2007 VOLUME 47 NO. 3

savannah's total logistics provider

750,000 square feet of warehouse space in close proximity to all port facilities two additional facilities total 600,000 square feet opening spring 2007

transportation with company owned trucks guaranteed for warehouse customers third party logistics division in partnership with a broad base of carriers efficient shipside operations available

ocean link inc.

tel: 912.966.5465 fax: 912.966.5455 www.ocean-link.com

In This Issue

2007 Volume 47 No. 3

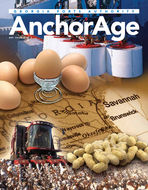

COVER STORY

INCREASED EAST COAST IPI ....................................................12

GEORGIA PORTS AUTHORITY

Feature

Ports' Economic Impact Felt Throughout the State of Georgia and Beyond ....................................8 GPA: Prepared for Your Business and Making Investments ..................................................................10 Increased East Coast IPI ......................................................................................................................................12 Oneida's Table is Set: Feast Your Eyes on Bryan County's Newest Distribution Center ..............17 IKEA Furnishes Southeast with State-of-the-Art Distribution Center ................................................18 TARGET Opens Doors to Largest Distribution Center ..............................................................................19

Emerging Markets

Cargo Flows into Texas: Opportunities for Savannah................................................................................14

Carrier Services

Maiden Voyages Dock at Port of Savannah ................................................................................................ 27

Project Cargo

Jumbo Steel for World Trade Center Memorial Shipped Through Savannah ................................ 24

Passing Through

Building for the Road Ahead: GPA Addresses Last-Mile Needs for Port of Savannah ................16

Sailing Schedule .......................................................................................................................................... 28

Portfolio

848 Million Pounds of Poultry .............................................................................................................................. 6 Passion for Performance .................................................................................................................................... 20 GPA Tests Technology for Harbor Deepening ............................................................................................ 33

Community Involvement

GPA Reciprocates Gifts with Port of Shimizu.............................................................................................. 34

Noteworthy

McCurry Named General Manager of External Affairs ............................................................................ 36

ROBERT C. MORRIS Editor (912) 964-3855

KAREN WILDS Managing Editor (912) 964-3885

AMY SHAFFER Copy Editor

JUDY WOLFE Advertising Associate (912) 964-3855

gaports.com

The Georgia Ports Authority AnchorAge is the official publication of the Georgia Ports Authority, published quarterly and distributed free of charge to more than 9,000 readers worldwide.

This publication is not copyrighted and permission is given for the reproduction or use of any original material, provided GPA's External Affairs office is contacted.

GEORGIA PORTS AUTHORITY ANCHORAGE P.O. Box 2406 Savannah, GA 31402 Phone: (912) 964-3855 Toll Free: (800) 342-8012 Fax: (912) 964-3921 Email: rmorris@gaports.com

WWW.GAPORTS.COM

3

AUTHORITY MEMBERS

Georgia Ports Authority

STEVE GREEN

Chairman

SAVANNAH

SUNNY PARK

Vice Chairman

ATLANTA

RUSTY GRIFFIN

Secretary/Treasurer

VALDOSTA

ZACKARY AULTMAN

Member

ALBANY

MAXINE H. BURTON

Member

BOGART

DONALD CHEEKS

Member

AUGUSTA

CLINT DAY

Member

NORCROSS

HUGH GILLIS

Member

SOPERTON

JIM LIENTZ

Ex-Officio Member

ATLANTA

BARTOW MORGAN, Jr.

Member

LAWRENCEVILLE

JOHN NEELY

Member

MAUK

ALEC POITEVINT

Member

BAINBRIDGE

HUGH M. TARBUTTON

Member

SANDERSVILLE

gyarboro@logistec.com / www.logistec.com

Professionalism

Logistec USA Inc., 225 Newcastle Street, P.O. Box 1411, Brunswick, Georgia 31521 / Telephone: (912) 264-4044 / Fax: (912) 267-6352

4

GPA ANCHORAGE

Perspective: Doug J. Marchand

Georgia's Ports Continue to Grow

PERSPECTIVE

maintaining safety in an increasingly busy workplace, are challenges that must be met with additional equipment, personnel and cutting-edge technologies.

By 2008, four additional ship-to-shore cranes will be delivered to the Port of Savannah. Fifteen ship-to-shore cranes are now in service and that total will increase to 23 by 2009.

G eorgia's deepwater ports continue to be one of the state's strongest economic engines. As a pillar of support for the transportation, manufacturing and wholesale/distribution centers, as well as the state's agricultural development, the ports translate into jobs, higher income, greater productivity and better services.

In 2006, the Georgia Ports Authority (GPA) partnered with the University of Georgia's Terry College of Business on a study titled, "The Economic Impact of Georgia's Deepwater Ports on Georgia's Economy in FY2006." According to the results of the study, Georgia's deepwater ports and inland barge terminals supported more than 286,476 jobs and contributed $14.9 billion in income, $55.8 billion in revenue and $2.8 billion in state and local taxes to Georgia's prospering economy.

Container Berth 9 is also in operation at the Port of Savannah. The GPA has increased its storage capacity by stacking containers higher to utilize available land. The use of rubber tired gantry cranes (RTGs) is pivotal in GPA's densification efforts. Currently, 46 RTGs are in use, with a projected 117 in operation by 2015.

With increased growth, the GPA relies on technology to stay ahead. A radio frequency (RF) network covers the ship-to-shore cranes and the RTG fleet enabling remote diagnostics of equipment performance currently in service at the Port of Savannah.

Maintaining a world-class port means hiring additional staff. Sixty new employees have joined the GPA to keep our 24/7 operational schedules moving along seamlessly in Savannah.

As Georgia's ports continue to grow, the Georgia Ports Authority is prepared for business that fuels the state and global economy.

The GPA must be prepared to handle rapid growth. Maximizing efficiencies, while

Doug J. Marchand, GPA's Executive Director

Executive Staff

DOUG J. MARCHAND Executive Director

CURTIS J. FOLTZ Chief Operating Officer

DAVID A. SCHALLER Chief Administrative Officer

THOMAS H. ARMSTRONG Director of Strategic Development and Information Technology

LISE MARSHALL Director of Human Resources

ROBERT C. MORRIS Director of External Affairs

MARIE H. ROBERTS Director of Finance

WILSON TILLOTSON Director of Engineering and Maintenance

JOHN D. TRENT Director of Operations

JOHN M. WHEELER Director of Trade Development

WWW.GAPORTS.COM

5

PORTFOLIO

848 Million Pounds o By John Powers

I

n round numbers, 848 million pounds of exported frozen chicken meat crossed Savannah's docks last year. The

largest share originated in Georgia's

poultry belt.

For more than 40 years, export poultry has been a prime contributor to balancing trade via Georgia's ports. Historically, the product was shipped breakbulk in the holds of refrigerated vessels. Today, shippers take advantage of the efficiencies of ocean shipment via refrigerated containers.

As avian flu concerns wane, surging volumes have created a demand for port-proximate cold storage facilities. "There are limited blast-freezing facilities at poultry origins," said Herman J. Brown, Jr., Georgia Ports Authority's (GPA) Trade Development Sales Representative. "Therefore, to accommodate their output, producers look to third-party facilities to freeze and store the poultry awaiting export."

Brown reported the recent opening of a 250,000-square-foot state-of-the-art facility. The facility is located 20 minutes from the port and will drive dramatic increases in poultry export at the Port of Savannah.

Georgia's thriving poultry business earns it a major role in the industry's trade association, the USA Poultry and Egg Export Council (USAPEEC). "We exist to support and expand the export of U.S. poultry and egg products," said Jim Sumner, USAPEEC President. "We work with government and private interests worldwide to eliminate trade restrictions and promote U.S. poultry as the safest, most wholesome and best-tasting in the world."

