1958

Bert Allenberg*

John H. Connelly

William Goetz

Floyd Hendrickson

BOARD OF DIRECTORS

Leland Hayward, Chairman

Harry White

GENERAL OFFICES:

T. R. Mitchell

Daniel O'Shea

Walter Roche

William B. Smullin

San Francisco International Airport

San Francisco 28, California

OFFICERS:

John H. Connelly

T. R. Mitchell

C. A. Myhre

E. Roger Dahl

R. E. Costello

Max A. King

Walter Roche

Floyd Hendrickson

President and General Manager

Executive Vice President

. Vice President-Finance

. Treasurer

Vice President-Traffic

Vice President-Sales

. Secretary

Assistant Secretary

AUDITORS

PRICE WATERHOUSE & CO.

120 Montgomery Street, San Francisco, California

REGISTRAR

Bank of America

300 Montgomery Street

San Francisco

* Deceased

TRANSFER AGENT

Crocker-Anglo National Bank

1 Montgomery Street

San Francisco

Leland Hayward.

Chairman

John H. Connelly

President

C. A. Myhre

Vice President

R. E. Costello

Vice President

Walter Roche

Secretary

T. R. Mitchell

Vice President

E. Roger Dahl

Treasurer

Floyd Hendrickson

Asst. Secretary

Max A. King

Vice President

1958

1957

1956

1955

1949

TO STOCKHOLDERS, EMPLOYEES, AND PATRONS

PACIFIC AIR LINES, INC.

OPERATING RESULTS

During the year 1958 more than 351,000 passengers were carried almost 79

million passenger miles in scheduled service, which is a 10 per cent increase

in number of passengers carried and 12 per cent increase in passenger miles

over the previous year. This growth was achieved in spite of the general busi-

ness recession which was felt along the Pacific Coast during the first half of

the year.

During this period more than 26,000 passengers were carried between Burbank-

Las Vegas and San Francisco/Oakland-Las Vegas, over which routes service

was inaugurated in September, 1957. Further substantial growth in this new

market is anticipated for the coming year.

Shown below is a ten-year comparison which sets forth the gains your Com-

pany has made in market penetration and indicates the growing importance of

the Company's contribution to the economic growth and development of the

Pacific area.

Miles Passengers Available Passenger

Flown Carried Seat Miles Miles

5,384,049 351,982 147,312,486 78,331,650

4,551,716 319,276 124,398,543 69,999,789

4,048,797 259,522 107,084,154 55,917,208

3,316,457 236,083 79,005,186 47,131,928

2,419,695 114,573 50,399,055 20,947,484

Load

Factor

53.2%

56.3

52.2

59.7

41.6

REVENUE AND EXPENSE

Your Company's revenue, excluding mail pay (subsidy), increased 22 per cent

over the previous year to a record high of $5,143,950. This increase was due

primarily to the record number of passengers carried and an approximate 10

per cent increase in passenger fares.

As indicated in prior reports, Pacific Air Lines has been operating since Jan-

uary 9, 1956, under a temporary Mail Rate sufficient only to cover our op-

erating break-even need. During December 1958 negotiations were begun

with staff members of the Civil Aeronautics Board towards establishing a

permanent mail rate, calculated to cover the above-mentioned break-even need

recognized as necessary by the Civil Aeronautics Board and, also, a return after

taxes, based on your Company's investment. These negotiations were concluded

early in 1959 and, on May 19, 1959, the Board issued an order fixing a per-

manent rate for the period from Januay 9, 1956, through September 30, 1958.

This order also fixed a rate for the year beginning October 1, 1958. In accord-

ance with this order, cash funds totaling $869,419 were received on June 15,

1959. These funds substantially improve the working capital position of your

Company as reflected in the accompanying financial statements.

The summary of the operating results for each of the three years ending De-

cember 31, ( after adjustment for this revised rate) is presented below:

YEAR ENDING DECEMBER 31

Revenues: 1956 1957 1958

From transportation of passengers,

freight, mail, etc. ------------------------ $3,573,724 $4,216,726 $5,143,950

Federal subsidy ------------------------------ 1,795,805 2,056,930 2,357,763

$5,369,529 $6,273,656 $7,501,713

Operating expenses ---------------------------- 5,154,251 6,044,896 7,263,997

Operating income ------------------------------ $ 215,278 $ 228,760 $ 237,716

Other expense, Net, ------------------------ 48,230 122,961 81,550

$ 167,048 $ 105,799 $ 156,166

Estimated Federal rncome taxes ______ 93,017 64,743 93,000

Net earnings for year ----------------- $ 74,031 $ 41,056 $ 63,166

FLIGHT EQUIPMENT

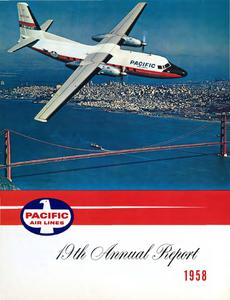

As previously reported to you, Pacific placed an order with Fairchild Engine

& Airplane Company on February 15, 1957, for three F-27 jet powered 44~

passenger aircraft. This order was subsequently increased to 6 aircraft, spare

Rolls Royce engines, and other related spare equipment.

