at this

point in their training program.

Republic's field sales force

participated in quarterly two-day

training seminars to enhance their

professionalism and job knowledge.

Topics included negotiation skills,

counselor selling, and time and

territory management. Emphasis

was given to expanding the sales

staffs knowledge of the eight

computer reservations systems that

list Republic flights. Republic's

automated marketing personnel

developed a detailed manual for

sales managers, outlining the

operations and capabilities of

various computer reservations

systems. This enables the sales

staff to discuss those systems

effectively with their travel agent

partners.

Frequent Flyer Perks

A significantelementinthe

drive to secure business

travelers is Republic's

liberal Frequent Flyer program

which rewards members for

repeated use of Republic flights.

The program's success is evidenced

by the fact that more than one

million business travelers are

Republic Frequent Flyers. Republic

gives Frequent Flyers a free

roundtrip ticket for every

20,000 miles credited to their

account. As 1985 ended. Republic

announced a major Frequent Flyer

improvement- the addition of

Radisson Hotels and Western

Airlines. Pan American World

Airways, along with Hertz and

National Car Rental, remained

members of the program. Thus,

Republic Frequent Flyers now are

able to earn free travel to Hawaii,

Europe, and other international

destinations by traveling on

Republic. Frequent Flyers also

earn mileage awards for using the

services of Radisson Hotels, Hertz,

and National and, in turn, the

three participants offer discounts

and free services to Republic

Frequent Flyers who earn free

tickets.

During 1985, Republic began an

intensive study of its front cabin

service and decided to replace

Business First Class with

First Class -

a move that made its

debut in February 1986. Menus

were studied, modified, and

upgraded; wines sniffed, swirled,

tasted, and selected; other

amenities evaluated, tested, and

chosen; and employees informed,

trained, and motivated to provide

the highest service standards. The

result is a First Class front cabin

that is available to Frequent

Flyers at the same rate as the

Business First Class service it

replaced. Other First Class

passengers pay prevailing industry

rates, generally 30 percent more

than coach fares. The marketing

strategy, again, is to make

Republic attractive to its primary

customers -

frequent business

travelers.

Both the Frequent Flyer program

and front cabin service were key

ingredients in Republic's successful

"Perks" advertising campaign

which was expanded during 1985.

The "Perks" approach effectively

targets business travelers with the

theme, "Perks: You've Earned

Them."

While most attention was paid to

developing the business travel

market. Republic also continued

efforts to capture its share of

vacation and leisure travelers.

These passengers are primarily

motivated by price considerations

and thus highlight the importance

of Republic's yield management

team. The airline was determined

to remain competitive with

low-cost carriers by offering the

same fares in an effort to attract

vacation travelers. As a result.

Republic refined its seat inventory

management and pricing functions

to make certain the proper mix of

discount and full-fare seats were

offered on all flights, which

maximized total revenue while

providing a full range of fares

attractive to all segments of the

traveling public. During 1985,

Republic became an industry

leader in pioneering pricing

initiatives that offered excellent

discounts to vacation and leisure

travelers, stimulating discretionary

travel and contributing to

profitability.

Travel agents

WhileRepublicmarketed

itself directly to the

consumer in 1985, the

airline also took major steps to

increase its visibility with the

nation's travel agencies. More than

80 percent of Republic tickets are

written by travel agents who are a

key element in Republic's financial

resurgence. To supplement the

airline's field sales force. Republic

instituted a telemarketing

department in 1985 so travel

agencies and corporate travel

departments can receive immediate

assistance on the phone from

experienced sales personnel. The

airline also reorganized its sales

staff into three regions

(continued on page 20)

RtpuWjc

Republic Express

Republic Express service, provided

by Republic's regional airline

partners, links Republic hubs at

Detroit, Minneapolis/St. Paul and

Memphis with smaller cities near

these main traffic centers. Under a

joint marketing agreement, the

regional carriers coordinate their

flight schedules to the hubs to

ensure quick, convenient

connections to Republic flights.

