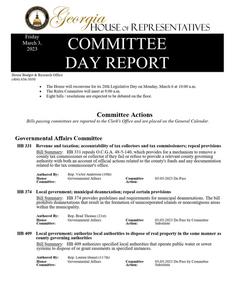

Friday March 3,

2023

COMMITTEE

DAY REPORT

House Budget & Research Office (404) 656-5050

The House will reconvene for its 28th Legislative Day on Monday, March 6 at 10:00 a.m. The Rules Committee will meet at 9:00 a.m. Eight bills / resolutions are expected to be debated on the floor.

Committee Actions

Bills passing committees are reported to the Clerk's Office and are placed on the General Calendar.

Governmental Affairs Committee

HB 331

Revenue and taxation; accountability of tax collectors and tax commissioners; repeal provisions

Bill Summary: HB 331 repeals O.C.G.A. 48-5-140, which provides for a mechanism to remove a county tax commissioner or collector if they fail or refuse to provide a relevant county governing authority with both an account of official actions related to the county's funds and any documentation related to the tax commissioner's office.

Authored By: House Committee:

Rep. Victor Anderson (10th) Governmental Affairs

Committee Action:

03-03-2023 Do Pass

HB 374 Local government; municipal deannexation; repeal certain provisions

Bill Summary: HB 374 provides guidelines and requirements for municipal deannexations. The bill prohibits deannexations that result in the formation of unincorporated islands or noncontiguous areas within the municipality.

Authored By: House Committee:

Rep. Brad Thomas (21st) Governmental Affairs

Committee Action:

03-03-2023 Do Pass by Committee Substitute

HB 409 Local government; authorize local authorities to dispose of real property in the same manner as county governing authorities

Bill Summary: HB 409 authorizes specified local authorities that operate public water or sewer systems to dispose of or grant easements in specified instances.

Authored By: House Committee:

Rep. Lauren Daniel (117th) Governmental Affairs

Committee Action:

03-03-2023 Do Pass by Committee Substitute

House of Representatives

Daily Report for March 3, 2023

Committee Actions

HB 426

Elections; retention and preservation of ballots and other election documents; revise provisions

Bill Summary: HB 426 removes the court seal requirement for copies of consolidated primary and election returns that each election superintendent files with the clerk of the superior court. The bill requires the clerk or county records manager to retain and preserve specified election materials for 24 months and prevent such materials from being altered, amended, damaged, modified, or mutilated. Ballots, numbered lists of voters, and oaths of poll officers are subject to public inspection after initial certification of election results.

The bill authorizes the State Election Board to promulgate rules and regulations relating to visual reviews of original ballots, copying ballots, and costs associated with such activities.

Authored By: House Committee:

Rep. Shaw Blackmon (146th) Governmental Affairs

Committee Action:

03-03-2023 Do Pass by Committee Substitute

HB 585

Georgia Development Impact Fee Act; enact

Bill Summary: HB 585 allows local boards of education of high-growth school systems to impose, levy, and collect educational development impact fees. The bill has an effective date of January 1, 2025, which is dependent on passage of a constitutional amendment to authorize educational development impact fees.

Authored By: House Committee:

Rep. Todd Jones (25th) Governmental Affairs

Committee Action:

03-03-2023 Do Pass

HR 303

General Assembly; authorize local boards of education to impose, levy, and collect development impact fees for educational facilities costs; provide - CA

Bill Summary: House Resolution 303 proposes an amendment to the Georgia Constitution to allow the General Assembly to authorize, by general law, local boards of education to impose, levy, and collect development impact fees and use the proceeds to pay for a share of additional educational facilities.

Authored By: House Committee:

Rep. Todd Jones (25th) Governmental Affairs

Committee Action:

03-03-2023 Do Pass

Judiciary Committee

HB 30

State government; definition of antisemitism; provide

Bill Summary: HB 30 provides a definition of antisemitism for purposes of state government, using the advisory definition of antisemitism adopted by the International Holocaust Remembrance Alliance (IHRA) on May 26, 2016. IHRA defines antisemitism as a certain perception of Jews, which may be expressed as hatred toward Jews, and includes rhetorical and physical manifestations of antisemitism directed toward Jewish or non-Jewish individuals and/or their property, toward Jewish community institutions, and religious facilities.

All state agencies will consider antisemitism as evidence of discriminatory intent for any law or policy which prohibits discrimination. Nothing in the bill will be construed to infringe upon First Amendment rights or an individual's right to engage in legally protected conduct or activity pertaining to U.S. foreign policy or international affairs.