The organization's annual winter meeting scheduled for December 11-13, 2007, in Arlington, Va., will put producers and shippers shoulder to shoulder with the administrative agencies that oversee the

production and export processes. Among these are the Animal and Plant Health Inspection Service, the Food Safety Inspections Service, and the Foreign Agriculture Service, as well as representatives of the Office of the U.S. Trade Representative.

Poultry exports at the Port of Savannah reached record levels in 2006. Port and industry officials expect 2007 volumes to set a new standard. Contributing to their optimism:

Photo: Russ Bryant 6

GPA ANCHORAGE

PORTFOLIO

f Poultry

Opening of additional port-proximate blast freezing and storage facilities;

Continued decrease in concerns about avian flu in poultry;

Impending startup of new ocean carrier container services with refrigerated container availability between Savannah and Asia via the Panama Canal and the Indian subcontinent via the Suez Canal;

Continued growth in Asia's traditional markets; and

Emergence of new global markets with surging volumes to the Middle East and the Mediterranean.

Poultry is big business in Georgia. As the top producer in the nation, Georgia's poultry industry draws the legislative attention of local, state and national officials committed to nurturing and expanding exports.

"We have two major areas of responsibility to our poultry industry exports," said U.S. Senator Saxby Chambliss, Ranking Republican Member of the Senate Agriculture Committee. "First, we must ensure that, both domestically and internationally, we maintain a level playing field and fair market access for Georgia producers. Secondly, we must continue to support infrastructure improvements that make our ports unsurpassed conduits for Georgia poultry."

To date, this coalition of producers, trade associations, concerned leadership and the Georgia Ports Authority has proven itself in the export marketplace. They are universal in optimism for continued international prosperity for Georgia's frozen assets.

U.S. Senator Saxby Chambliss

WWW.GAPORTS.COM

7

FEATURE

Ports' Economic Impact Throughout the State of and Beyond

By Erica Savage

G eorgia's deepwater ports, a major linchpin in the state's economy, are generating substantial economic impacts and fueling the global economy. The ports, owned and operated by Georgia Ports Authority (GPA), and located in Savannah and Brunswick, continue to attract the transportation and logistics industry as one of the main clusters of distribution activity in North America.

The GPA experienced yet another year of impressive results, once again illustrating the ports' dramatic economic impact on the state of Georgia.

In 2006, the GPA partnered with the University of Georgia's Terry College of Business on a study titled, "The Economic Impact of Georgia's Deepwater Ports on Georgia's Economy in FY2006."

That study showed Georgia's deepwater ports and inland barge terminals supported more than 286,476 jobs and contributed $14.9 billion in income, $55.8 billion in revenue and $2.8 billion in state and local taxes to Georgia's prospering economy.

According to Jeffery M. Humphreys, the report's author and director of the Terry College's Selig Center for Economic Growth, "Deepwater ports are one of Georgia's

strongest economic engines, fostering the development of virtually every industry year after year."

In the last decade alone, the GPA yielded dramatic returns on port investments. Container throughput, measured in twenty-foot equivalent units (TEUs), has tripled from 606,176 to 2.04 million TEUs. Vehicles arriving in Brunswick have quadrupled in the last decade as well from 98,865 to 368,425 in FY2006.

Infrastructure improvements at the Port of Savannah include a series of strategic expansions, thereby positioning the ports for an expanded share of the regional and national waterborne cargo traffic. The expansions include the completion of Phase Two of Container Berth 8. With this completion, the Port of Savannah's berthing space has increased to more than 9,800 linear feet; adding a 20-percent increase in capacity and becoming the nation's largest single terminal container facility.

In FY2006, announcements of several new shipping services at the Port of Savannah included a 20-year agreement with Maersk Line and a 15-year agreement with CMA CGM, with further enhanced growth prospects.

Target and IKEA have built three million additional square feet of distribution space at the Savannah River International Trade Park.

The Port of Brunswick continues its lucrative niche with agricultural cargo

8

GPA ANCHORAGE

FEATURE

Felt Georgia

and car shipments. The expansion of the Anguilla Junction rail interchange yard and the addition of the CSX/NS connector already have and will continue to support increased volumes in both grain and automobiles at Colonel's Island.

"Every corner of the state relies upon Georgia's ports to export goods that fuel small and large business, as well as to import products making Georgia the transportation and logistics hub of the Southeast," said Doug J. Marchand, GPA's Executive Director. "Never before has it been more evident that the GPA's efforts to promote growth and commerce through international trade create economic opportunities throughout our state."

In FY2006, the port's output impact was 44 percent higher, its gross state product was 32 percent higher and its labor income impact was 26 percent higher than a similar study conducted for FY2003.

"With continued positive growth in all key business sectors, it comes as no surprise that Georgia's ports are a vital factor in the well-being of our economy," said Mack Mattingly, the former U.S. senator who just completed two years as Chairman of GPA's Board of Directors.

Between 2000 and 2005 alone, the Port of Savannah was the nation's fastest growing port with a compounded annual growth rate of 16.5 percent, while the national average was 9.7 percent.

"The success of Georgia's ports can be largely contributed to a pro-port, pro-business operation environment," said Georgia Gov. Sonny Perdue. "Humphreys' study clearly demonstrates that our ports are having a strong and growing impact on our state's economy."

Of the 361 ports in the United States, Savannah is ranked as the number-four container port and Brunswick is the numbersix auto importer/exporter.

"We didn't grow to be the fourth largest U.S. container port by chance," said Marchand. "Geography, intermodal connections and the ability to grow with our customers' business have proven instrumental to our growth; however, our ability to project, plan and make necessary adjustments along the way to stay ahead of the growth curve has proven equally important." Containerized cargo accounts for 87 percent of Georgia's ports' economic impact.

Photo: David Smalls

WWW.GAPORTS.COM

Photo: Russ Bryant 9

FEATURE

GPA: Prepared for Your Business and Mak

By Betty Darby

I

nvestments and improvements in the Georgia Ports Authority's Engineering and Maintenance division draw on the

latest technology to help GPA's

two deep-water ports handle increased

container business.

The Port of Savannah now ranks as the second busiest container port on the U.S. East Coast. In the fiscal year completed June 30, 2007, it handled 2.3 million twenty-foot equivalent units (TEUS). "It has put demands on our equipment, and demands on our resources, so we've developed an efficient strategy to accommodate those demands." said GPA's Wilson Tillotson, Director of Engineering, where he oversees a total staff of 109.

The GPA has a plan to invest $350-million in modern equipment during the next eight years. The new equipment will efficiently handle increasing cargo volumes.

Important items on that investment list are additional ship-to-shore cranes. The port has 15 in service now, and four more are on order for delivery by 2008. The GPA will have a total of 23 cranes in service by 2009.

Six existing cranes have been refitted and raised 20 feet to accommodate larger vessels.

Maximizing the use of available land and maintaining safety in an increasingly busy workplace are the driving factors behind a switch from the top lifts that previously dominated the docks to rubber-tired gantries (RTGs), Tillotson explained.

The port's stock of RTGs has already been beefed up to 46, compared to 15 merely four years ago. But that's nothing compared to what's yet to come: by 2015, there will be 117 RTGs working the stacks at the Port of Savannah.

The additional cranes and new container storage facilities have and will continue to significantly increase Savannah's capacity.

"The primary advantage of the RTG is that it allows you to get more capacity out of the same area. It's safer, too, and there's less potential for damage to cargo," Tillotson said.

The RTGs can operate with less room between stacks. As a result, the process of reconfiguring all of the container stacks has begun, turning them parallel to the river, rather than perpendicular. A by-product of

this new configuration will be a more coherent, and inherently safer, traffic pattern.

In addition to dramatic increases in the amount of equipment, Engineering and Maintenance is turning to technology to maximize the work it can get out of each machine.