Minneapolis/St. Paul

Detroit Memphis

REDublic AirUnes

System Route Map -

March 2, 1986

19

1985 in review (continued)

(continued from page 17)

headquartered at the airline's

hubs, Detroit, Minneapolis/

St. Paul, and Memphis. At the

General Office, an area marketing

staff was formed to provide the

sales regions with timely,

responsive support from senior

marketing officials.

Republic formed a Travel Agency

Advisory Board during 1985. The

membership consists of key travel

agency owners and managers plus

Republic's top marketing staff. The

group meets quarterly to exchange

information, share problems, and

devise solutions. Among the

results of the Board's discussions

was a public reaffirmation by the

airline of its unqualified support

for the travel agency ticket

distribution system and Republic's

opposition to "corporate

self-dealing" whereby a company

establishes a travel agency

primarily for its own benefit.

Republic also played an

important role in the 1985 annual

meeting of the American Society of

Travel Agents in Rome, including

co-sponsorship of closing-day

deliberations and ceremonies.

Republic's Fleet

Number of Aircraft

Aircraft

No. of

Seats

On

Owned Leased Total Order Options

B-757-2S7 190 3 3 3 6

B-727-200 143 15 3 18

MD-80 143 7 1 8

DC-9-50 122 16 12 28

DC-9-30* 95 56 8 64

DC-9-10 78 31 3 34

Convair 580 48 13 13

Total 138 30 168 3 6

Fleet improvements

BecauseofRepublic's

impressive traffic gains

during the year, the

airline ordered six Boeing 757

jetliners to meet increased

demand. Three of the fuel efficient,

190-passenger aircraft entered

service in December and the

remaining three will join Republic

by mid-1986. Republic has options

for future delivery of six more

Boeing 757s.

The Boeing 757s are used on

long-haul flights, principally from

Detroit to the West Coast. Load

factors on these flights have been

excellent while fuel consumption

and noise generation have been

remarkably low.

Republic added eight other

aircraft to its fleet in 1985 -

three

Boeing 727-200s and five

McDonnell Douglas DC-9s.

In addition to the fleet

expansion. Republic's maintenance

and engineering division undertook

a number of major modifications to

Republic aircraft to improve

passenger comfort. Republic's

DC-9-lOs were reconfigured to

include a First Class forward

cabin. This standardized Republic's

jet fleet, which allowed First Class

service to be offered on all legs of

a passenger's itinerary. In

addition, a project was begun to

install new trimline seats in all

Republic DC-9-30 aircraft. Seating

capacity will increase from 95 to

100 and at the same time

passengers will receive extra leg

room, thanks to the latest

technology in passenger seating

comfort.

Republic's maintenance and

engineering division helped

*DC-9-30 aircraft will have 100 seats effective June 15, 1986.

develop several advances in

maintenance technology which will

become standards in the airline

industry in the future. For

example, Republic was the first

airline to use portable horoscopes

for detailed inspections of engine

combustion chambers. The new

equipment and procedures allow

careful inspections while the

engine is still mounted on the

aircraft. This reduces the need to

remove and dismantle engine

components. Republic also installed

a computerized machining center

at its Atlanta maintenance base

which will save more than

$250,000 annually in metal

fabrication expenses. This center is

used to create engine gearboxes,

seat track channeling, bearing

liners, and other components.

Republic was the airline that

pioneered bead-blasting for

stripping paint from aircraft

exteriors. The stripping process,

using recyclable plastic beads, is so

precise it allows the removal of a

single coat of paint without

roughing up the fuselage. An

aircraft can be stripped and

repainted every five days instead

of every seven days.

Maintenance and engineering

personnel also were eager to share

their cost-saving ideas through the

Company's suggestion program. A

team of three mechanics developed

a probe to be installed in DC-9

auxiliary power units that is

credited with reducing carbon seal

failures on an average of 18 power

units annually. Another mechanic

initiated a program to develop

in-house a component of the DC-9

temperature control system, while

a worker in Republic's sheet metal

shop designed, manufactured, and

installed the lower panel of cockpit

doors, saving expensive

replacement purchases from an

outside supplier. Other ideas made

similar contributions.