Authored By: House Committee:

Rep. John Carson (46th) Judiciary

Committee Action:

03-03-2023 Do Pass by Committee Substitute

House of Representatives

Daily Report for March 3, 2023

Committee Actions

HB 370 Equity; procedure for clearing title to coastal marshlands; provide

Bill Summary: HB 370 creates a process for clearing up ambiguities in coastal marshland titles and proving that certain named individuals are the owners of property in fee simple interest (owned completely, without any limitations or conditions).

Any coastal marshlands and uplands subject to a decree will be restricted to utilization for conservation purposes, provided it will not limit any right of the public to access navigable waters. Individuals who claim a grant to coastal marshlands can bring a proceeding in rem (directed towards property) to establish title to the coastal marshland, and may present an abstract of title to the State Properties Commission (SPC) prior to filing a proceeding that traces the title of the coastal marshland to a grant. Process will be served upon the SPC, and within 30 days of service, the SPC will provide a copy of the petition to the attorney general and the Department of Administrative Services.

Along with the petition, the petitioner will file a motion for appointing a special master, who has jurisdiction to determine the validity of that land grant. Following the special master's report, the court will issue a decree stating that the coastal marshlands are restricted for conservation purposes and vest title to the petitioner if that is the case. A petitioner that obtains a decree stating that the petitioner has traced the property title to a grant from the Crown of England will be entitled to pursue conservation actions for the coastal marshlands.

Authored By: House Committee:

Rep. Jesse Petrea (166th) Judiciary

Committee Action:

03-03-2023 Do Pass by Committee Substitute

HB 442

Law enforcement agencies; judicial procedure for purging a person's involuntary hospitalization information; provide

Bill Summary: HB 442 provides a judicial procedure for purging a person's involuntary hospitalization information received by the Georgia Crime Information Center for background check purposes, comprised of a person petitioning the court in which the hospitalization proceedings occurred for relief. Within 60 days of the opposing civil party or prosecuting attorney receiving the petition, the court will hold a hearing unless extended for good cause. The court will consider evidence about what caused the petitioner's: hospitalization; mental health and criminal history records; reputation; and changes in circumstances since hospitalization.

The court will grant the petition if it finds by a preponderance of evidence that the petitioner will not likely act in a dangerous manner and, granting relief is consistent with the standards for issuing a weapons carry license. A person involuntarily hospitalized may only petition for relief 12 months after the person is discharged from involuntary hospitalization.

Authored By: House Committee:

Rep. Debbie Buckner (137th) Judiciary

Committee Action:

03-03-2023 Tabled

HB 572

Elections; rename Georgia Government Transparency and Campaign Finance Commission as the State Ethics Commission

Bill Summary: HB 572 renames the Georgia Government Transparency and Campaign Finance Commission as the State Ethics Commission. The bill authorizes the commission to impose civil penalties against a county election superintendent, municipal clerk, or county chief executive officer who willfully fails to properly transmit a copy of a candidate's disclosure report.

The bill exempts general election contributions of more than $1,000 from the two business day report period requirement of a primary election, and exempts retired judges and senior judges from being required to file an affidavit with financial disclosure statements.

Authored By: House Committee:

Rep. Matt Reeves (99th) Judiciary

Committee Action:

03-03-2023 Do Pass by Committee Substitute

House of Representatives

Daily Report for March 3, 2023

Committee Actions

HR 302

General Assembly; appropriation of funds received from certain legal judgments or settlements; provide - CA

Bill Summary: House Resolution 302 proposes a constitutional amendment requiring all funds derived from any legal judgements or settlements awarded to or entered into by the state after January 1, 2025 to be appropriated by the General Assembly. Any excess, changed, or unanticipated federal funds received by the state shall also be appropriated by the General Assembly.

Authored By: House Committee:

Rep. Beth Camp (135th) Judiciary

Committee Action:

03-03-2023 Do Pass

Motor Vehicles Committee

HB 151 Special license plates; Alpha Phi Alpha Fraternity, Inc.; establish Bill Summary: HB 151 makes the specialty license plate honoring Alpha Phi Alpha Fraternity Incoporated eligible for revenue sharing.

Authored By: House Committee:

Rep. Temaine Teddy Reese (140th)

Motor Vehicles

Committee

Action:

03-03-2023 Do Pass

HB 515

Motor vehicles; eligible applicants for limited driving permits to submit to proof of completion of certain courses; require

Bill Summary: HB 515 requires an individual cited for driving under the influence to enroll in a certified DUI Alcohol or Drug Use Risk Reduction Program prior to conviction in able to obtain a limited driving permit. The bill increases the fee an approved clinic may charge for a court-ordered defensive driving course from $95 to $125. The fee a certified DUI Alcohol or Drug Use Risk Reduction Program may charge for an assessment is increased from $100 to $125.