The first 3 F-27 airplanes were placed in revenue service on April 26, 1959,

and the last 3, which were delivered in June, 1959, were placed in service as

of July 1, 1959.

Financing for the above aircraft was arranged through the Bank of America

on November 21, 1958, in the amount of $5,631,000, and, in accordance with

Public Law No. 307, $4,631,000 of this loan is guaranteed by the United

States Government.

Principal payments will aggregate $663,000 per year through 1963 and

$463,000 per year for 1964 through 1968. It is anticipated that principal pay-

ments and a substantial portion of the interest payments will be provided by

depreciation on all the Company's aircraft and related equipment.

Your Company's aircraft fleet now consists of 6 F-27 44-passenger jet powered

aircraft; 7 Martin 44-passenger aircraft; 10 Douglas 28-passenger DC-3's;

1 Lockheed 6-place aircraft; and 1 PBY 28-place amphibian. The Lockheed is

used by Company executives, auditors, and personnel in inspections of your sta-

tions at 28 cities. The amphibian will be used in charter and Catalina Island

servICe.

ROUTE DEVELOPMENTS

In our continuing effort to strengthen, improve, and expand our system, the

Company was involved in three major route cases during the year:

The PACIFIC NORTHWEST case concerned the question of additional

local air service along the northern half of the Pacific Coast. On May 28,

1959, a Board order was issued whereby your Company's route was ex-

tended north to Portland and by the same order the route of West Coast

Airlines was extended south to San Francisco. It is anticipated that service

to Portland will be inaugurated ( with your Company's newly-acquired

jet powered Fairchild F-27 aircraft) during the summer of 1959.

In the PACIFIC SOUTHWEST case Civil Aeronautics Board certifica-

tion is sought to provide non-stop service between the following pairs of

cities: San Francisco-Los Angeles; San Francisco-Las Vegas; Burbank-Las

Vegas; Los Angeles-Las Vegas; and Sacramento-Reno. Your Company has

also applied to provide service to the San Joaquin Valley cities of Fresno,

Modesto, and Visalia, as well as authority to serve the cities of San Diego,

Palm Springs, and Long Beach. Formal hearings commenced in April,

1959, and it is expected that a final Board decision will be reached in

1960.

In the SERVICE TO SANTA CATALINA case, Docket No. 7149, the

Company requested authority to provide service to Santa Catalina from

Burbank, Los Angeles, Long Beach, and San Diego. This application was

rejected by an order of the Board issued in April, 1959. However, upon

petition for reconsideration, the Civil Aeronautics Board on June 4, 1959,

issued Exemption Order No. E-13981 authorizing inauguration of service

from Los Angeles, Burbank, and Long Beach to Catalina on a temporary

basis pending final decision on our petition for reconsideration.

PERSONNEL

The progress made by your Company during 1958 was due in a large measure

to the efforts of Pacific's skilled and loyal employees, all of whom are now cov-

ered by a Company pension plan. During this period Pacific reached amicable,

collective bargaining agreements with all segments of its work force without

loss of a single man-day due to labor disputes. These contracts provide rates

of pay, fringe benefits, and working conditions in line with other compara-

ble carriers. No labor problems are anticipated for the coming year.

IN MEMORIAM

The death of our beloved Director, Bertrum Allenberg, on November 27,

1958, terminated a long, fruitful, and happy association. His pleasant, warm

companionship and sage advice will be greatly missed. He not only created

a better section of the world in which he lived, but impelled by brotherly love

and generosity, earned the ever-lasting gratitude of those who benefit from

his association and memory.

I

I Elko

--Q.

-- / 0

---- ':It Lake

City

b ---

Ely

/ ----- b;

Muysvnle :eno :

-- .

--- , :

Sacramento

I \

I :

Stockton I ' \

.. tf odes'tl ,

i

Merced~ ,~ \

io(F,esno :

'\--... '

.