"We're in the throes of tying all our equipment into our RF (radio frequency) network," said Paul E. Harkness, who was recently promoted to General Manager of Maintenance under a sweeping reorganization that streamlines the way Engineering and Maintenance handles its duties.

The RF networking puts the designated equipment into wireless touch with central monitors in Harkness' office. Beginning with the ship-to-shore cranes and ultimately moving on to the RTG fleet, networking will enable remote diagnostics. Already, a glance at the two monitors in his office gives Harkness a graphic image of the operating health of many of the cranes.

"We're working toward being able to identify a problem so that we don't end up going to the top of the crane and finding the problem is down below," Harness said. "Of course, somebody's still got to go turn the wrench."

Simply keeping up with the increased business isn't enough. The goal is to keep up while retaining a long-established record of excellent service.

"World-class downtime," is how Paul Harkness, General Manager of Maintenance, describes it. The Port of Savannah has a 0.52

Photo: David Smalls 10

GPA ANCHORAGE

FEATURE

ing Investments

percent downtime record or, in other words, three minutes per ten-hour shift.

"Ninety-nine percent is pretty common. To get to 99.5 percent is world class," Harkness said. Part of the challenge of keeping that downtime figure or, as Tillotson prefers to call it, "uptime" is finding time to perform maintenance. Loading and unloading goes on 24/7. The traditionally slower night hours have increased capacity to where 45 percent of ships' cargo gets handled at night. That means maintenance staff must adapt to non-traditional schedules to get the job done.

In response to the pressures of growth, Tillotson has reshaped the entire department. Engineering and Maintenance's responsibilities cover a wide range of diverse skills writing specifications for new equipment, supervising the contractors to whom construction responsibilities are delegated, keeping multi-million dollar equipment fleets operating, ensuring environmental compliance, even remodeling office space. To better handle the demands, the new structure breaks those duties into four segments:

Equipment and Facilities Engineering, managed by Richard Cox, which covers capital and maintenance projects, equipment procurement and improvement, and facility maintenance;

Engineering Services, managed by Randy Weitman, which coordinates with such agencies as the Georgia Department of Transportation and public utilities, external projects and document management;

Maintenance, which covers fleet and crane maintenance, storerooms, and equipment safety; and

Environmental, which is managed by Natalie Schanze.

WWW.GAPORTS.COM

GPA: PREPARED FOR YOUR BUSINESS

As Environmental Affairs Manager for the Georgia Ports Authority (GPA), Natalie Schanze ensures that GPA conducts business in harmony with the environment.

Schanze began serving GPA 16 years ago, as a consultant. Initially, her work focused on wetlands permitting. As GPA continued exponential growth economically and physically, GPA also grew in its role as an environmental leader. This, in turn, increased the scope of environmental management needed, leading GPA last year to convert Schanze' role from consultant to staff member, as Environmental Affairs Manager.

"Even though I had developed a highly successful consulting career, using my 26 years' experience to help other government clients such as Greater Orlando Aviation Authority and Charleston Commissioners of Public Works, I consistently found my work with GPA to be the most rewarding." Schanze continues, "Because of our ability to satisfy customer needs, GPA has an incredibly dynamic near-term future. I am really excited about what we'll accomplish, for the economy as well as the environment."

Overseeing environmental stewardship at GPA's terminals in four cities--Savannah and Brunswick deep-water terminals, and Bainbridge and Columbus barge terminals-- requires close interaction with GPA planning, engineering and operations groups. GPA tasks Schanze with interjecting environmental considerations into the balance.

Schanze explains, "Because port terminals are, by definition, adjacent to important water bodies, terminal expansion and operations take place at the water's edge, where some of our country's most important natural resources also occur." It is Schanze's task to see that the activities at GPA terminals are conducted in harmony with maintaining clean air, uncontaminated soil, water resources (wetlands; water for drinking; fishing; and recreation) and the animals that live within these habitats. Just as important when planning expansions, GPA thoroughly considers potential impacts to human resources, including surrounding communities as well as cultural and archaeological resources. Schanze adds, "More recently, we have been working to increase our effectiveness in conserving our nation's fuel supply."

Schanze attributes a good portion of her success at GPA to the great relationships she

has with environmental interests, including regulatory specialists at the U.S. Army Corps

of Engineers. GPA enjoys input from biologists, geologists, and other experts at the

Corps in refining GPA project designs, so that the project in final form meets both

transportation and environmental needs.

Photo: David Smalls

11

FEATURE

INCREASED EAST COAST IPI

By John Powers

D on't call it "Reverse IPI". Reverse implies backwards or unnatural when the fact is, Interior Point Intermodal (IPI) via Savannah is the soul of logic.

Witness the 14.5-percent growth in container volume during FY2007, further evidenced by a July that was 28 percent busier than the same month last year.

A large portion of this growth is driven by imports of Asian manufactured goods. While such shipments traditionally moved through U.S. West Coast ports, times have decidedly changed. "As imports continue to grow from Asia, U.S. West Coast ports are reaching capacity limits," said Bill Clement, Assistant Vice President for CSX Intermodal. "Factors such as labor issues, public pressure to curtail operations and continued population growth in the areas of the port have caused an increase in traffic headed through the Panama and Suez Canals to East Coast ports." Equipment shortages and terminal congestion issues further crimp the supply chain.

These limitations are having a chilling effect on the two touchstones of the logistics equation. "Via the West Coast, published transit times of 19 days to markets like Chicago and Atlanta are actually clocking in at 28 to 32 days," said Georgia Ports Authority (GPA) Director of Trade Development John Wheeler. "These numbers make Savannah transit favorable to huge market sectors." In addition, carrier IPI rates via Savannah are running as much as $300 per container less than West Coast routings. Predictability and consistency of transit are highly attractive to shippers seeking optimal reliability in their supply chains, according to Wheeler.

Beyond current constraints on the West Coast, Savannah makes sense for multiple reasons. First and foremost, 60 percent of the U.S. population lives east of the Mississippi River. Curtis Foltz, GPA's Chief Operating Officer, detailed additional advantages:

Proximity to key markets Outstanding, reliable steamship services Ample and increasing steamship capacity Competitive transit times On-terminal service by two Class I railroads

The presence of both CSX and Norfolk Southern in proximity to Savannah's docks spells ample, competitive carriage for both ocean carriers and cargo owners. According to Jeff Heller, Assistant Vice President of International Marketing for Norfolk Southern, "The on-dock service that launched with the opening of the Mason Intermodal Container Transfer (ICTF) facility has become very popular with steamship lines eager to eliminate drays."

Savannah's continued emergence as a leading IPI hub demands a program of continuous enhancements to its rail infrastructure. Recently at the Mason ICTF, trackage has been increased by 25 percent, and switching operations improved to allow direct pulls from the yard. At Chatham ICTF, which is currently under construction, overhead cranes will be installed to maximize freight density and throughput. Available space and operational enhancements will permit doubling both facilities capacity by 2015.

Both rail providers are making good use of the GPA's terminal improvements. "Five years ago, we operated two to three trains per

week each direction," said Heller. "Now, we're up to 10 weekly, and will easily add more daily trains as demand increases."

Track upgrades on lines serving Savannah and capacity increases will enable CSX to better handle the surge, according to Clement.

The port and its carriers have a lofty objective. "Together, we have put the hardware, technology and people in place to maximize cargo velocity across our terminal," said Foltz. "Our objective is to clear, rail bill, load and dispatch every rail container in less than 24 hours." With 95 percent of all clearances and waybills executed before vessels dock, the dwell time is often considerably lower.

On the port-wide scale, Wheeler pointed to terminal optimization as the key to sustaining intermodal momentum. "Our annual container handling capacity at Garden City Terminal will triple to six million TEUs (twenty-foot equivalent units) by 2018. We have room to grow, which means we'll be able to accommodate additional cargoes, and the increasingly larger vessels that will deliver them."