Authored By: House Committee:

Rep. Derrick McCollum (30th) Motor Vehicles

Committee Action:

03-03-2023 Do Pass by Committee Substitute

HB 618 Special license plates; retired members of the active reserve components and the Georgia National Guard; provide for design

Bill Summary: HB 618 changes the design of specialty license plates for retired members of the reserve and Georgia National Guard by displaying "Retired" in lieu of the county of issuance.

Authored By: House Committee:

Rep. Lynn Gladney (130th) Motor Vehicles

Committee Action:

03-03-2023 Do Pass

Public Safety & Homeland Security Committee

HB 451 Public officers and employees; supplemental, illness-specific insurance for certain first responders with occupational post-traumatic stress disorder; require provision

Bill Summary: HB 451 requires a public entity to provide supplemental, illness-specific insurance to certain first responders diagnosed with occupational post-traumatic stress disorder (PTSD).

Authored By: House Committee:

Rep. Devan Seabaugh (34th) Public Safety & Homeland Security Committee

Action:

03-03-2023 Do Pass by Committee Substitute

House of Representatives

Daily Report for March 3, 2023

Committee Actions

Ways & Means Committee

HB 101 Income tax; change certain definitions

Bill Summary: HB 101 amends O.C.G.A. 48-7-29.16, relating to tax credits for contributions to student scholarship organizations, by increasing the aggregate amount of tax credits allowed to $130 million in 2024.

The bill amends O.C.G.A. 48-7-29.20, relating to tax credits for contributions to rural hospital organizations, by increasing the aggregate amount of tax credits allowed from $75 million to $80 million. The limit for a member of a limited liability company, a shareholder of a Subchapter 'S' corporation, or a partner in a partnership is increased from $10,000 to $25,000. The sunset provision for the credit is changed to December 31, 2028. The bill also amends O.C.G.A. 31-8-9.1 to add "rural freestanding emergency department" to the definition of eligible "rural hospital organization".

The bill adds O.C.G.A. 48-7-29.26 to allow for tax credits for contributions by taxpayers to qualified mortgage loan originators. A "qualified mortgage loan originator" is defined as a nonprofit corporation that, among other stipulations, acts as a mortgage loan originator to make mortgage loans for disadvantaged individuals, operates in a manner considered to be charitable, and provides mortgage loans with terms that are favorable to the borrower. The aggregate amount of tax credits allowed per calendar year will not exceed $10 million per calendar year and each qualified loan originator is limited to accepting $2 million per year. Credit limits for taxpayers will be set as the following: $5,000 per year for individuals; $10,000 per year for married couples filing jointly; and $10,000 for a member of a limited liability company, a shareholder of a Subchapter "S" corporation, or a partner in a partnership.

A corporation may receive a credit not to exceed 75 percent of the entity's income tax liability. The bill provides for the registration of qualified mortgage loan originators, requirements for a website that will be created by the Department of Revenue, and the process that a taxpayer is to follow to make contributions to a qualified mortgage loan originator.

The bill amends O.C.G.A. 48-7-29.21, relating to tax credits for qualified education donations for the purpose of awarding grants to public schools, by extending the repeal date to December 31, 2028.

Authored By: House Committee:

Rep. Clint Crowe (118th) Ways & Means

Committee Action:

03-03-2023 Do Pass by Committee Substitute

HB 170

Sales and use tax; taxation of certain digital products and services; provide

Bill Summary: HB 170 amends Title 48, Chapter 8, relating to sales and use tax, by allowing for the imposition of sales and use tax on the retail purchase or sale of certain digital goods, products, and services to an end user. The sale must be for permanent use of the product and cannot be contingent on a reoccurring payment agreement.

Authored By: House Committee:

Rep. Kasey Carpenter (4th) Ways & Means

Committee Action:

03-03-2023 Do Pass by Committee Substitute

HB 223

Revenue and taxation; procedures for certain local governments to change certain nonprofit organizations engaged to promote tourism, conventions, and trade shows for such jurisdiction; provide

Bill Summary: HB 223 amends O.C.G.A. 48-13-51, relating to excise tax on rooms, lodgings, and accommodations, by requiring any local governing authority that has collected more than $500,000 in taxes for three consecutive fiscal years to reach an agreement with any designated private sector nonprofit organization that promotes tourism, conventions, and trade shows before any changes can be made to the destination marketing organization. If an agreement is reached, any proposed changes must be reviewed by the Hotel Motel Tax Performance Review Board.