In late 1985, the Federal

Aviation Administration released

results of an intensive study of

maintenance programs at

300 airlines and found Republic

with the lowest percentage of

unsatisfactory maintenance

inspections among the major

airlines -

a credit to the pride and

professionalism of the 2,900 men

and women of the maintenance

and engineering division.

Summary

A firmfocusonfrequent

business travelers was

Republic's success formula

in 1985. An effective route system

coupled with professional, caring

employees who provide quality

service consistently, attracted new

passengers and retained the

loyalty of Republic's Frequent

Flyers.

Travelers can work or relax

away from the hubbub of airport

passenger concourses by

becoming Republic Executive

Suite members. A variety of

amenities cater to the needs of

frequent business passengers.

Consolidated balance sheets

(in thousands)

ASSETS December 31

1985 1984

CURRENT ASSETS

Cash and short-term cash investments

Accounts receivable-less allowances.

.

Parts and supplies-less reserves

Prepaid expenses and other

$ 300,085

158,108

35,657

34,435

528,285

$ 123,143

109,193

38,898

31,562

302,796

PROPERTY AND EQUIPMENT OWNED

Flight equipment

Ground property and equipment

Less accumulated depreciation

924,199

130,067

1,054,266

419,797

634,469

891,776

113,312

1,005,088

361,154

643,934

PROPERTY AND EQUIPMENT UNDER CAPITAL LEASES

Flight equipment

Ground property and equipment

Less accumulated amortization

153,828

12,468

166,296

62,433

103,863

157,145

16,281

173,426

55,682

117,744

DEFERRED CHARGES AND OTHER ASSETS 19,680

$1,286,297

20,435

$1,084,909

22

REpublic AIrLInes

LIABILITIES AND STOCKHOLDERS' EQUITY December 31

1985

CURRENT LIABILITIES

Current maturities of long-term debt $ 83,802

Current obligations under capital leases 9,207

Air traffic liability 128,647

Accounts payable 76,776

Accrued compensation and vacation benefits 58,230

Accrued interest 18,506

Accrued pension liability 7,067

Other accrued expenses 33,466

415,701

1984

$ 59,696

8,712

84,661

43,776

46,872

11,214

22,464

26,751

304,146

LONG-TERM OBLIGATIONS

Long-term debt-less current maturities . . .

Noncurrent obligations under capital leases

Long-term pension liability and other

509,434

124,225

40,856

674,515

538,282

136,933

68,908

744,123

COMMITMENTS AND CONTINGENCIES (Notes B, D, I and L)

REDEEMABLE PREFERRED STOCK OF SUBSIDIARY -

28,000

STOCKHOLDERS' EQUITY

Preferred stock-authorized 25,000,000 shares of $.01 par value

Common stock-authorized 60,000,000 shares of $.20 par value;

outstanding-33,567,241 shares in 1985 and 30,639,390

shares in 1984 6,713 6,128

Additional paid-in capital 129,097 114,664

Retained earnings (deficit) 55,076 (118,176)

Employee stock to be issued 15,699 26,571

Unearned compensation for stock to be issued (10,504) (20,547)

196,081 8,640

$1,286,297 $1,084,909

The accompanying notes are an integi'al part of these statements.

23

Consolidated statements of operations

(in thousands, except per share amounts)

Year Ended December 31

OPERATING REVENUES 1985 1984 1983

Passenger .

$1,598,237 $1,415,583 $1,388,285

Cargo 83,832 77,318 76,626

Other 52,328 54,331 46,583

1,734,397 1,547,232 1,511,494

OPERATING EXPENSES

Salaries and benefits 530,911 506,905 581,496

Aircraft fuel 369,912 359,417 390,937

Agency commissions 132,180 104,420 102,258

Rentals and landing fees 79,084 75,290 76,863

Maintenance materials and repairs 69,485 58,167 58,111

Depreciation and amortization 76,482 74,008 70,625

Other 310,013 269,023 262,221

1,568,067 1,447,230 1,542,511

Operating profit (loss) 166,330 100,002 (31,017)