Hinterland Redefined

The days when routing decisions were made with a map and set of dividers are history. Heller defined the new "big vision" of the Port of Savannah and its ocean and surface carriers. "Historically, Savannah's business reached locally to Charlotte, Atlanta and Memphis," said Heller. "As more vessels make their way through the Suez and Panama Canals, it makes sense to further our reach to Chicago, Dallas and ultimately to the West Coast."

12

GPA ANCHORAGE

FEATURE

Wheeler identified Chicago as the next big destination for Savannah freight. "A number of the big retailers are building distribution centers adjacent to rail yards in Chicago," said Wheeler.

GPA's distribution center strategy continues to produce major cargo dividends for the port. "Recently, larger retailers have developed distribution centers near the port area to transload their international shipments into domestic truck or rail container movements for delivery to regional stores," said Clement. "This is a change from traditional intact container movements, driven by investments in key infrastructure and a drive for efficiency."

Beyond China

The list of origination points for import freight entering Savannah is diversifying. While China will remain the dominant source for manufactured imports, new players are on the horizon. Wheeler listed Vietnam, Malaysia, Thailand and the Philippines as emerging contenders. He singled out India, with its 1.2-million educated, English-fluent citizens, as a potential heavyweight.

A number of these new producer nations lie along trade lanes that favor Suez routings. Lower transit times and lack of Suez vessel size limitations are driving slot costs down and interest among shippers up. Freight hungry carriers are hurrying to add westbound sailings from these areas to the U.S. East Coast.

Savannah is a prime beneficiary. The port already enjoys five weekly sailings from Asia

via the Suez, with several more imminent. This is fortified by another 18 weekly offerings via all-water service through Panama. A number of carriers offer both to optimize routing options.

Currently, Singapore is the unofficial dividing line for all-water shipments to the U.S. East Coast. Cargo that transships through that port, or ports to its west, is generally routed via the Suez. Freight from Hong Kong and ports further east tends to move via the Panama Canal. However, steamship line competition and creative routing are combining to gradually push this arbitrary line further east. In certain instances, even Hong Kong shipments flow more logically through the Suez.

International name recognition, a burgeoning steamship portfolio and multiple distribution centers are catching the eye of non-Asian producers as well. Wheeler cited increasing attention to Savannah's intermodal capabilities from cargo and carrier interests in Northern Europe, the Mediterranean and South America.

Savannah is rapidly shedding its image as the hub for China-origin freight in favor of an expanded role as the leading global hub in the Southeast. "The state and the port need to continue to invest in the port and its connections with the rail system and local

roadway network," said Clement. "The port needs to retain a focus on distribution center development. CSX needs to continue to invest in its rail network to support traffic growth to and from the port."

SAVANNAH RAIL

Transit to:

(days)

Atlanta

1

Birmingham

2

Charlotte

2

Chicago

3

Cincinnati

3

Cleveland

3

Columbus

3

Greenville

2

Dallas

3

Houston

3

Meridian

3

Nashville

3

New Orleans

3

Orlando

2

Source: U.S. Rail Desktop

For ocean and inland transit times, visit www.gaports.com to download your copy of

Savannah's Global Carrier Services Tool.

WWW.GAPORTS.COM

13

EMERGING MARKETS

CARGO FLOWS INTO TEXAS: O

By Danny Tomlinson, Market Research Analyst

W hen Texas importers consider U.S. port options, they increasingly are incorporating the Port of Savannah into their logistics plan. Savannah's reliability of

CY06 Port Market Share for Imports to Texas

FREEPORT TX 2%

SAVANNAH GA 2%

OAKLAND CA 2%

OTHER 4%

service, number of ocean services, and competitive inland transit times have helped make it the fastest growing major U.S. port

NEW YORK NY 4%

LOS ANGELES CA 32%

on the East, West, and Gulf Coasts in terms of twenty-foot equivalent unit (TEU) growth. In fact, through June 2007, Savannah's container traffic had grown 17 percent

HOUSTON TX 25%

Source: PIERS

LONG BEACH CA 29%

overall, while the U.S. increased three

percent. Interestingly, cargo imported Savannah's strong service connections and from LA/LB. However, Southeast Asia and

through Savannah and destined for Texas has increased 30 percent during the last

interstate/rail access versus that of other ports on the East and West Coasts often give

India trade lanes are also growing for the Dallas import market. Southeast Asia is a

three years, from 12,000 TEUs in 2004 to it an attractive edge for importers. Savannah growing source of furniture imports to Texas,

15,000 TEUs in 2006. The Savannah to Texas connection is projected to grow 42 percent

stands out as a viable port alternative to southern West Coast port congestion and

and India increasingly supplies Texas' apparel market.

in 2007 to nearly 22,000 TEUs. Most of this higher inland transit times from northern

growth was due to Savannah's position as a major Asia trade gateway among U.S. ports.

East Coast ports.

For cargo entering the East Coast to Texas, Savannah holds both a comparative cost and

Savannah's inland transit times to time advantage with its rail and truck

In 2006, Texas imported 818,595 TEUs globally. About 62 percent of the cargo

destinations in Texas often out compete ports on the West Coast. From Savannah,

connections to the Greater Dallas area. Truck times to Dallas can be at least 20 hours from

entered via West Coast ports, especially cargo travels 1,029 miles to Dallas or 2.5 New York (1,566 miles) and Baltimore (1,365

Oakland, Seattle, Tacoma, and Los Angeles/Long Beach (LA/LB). Nearly 60

days by rail, which is closer and faster than the inland distances and transit times for

miles) versus 15 hours from Savannah (1,029 miles). Fifty-six percent of the cargo destined

percent of all U.S. imports going to Texas LA/LB (1,443 miles), Oakland (1,811 miles), for Texas from the East Coast entered in New

came from Northeast Asia - mostly via the West Coast. Most of the cargo that entered

Tacoma (2,213 miles), and Seattle (2,201 miles). Sixty-eight percent of the cargo

York, while 16 percent entered Baltimore. Key Texas cargo destinations were Irving and

via Gulf and East Coast ports came from (mostly retail goods and furniture from Dallas/Ft. Worth.

North Europe.

Northeast Asia) destined for Dallas came

Surprisingly, the Port of Houston handles

TEXAS IMPORTS VIA SAVANNAH

only 25 percent of Texas' imports. Yet it

TEUs

24,500 22,500 20,500 18,500 16,500 14,500

moves approximately 75 percent of the container traffic in the Gulf of Mexico and continues to operate at capacity. Bayport, which opened its first phase in February 2007, is already at capacity, with its second phase opening in late 2007 or early 2008.

12,500 10,500

Source: PIERS

2004 * Projection

2005

2006

2007*

From the Port of Houston's perspective, most of its import cargo went to Texas, with

14

GPA ANCHORAGE

Opportunities for Savannah

California second (five percent of the Port of Houston's imports). A large amount of Houston imports came from North Europe, East Coast South America, and the Mediterranean, some of which was destined for the U.S. Southeast, as well as New York, New Jersey and Illinois. With all that the Port of Savannah has to offer, it is a strong competitor to ports on the East, West, and Gulf Coasts for imports to Texas.

EMERGING MARKETS

PASSING THROUGH

Building for the Road Ahead: GPA Addresses Last-Mile Needs for Port of Savannah

By Erica Savage

Senate Transportation Chairman Jeff Mullis

House Transportation Chairman Vance Smith

W hen the Georgia's Joint Study Committee on Transportation Funding held its second meeting at Savannah's Coastal Georgia Center, the Georgia Ports Authority (GPA) was there, addressing future growth plans and road needs for Georgia's deepwater ports. "We want to thank the committee not only for choosing Savannah as one of its host cities, but for giving GPA an opportunity to showcase why Savannah's port is one of the fastest growing container ports in the world," said Robert Morris, GPA's Director of External Affairs. The eight-member committee is co-chaired by Senate Transportation Committee Chairman

16

Jeff Mullis and House Transportation Committee Chairman Vance Smith. The committee is dedicated to finding alternative funding mechanisms for improving state infrastructure and transportation systems.