Authored By: Rep. Ron Stephens (164th)

House of Representatives

Daily Report for March 3, 2023

Committee Actions

House Committee:

Ways & Means

Committee Action:

03-03-2023 Do Pass

HB 283

Sales and use tax; change manner and method of imposing and collecting taxes on new manufactured single-family structures

Bill Summary: HB 283 amends 48-8-3, relating to sales and use tax, by eliminating a state sales tax exemption of 50 percent on the sale of manufactured homes. The bill subsequently creates O.C.G.A. 48-8-3.6, which limits the taxable sales price for the first retail sale of new manufactured singlefamily structure to 60 percent of the invoice amount.

The bill amends O.C.G.A. 48-7-29.17, relating to a tax credit for the purchase of an eligible singlefamily residence, by allowing a tax credit of 1.2 percent of the purchase price of an eligible singlefamily residence purchased between July 1, 2023 and June 30, 2024. An eligible single-family residence is defined as a single-family structure, including a condominium unit, valued at $250,000 or less. The credit is available only to first-time homebuyers, which is defined as an individual that has not owned a principal residence in the preceding three-years before the date of purchase.

Authored By: House Committee:

Rep. Beth Camp (135th) Ways & Means

Committee Action:

03-03-2023 Do Pass by Committee Substitute

HB 322

Ad valorem tax; property bills shall not include any nontax related fees or assessments; provide

Bill Summary: HB 322 amends O.C.G.A. 48-5-33, relating to ad valorem taxation of property, to prohibit the inclusion of nontax related fees or assessments on an ad valorem tax bill other than the ad valorem assessment of the real property. Nontax related fees or assessments do not include any fee or charge related to delinquent ad valorem property tax collections. Any partial payment provided by a taxpayer to the tax commissioner or local fiscal authority will first be applied to the outstanding balance of ad valorem taxes on real property that are due.

Authored By: House Committee:

Rep. Sandra Scott (76th) Ways & Means

Committee Action:

03-03-2023 Do Pass

HB 449

Ad valorem tax; breach of a covenant for bona fide conservation use related to solar generation of energy; repeal an exception

Bill Summary: HB 449 amends O.C.G.A. 48-5-7.4, relating to bona fide conservation use property, by eliminating an exception to the breach of a covenant for bona fide conservation use granted for land on which an installation of solar energy generating equipment is located.

Authored By: House Committee:

Rep. David Knight (134th) Ways & Means

Committee Action:

03-03-2023 Do Pass

HB 454

Revenue and taxation; Internal Revenue Code and Internal Revenue Code of 1986; revise terms

Bill Summary: HB 95 amends O.C.G.A. 48-1-2 relating to income tax definitions by providing an update to the definition of "Internal Revenue Code" and stipulating that Section 174 of the Internal Revenue Code be included with other sections that will be treated as they were in effect before Public Law 115-97 was enacted in 2017.

The bill amends O.C.G.A. 48-7-20, relating to individual income tax rates, by clarifying that on January 1, 2024, the income tax imposed will be 5.49 percent and can be reduced annually at a rate of 0.10 percent if certain conditions are met, beginning on January 1, 2025, until the rate reaches 4.99 percent. The bill adds O.C.G.A. 48-7-27.1 to allow for eligible itemizers, defined as eligible residents that choose to deduct certain itemized nonbusiness deductions, to receive a credit of $300.

The bill amends 48-7-40.24, relating to tax credits for jobs associate with large-scale projects, by including a pandemic, defined as a disease outbreak that affects a significant portion of the

House of Representatives

Daily Report for March 3, 2023

Committee Actions

population and impacts the ability to conduct business, to terms qualifying as "force majeure".

Authored By: House Committee:

Rep. Shaw Blackmon (146th) Ways & Means

Committee Action:

03-03-2023 Do Pass by Committee Substitute

Committee Meeting Schedule

This meeting schedule is up to date at the time of this report, but meeting dates and times are subject to change. To keep up with the latest schedule, please visit www.legis.ga.gov to view all upcoming events.

Monday - March 6, 2023

7:30 AM JUDICIARY NON-CIVIL COMMITTEE (House)

132 CAP

VIDEO Agenda

8:00 AM INSURANCE COMMITTEE (House)

606 CLOB

VIDEO Agenda

8:00 AM JOINT APPROPRIATIONS CONFERENCE COMMITTEE (House) 403 CAP

VIDEO Agenda

8:00 AM SMALL BUSINESS DEVLOPMENT COMMITTEE (House)

506 CLOB

VIDEO Agenda

8:00 AM GOVERNMENTAL AFFAIRS COMMITTEE (House)

406 CLOB

VIDEO Agenda

9:00 AM RULES COMMITTEE (House)

341 CAP

VIDEO Agenda

10:00 AM FLOOR SESSION (LD 28 Crossover) (House)

House Chamber VIDEO