\ .

........... ~ :

ll-v; .. 1,a ........

" ....

.

~

t" .. ,. as Vegas

I

I

I

---

ern ,~#

I ------ Grand Canyon

I' -.. "O

# I

le

I

..

~

# I

/\~ # :,.

'QI I

01 Needles

J-~ Rterside

?~

I ~..

....

... .

.

....

I ~Palm ~prongs

..,.

.

-~

---,.. ....

I

) - - - - - - - ~ ~ T,csori

San O;ego I

)

~

0 Phoenix

FUTURE

With your Company's extended routes over which our new equipment will

operate, combined with our strengthened financial position, we look forward

to 1959, based on results to date, as a good year for Pacific Air Lines. As the

rapid growth of this region continues, your Company, whose routes cover the

very heart of the Pacific area, may be expected to become an increasingly valued

property. Growth trend curves based on historical statistical data of only our

Martin equipment and recent F-27 passenger loads indicate possibilities of at-

taining average annual loads of approximately 33 passengers while, at the

same time, offering a frequency of service suitable to traffic needs, sound econ-

omy, and maintaining an conomically realistic competitive position in our major

markets. To meet these growth demands, additional modern equipment will be

required in order to provide the public with adequate service. Although your

management feels that a reasonably high frequency of flights should be offered

where warranted, a careful balance, however, must be maintained between

flight frequency, cost and traffic development. High frequency, brought about

as a result of small aircraft capacity, is economically undesirable. Therefore,

in order to avoid resorting to high flight frequencies, with the attendant in-

crease in operating costs, aircraft of approximately 55-passenger capacity, per-

mitting an operating load factor of 60 per cent, may be indicated in servicing

our most dense routes, which routes, of course, offer the maximum opportunity

for profit. The capital requirements to finance further equipment needs will

impose underwriting problems; however, improvements in net earnings should

also result.

The retirement of the DC-3's begins a new era in local air service as there is

now available ample, comparative statistical data indicating that the saleability

of DC-3 service is not conducive to traffic development. As the transition to

modern equipment takes place, passenger loads will increase through substan-

tial diversion of intercity traffic presently moving via automobiles, buses, and

trains, resulting in increased revenue and less subsidy. The traffic potential of

our densely populated area can not be developed fully without the most modern

equipment.

President

Operating revenues:

Passenger _______________________________ _

_______________________________________________ _

Mail ----------------------------------------------------------------------------------------

Charter and contract operations --------------------------------------------

Express, freight and excess baggage ------------------------------------

0th er _____________________________________________________________________________________ _

Federal subsidy ----------------------------------------------------------------------

Operating expenses:

Flying operations ------------------------------------------------------------------

Direct maintenance-flight equipment --------------------------------

D . . fl" h .

eprec1atton- 1g t eqmpment --------------------------------------------

Direct maintenance-ground equipment ------------------------------

Maintenance burden -------------------------------------------------------------

Passenger service --------------------------------------------------------------------

Aircraft servicing ------------------------------------------------------------------

Traffic servicing --------------------------------------------------------------------

Promotion and sales --------------------------------------------------------------

Advertising ----------------------------------------------------------------------------

General and administrative ----------------------------------------------------

Depreciation-ground equipment ----------------------------------------

Operating income

Other (income) and expenses:

Interest _

____________

___________________________________________ . __________________________ _

Extension and development --------------------------------------------------

Net loss on disposition of assets ------------------------------------------

Adjustment of spare parts inventory _____________________________________ _

Others, net ------------------------------------------------------------------------------

Estimated federal income taxes

Net earnings for year------------------------------------

Retroactive subsidy for 1956 less related federal income tax _____ _

Earnings retained for use in the business:

Balance, beginning of year ----------------------------------------------------

Balance, end of year --------------------------------------

Year ended December 31

1958 1957

(Note C)

$4,603,419 $3,791,591

122,400 116,605

289,475 199,257

113,321 91,684

15,335 17,589

5,143,950 4,216,726

2,357,763 2,056,930

7,501,713 6,273,656

2,372,282 1,906,179

1,201,281 1,014,200

358,157 350,955

3,931,720 3,271,334

117,336 82,204

44(011 351,828

287,117 231,340

481,018 379,739

1,063,402 870,970

168,822 122,900

243,739 218,956

429,872 424,850

99,960 90,775

3,332,277 2,773,562

7,263,997 6,044,896

237,716 228,760

61,798 62,757

14,377 10,172

10,129 6,741

43,417

(4,754) (126)