"Transportation is key to our economic development process," said former Georgia Department of Economic Development Commissioner Craig Lesser. "Our ports in Savannah and Brunswick under the leadership of Doug J. Marchand have resulted in huge economic benefits to our state."

During the last two fiscal years, the Port of Savannah has exceeded even the most optimistic expectations. In FY2007, 2.338 million twenty-foot equivalent units (TEUs) transited Savannah's container operations, surpassing the previous year's record by 14.5 percent and making it the fourth largest container port in America.

"As our market share continues to climb, the importance of Georgia's ports on the state, regional and national economies also climbs," said Marchand, GPA's Executive Director. "With an aggressive expansion program in place, Georgia's deepwater ports will continue to thrive, generating even more substantial economic impact in future fiscal years."

In order to ensure sustainable growth and development, GPA has devised a long-term strategic plan called Focus 2015. According to Stacy Watson, GPA's Manager of Economic and Industrial Development, the port has authorized funding for more than $1.2 billion in capital expansion projects to improve the capacity and efficiency of its terminals and the waterways leading to them. "These capital expansion projects, under Focus 2015, will nearly triple the capacity for the Port of Savannah and will increase the port's economic impact on the state of Georgia, ensuring Savannah's position and dominance in the Southeastern U.S.," Watson said.

As a major southeastern logistics hub, with 65 million consumers, Georgia is located in a rapidly growing economic region. It is home to the busiest airport in the nation and the fastest growing port in the nation. Also, it has a geographic advantage over its competition. "The dramatic growth of our ports has created an urgent need to build and expand roads and rails leading to the port," Morris said. The four projects, collectively known as "last-mile projects," include the completion of the Jimmy Deloach Connector, Brampton Road Connector, Hwy 307 overpass and updates to Grange Road.

According to Morris, all four projects will connect GPA's Savannah facilities directly to I-95, I-16 and beyond. "They will improve our rail connectivity, separate local commuter traffic from port traffic and reduce cost for businesses," said Morris.

In a FY2006 study titled, "The Economic Impact of Georgia's Deepwater Ports on Georgia's Economy," Jeffery M. Humphreys, Director of the The University of Georgia's Selig Center for Economic Growth, investigated the ports' substantial economic impact on the state. "Deepwater ports are one of Georgia's strongest economic engines, fostering the development of virtually every industry year after year," said Humphreys. "The ports are especially supportive of other forms of transportation, manufacturing, and wholesale/distribution centers."

Georgia's ports are growing, and expansion on the roads beyond the port terminals is vital to the statewide economy.

According to Marchand, "Our ability to project, plan and make necessary adjustments along the way to stay ahead of the growth curve has proven instrumental in our exponential success. Our reliable and efficient operations will only be reinforced with the completion of these last-mile projects. We haven't taken our eye off the future, and it shows."

GPA ANCHORAGE

WWW.GAPORTS.COM

FEATURE

ONEIDA's Table is Set: Feast Your Eyes on Bryan County's Newest Distribution Center

By Erica Savage

T

he Port of Savannah has welcomed yet another distribution center to its growing customer base, further solidifying its reputation as a key Southeastern logistics hub for national retailers. Oneida Ltd., one of the world's leading stainless steel and

silverplated flatware manufacturers, opened a new distribution center in Bryan

County, Ga., in late April 2007. The 500,000-square-foot leased facility, located just south of the

Port of Savannah, is fully operational and will handle all the company's shipping requirements

for the eastern half of the United States.

"The Savannah facility completes our U.S. supply chain strategy, providing vastly improved transit times, and therefore increasing speed to market," said Jim Joseph, Oneida's President. "It is a visible sign of the company's transformation."

Oneida, along with some of the nation's best-known stores, recently added its name to the list of 18 major distribution centers in Savannah and the 70 others within five hours of the port. "The factors that make Savannah the obvious choice are undeniable," said Stacy Watson, Georgia Ports Authority's (GPA) Manager of Economic and Industrial Development. "Geography, intermodal connections and our ability to grow with customer businesses are just a few reasons why Oneida and other companies, like IKEA and Target, have chosen to locate their import distribution centers here."

Doug J. Marchand, GPA's Executive Director, welcomed Oneida to Bryan County: "We appreciate Oneida's confidence in the Georgia Ports Authority. As the nation's fastest growing container port and one of the state of Georgia's strongest economic engines, this is another example of the Port of Savannah's ability to handle additional business."

The opening of Oneida's new distribution center is another illustration of the economic impact that the port brings to Georgia's communities. The distribution center employs 150 people, including 19 individuals who have moved to Georgia from upstate New York.

Since December 2005, Oneida has operated a West Coast distribution center in Lebec, Calif. The additional Georgia facility completes Oneida's operational reconfiguration of its North American logistics and distribution platform, by reducing cost, improving service and simplifying product flows.

Oneida will continue to maintain its administrative and operational functions in Oneida, N.Y., where the company was founded more than a century ago.

The strategic role the GPA plays among national retailers (e.g. Target, Lowe's and now Oneida) has proven to be instrumental to its growth. According to Tom Armstrong, GPA's Director of Strategic Development and Information Technology, a growing port like Savannah can have a positive impact on future business endeavors for retailers. "If you come to the Port of Savannah," said Armstrong, "we will grow your business."

17

FEATURE

IKEA Furnishes Southeast with State-of-the-Art Distribution Center

By Ross Glendye

I

KEA, a leading retailer in home furnishings, celebrated the grand opening of its state-of-the-art southeastern distribution center on June 27 2007. Located in the Savannah River International Trade Park, the 685,000-square-foot facility will expand to

1.7 million square feet in the future. The Georgia Ports Authority is expected to see an

additional 15,000 TEU units annually and 125 jobs as a result of IKEA's investment.

"We are so proud of the economic development and port business we are generating with the opening of this new facility," said Ed Morris, IKEA's Distribution Center Manager. "This distribution center now can ensure that the unique IKEA product selection and shopping experience will be available to customers in the Southeast, just as it is to others elsewhere in the U.S."

The Savannah distribution center will supply inventory for IKEA stores in the Southeast and Texas. IKEA has 13,000 suppliers in 53 different countries that will stock its distribution centers.

"The people of IKEA have made a commitment to the GPA and the state of Georgia by selecting the Port of Savannah for this distribution center," said Steve Green, Chairman of the GPA Board of Directors. "Just like IKEA's pledge to its customers, we will be devoted to providing the best and most efficient service possible."

TARGET Opens Doors to Largest Distribution Center

By Ross Glendye

S

avannah is now home to Target's largest U.S. import warehouse, weighing in at 2.1 million square feet. The new warehouse will store and distribute overseas cargo and merchandise for Target's Southeastern stores.

"Target is a valued member of our business community, and a strong asset to Georgia's economy," Georgia Gov. Sonny Perdue said to those gathered at the ribbon-cutting ceremony in June 2007. "The investments we have made in our infrastructure, particularly at our ports, continue to result in new investment and job creation."

This new import warehouse will create 580 jobs with 100 employees being Savannah area residents. This will bring Target's total employment to more than 8,900 people in Georgia. Eight hundred of those jobs come from the 1.5 million-square-foot distribution center in Tifton, Ga.

"We are excited about Target's decision to come to Savannah," said John Petrino, General Manager of Trade Development for the Georgia Ports Authority. "Target is one of the largest and fastest growing retailers in the world. It is only fitting that they open a facility near one of the largest and fastest growing ports in America."

