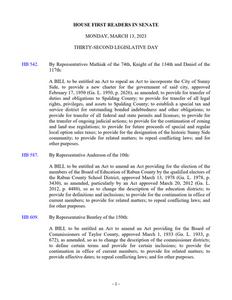

HOUSE FIRST READERS IN SENATE MONDAY, MARCH 13, 2023

THIRTY-SECOND LEGISLATIVE DAY

HB 542. HB 587. HB 609.

By Representatives Mathiak of the 74th, Knight of the 134th and Daniel of the 117th:

A BILL to be entitled an Act to repeal an Act to incorporate the City of Sunny Side, to provide a new charter for the government of said city, approved February 17, 1950 (Ga. L. 1950, p. 2626), as amended; to provide for transfer of duties and obligations to Spalding County; to provide for transfer of all legal rights, privileges, and assets to Spalding County; to establish a special tax and service district for outstanding bonded indebtedness and other obligations; to provide for transfer of all federal and state permits and licenses; to provide for the transfer of ongoing judicial actions; to provide for the continuation of zoning and land use regulations; to provide for future proceeds of special and regular local option sales taxes; to provide for the designation of the historic Sunny Side community; to provide for related matters; to repeal conflicting laws; and for other purposes.

By Representative Anderson of the 10th:

A BILL to be entitled an Act to amend an Act providing for the election of the members of the Board of Education of Rabun County by the qualified electors of the Rabun County School District, approved March 13, 1978 (Ga. L. 1978, p. 3430), as amended, particularly by an Act approved March 20, 2012 (Ga. L. 2012, p. 4480), so as to change the description of the education districts; to provide for definitions and inclusions; to provide for the continuation in office of current members; to provide for related matters; to repeal conflicting laws; and for other purposes.

By Representative Bentley of the 150th:

A BILL to be entitled an Act to amend an Act providing for the Board of Commissioners of Taylor County, approved March 1, 1933 (Ga. L. 1933, p. 672), as amended, so as to change the description of the commissioner districts; to define certain terms and provide for certain inclusions; to provide for continuation in office of current members; to provide for related matters; to provide effective dates; to repeal conflicting laws; and for other purposes.

- 1 -

HB 610. HB 619. HB 622. HB 632.

By Representative Bentley of the 150th:

A BILL to be entitled an Act to amend an Act changing the number of members of the Board of Education of Taylor County, approved April 17, 1975 (Ga. L. 1975, p. 3486), as amended, so as to change the description of the education districts; to define certain terms and provide for certain inclusions; to provide for continuation in office of current members; to provide for related matters; to provide effective dates; to repeal conflicting laws; and for other purposes.

By Representatives Houston of the 170th and Cannon of the 172nd:

A BILL to be entitled an Act to amend an Act providing for election of the members of the board of education of Cook County, approved March 28, 1986 (Ga. L. 1986, p. 5499), as amended, particularly by an Act approved May 16, 2007 (Ga. L. 2007, p. 3528), so as to change the provision relating to the compensation of the members of the board; to provide an effective date; to repeal conflicting laws; and for other purposes.

By Representatives Gambill of the 15th and Scoggins of the 14th:

A BILL to be entitled an Act to amend an Act to provide a homestead exemption from certain Bartow County ad valorem taxes for county purposes in the amount of $5,000.00 of the assessed value of the homestead for certain residents of that county, approved March 24, 1994 (Ga. L. 1994, p. 4058), so as to increase the exemption to $15,000.00; to provide for compliance with constitutional requirements; to provide for a referendum, effective dates, and automatic repeal, mandatory execution of election and judicial remedies regarding failure to comply; to repeal conflicting laws; and for other purposes.

By Representatives Crawford of the 84th, Oliver of the 82nd, Drenner of the 85th and Evans of the 89th:

A BILL to be entitled an Act to amend an Act providing a homestead exemption from certain City of Decatur ad valorem taxes, approved April 19, 2000 (Ga. L. 2000, p. 4285), as amended, particularly by an Act approved April 26, 2016 (Ga. L. 2016, p. 3627), so as to modify the amount of a homestead exemption from City of Decatur ad valorem taxes for municipal purposes except for ad valorem taxes levied to pay interest on and to retire municipal bonded indebtedness in the amount of $40,000.00 of the assessed value of the homestead for residents of that city; to provide for applicability; to provide for compliance with constitutional requirements; to provide for a referendum, effective dates, automatic repeal, mandatory execution of election, and judicial remedies regarding failure to comply; to repeal conflicting laws; and for other purposes.

- 2 -

HB 633. HB 634. HB 635.