81,550 122,961

156,166 105,799

(93,000) (64,743)

63,166 41,056

69,021

1,134,353 1,024,276

$1,197,519 $1,134,353

ASSETS

Current Assets:

Cash

Accounts receivable:

United States Government- mail, pas-

sengers and other --------------------------------

Traffic and agents ------------------------------------

Miscellaneous, less allowance for pos-

sible losses (1958-$8,306; 1957-

$13,000) ----------------------------------------------

Employees -----------------------------------------------

Inventories of materials and supplies, at

approximate cost, not in excess of mar-

ket ____

_____

_

_

_

____

_

___

_

_

___

___________

______

____________

_

_

_

__ _

Prepaid expenses ------------------------------------------

Property and Equipment, at cost:

Flight equipment - pledged under notes

payable ----------------------------------------------------

Ground and other equipment _

______

________

_

_

_

___

_

Less-Accumulated depreciation ______

_____

_

_

_

Construction in progress ------------------------------

Deposits on purchase of flight equipment

(Note B) -----------------------------------------------

Investments in Service Organizations,

at cost

Deferred Charges:

Extension and development expense _________ _

Other ------------------------------------------------------

December 31

1958

$ 61,930 $

1,672,273

211,461

74,806

7,672

248,315

41,064

2,317,521

4,215,728

725,778

4,941,506

2,750,206

2,191,300

156,296

385,786

2,733,382

4,321

32,802

32,802

1957

12,120

989,727

160,038

26,192

3,834

233,379

3'6;059

1,461,349

3,832,399

678,956

4,511,355

2,123,072

2,388,283

92,695

145,786

2,626,764

4,321

37,521

64,681

102,202

$5,088,026 $4,194,636

LIABILITIES

Current Liabilities:

Notes payable - current instalments on

long-term debt ----

0 ---- --- ---- --- - ----- - -------- - ----- -

Accounts payable ----------------------------------------

Taxes collected or withheld from others ___ _

Accrued expenses ----------------------------------------

Transportation sold, not yet used or re-

funded ---------------------------------------------------

Estimated federal income taxes ____

_____________ _

Long-Term Debt:

5o/o notes payable to bank-secured by

chattel mortgage on flight equipment-

maturing in monthly instalments to De-

cember 15, 1963. (Note A)-------------------

Conditional sales contract ----------------------------

Provision For Federal Income Taxes of Future

Years

Capital Stock and Surplus:

Common stock:

Authorized, 40_

,000,000 shares of 50c

par value per share

Issued, 671,410 shares ---------------------------

Paid-in surplus --------------------------------------------

Earnings retained for use in the business,

per accompanying statement (Notes A

and C) ---------------------------------------------------

$

December 31

1958 1957

349,415

1,439,901

131,182

193,334

30,390

349,820

2,494,042

735,387

6,274

741,661

72,775

335,705

246,324

1,197,519

1,779,548

$ 490,187

917,697

92,108

155,960

29,997

172,742

1,858,691

515,787

515,787

103,776

335,705

246,324

1,134,353

1,716,382

$5,088,026 $4,194,636

NOTES TO FINANCIAL STATEMENTS

NOTE A:

December 31, 1958

NOTE B:

Notes payable at December 31, 1958 comprised

the following:

5 % secured bank loan, under agree-

ment dated May 1, 1957, due June

15, 1958. Repayment extensions

were obtained and the indebted-

ness was liquidated on June 17,

1959 ------------------------------------------------$ 142,000

5 % secured bank loan, under agree-

ment dated November 21, 1958,

payable in monthly instalments of

$16,700 commencing January 15,

1959-secured by the Company's

present flight equipment _

_________

_____

_

Conditional sales contracts ______________

_

_

935,787

13,289

$1,091,076

In addition to the foregoing, the Company entered

into two new bank loan agreements dated Novem-

ber 21, 1958 to finance the purchase of new flight

equipment ( see Note B); the particulars of the loan

agreements are as follows:

5 % loan, payable in monthly in-

stalments of $5,500 for each new

Fairchild aircraft acquired, to Jan-

uary 15, 1960, and $33,000 month-

ly thereafter-to be secured by

new Fairchild aircraft and equip-

ment ------------------------------------------------$3,964,500

5 % loan, payable in monthly in-

stalments of $5,550, commencing

July 15, 1959-to be secured by

new Fairchild aircraft and equip-

ment. ---------------------------------------------- 666,500

On November 17, 1958, the Civil Aeronautics

Board undertook to guarantee 90% of the principal

amount and 100 % of the interest on the two 5 %

loans aggregating $4,631,000.