Target has 47 stores in Georgia, 10 of them are Super Targets.

"We could not be more pleased or excited about the tremendous opportunities that this new facility will bring to the people of Savannah, the great state of Georgia and Target's expanding operations in the Southeast," said Mitch Stover, Target's Senior Vice President of Distribution.

FEATURE Photo: David Smalls

PORTFOLIO

PASSION FOR

Brunswick Welcomes the Sporty Side of Luxury

By Edward H. H. Howard

R

ich in tradition and sporting success, the makers of Bentley and Maserati automobiles have

selected the Port of Brunswick

for import processing.

On August 6, 2007, the V. G. Transport M/V Atlas Highway, brought the first shipment of Bentley automobiles into the Port of Brunswick at Colonel's Island Terminal. That historic arrival closely followed the first shipment through Brunswick of Maseratis.

"The Bentley and Maserati contracts show that the Port of Brunswick is a leader in auto importing/exporting," said Doug Marchand, Georgia Ports Authority (GPA) Executive Director. "Thanks to our focus on the Ro/Ro business and available facilities, road and rail infrastructure, and ideal climate, Brunswick offers an unbeatable location."

Bentley chose the Port of Brunswick for its entire product line -- Continental Flying Spur, Continental GT, Continental GTC,

Arnage and Azure. The company plans to ship approximately 1,000 cars annually through Colonel's Island, accounting for nearly 25 percent of its U.S. sales.

"The Port of Brunswick is an integral part of our supply chain and a great location for importing," said Rochelle Govier, Sales & Distribution Manager for Bentley Motors, Inc. "Georgia, along with the Southeastern United States is experiencing significant population growth and utilizing the Port of

20

GPA ANCHORAGE

PORTFOLIO

PERFORMANCE

Brunswick allows us to best respond to growth in the region and also provides proximity to our southern dealers."

Maserati also has joined the roster of cars imported through the Port of Brunswick's Ro/Ro facility on Colonel's Island. On July 10, 2007, the first Maseratis arrived at Colonel's Island on Wallenius Wilhemsen Logistics' M/V Asian Chorus. Maserati North America, Inc. will import up to 800 cars annually, including the Quattroporte and GranTurismo. One of Maserati's major markets is the U.S. South Atlantic. The Port

of Brunswick is an ideal port location to reach this market area.

These prestigious new clients illustrate how the Port of Brunswick is redefining the pace of trade, with a deeper harbor, room to grow, and recent infrastructure improvements.

The deepening of the Brunswick harbor to 36 feet mean low water is now complete, allowing all Ro/Ro ships in the world's fleet to call on Brunswick. The additional water depth combined with recent rail improvements provides

manufacturers increased efficiencies and cost savings.

"The U.S. Route 17 overpass now is complete and allows the automobile industry on Colonel's Island unencumbered access to 900-plus acres for expansion," said Bill Jakubsen, GPA Sales Manager. "In addition, the auto manufacturers have a premium port to expand their operations without having to compete for space with large container ports."

WWW.GAPORTS.COM

21

PROJECT CARGO

ABOUT THE WORLD TRADE CENTER MEMORIAL FOUNDATION

The World Trade Center Memorial Foundation, Inc. is the not-for-profit corporation established in 2003 to realize the Memorial quadrant at the World Trade Center site. The Foundation will raise the funds, oversee the design, and operate the Memorial and Museum located on 8 of the 16 acres of the site.

The Memorial will remember and honor the thousands of people who died in the horrific attacks of February 26, 1993, and September 11, 2001. The design, "Reflecting Absence," created by Michael Arad and Peter Walker, consists of two pools that reside in the footprints of the original Twin Towers surrounded by a plaza of oak trees. The Arad/Walker design was selected from a design competition, which included more than 5,000 entrants from 63 nations.

The Museum will communicate key messages that embrace both the specificity and the universal implications of the events of 9/11; document the impact of those events on individual lives, as well as on local, national and international communities; and explore the legacy of 9/11 for a world increasingly defined by global interdependency.

In April 2007, the Foundation announced that it has raised more than $300 million towards its $350 million private fundraising goal. More than 33,800 donations have been made by donors in all 50 states and 27 foreign countries. Donations can be made through the Foundation's website, and more information on the Foundation can be found at, www.buildthememorial.org, or by calling 1-877-WTC-GIVE.

24

Photo: Stephen Morton

Jumbo Steel for World Through Savannah

Photo: Stephen Morton

S

teel I-beams that will form the World Trade Center Memorial and Museum arrived in the Port of Savannah in August 2007 aboard the Marielle Bolten. The 638-short-ton (580 metric tons) steel order was milled at Arcelor Mittal in Luxembourg. Its

4,771-mile journey which included a stop in Philadelphia continued from Savannah

after it was loaded aboard trucks. On hand to watch the arrival at Ocean Terminal were

Memorial Foundation President and CEO Joseph Daniels and Owen Steel President

David Zalesne.

"The arrival of the Memorial steel is another step forward in our effort to build a permanent national tribute to the innocent victims of the attacks," said New York City Mayor and WTC Memorial Foundation Chairman Michael R. Bloomberg. "The steel symbolizes our resilience and resolve to rebuild the World Trade Center. The Memorial will be the heart of the rebuilt site, offering reflection on the past and hope for the future. Later this year, we expect the steel will begin to rise from the site."

"This is an important moment for all those working to build the Memorial and Museum," said Memorial Foundation President Joe Daniels. "The steel will now make its way to Columbia, South Carolina, where it will be turned into the jumbo steel columns that will support the entire project."

In May 2007, the Foundation and The Port Authority of New York and New Jersey selected Owen Steel Company, Inc. to supply, fabricate and erect the steel for the Memorial project. The jumbo steel represents approximately 20 percent of the steel for the project. The remaining 80 percent of the structural steel will be rolled at domestic mills and delivered to Owen Steel for fabrication.

GPA ANCHORAGE

PROJECT CARGO

Trade Center Memorial Shipped

In total, approximately 2,149 metric tons (2,362 short tons) of Arcelor jumbo steel sections will arrive in Savannah for the project. Only two steel mills in the world produce sections of steel that fit both the jumbo steel size requirements and U.S. specifications. Under the direction of Owen Steel Company, the jumbo steel was rolled at Arcelor Mittal in Luxembourg and shipped to the United States for fabrication. The Arcelor mill is one of a decreasing number of mills that are integrated. Integrated mills make the steel from its basic ingredients and not from scrap. Raw materials such as nickel, copper, sulphur and carbon are mixed and melted to produce the steel.

"This milestone is a clear indication that we are moving aggressively to build a Memorial that will ensure that future generations never forget the events of 9/11," said The Port Authority of New York and New Jersey Chairman Anthony R. Coscia. "The Port Authority is honored to take on this extraordinary challenge, and it will continue to monitor the progress of construction so that the Memorial is built on budget and on schedule."

The Port Authority of New York and New Jersey Executive Director Anthony Shorris said, "This Memorial is our solemn tribute to our 84 colleagues and the nearly 2,700 others we lost on that tragic day - a physical reminder of our duty to honor those who died and inspire those who survived. When the steel arrives on site later this year and the Memorial begins to rise toward street level, we hope it will remind everyone who sees it of how far we've come in the last six years, and also of how much remains to be done."

Georgia Ports Authority Executive Director Doug J. Marchand said, "As the U.S. port of entry, the Port of Savannah is proud to have played a historic part in the movement of this

WWW.GAPORTS.COM

very special cargo. Our role in helping to facilitate the building of the World Trade Center Memorial stands as an inspiration to our employees and all of Georgia. We are extremely appreciative of this opportunity."