By Representatives Crawford of the 84th, Oliver of the 82nd, Drenner of the 85th and Evans of the 89th:

A BILL to be entitled an Act to amend an Act providing certain homestead exemptions from City of Decatur ad valorem taxes for certain residents of said city, approved March 27, 1985 (Ga. L. 1985, p. 4140), as amended, particularly by an Act approved April 26, 2016 (Ga. L. 2016, p. 3630), so as to modify the amount of the homestead exemption from $10,000.00 to $15,000.00 for residents of such city who are 65 years of age or older; to provide for compliance with constitutional requirements; to provide for a referendum, effective dates, automatic repeal, mandatory execution of election, and judicial remedies regarding failure to comply; to repeal conflicting laws; and for other purposes.

By Representatives Crawford of the 84th, Oliver of the 82nd, Drenner of the 85th and Evans of the 89th:

A BILL to be entitled an Act to provide for a new homestead exemption from City of Decatur ad valorem taxes for municipal purposes in the amount of $40,000.00 for each resident of the City of Decatur who resides upon real property subject to a written lease having an initial term of not less than 99 years with a landlord that is an entity exempt from taxation under Section 501(c)(3) of the federal Internal Revenue Code and who owns all improvements located on the real property; to provide for related matters; to provide for compliance with constitutional requirements; to provide for a referendum, effective dates, and automatic repeal, mandatory execution of election, and judicial remedies regarding failure to comply; to repeal conflicting laws; and for other purposes.

By Representatives Crawford of the 84th, Oliver of the 82nd, Drenner of the 85th and Evans of the 89th:

A BILL to be entitled an Act to amend an Act providing a homestead exemption from City of Decatur ad valorem taxes for certain residents of said city, approved April 26, 2016 (Ga. L. 2016, p. 3636), so as to increase to $25,000.00 the amount of the assessed value of the homestead for residents of such city who are 62 years of age or older and whose income does not exceed $60,000.00; to provide for compliance with constitutional requirements; to provide for a referendum, effective dates, automatic repeal, mandatory execution of election, and judicial remedies regarding failure to comply; to repeal conflicting laws; and for other purposes.

- 3 -

HB 645. HB 649. HB 671.

HB 672.

By Representative Yearta of the 152nd:

A BILL to be entitled an Act to amend an Act to provide a new charter for the City of Sylvester, approved May 13, 2008 (Ga. L. 2008, p. 4219), as amended, so as to authorize the municipal court to levy and collect a technology fee; to provide for authorized uses of the proceeds of such fee; to provide for related matters; to repeal conflicting laws; and for other purposes.

By Representatives Dempsey of the 13th, Lumsden of the 12th and Barton of the 5th:

A BILL to be entitled an Act to amend an Act providing for the compensation of the members of the County Board of Education of Floyd County, approved March 18, 1959 (Ga. L. 1959, p. 3203), as amended, particularly by an Act approved April 2, 2019 (Ga. L. 2019, p. 3618), so as to provide for the compensation of the members of such board of education; to provide for an effective date; to repeal conflicting laws; and for other purposes.

By Representatives Reeves of the 99th, Hong of the 103rd and Clark of the 100th:

A BILL to be entitled an Act to amend an Act providing a homestead exemption from all City of Sugar Hill ad valorem taxes for any city purposes in the amount of $2,000.00 of the assessed value of the homestead for residents of said city who are 65 years of age or over, approved March 25, 1994 (Ga. L. 1994, p. 4194), so as to increase the exemption from $2,000.00 to $10,000.00; to provide for applicability; to provide for compliance with constitutional requirements; to provide for a referendum, effective dates, automatic repeal, mandatory execution of election, and judicial remedies regarding failure to comply; to provide for related matters; to repeal conflicting laws; and for other purposes.

By Representatives Reeves of the 99th, Hong of the 103rd and Clark of the 100th:

A BILL to be entitled an Act to amend an Act providing a homestead exemption from all City of Sugar Hill ad valorem taxes for city purposes in the amount of $2,000.00 of the assessed value of the homestead for residents of said city, excluding land in excess of one acre, approved April 4, 1991 (Ga. L. 1991, p. 4675), so as to increase the exemption from $2,000.00 to $10,000.00; to provide for compliance with constitutional requirements; to provide for a referendum, effective dates, automatic repeal, mandatory execution of election, and judicial remedies regarding failure to comply; to provide for related matters; to repeal conflicting laws; and for other purposes.

- 4 -

HB 673.

By Representatives Reeves of the 99th, Hong of the 103rd and Clark of the 100th:

A BILL to be entitled an Act to provide a homestead exemption from the City of Sugar Hill ad valorem taxes for municipal purposes in the amount of $10,000.00 of the assessed value of the homestead for residents of that city whose income does not exceed $10,000.00 per annum and who are disabled or who are 62 years of age or older; to provide for definitions; to specify the terms and conditions of the exemption and the procedures relating thereto; to provide for applicability; to provide for compliance with constitutional requirements; to provide for a referendum, effective dates, automatic repeal, mandatory execution of election, and judicial remedies regarding failure to comply; to repeal conflicting laws; and for other purposes.

- 5 -