OTHER EXPENSES (INCOME)

Interest expense 90,092 97,000 97,852

Interest income

Gain on disposition of property, equipment

(17,897) (6,870) (2,468)

and lease rights (21,368) (17,316) (923)

Sale of tax benefits -

(13,046)

Other-net (4,028) (2,323) (1,401)

Earnings (loss) before income taxes

46,799 70,491 80,014

and extraordinary items 119,531 29,511 (111,031)

INCOME TAXES 50,300 15,802 -

Earnings (loss) before extraordinary items 69,231 13,709 (111,031)

EXTRAORDINARY ITEMS

Effect of utilization of tax loss carryforwards 45,600 15,802 -

Gain on pension plan termination 62,175 - -

107,775 15,802 -

NET EARNINGS (LOSS)

NET EARNINGS (LOSS) PER COMMON SHARE

PRIMARY

.

$ 177,006 $ 29,511 $ (111,031)

Before extraordinary items $1.80 $.30 $(4.28)

Extraordinary items 2.94 .46 -

Net earnings (loss)

NET EARNINGS (LOSS) PER COMMON SHARE-

FULLY DILUTED

$4.74 $.76 $(4.28)

Before extraordinary items $1.53 $.29 $(4.28)

Extraordinary items 2.45 .46 -

Net earnings (loss) $3.98 $.75 $(4.28)

The accompanying notes are an integral part of these statements.

24

REpublic AIrUnes

Consolidated statements of changes in financial position

(in thousands)

Year Ended December 31

CASH AND SHORT-TERM CASH INVESTMENTS

AT BEGINNING OE YEAR

1985 1984 1983

. .

$123,143 $ 59,781 $125,484

FUNDS PROVIDED

Earnings (loss) before extraordinary items 69,231 13,709 (111,031)

Add non-cash items:

Depreciation and amortization 76,482 74,008 70,625

Amortization of unearned compensation 10,043 6,024 -

Other 3,881 1,043 1,966

Net change in certain working capital items 53,476 21,749 (35,381)

Cash provided from (used in) operations,

exclusive of extraordinary items 213,113 116,533 (73,821)

Extraordinary items 107,775 15,802 -

Extraordinary item not affecting cash (62,175) - -

Cash provided from (used in) operations 258,713 132,335 (73,821)

Net book value of property and equipment

dispositions 4,335 10,285 2,372

Increase in long-term obligations 166,267 2,181 30,887

Deferral of pension payments 22,088 23,010

Issuance of common stock and warrants 11,289 36 62,532

Other 24,455 6,386 4,875

465,059 173,311 49,855

FUNDS USED

Additions to property and equipment 57,804 15,926 59,969

Payment of long-term obligations 183,222 75,866 44,985

Redemption of preferred stock 28,000 - -

Payment of cash dividends on preferred stock 3,754 4,550 1,820

Employee stock issued 10,872 - -

Other 4,465 13,607 8,784

288,117 109,949 115,558

INCREASE (DECREASE) IN CASH AND

SHORT-TERM CASH INVESTMENTS 176,942 63,362 (65,703)

CASH AND SHORT-TERM CASH INVESTMENTS

AT END OF YEAR . .

$300,085 $123,143 $ 59,781

INCREASE (DECREASE) IN CASH FROM CHANGES

IN CERTAIN WORKING CAPITAL ITEMS

Accounts receivable . .

$ (48,915) $ 10,497 $ 1,284

Parts and supplies 3,241 10,864 (393)

Prepaid expenses and other (2,873) 2,272 (1,021)

Air traffic liability 43,986 11,183 5,341

Accounts payable 33,000 2,288 (12,415)

Accrued expenses (1985 excludes pension

liability relating to extraordinary item) 25,037 (15,355) (28,177)

$ 53,476 $ 21,749 $ (35,381)

The accompanying notes are an integral part of these statements.

25

Consolidated statements of changes in stockholders^ equity

Years ended December 31, 1983, 1984 and 1985

(in thousands)

Ck)minon Stock

Shares

Additional

Paid-In

Retained

Earnings

Employee

Stock to

Unearned

Compen-

Issued Amount Capital (Deficit) be Issued sation

Balance at January 1, 1983 .