The Hipage Company, Inc. served as the broker that cleared the shipment through U.S. Customs. Upon arrival at the Port of Savannah, the steel was discharged from the vessel and was loaded onto trucks to be marshaled in a storage yard at Ocean Link, located in Savannah, Ga. Stevedoring Services of America worked under Owen's direction to discharge the vessel, and Gemi Trucking, Inc. transported the steel to the storage yard.

From there, the material was shipped to Owen Steel Company's facilities in Columbia, S.C., and will be fabricated to meet the specifications of the columns for the World Trade Center Memorial and Museum. During fabrication, Owen Steel will take the raw material from Arcelor and cut the material to the specified lengths. Secondary material will then be welded to the main members, necessary holes will be punched and drilled and the individual pieces that comprise the skeleton of the building will be shipped to the World Trade Center site.

Photo: Stephen Morton

"Owen Steel Company is proud to be part of the team building the World Trade Center Memorial and Museum, honoring the memory of the victims of 9/11," said Owen Steel Company President David Zalesne. "The arrival of this first steel at our plant in Columbia, South Carolina, will be a major step in the construction process, and we are all excited about getting down to the hard work of turning raw steel into the Memorial. Owen Steel has built many landmark projects, but nothing has inspired our workforce quite like the opportunity to put their hands on the steel for the World Trade Center Memorial."

Construction of the World Trade Center Memorial began in March 2006 with preliminary work to cover the original box beam columns that outline the perimeters of the Twin Towers. In August 2006, heavy construction work began to build the footings that will hold up the Memorial, Museum and the Museum Pavilion. Work on the footings is expected to be completed in the third quarter of 2007. Steel fabrication will begin later this year, and the first pieces of steel are expected to be erected at the World Trade Center site in December 2007.

Photo: Stephen Morton 25

Maiden Voyages Dock at Port of Savannah

CARRIER SERVICES

CMA CGM M/V Jamaican

The arrival of the CMA CGM M/V Jamaican in July 2007 marked the beginning of the SAX / ESX North Asia Service to Savannah. The service rotation is Shanghai, Ningbo, Shanghai, Chiwan, Hong Kong, Panama, Manzanillo, Savannah, New York, Norfolk, Kingston, Panama and Ningbo.

STAR M/V Java

The Star M/V Java arrived at the Ocean Terminal in July 2007. It was completed in November 2006 at the Mitsui Engineering and Shipbuilding Company, Ltd yard. Spanning almost 650 feet, the general cargo carrier travels at an average speed of 16 knots.

M/V Tortugas

Wallenius Wilhelmsen logistics' M/V Tortugas arrived at the Port of Savannah's Ocean Terminal in July 2007, during its maiden voyage. The vessel, completed in November 2006, spans 656 feet in length and has a total stowage capacity of 591,982 square feet, giving it the capacity of 6,354 automobile units.

MOL M/V Experience

The newly built MOL M/ V Experience arrived at the Port of Savannah in August 2007, the first vessel of the Suez Express (SZX) service. Built in Pusan, Korea, the 4,800-TEU vessel was completed in July 2007. The service rotation is Port Kelang, Singapore, Colombo, Suez Canal, Nhava Sheva, Mundra, Damietta, New York, Norfolk, Charleston and Savannah.

SAGA M/V Frontier

The SAGA M/V Frontier arrived at the Port of Savannah's Ocean Terminal in August 2007 on its maiden voyage. The Frontier is the fifth in a series of nine ships being constructed for Saga Forest Carriers by Oshima shipyard in Japan. The 10-hold open-hatch bulk carrier contains 40MT traveling gantry cranes and is designed to carry unitized cargo such as woodpulp and bundled lumber.

Herman J. Brown, Jr., Georgia Ports Authority's (GPA) Sales Representative of Trade Development, presented Captain Kazuyuki Nakashima with a gift aboard the M/V Oakland.

OOCL M/V Oakland

The OOCL M/V Oakland arrived at the Port of Savannah's Garden City Terminal in July 2007. The new vessel joins the Asia East Coast Express AEX Rotation. Rotation port calls are (Eastbound) Laem Chabang, Singapore, Colombo, Jeddah, Gioia Tauro, Halifax, New York and Savannah; (Westbound) Savannah, Norfolk, New York, Halifax, Gioia Tauro, Jeddah, Colombo, Singapore and Laem Chabang.

WWW.GAPORTS.COM

27

Port of Savannah

Visit us online at www.gaports.com to download your copy of the Global Carrier Services Tool for all-water and inland transit times.

It's just one more way the Georgia Ports Authority is "Redefining the Pace of Trade".

Photo: David Smalls

Port of Savannah

Trade Area/Line

Agent

Frequency

Terminal

Type Service

Savannah

Ocean Carrier Agency Key

Africa (East-South-West) CMA CGM ......................................................CC ......................Weekly ....................GCT ..................................CONT/REF Hapag-Lloyd ................................................HPL ....................Weekly ....................GCT ..................................CONT/REF Hoegh Autoliners ........................................HU ..................Fortnightly..................OT ..........................................RO/RO Maersk ............................................................MS ......................Weekly ....................GCT ..................................CONT/REF Mediterranean Shipping..........................MSC ....................Weekly ....................GCT ..................................CONT/REF Safmarine ......................................................MS......................10 Days ....................OT ..........BB/CONT/REF/RO/RO ZIM ..................................................................ZIM ....................Weekly ....................GCT ..................................CONT/REF

Australia/New Zealand Australia National ......................................AUS..................Bi-Weekly ................GCT ..................................CONT/REF CMA CGM ......................................................CC ..................Bi-Weekly ................GCT ..................................CONT/REF Hamburg Sud................................................HS ......................Weekly ....................GCT ..................................CONT/REF Hapag-Lloyd ................................................HPL ..................Bi-Weekly ................GCT ..................................CONT/REF Maersk ............................................................MS ......................Weekly ....................GCT ..................................CONT/REF Marfret............................................................CAP..................Bi-Weekly ................GCT ..................................CONT/REF Safmarine ......................................................MS ......................Weekly ....................GCT ..................................CONT/REF Wallenius Wilhelmsen Logistics..........WWL ..................10 Days ....................OT ..........BB/CONT/REF/RO/RO

Caribbean/Islands of the Atlantic China Shipping ............................................CS ......................Weekly ....................GCT ..................................CONT/REF CMA CGM ......................................................CC ......................Weekly ....................GCT ..................................CONT/REF Emirates ........................................................ESL ....................Weekly ....................GCT ..................................CONT/REF Evergreen Line ..............................................E........................Weekly ....................GCT ..................................CONT/REF Hapag-Lloyd ................................................HPL ....................Weekly ....................GCT ..................................CONT/REF Mediterranean Shipping..........................MSC ....................Weekly ....................GCT ..................................CONT/REF NYK ................................................................NYK ....................Weekly ....................GCT ..................................CONT/REF ZIM ..................................................................ZIM ....................Weekly ....................GCT ..................................CONT/REF

ACL APL AUS B BAR C

CAP CC COS CS E ESL

Atlantic Containers (800) 225-1235 APL (800) 999-7733 Australia National (912) 963-2825 Biehl & Company (912) 234-7221 Barwill Agency (912) 233-3239 Carolina Shipping Company, LP (912) 234-7221 Capes Shipping (888) 627-3738 CMA CGM (America) Inc. (201) 770-5268 COSCO (843) 769-5443 China Shipping (912) 231-6568 Evergreen Line (843) 856-7600 Emirates Shipping Agencies (USA) 1-866-488-5501