Under the terms of the November 21, 1958 loan

agreements, the Company has agreed that ( 1) it will

not, without the prior written consent of the bank,

pay any dividencfs ( except in stock) or purchase,

redeem or otherwise acquire for value any of its out-

standing shares, and ( 2) commencing January 1,

1959 will maintain current assets at least equal to

current liabilities; for the purpose of this computa-

tion, current instalments under the November 21,

1958 loan agreements may be excluded from current

liabilities and 60-75 % of any claims for retroactive

subsidy pending before the Civil Aeronautics Board,

less provision for taxes, may be included in current

assets.

The Company has agreed to purchase six new Fair-

child F-27 turbo-prop aircraft and related spare en-

gines, equipment and parts for a total cost of approxi-

mately $5,340,000, against which advance payments

of $385,786 had been made as of December 31,

1958. All aircraft and a substantial portion of the

equipment was received during the first half of 1959.

Payment therefor has been made principally from

the proceeds of the bank loans as mentioned in

Note A.

NOTE C:

On June 9, 1959 the Civil Aeronautics Board fixed

the rates of compensation which the Company is to

receive for the transportation of mail by aircraft after

January 9, 1956. As a result of this settlement, which

was recorded in the accounts as of December 31,

1958 the statement of earnings for 1957 has been

restated as follows:

Previously As

reported restated

1957 earnings ____________

$ 103,139 $ 41,056

Adjustment applicable

to 1956 ________

__________ 125,645 69,021

Earnings retained for

use in the business,

December 31, 1957, 1,253,060 1,134,353

NOTE D:

On September 8, 1958, the Board of Directors ap-

proved a participating retirement plan for all employ-

ees of the Company, other than those who participate

in the retirement plan for pilots. The plan is insured

and is effective July 1, 1958. To become eligible to

participate in this plan an employee must have had

five years service with the Company and have attained

the age of 25; no credits accrue to employees for serv-

ices prior to July 1, 1958. The estimated cost to the

Company of such plan for the first policy year is

$25,000.

As at December 31, 1958, the estimated unfunded

portion of past service costs, payable over the next

eight years, under the retirement plan for pilots,

amounted to approximately $153,000.

NOTE E:

In accordance with the request of the Civil Aero-

nautics Board the Company has in 1958 transferred

def erred overhaul costs from def erred charges to

flight equipment and the 1957 figures have been re-

stated in order to be comparable. The Company also

in 1958 changed its method of providing for the

cost of overhaul of aircraft. The result of such change

was to increase the charge to direct maintenance by

approximately $40,000.

PRICE WATERHOUSE & Co.

To the Board of Directors of

Pacific Air Lines, Inco

120 MONTGOMERY STREET

SAN FRANCISCO 4

June 29 1959

In our opinion, the accompanying statements present fairly

the financial position of Pacific Air Lines, Inc o at December 31 1958

and the results of its operations for the year, in conformity with

generally accepted accounting principles o These principles have been

applied on a basis consistent wi~h that of the preceding year, except

for the change which we approve, in the basis of providing for the

cost of overhaul of aircraft as described in Note E to the financial

statementso Our examination of these statements was made in accord-

ance with generally accepted auditing standards, and accordingly

included such tests of the accounting records and such other auditing

procedures as we considered necessary in the circumstanceso Certain

receivables from the United States Government selected for tests were

not confirmed by direct correspondence, but we satisfied ourselves as

to these amounts by means of other auditing procedures.

Pacific Air Lines provides fast, comfortable, economical flights

to major vacation areas of the Pacific Southwest.

Portland and Catalina are now easily accessible with

Pacific's new swift service.

For a more enjoyable vacation, arrive refreshed and

relaxed-Above All Fly Pacific Air Lines!

Las Vegas offers the vacationer the quietness and stillness of a desert

night as well as excitement of the bright lights and the spinning wheel.

The relaxing atmosphere of Avalon has

made Catalina Island a favorite of millions.

DING

BLUFF

ICO I

RYSVILLE

-----~~ RENO

RAMENTO

I

I

OCKTON

I

I

JOSE

,~ :

",. : FRESNO

----

LEGEND

- = Routes

Non stop

Service

New Routes

-Pending

CAB Action

Francisco-Oak

ctions of this b

The charm and serenity of Santa Barbara remain unchanged

since the days of the Padres and the Conquistadores.

PACIFIC

AIR LINES

JETHAWK