22,066 $4,413 $ 53,811 $ (30,286) $ $

Cash dividends on redeemable preferred stock . .

- - -

(1,820) - -

Issuance of common stock and warrants

.

8,564 1,713 60,819 - - -

Net loss for 1983 - - -

(111,031) - -

Balance at December 31, 1983 .

30,630 6,126 114,630 (143,137) -- --

Cash dividends on redeemable preferred stock . .

- - -

(4,550) - -

Issuance of common stock 9 2 34 - - -

Employee stock to be issued .

- - -

26,571 (26,571)

Amortization of unearned compensation .

- - - -

6,024

Net earnings for 1984 - - -

29,511 - -

Balance at December 31, 1984 .

30,639 6,128 114,664 (118,176) 26,571 (20,547)

Cash dividends on redeemable preferred stock . .

- - -

(3,754) - -

Exercise of stock options

Issuance of common stock under

110 22 398 -- - -

employee stock agreements

Tax benefit derived from issuance

.

2,818 563 10,306 -

(10,872) -

of employee stock - -

3,729 - - -

Amortization of unearned compensation .

- - - -

10,043

Net earnings for 1985 - - -

177,006 - -

Balance at December 31, 1985 .

33,567 $6,713 $129,097 $ 55,076 $15,699 $(10,504)

The accompanying notes are an integral part of these statements.

Auditors^ report

GrantThomton S Member Firm

Grant Thornton International

Stockholders and Board of Directors

Republic Airlines, Inc.

We have examined the consolidated balance sheets of Republic Airlines, Inc. (a Wisconsin corporation) and its subsidi

ary as of December 31, 1985 and 1984, and the related consolidated statements of operations, changes in stockholders'

equity, and changes in financial position for the years ended December 31, 1985, 1984 and 1983. Our examinations

were made in accordance with generally accepted auditing standards and, accordingly, included such tests of the ac

counting records and such other auditing procedures as we considered necessary in the circumstances.

In our opinion, the financial statements referred to above present fairly the consolidated financial position of Republic

Airlines, Inc. and its subsidiary as of December 31, 1985 and 1984, and the consolidated results of their operations

and changes in their financial position for the years ended December 31, 1985, 1984 and 1983, in conformity with

generally accepted accounting principles applied on a consistent basis.

AOu\A

Minneapolis, Minnesota

February 17, 1986

26

REPublic AIrUnes

Notes to financial statements

December 31, 1985, 1984, 1983

Note A -

Summary of Significant Accounting Policies

1. Principles of Consolidation: The consolidated financial state

ments include the accounts of Republic Airlines West, Inc., a

wholly owned subsidiary. All significant intercompany trans

actions have been eliminated. In December 1985, Republic Air

lines West, Inc. completed a plan of dissolution whereby all of

its remaining assets and liabilities were transferred to Republic

Airlines, Inc.

2. Parts and Supplies: Spare parts and supplies relating to flight

equipment are priced at average cost. An allowance for obsoles

cence ($16,213,000 at December 31, 1985, and $15,660,000 at

December 31, 1984) is provided for repairable parts by allocating

their cost over the life of the related aircraft.

3. Prepaid Expenses-Engine Overhaul: The Company reclassi

fies to a current prepaid expense the estimated portion of the

purchase price of flight equipment attributable to its overhaul

expected to be consumed within the next 12 months ($21,149,000

at December 31, 1985, and $21,070,000 at December 31, 1984).

Actual overhaul costs are charged to expense as incurred.

4. Property, Equipment and Depreciation: Owned property and

equipment are stated at cost. Property and equipment acquired

under capital leases are stated at the lower of the present value

of minimum lease payments or fair market value at the incep

tion of the lease. Depreciation and amortization of property and

equipment are based on the straight-line method. Estimated

useful lives range from 10 to 20 years for flight equipment and

3 to 25 years for ground property and equipment. Residual

values vary from zero to 15%. Property and equipment under

capital leases and leasehold improvements are amortized over

the lease term or the estimated useful life of the asset, which

ever is less.