28

GPA ANCHORAGE

Savannah

Ocean Carrier Agency Key

HJ

HPL

HS

HU HYU ISS K

MOL MS MSC NL NYK

OOC SS STR

TER TUR

UA

WWL

YM ZIM

Hanjin Shipping Co., LTD. (912) 966-1220 (678) 239-0200 Hapag-Lloyd (America) (912) 238-3510 (800) 351-8811 Hamburg Sud (888) 920-7447 (888) 930 7447 Hoegh Autoliners Inc. (904) 696-7750 Hyundai (704) 972-3100 Inchcape Shipping (912) 644-7151 K-Line (800) 609-3221 (770) 618-4100 Mitsui OSK Lines (843) 965-4900 Maersk (800) 321-8807 Mediterranean Shipping (843) 971-4100 Norton Lilly International (912) 966-3000 NYK Marine (912) 964-9413 (770) 956-9444 OOCL (USA), Inc. (888) 388-6625 Southern Shipping (912) 644-7083 Star Shipping (912) 236-4144 (770) 226-5900 Terminal Shipping (912) 964-5200 Turkon Line (201) 866-6966 (912) 966-1008 United Arab (912) 233-1970 (908) 272-0050 Wallenius Wilhelmsen Logistics (912) 965-7450 Yang Ming (America) Corp. (912) 238-0329 Zim American-Israeli (912) 964-3100

Savannah Terminal and Cargo Service Keys

GCT OT CONT BB BULK RO/RO REF

Garden City Terminal Ocean Terminal Container Breakbulk Bulk Roll-On/Roll-Off Refrigerated

Trade Area/Line

Agent

Port of Savannah Sailing Schedule Continued

Frequency

Terminal

SAILING SCHEDULE

Type Service

Far East/Indonesia/Malaysia APL ..................................................................APL ....................Weekly ....................GCT ..................................CONT/REF Australia National ......................................AUS ....................Weekly ....................GCT ..................................CONT/REF China Shipping ............................................CS ......................Weekly ....................GCT ..................................CONT/REF CMA CGM ......................................................CC ......................Weekly ....................GCT ..................................CONT/REF COSCO ..........................................................COS ....................Weekly ....................GCT ..................................CONT/REF Emirates ........................................................ESL ....................Weekly ....................GCT ..................................CONT/REF Evergreen Line ..............................................E........................Weekly ....................GCT ..................................CONT/REF Hanjin ..............................................................HJ ......................Weekly ....................GCT ..................................CONT/REF Hapag-Lloyd ................................................HPL ....................Weekly ....................GCT ..................................CONT/REF Hyundai ........................................................HYU ....................Weekly ....................GCT ..................................CONT/REF Hyundai General Cargo ............................ISS ....................Monthly ....................OT ....................................................BB K-line..................................................................K........................Weekly ....................GCT ..................................CONT/REF Maersk ............................................................MS......................Weekly ....................GCT ..................................CONT/REF Mediterranean Shipping..........................MSC ....................Weekly ....................GCT ..................................CONT/REF Mitsui OSK....................................................MOL ....................Weekly ....................GCT ..................................CONT/REF NYK ................................................................NYK ....................Weekly ....................GCT ..................................CONT/REF Oldendorff ....................................................BAR....................Monthly ....................OT ....................................................BB OOCL ............................................................OOC ....................Weekly ....................GCT ..................................CONT/REF Pan Ocean ....................................................BAR ................Fortnightly..................OT ....................................................BB Rickmers-Linie ..............................................C ..................Inducement ................OT ....................................................BB Safmarine ......................................................MS......................Weekly ....................GCT ..................................CONT/REF Saga ..................................................................C ......................Monthly ....................OT ....................................................BB Stolt ..................................................................ISS ..................Fortnightly ................GCT ............................................BULK Toko....................................................................C....................Fortnightly..................OT ....................................................BB United Arab ..................................................UA......................Weekly ....................GCT ..................................CONT/REF Wallenius Wilhelmsen Logistics..........WWL ..................10 Days ....................OT ..........BB/CONT/REF/RO/RO Yang Ming ......................................................YM......................Weekly ....................GCT ..................................CONT/REF ZIM ..................................................................ZIM ....................Weekly ....................GCT ..................................CONT/REF

Mediterranean China Shipping ............................................CS ......................Weekly ....................GCT ..................................CONT/REF CMA CGM ......................................................CC ......................Weekly ....................GCT ..................................CONT/REF COSCO ..........................................................COS ....................Weekly ....................GCT ..................................CONT/REF Evergreen Line ..............................................E........................Weekly ....................GCT ..................................CONT/REF Hanjin ..............................................................HJ ......................Weekly ....................GCT ..................................CONT/REF Hapag-Lloyd ................................................HPL ....................Weekly ....................GCT ..................................CONT/REF K-line..................................................................K........................Weekly ....................GCT ..................................CONT/REF Maersk ............................................................MS......................Weekly ....................GCT ..................................CONT/REF Mediterranean Shipping..........................MSC ....................Weekly ....................GCT ..................................CONT/REF NSCSA ..............................................................B ......................21 Days ....................OT ..........BB/CONT/REF/RO/RO NYK ................................................................NYK ....................Weekly ....................GCT ..................................CONT/REF OOCL ............................................................OOC ....................Weekly ....................GCT ..................................CONT/REF Safmarine ......................................................MS......................Weekly ....................GCT ..................................CONT/REF Star Shipping ..............................................STR ....................Monthly ....................OT ....................................................BB Turkon ............................................................TUR ....................Weekly ....................GCT ..................................CONT/REF United Arab ..................................................UA......................Weekly ....................GCT ..................................CONT/REF ZIM ..................................................................ZIM ....................Weekly ....................GCT ..................................CONT/REF

North Europe/UK/Ireland/Scandinavia/Baltic APL ..................................................................APL ....................Weekly ....................GCT ..................................CONT/REF Atlantic Container Line............................ACL ....................Weekly ....................GCT ..................................CONT/REF Australia National ......................................AUS ....................Weekly ....................GCT ..................................CONT/REF CMA CGM ......................................................CC ......................Weekly ....................GCT ..................................CONT/REF Evergreen Line ..............................................E........................Weekly ....................GCT ..................................CONT/REF Hamburg Sud ................................................HS ......................Weekly ....................GCT ..................................CONT/REF Hapag-Lloyd ................................................HPL ....................Weekly ....................GCT ..................................CONT/REF Hyundai ........................................................HYU ....................Weekly ....................GCT ..................................CONT/REF Jo Tankers ......................................................SS ..................Fortnightly ................GCT ............................................BULK

For all-water and inland transit times and services, visit the GPA Global Carrier Service Matrix at www.gaports.com.

WWW.GAPORTS.COM

29

SAILING SCHEDULE

Trade Area/Line

Agent

Frequency

Terminal

Type Service

Savannah Terminal and Cargo Service Keys

Port of Savannah Sailing Schedule Continued

Maersk ............................................................MS......................Weekly ....................GCT ..................................CONT/REF Marfret............................................................CAP..................Bi-Weekly ................GCT ..................................CONT/REF Mediterranean Shipping..........................MSC ....................Weekly ....................GCT ..................................CONT/REF Mitsui OSK....................................................MOL ....................Weekly ....................GCT ..................................CONT/REF NYK ................................................................NYK ....................Weekly ....................GCT ..................................CONT/REF OOCL ............................................................OOC ....................Weekly ....................GCT ..................................CONT/REF Rickmers-Linie ..............................................C ..................Inducement ................OT ....................................................BB Saga ..................................................................C ......................Monthly ....................OT ....................................................BB VOC STEEL ..................................................TER ....................Monthly ....................OT ....................................................BB Wallenius Wilhelmsen Logistics..........WWL ..................10 Days ....................OT ..........BB/CONT/REF/RO/RO ZIM ..................................................................ZIM ....................Weekly ....................GCT ..................................CONT/REF

GCT OT CONT BB BULK RO/RO REF

Garden City Terminal Ocean Terminal Container Breakbulk Bulk Roll-On/Roll-Off Refrigerated