5. Deferred Charges: Expenses incurred in connection with the

issuance of long-term obligations are deferred and amortized on

a straight-line basis over the terms of the related obligations.

6. Passenger Revenue: Passenger revenue is recognized when

the transportation service is provided. Tickets sold but unused

are classified as a current liability.

7. Retirement Plan Costs: The Company has defined benefit and

contribution plans covering all employee groups. Current service

costs are accrued and funded on a current basis. For defined

benefit plans, prior service costs are amortized over varying

periods up to 40 years with funding determined under the unit

credit, aggregate frozen liability, and individual entry age

normal methods.

8. Income Taxes: The Company uses the flow-through method

of accounting for investment tax credits which reduces income

tax expense when the related liability is reduced. Investment

credits not applied currently are offset against deferred income

taxes to the extent they are applicable to previously deferred

taxes becoming payable in the carryover periods. The Company

recognizes deferred income taxes resulting from differences in

financial and income tax reporting.

9. Reclassification: Certain amounts for 1984 and 1983 have

been reclassified to conform with the 1985 financial statement

presentation.

Note B -

Sale of Tax Benefits -

The leasing provisions of the

Economic Recovery Tax Act of 1981 allowed the Company to

enter into sale-leaseback transactions for income tax purposes

involving certain equipment additions. As a result of these trans

actions, the Company recognized other income (net of related

expenses) of $13,046,000 in 1983, $17,752,000 in 1982, and

$28,930,000 in 1981. Provisions of these transactions include,

among other things, indemnification of the buyer against loss

of the stipulated tax benefit amount.

Note C -

Long-Term Debt -

All flight equipment and certain

ground property and accounts receivable (accounts receivable

of $38,060,000 at December 31, 1985, and $38,511,000 at

December 31, 1984) are pledged as collateral against the long

term debt, consisting of the following at December 31 (in

thousands):

1985 1984

Bank Credit Agreement (a) $185,895 $333,154

Installment notes (b) 142,021 140,507

Equipment trust notes:

14-5/8%

due February 1, 1990 (c) 73,056

15-1/8%

due February 1, 1993 (c) 72,901

9% due May 1, 1993 (d) 23,550 26,700

Due July 1, 1998 (d) 6,746 7,265

Subordinated debentures (e);

13% called in 1986 12,360 13,310

10-1/8% called in 1986 73,353 73,278

Sundry 3,354 3,764

Total long-term debt 593,236 597,978

Less current maturities (f) 83,802 59,696

$509,434 $538,282

(a) The balance at December 31, 1985, is scheduled to be retired

with quarterly installments aggregating $58,425,000 in 1986,

$35,500,000 in 1987, $38,000,000 in 1988 and 1989, and a final

payment of $15,970,000 in 1990. The Company is required to

prepay indebtedness under the Bank Credit Agreement to the

extent the Company achieves profits in excess of specified

27

Notes to financial statements (continued)

December 31, 1985, 1984, 1983

amounts, and from net proceeds from the disposition of flight

equipment. Included in the 1986 aggregate quarterly in

stallments is a prepayment of $29,425,000 due in April 1986.

Interest is paid monthly to each participating bank at 1/2% over

the Citibank, N.A. alternative rate or other rates as negotiated

with the individual bank participants. The effective rate at

December 31, 1985, was 10%.

Current covenants in the Bank Credit Agreement, as amended,

require the maintenance of debt-to-equity ratios and place re

strictions on dividend payments and capital expenditures. The

most restrictive covenant requires the maintenance of minimum

tangible net worth, as defined in the Bank Credit Agreement.

The Company and the banks executed letter amendments and

agreements during 1985 which amend the covenants and, based

on assumed operating results, will allow the Company to remain

in compliance over the remaining term of the loan.

The Company is required to maintain average compensating

balances of 10% of the monthly average loan outstanding and

to pay interest on any compensating balance shortfall at 1/2%

over the Citibank, N.A. alternative rate. During 1985 the